UK homeowners are feeling brighter

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The new year bounce

A new survey confirms the notable turnaround in housing market sentiment during the early weeks of the year.

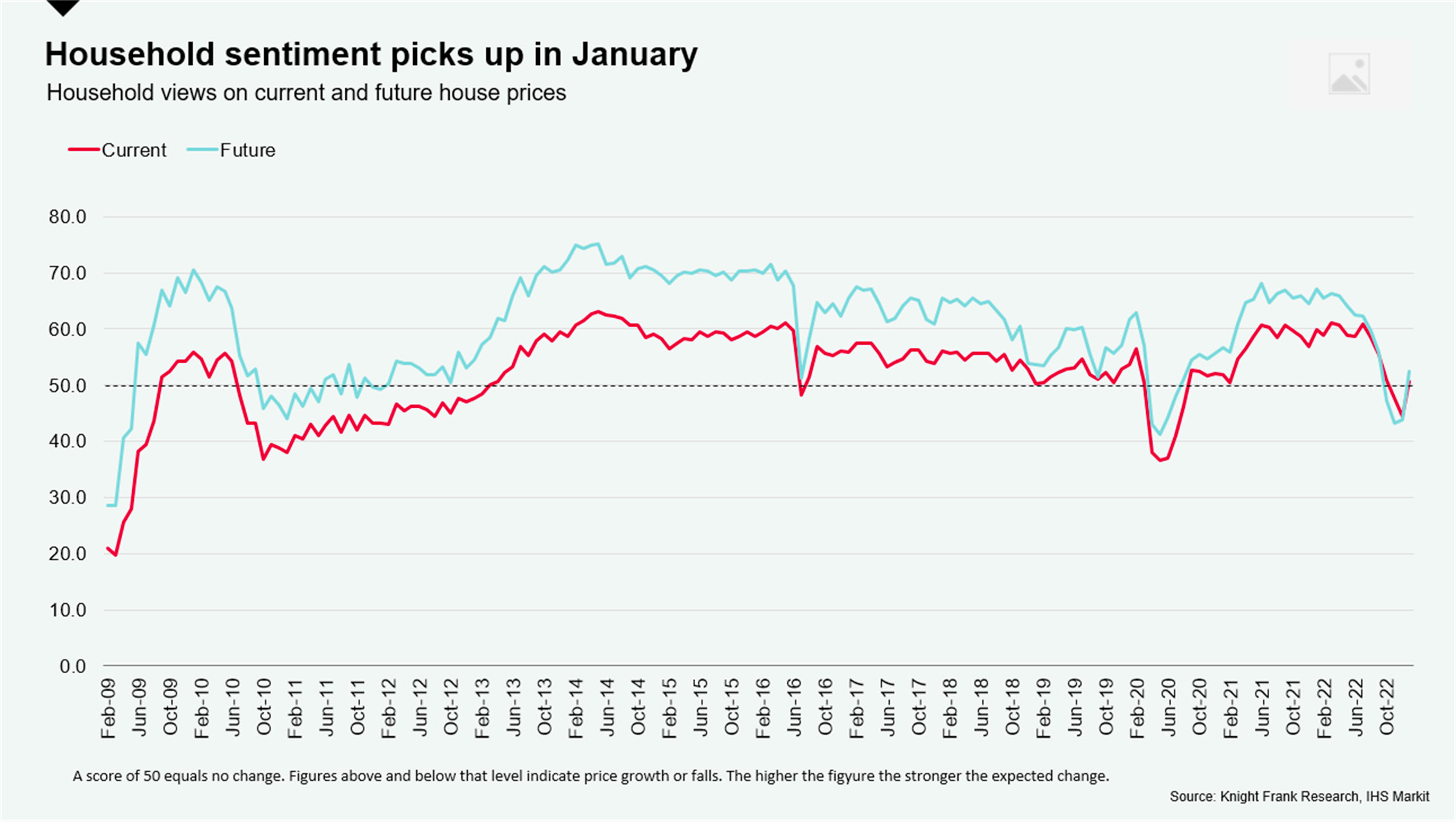

The December slowdown started early this year in the wake of the mini-budget, but Rightmove data published early last week suggested the traditional new year rebound had been particularly strong. The latest survey from IHS Markit confirms that household views on the current trajectory of house prices rebounded into positive territory following two consecutive contractions (see chart). Views on the future trajectory of house prices also moved into positive territory following three consecutive monthly contractions.

Our own housing market sentiment survey, out today, reveals that energy costs are the key driver for those looking to buy a more energy efficient home. More than a third of our survey respondents cited rising energy costs as the key factor, while 20% cited the spectre of future environmental regulations affecting the value of inefficient homes. Some 18% have a preference to own a greener home and said they would pay more for it, if necessary.

That chimes with the latest RICS survey, which revealed that 40% of agents (that had an opinion on the matter) were seeing greater interest from buyers in homes that are more energy efficient. Meanwhile, 41% of respondents noted that sellers were attempting to attach a price premium on homes with a high energy efficiency rating.

Rental rebalancing, continued

Earlier this week, we covered signs that supply in the lettings market was beginning to grow from a low base.

The number of new lettings listings in the final two months of last year was 15% higher in England and Wales than the same period in 2021, according to figures from OnTheMarket. Figures from Rightmove, out this morning, confirm that the number of available homes to rent climbed 13% between October and December compared with the same period a year earlier, the largest annual jump in almost a decade.

Tenant competition has eased by a third since September, when the gap between the supply of homes and demand from tenants hit the highest level since records started in 2012. That puts tenant competition down about 6% compared to the same period in 2021.

Rental supply may pick up further after the spring as price expectations are more fully put to the test and more so-called ‘accidental landlords’ are created.

Commercial property values

Rising interest rates and higher borrowing costs are weighing on investor demand in commercial property markets, squeezing valuations. Investor enquiries fell across all sectors for the first time since the start of the pandemic during the fourth quarter, according to the latest RICS commercial property survey.

Values will eventually adjust to the 'new normal' for interest rates, which will support volumes. Capital values declined at a slower rate during December, boosting total returns. The MSCI UK All Property total return increased by +228bps during the month to -3.3%, the strongest monthly improvement since August 2016.

UK All Property capital values contracted by 3.7% in December, easing from a 6% decline in November. The retail sector was most resilient, with a decline of 2.6%. That was largely supported by the shopping centre subsector, which saw capital value declines of only 0.7%. Office capital values contracted by -3.4% during the month, while industrial values were down by 5%.

The investment market stands in contrast to occupier markets, particularly when it comes to offices - see Wednesday's note.

Calling the bottom of US housing, continued

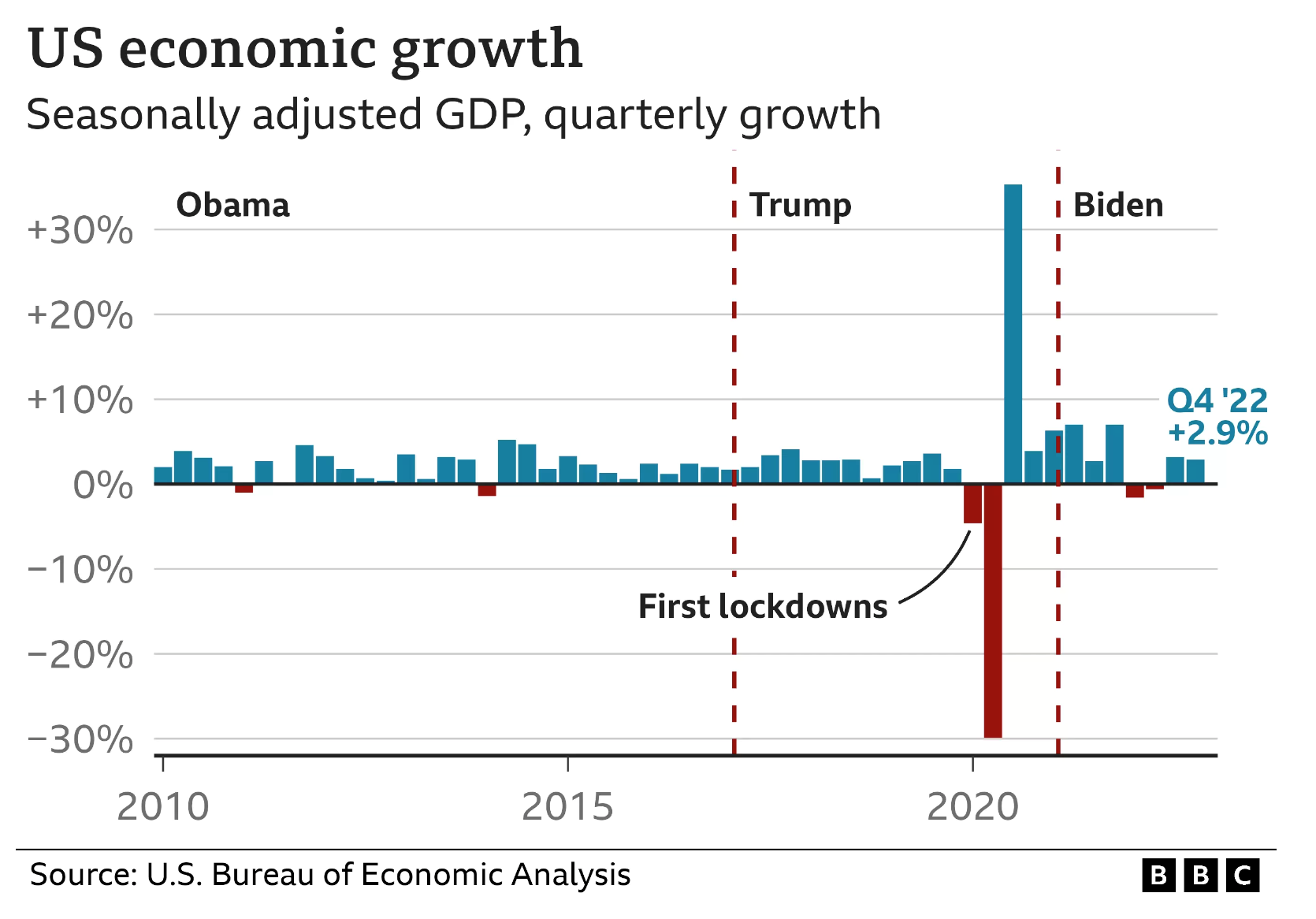

The US economy expanded by a better-than-expected annual rate of 2.9% during the final quarter of 2022, down from 3.2% during Q3 (see chart). The figures were dragged down by housing investment, which contracted at an annual rate of 27% - largely due to declines in the construction of new homes.

A recession remains a possibility. Personal consumption, the most important driver of the US economy, underperformed. However, there are unquestionably reasons to be cheerful. The economy has grown 6.7% under Biden so far and inflation for the past 6 months has averaged just 1.9%, notes economist Paul Krugman.

Mortgage rates eased again last week and, as a result, "home purchase demand is thawing from the months-long freeze that gripped the housing market," says Freddie Mac. The thirty year rate now sits at 6.13%, down from a peak or more than 7% in November. We covered signs that the US housing market may have bottomed out on Monday.

In other news...

Bank of England must slowdown interest rate rises, warns ex chief economist (Telegraph), Bank of England set to hike to 4% as rate peak looms (Reuters), LVMH sales make light of downturn (Times), and finally, Manhattan’s Spiral Tower lands new tenants migrating west (Bloomberg).