Will buyers pay a premium for energy efficient homes?

Making sense of the latest trends in property and economics from around the globe

6 minutes to read

A muted December

The latest RICS Residential Market Survey confirms that December was particularly quiet in the property market, with net balances for both new buyer enquiries (-39) and new listings (-23) wallowing in deeply negative territory.

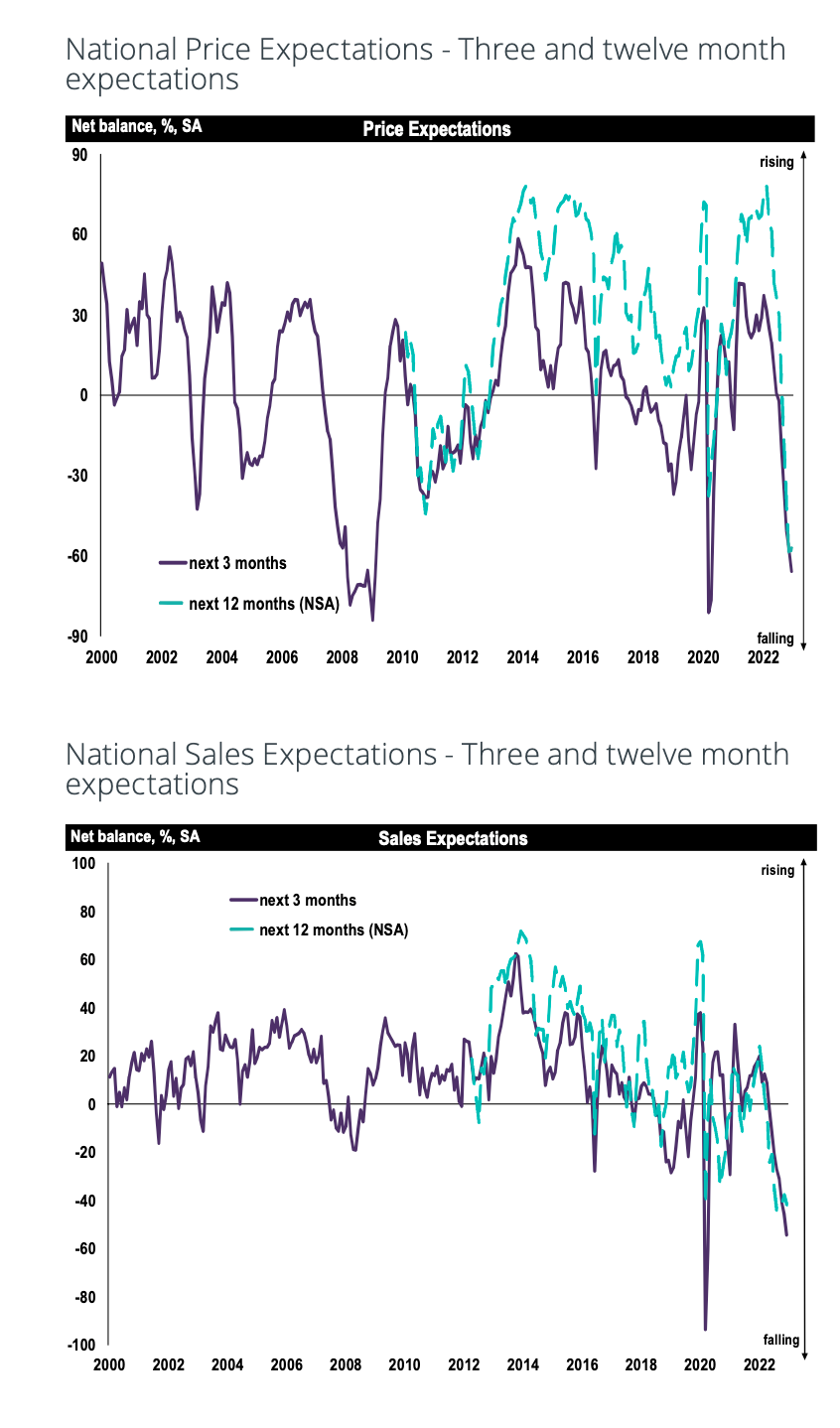

The downward momentum in sales became further entrenched across virtually all parts of the UK over the month, with respondents in the North West of England, Scotland, Wales and London all citing a particularly subdued month for activity. Near-term sales expectations turned a little more downbeat, posting a net balance figure of -54% compared to -46% last time (see chart).

Christmas came early in the property market as movers iced plans in the wake of the mini-budget. We talked earlier this week about the pronounced new year bounce as homeseekers returned amid sizeable declines in mortgage rates.

Average UK house prices increased by 10.3% in the year to November 2022, down from 12.4% in October 2022, according to ONS figures released Wednesday. The average UK house price was £295,000 in November 2022, which is £28,000 higher than this time last year but a slight decrease from last month's record high of £296,000.

Mortgage affordability

The ONS data shows how little affordability is likely to improve if house prices decline in line with our expectations. Indeed, the trajectory of mortgage rates will have a far greater impact, as Tom Bill explores this morning.

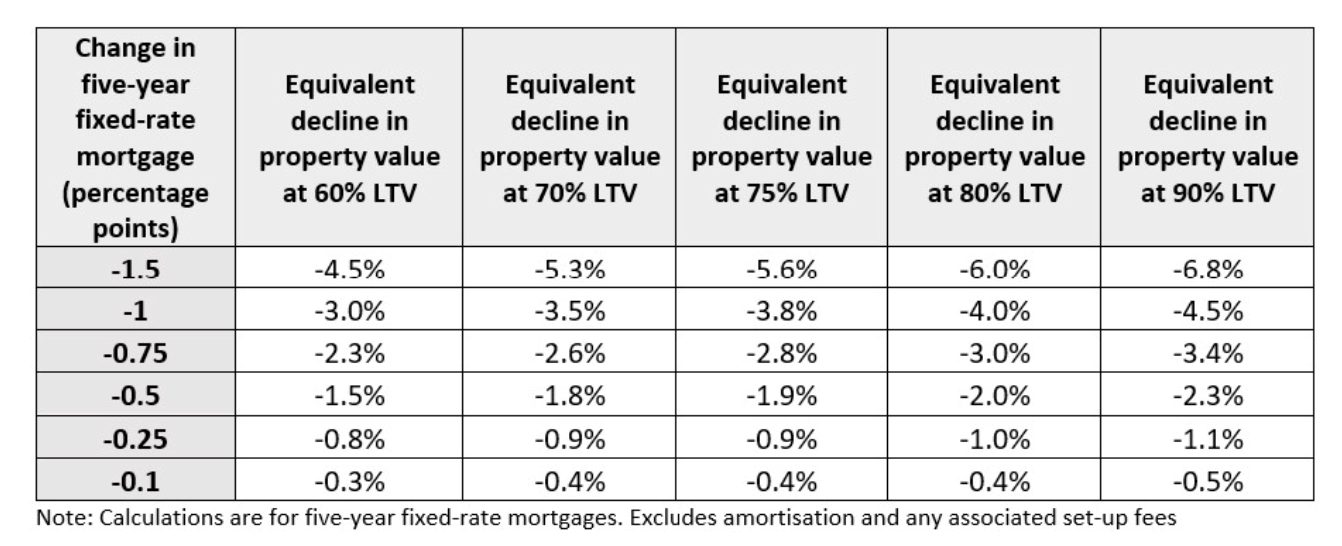

For anyone seeking a five-year fixed-rate mortgage at an LTV of 90%, for example, a decline of 1 percentage point on the rate (for example from 6% to 5%) is the equivalent of 4.5% of the property’s value.

Based on a property worth £500,000, a 90% mortgage would require a loan of £450,000. A decline of one percentage point would equate to £4,500 per year or £22,500 over the period of the five-year fix, a sum that represents 4.5% of the £500,000 value. The figures would differ slightly if amortisation was taken into account, depending on the overall length of the mortgage.

At an LTV ratio of 60%, the equivalent saving on the mortgage rate would equate to 3% of the property’s value, as the table shows.

"For anyone attempting to buy at the right time this year, they can operate with more precision by monitoring the mortgage market," Tom writes. "Although UK house prices are expected to fall this year, waiting for the bottom is an unrealistic proposition for some buyers and an inexact science for anyone attempting it."

Canvassing the lenders

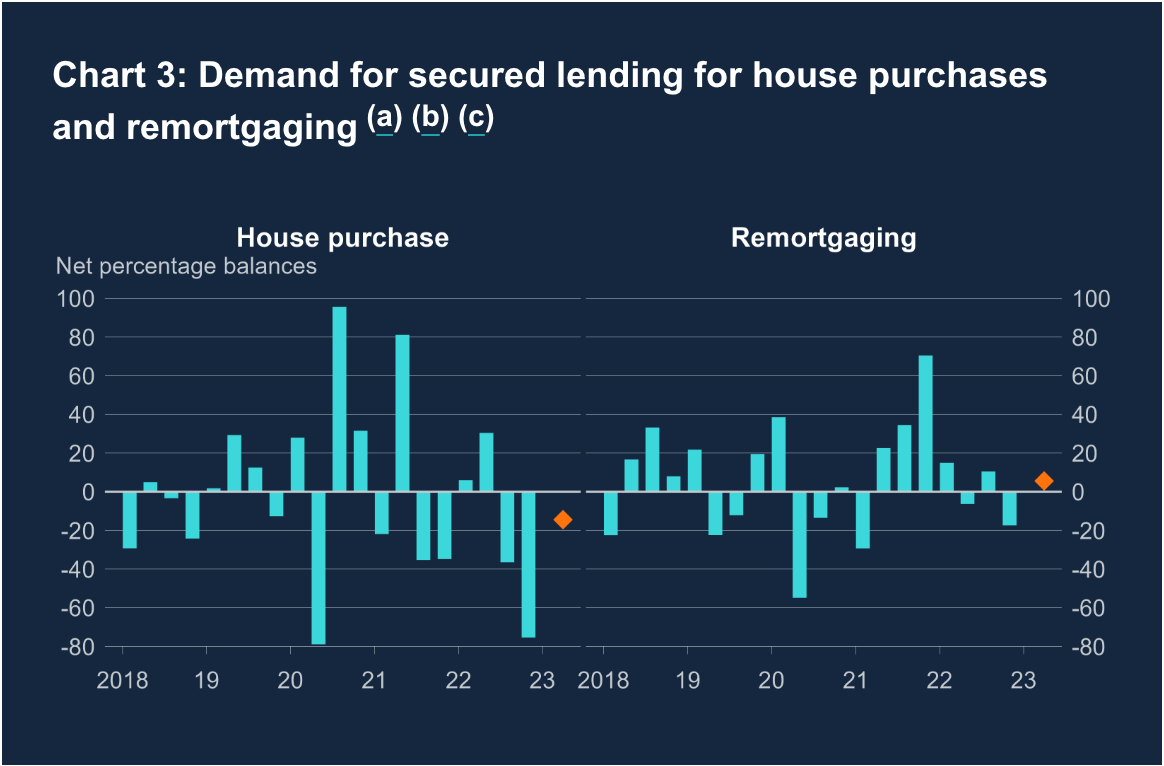

The Bank of England's quarterly Credit Conditions Survey of lenders illustrates the scale of the drop off in mortgage lending during the final quarter. The drop in demand for mortgages for house purchase was particularly pronounced (see final blue bar on left chart) and is expected to ease further during Q1 (see orange diamond), though only marginally in comparison.

Demand to remortgage is likely to bounce back, according to lenders surveyed. That's likely as a result of more favourable mortgage rates.

"'Borrowers can clearly see that conditions are better than they were just a few weeks ago and rates, though declining, are unlikely to ease much further and now is a good time to act," Simon Gammon of Knight Frank Finance tells the Mail. "We're now entering a "new normal" for mortgage rates, with the best five year fixed products a little under 4.5 per cent."

Tight supply in the student sector

Earlier this week, we revealed that almost £7 billion was invested in purpose-built student accommodation (PBSA) in 2022, a 62% year-on-year rise. Inflation has been a factor driving investment into the sector as students opt for more certainty over their outgoings.

Ollie Knight this morning takes a deeper dive into the degree to which supply is failing to keep up with demand. Analysis of the development pipeline points to 25,700 bed spaces currently under construction and expected to be delivered in time for the 2023 academic cycle. Beyond next year, there are a further 69,500 bed spaces in the pipeline with full planning permission granted. Overall, that means there are an additional 95,000 bed spaces in the planning pipeline.

Delivery is still likely to be dwarfed by recent and expected growth in student numbers. The shortfall in markets with the strongest historic growth in student numbers, like Bristol and Manchester, is increasing at a rate of over 1,000 bed spaces per year. In both markets, over the last five-years for every new bed space that has been added to supply each year, three more additional full-time students have been added to the population.

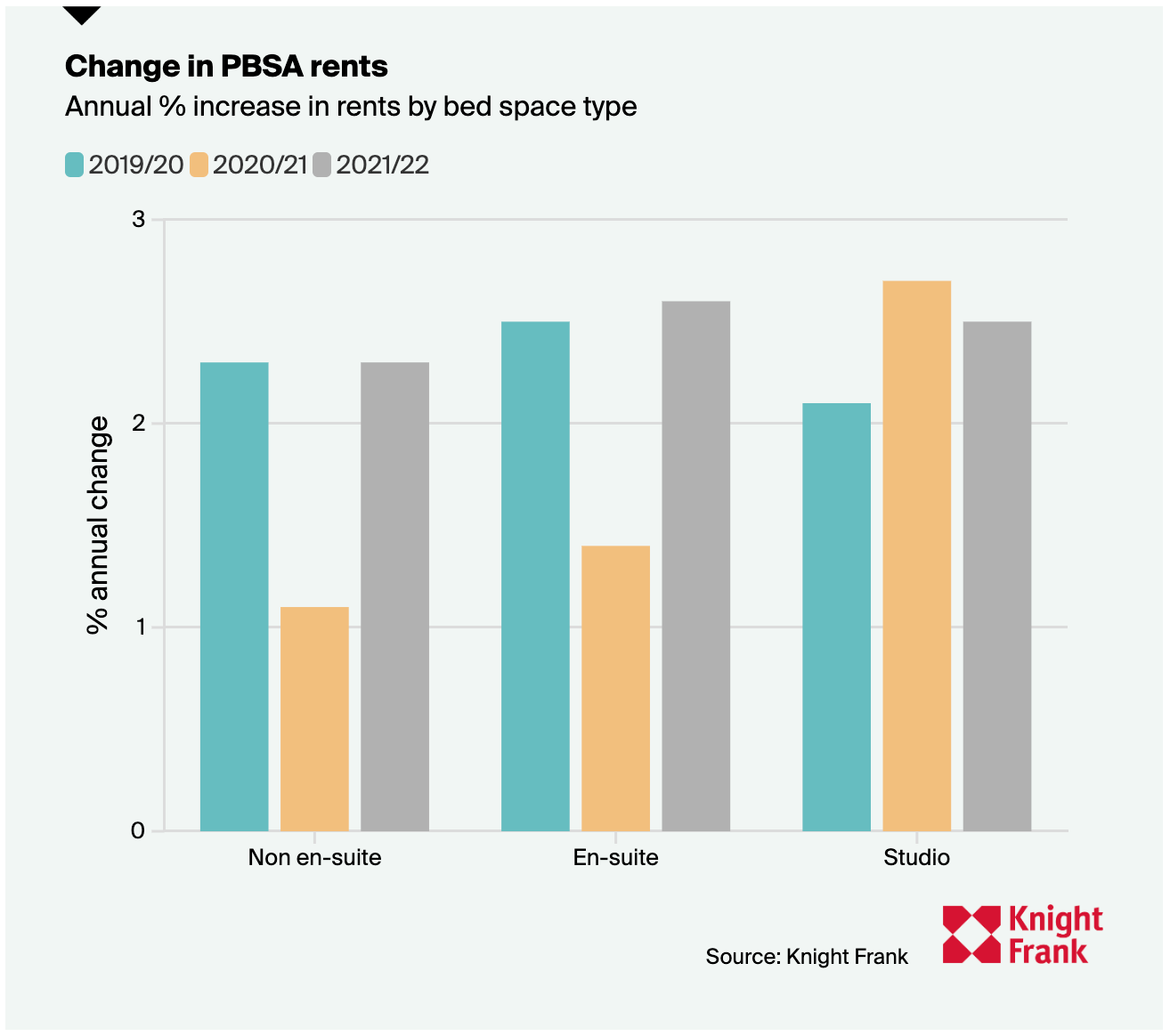

Headline rental growth for PBSA increased by 2.6% for the 2021/22 academic year, according to Knight Frank’s Student Property Index.

Leaky homes

The RICS Survey (above) included a new set of additional questions looking at the impact of energy efficiency ratings on sales market behaviour:

"When asked whether or not respondents are seeing greater interest from buyers in homes that are more energy efficient, around 40% of the survey sample (of those that had an opinion on the matter) replied in the affirmative, although this was outweighed by 60% who said they were not seeing this. Meanwhile, 41% of respondents noted that sellers were attempting to attach a price premium on homes with a high energy efficiency rating.

"By the same token (after excluding those that did not have a view), 61% of contributors stated that highly energy efficient homes were holding their value in the current market."

Any emergence of price premiums for energy efficient homes will come as a relief to the government, which is struggling with the economics of cutting emissions from the UK's draughty homes. Market incentives might fill some of the gap left by a lack of substantial government subsidies. Former energy minister Chris Skidmore released his 'Mission Zero' report last week, which illustrated the scale of the task at hand, and raised more questions than it answered as to how substantial cuts to emissions will be funded - we covered it in depth in our new ESG newsletter, which you can read here.

For a new edition of Intelligence Talks, I'm joined by Knight Frank's Head of ESG Consulting Jonathan Hale, and property writer Patrick Gower, to discuss Mr Skidmore's report, and to take stock of the challenges ESG presents in both commercial and residential markets. Listen here, or wherever you get your podcasts.

In other news...

Global property market faces $175 Billion debt spiral (Bloomberg), Hong Kong home prices to drop 10% before rebound, Goldman says (Bloomberg), KKR real estate fund curbs redemptions in echo of Blackstone move (FT), and finally, Falling energy prices offer ‘easier path’ out of inflation crisis, says Bank of England (FT).