Florida property market: A magnet for migration and real estate investment

The sunshine state has seen a rise in cash and foreign buyers as US$1 million+ homes make up a significant proportion of transactions.

2 minutes to read

We delve deeper into Florida's transaction and sales volumes as part of the Florida Market Insight Q4 2023 Report.

Florida's real estate market has become a thriving hub, a magnet for migration and a hotspot for lucrative real estate investments.

This dynamic market is shaped by several key factors: the presence of prominent tech companies, a vibrant sports scene, favourable tax policies, and a discerning clientele seeking luxury living.

The current state of the real estate market in Florida is experiencing an unprecedented surge in interest, making it an increasingly attractive destination for individuals and businesses in the finance, sports, and art sectors.

According to the National Association of Realtors, Florida accounted for an impressive 23% of foreign purchases in the US in 2022. Notably, South Florida has witnessed a remarkable 78% increase in foreign driver's license exchanges in the year to date compared to the same period in 2022, indicating a growing influx of new residents seeking to call this sunny state their home.

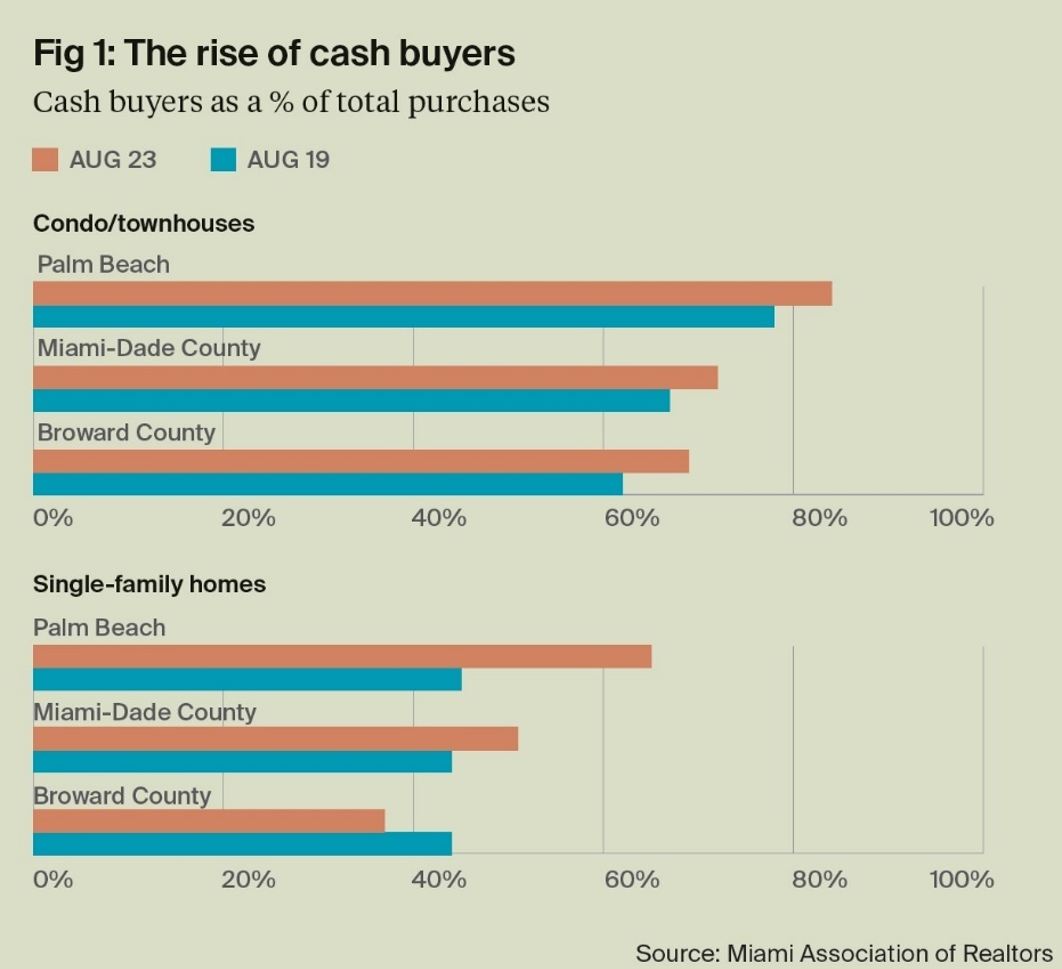

Cash buyers dominate the luxury real estate market

In the South East region of Florida, cash buyers have taken the lead, representing a significant portion of all property sales over US$1 million.

This trend is particularly noticeable in Palm Beach, where 84% of condo and townhouse sales in August 2023 were cash purchases, showing a substantial increase from 78% in August 2019, according to the Miami Association of Realtors (Fig.1).

The combination of rising mortgage rates and a steady flow of financially robust out-of-state and overseas buyers has contributed to this development, cementing Florida's reputation as a premier luxury real estate market.

Split market: Price bands and location

Higher mortgage costs are persuading those with homes priced below US$1 million to stay put or rent their property, leading to a smaller pool of properties for sale, but easing the pressure on rents within the single-family home market.

Above the US$1 million threshold, supply is less constrained resulting in higher transaction levels. In Miami- Dade County, single-family homes priced at US$1 million+ made up 20% of sales in August 2023 (7% in August 2019) and 21% in Palm Beach (7% in August 2019).

The most desirable suburbs such as Palm Beach, recently dubbed “The Hamptons of the South”, are experiencing tight inventory levels, however across the water, West Palm Beach is reinventing itself as a redevelopment hotspot with projects such as Olara Residences, Alba and Mr. C all coming to the market.

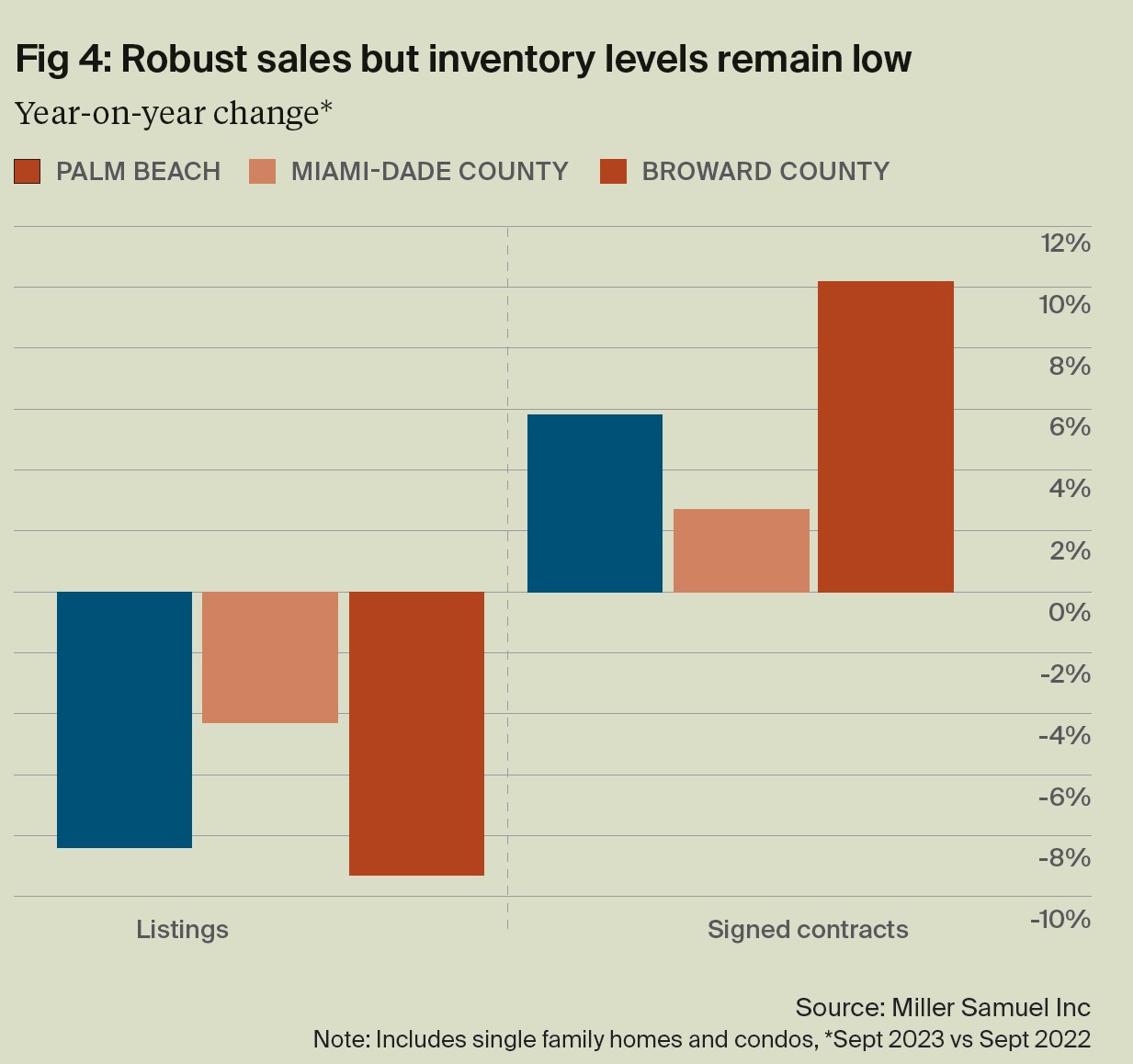

Latest data from Miller Samuel shows Broward County, home to Fort Lauderdale having seen the biggest decline in listings in the year to September 2023, down 9% overall (Fig 4).

Photo by Luiz Cent on Unsplash