UK farmland values hit record high

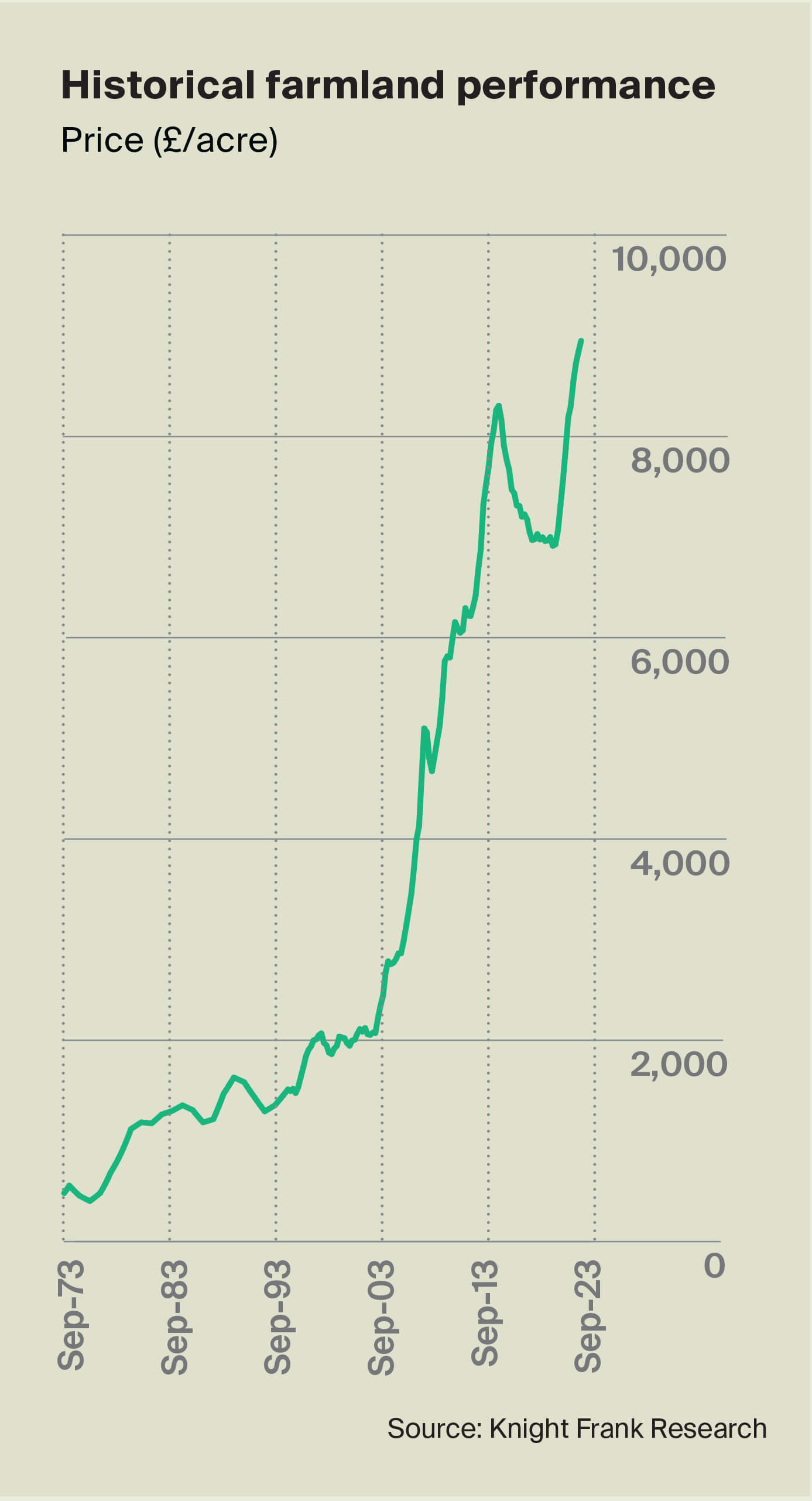

The price of bare agricultural land in England and Wales rose by 1% to hit another record high in the third quarter of 2023, according to the latest instalment of the Knight Frank Farmland Index.

2 minutes to read

On average, an acre of land is now worth £8,951. This represents an 8% rise on the year, just ahead of the latest inflation figures of 6.7%.

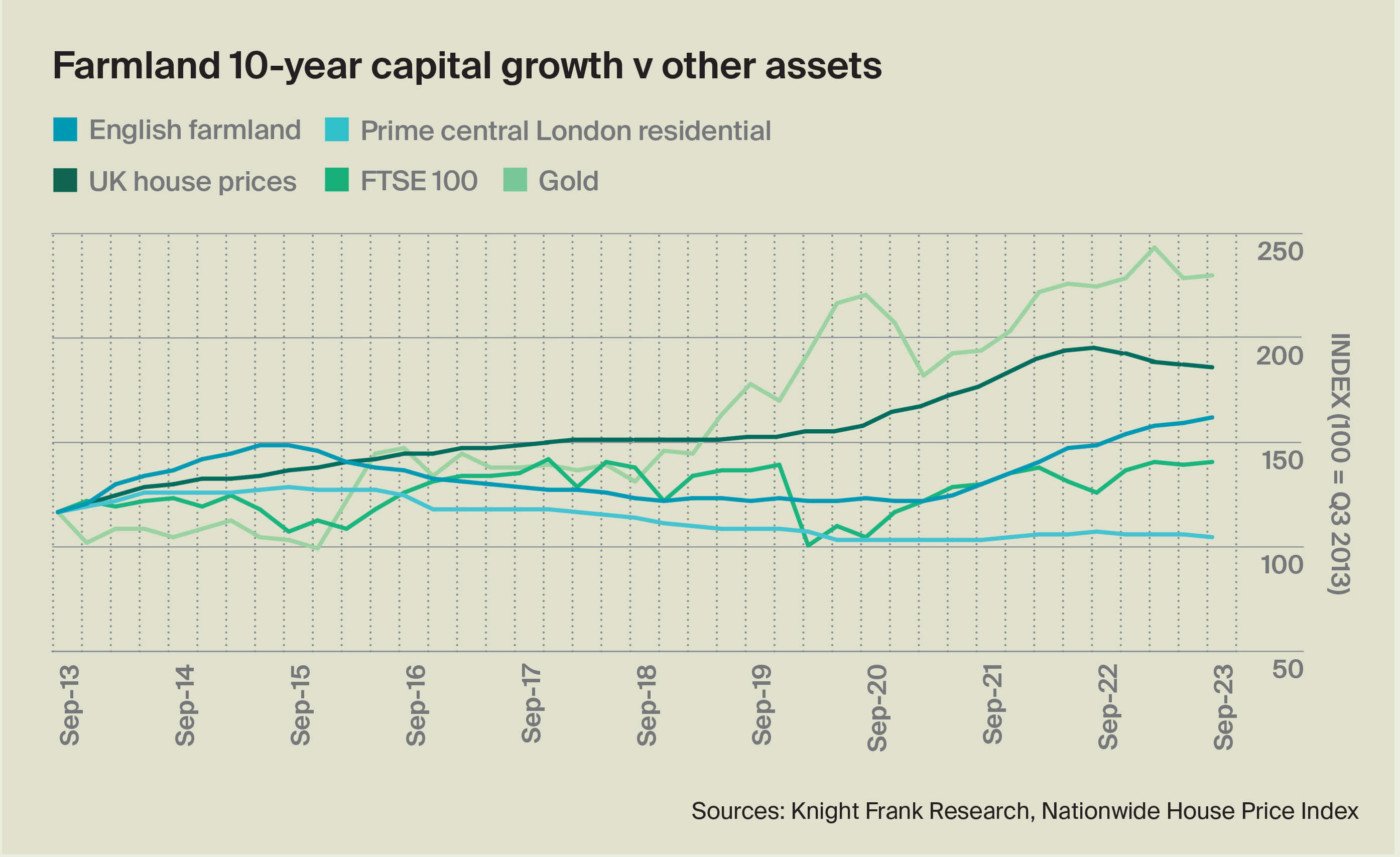

Of the other asset classes we track, only the FTSE 100 index (+10%) has outperformed farmland over the past 12 months. Looking back five years, farmland values have risen by 27%, bested only by gold (+67%).

Will farmland values continue to rise?

It does, however, appear as if the farmland market is at, or very close, to its near-term peak. Average values may hit £9,000/acre by the end of the year, but after that 2024 looks set to be a period of consolidation as supply and demand become more balanced. Property markets also generally tread water in a General Election year.

The volume of publicly advertised farmland is up by a quarter so far this year to around 80,000 acres, but this is still well below historical levels and there are few signs of a vast increase over the next 12 months, despite ongoing reductions in the amount of direct support payments that farmers are receiving from the government.

Demand remains strong, particularly from farmers who have sold land or had it compulsorily purchased for housing developments and infrastructure projects like HS2 and need to “rollover” any capital gains into new investments. In localised cases, this has driven prices over £15,000/acre.

Environmental buyers are still in the market but are reportedly becoming slightly less active due to a lack of clarity around the development of nature-based finance frameworks in the UK.

Thumbnail image: Stockwell Farm, near Cowley, Oxfordshire runs to almost 900 acres and includes a six-bed house and 150,000sq ft of modern buildings. It is guided at £18.5 million.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here