The ECB is worried about commercial real estate loans

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Chancellor Jeremy Hunt will deliver his autumn statement later today. Briefings to the papers over the past 48 hours suggest that among the flagship policies will be "a £9 billion permanent tax break for business".

That will come in the form of an extension of "full expensing" rules that were due to expire in 2026, allowing companies to make immediate deductions on certain spending, writes the FT. That might sound boring, but one government insider tells the paper that it would be the “biggest business tax cut in modern British history”.

Key property policies floated in recent weeks include stamp duty reform. According to yesterday's Times, "some senior Tories say he should scrap it altogether, costing £10 billion a year. Less costly would be to raise the threshold for first-time buyers in London and the southeast in particular." We could also see an extension of the mortgage guarantee scheme, due to end in December.

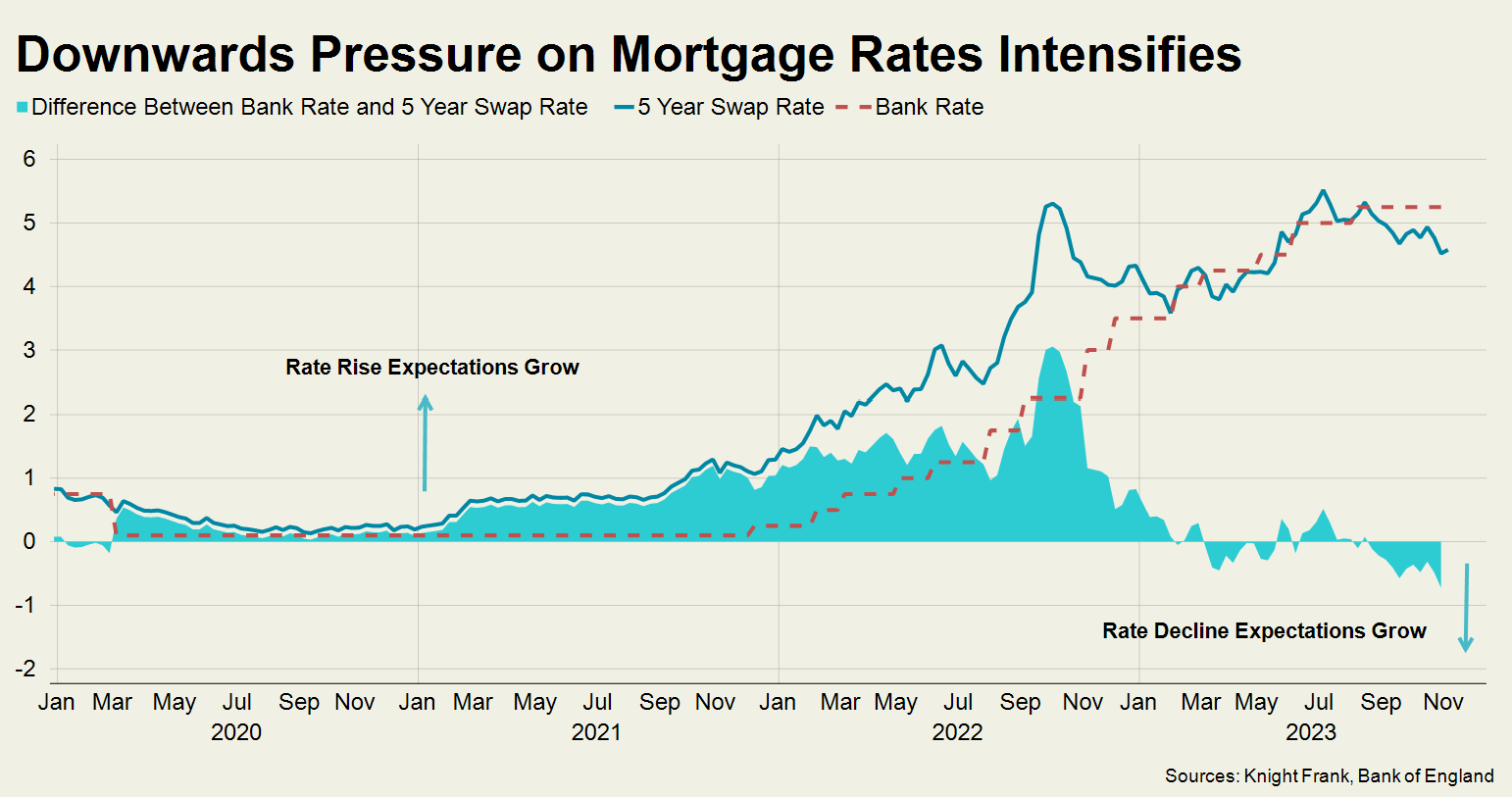

Both would provide differing boosts to housing market sentiment, which is already improving as mortgage rates continue to tick lower. See Tom Bill's Monday update for more on that. The fact the five-year swap rate is currently lower than the bank rate (as the chart below shows) demonstrates that financial markets believe the direction of travel for borrowing costs is down.

Vulnerabilities

The European Central Bank said yesterday there are now "substantial vulnerabilities" in the loan books of banks in the euro area, particularly when it comes to lending to commercial real estate (CRE) firms.

The warning came as part of its twice yearly Financial Stability Review, and set a markedly different tone to the Bank of England's, out last month, which said UK banks' exposure to declines in CRE values posed little threat to financial stability. That was in part because values had dropped more quickly than in the euro area and the US, yet arrears had remained low by historic standards.

Roughly 10% of loans at euro area banks have exposure to CRE, the ECB said. Average rates on new loans for the purchase of CRE assets have increased by 2.6 percentage points since interest rates started moving upwards. The rise in borrowing costs has prompted a 47% fall in transaction volumes, which has "inhibited price discovery". As a barometer for pricing, the ECB offers the fact that the euro area’s largest listed landlords are trading at a discount of more than 30% to net asset value (NAV), their largest discount since 2008.

Refinancing

The ECB noted that there was a widening difference in the performance of prime and non prime assets: “these results suggest there are substantial vulnerabilities in this loan book, particularly when considering that it is expected that both higher financing costs and reduced profitability will persist for a number of years. Indeed, business models established on the basis of pre-pandemic profitability and low-for-long interest rates may become unviable over the medium term."

The ECB is more relaxed about banks' exposure to the residential sector, despite the fact that it accounts for almost 30% of total loans. The sector is being supported by robust labour markets, while rising construction costs and supply shortages are underpinning values. However, over the medium term, the sector's "exposure to both physical and transition climate risk could lead to lower valuations for properties in certain locations and housing units with lower energy efficiency."

Miami

What drew Lionel Messi, Jeff Bezos and famed hedge fund manager Ken Griffin to Miami?

No doubt the 5.5% corporate tax rate played a role, but climate, lifestyle and Miami's transformation into an international sports capital probably also helped. Whatever the deciding factors were, property buyers want a slice of the action.

Florida accounted for almost a quarter of foreign purchases in the US last year, according to the National Association of Realtors. South Florida has witnessed a remarkable 78% increase in foreign driver's license exchanges so far this year, indicating a growing influx of new residents.

For more, see our new report by Kate Everett-Allen.

Foodstores

Foodstores were among the best performing commercial real estate sectors during the COVID-19 pandemic.

The sector achieved total returns of 6.6% and 15.4% in 2020 and 2021 respectively, comfortably outpacing the performance of the wider Retail (-14.0% / 8.4%) and Office (-1.1% / 5.7%) markets. Stellar income returns of 5.3% and 5.0% also saw it even pull ahead of Industrial (4.2% / 3.8%).

Investors are increasingly drawn to the sector’s defensive characteristics, according to a new, in-depth report by Stephen Springham and Emma Barnstable. As economic uncertainties persist, the demand for secure, long-term income has taken precedence in many investment strategies. After all, grocery shopping remains an essential, non-negotiable expense, even during economic hardship. Consumer retail sales values remain buoyant as a result, with operators eager to capture spend within their stores.

A broad spectrum of investors are now running the rule over the sector, from pension funds, sovereign wealth and private equity players.

In other news...

Housing delivery in Birmingham is running about 60% below the city's target. Anna Ward considers the case for investing.

Elsewhere - M&S wins judicial review of Marble Arch store plan (Reuters), over 75% of foreign money invested into Chinese stocks in 2023 has left (FT), the share of US homes that are mortgage-free jumps to 40% (Bloomberg), and finally, Bank of England governor warns markets not to expect inflation to fall quickly (FT).