Why are UK farmland values continuing to rise?

Strong demand for farmland across the country is pushing up prices. We explore Knight Frank’s latest research and talk to the members of the firm’s Farms & Estates team to find out more.

4 minutes to read

Article updated 30/06/2023

This article forms part of The Rural Report 2023/24 offering rural property owners and businesses the latest news, guidance, advice and key insights in rural markets.

Download The Rural Report 2023/24

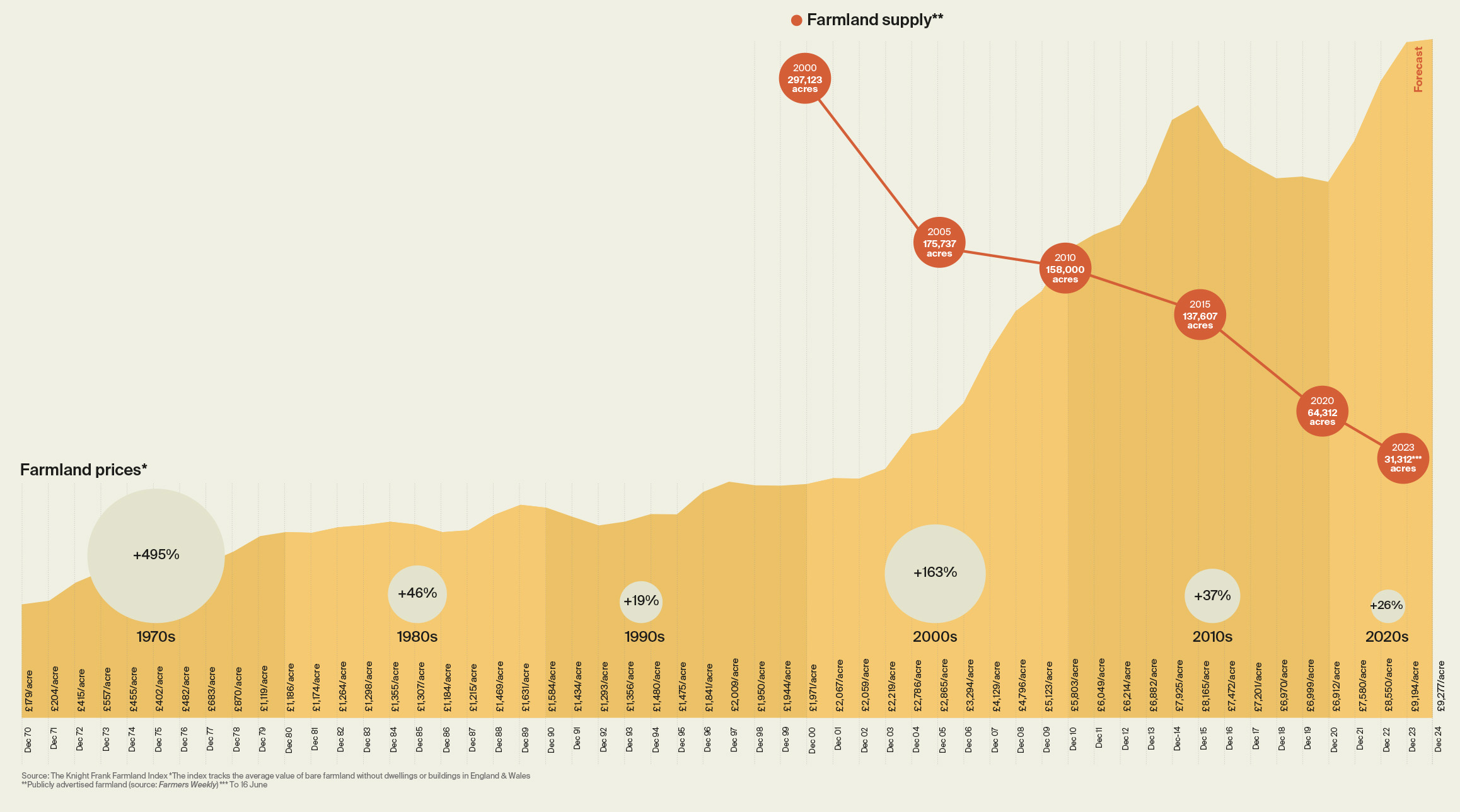

Low supply helped the value of farmland keep pace with double-digit inflation in 2022 and prices are set to continue rising for the rest of 2023, but the forthcoming general election could well cause the market to flatten out in 2024.

UK farmland values

Click image to download

Is natural capital influencing farmland values?

The value of agricultural land is once again on the march, up by an impressive – and inflation-busting – 13% last year. But now the fields are lined with a new asset class, natural capital, that was hardly on the radar in 2008.

“Everybody is talking about it,” agrees Will Matthews, Head of Farm & Estate Sales. Will says there are broadly two sorts of environmentally-minded buyer who get in touch with him looking to buy “I farmland. “On the one hand you have the lifestyle altruists who have always been on the lookout for a beautiful place to live in the countryside, but now they are talking about things like rewilding and carbon credits from planting trees.

“On the other you have the green investors who want to use natural capital to offset their own carbon emissions or package it up in a way that can be sold to other people. Some are still acting altruistically, but others are more commercially driven. Even the business-minded farmers who enquire about properties will be talking about regenerative agriculture these days.”

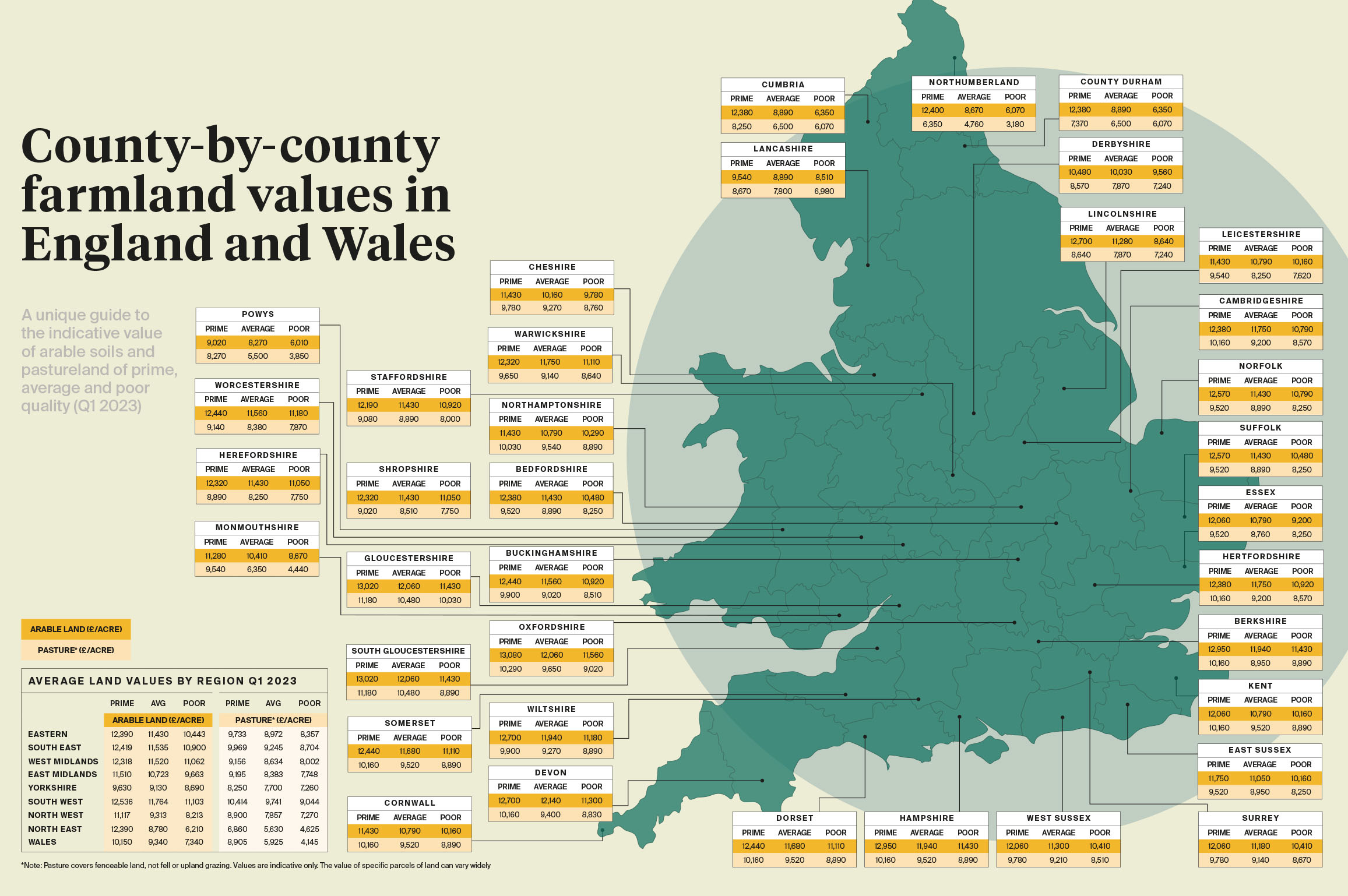

County-by-county farmland values

Click image to download

A new type of farmland buyer

It’s certainly changed the way property agents like Will look at what they are selling and who the potential purchasers could be, as he explains. “The Rothbury Estate in Northumberland (page 44) that we’ve just launched is a great example. Previously the emphasis would have been on its amazing sporting opportunities, but now we’re talking a lot about its potential to sequester carbon and boost biodiversity. And I’m certain that will be reflected in those who are interested in buying it.”

But that’s not to say it will be definitely be bought by a carbon fund or similar new owner, stresses Will. “Traditional high-net-worth buyers are still very active in the market and have deep pockets, so it could well go to a private individual.”

And there lies the rub, points out Will. “At the moment there is this focus on environmental buyers and their impact on the farmland market, but they aren’t actually buying a huge number of the properties we are selling. While they certainly generate a lot of the enquiries we get, they still face competition from tax-driven buyers who have sold land for development, existing farming businesses and lifestyle buyers. Green investors can only afford to pay so much before their sums don’t add up.”

Low supply

However, when the supply of farmland is so low (see chart on page 37), just the presence of a new sort of buyer is enough to create upwards pressure on prices, explains Andrew. “We’ve seen the volume of land on the market steadily declining over the years, so having an extra party fighting over what is available really does support prices.

“We saw the same pattern in the early 2000s when a number of Danish and Dutch farmers started acquiring arable land in East Anglia. There weren’t huge numbers of them, but it gave the market that had been kicking around at £2,500/acre for a number of years a real boost.”

The pattern, however, looks slightly different when you head over the Scottish and Welsh borders, points out Tom Stewart-Moore, Knight Frank’s Head of Farm Sales in Scotland. “When it comes to hill ground suitable for planting trees, farmers are often losing out to funds looking to create woodland carbon credits. At the levels being paid now livestock producers who would typically have acquired this type of relatively unproductive land just can’t compete, so much so it’s become a real political issue.”

The future of green buyers

“I don’t think the environmental buyer is a passing fad,” reckons Will. “As the income generated from natural capital becomes a more important part of farm incomes, I think the line between traditional and so-called green buyers will become more blurred. Instead of asking about soil types and crop yields, potential farmer buyers will be expecting to see baseline natural capital surveys.”

Andrew agrees. “As the post-Brexit impact of removing area-based subsidies like the Basic Payment Scheme becomes more apparent and commodity markets become more volatile, you would have expected farmland values to come under a bit of downward pressure, but at the moment we aren’t seeing that. Whether the headlines will still be talking about this green gold in 15 years remains to be seen, but if more farms do eventually come to the market it will certainly help support prices.”