UK residential property sector continues to cool in August

Cost of borrowing weighs on activity in sales market.

4 minutes to read

A slower than usual August was how Rightmove described it, noting the number of agreed sales in the month were down 19% on August 2019 (pre-pandemic). There were fewer new sellers too, with the number of new properties coming up for sale down 6% compared with the ten-year average.

It chimed with the RICS UK Residential Market Survey, which found house prices and sales activity continued to weaken in August.

A headline net balance of -47% of respondents to the RICS survey reported a decline in new buyer enquiries during the month as the higher cost of borrowing continued to weigh on demand.

The reading for new sales was also -47%, the weakest result since the early phases of the pandemic. A reading of below zero indicates a contraction.

Near-term sales expectations remain subdued, albeit the headline net balance in the survey did turn marginally less negative, at -38%, compared to last month’s reading of -45%.

The slump in activity meant there was no respite for prices, with both Nationwide and Halifax recording sizeable annual falls of 5.3%% and 4.6% respectively, albeit these were relative to the record-high property prices seen the previous summer.

The latest UK provisional property transactions released in August by HMRC showed a fall of 16% to 86,190 in July 2023 compared with the same month a year earlier.

Data tracking mortgage approvals for house purchase also showed no signs of an uptick in demand in the near term, with the data from the Bank of England showing a month on month fall of 9.5% to 49,400 approvals in July.

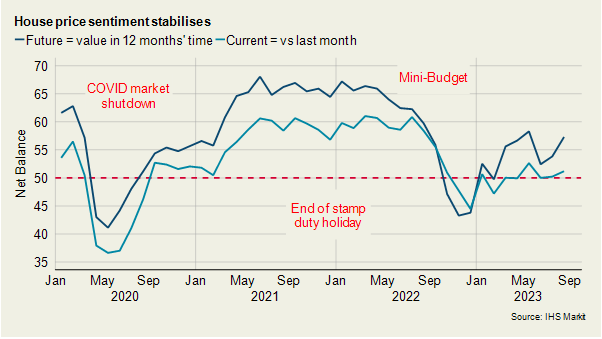

Despite this, IHS Markit’s Household Sentiment Survey suggests people can see light at the end of the tunnel. The index for future house prices (what households think will happen to the value of theirs in 12 months’ time compared with now) climbed for a second month in a row to reach 57 in August. A score of over 50 represents increasing confidence that prices will climb (see chart).

However, conditions remain challenging for tenants (aside from in prime Central London – see below). A net balance of +47% of RICS survey respondents said demand rose during August. Landlord instructions continued to fall, down -20% in August with anecdotal comments highlighting that some landlords are choosing to leave the sector. Tenant demand has outpaced supply each month since the reopening of the UK economy after the first lockdown in 2020.

Prime London Sales

While the prime London market has been affected by the uncertainty of the last 12 months, it has been less marked than many areas of the UK.

For example, while the Nationwide UK house price index fell below -5% in the year to August, average prices in prime central London (PCL) declined by just 1.4% annually. In prime outer London, the fall was -0.8%.

Knight Frank sales data also shows that the number of exchanges in London during July and August was 15% above the five-year average, while that figure was down by 4% across the whole country.

The fact prices across the capital were subdued compared to other parts of the UK during the pandemic has helped support activity. A higher proportion of cash buyers has also played its part.

Prime London Sales Report - August 2023

Prime London Lettings

Rental value growth in prime London postcodes continued to decline in August as supply built and demand cooled.

More owners are opting to let out their property due to the weakness in the sales market caused by rising mortgage rates.

Meanwhile, demand has dipped over the summer for reasons that include a dip in the number of Chinese students choosing to attend university in the UK.

As a result, average rental value growth in PCL fell to 12.4% in the year to August, which was the lowest level since September 2021. In prime outer London (POL), the figure was 11.5%, the weakest it has been since October 2021.

Prime London Lettings Report - August 2023

Country market

A wave of new supply means buyers in the autumn market have the greatest amount of choice since the first year of the pandemic in 2020.

Market valuation appraisals in August were up 12% versus the five-year average (excluding 2020).

While a year of climbing borrowing costs has squeezed affordability, putting prices under pressure, if interest rates are near to their peak as the Bank of England has suggested, the resulting improvement in sentiment could make for a stronger end to 2023.

While there are fewer buyers than during the recent boom period, demand has not evaporated.

The ratio of new prospective buyers (demand) to new instructions (supply) climbed in August to 7.4 buyers per property. While down from pandemic highs it is in line with the 7.6 average between 2015 and 2019 before the pandemic.