Key findings from ESG Property Investor Survey

Investors are increasingly looking to improve quality of their existing portfolio as ESG regulations continue to influence real estate decisions.

3 minutes to read

ESG is important for businesses, and real estate investors are also recognising its value. This was reflected in the responses from our ESG Property Investor Survey.

UK and EU regulations are making buildings in commercial and residential areas more efficient. However, in the UK, we estimate about 70% of commercial space will not meet the proposed Minimum Energy Efficiency Standards of EPC B rating by 2030.

Furthermore, our latest (Y)OUR SPACE report of more than 300 global occupiers found that almost all respondents said ESG strategies and commitments will influence real estate decisions over the next three years.

How have investors responded to changing ESG requirements?

The ESG property Investor Survey asks investors about their property investments and ESG, focusing on UK and Europe. It includes 45 investors with £300 billion in assets under management. When asked what nationalities their capital represents, the investors stated Europe, the UK, north America and Asia-Pacific.

Below are the key findings from the survey:

1. The bifurcation of property will continue with demand growing for most sustainable assets

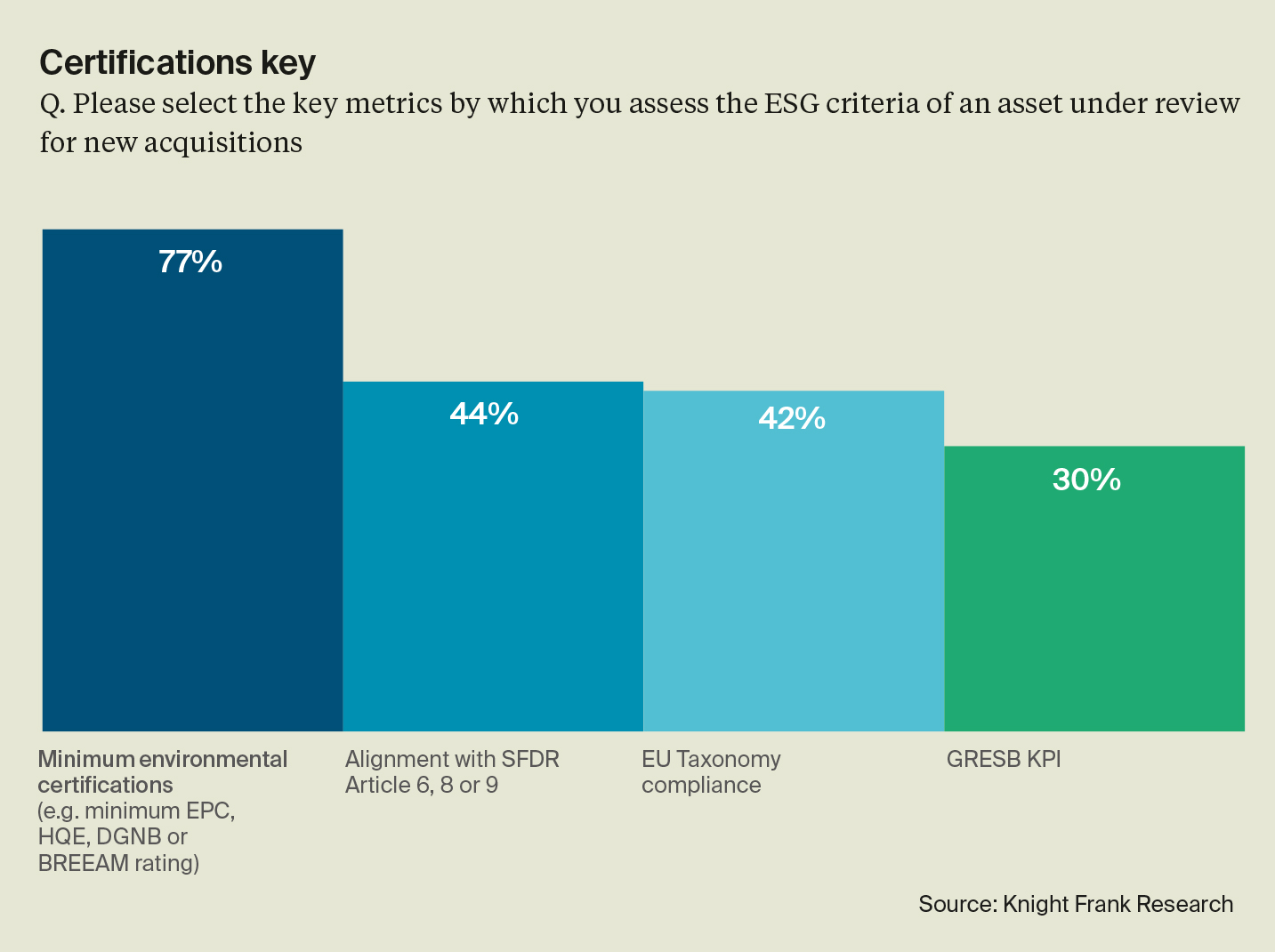

There are 77% of surveyed investors that have a minimum environmental criteria for new acquisitions. Of those targeting EPCs, over 50% require a minimum B rating, the proposed minimum energy efficiency rating in the UK from 2030.

This bifurcation of property is particularly acute for offices, and the level of sustainability required to attract institutional investors.

Our previous research found that central London offices command a rental and sales premia for BREEAM certified buildings.

2. Investors move to minimise risk and implement strategies for net zero goals

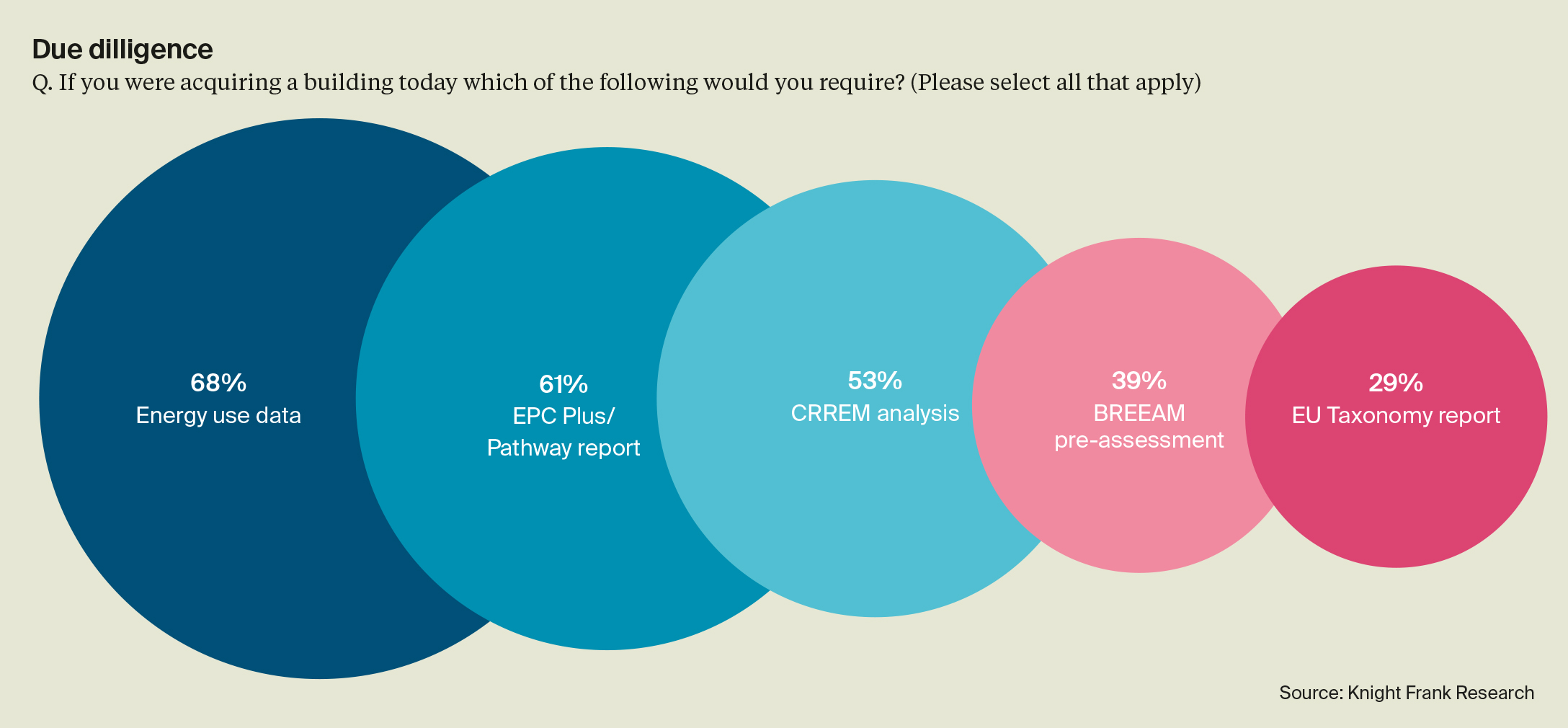

Of the investors, 74% use CRREM analysis for their current portfolio, and over half need it for acquisition due diligence.

This will help investors reduce risk and reach net zero goals. Also, over half require CRREM analysis before buying new assets to see how they will affect the overall portfolio performance.

3. Enhanced ESG due diligence on acquisitions becoming standard

The survey reveals 61% require an EPC Plus/Pathway report before acquisition in preparation for forthcoming regulation to understand what measures, if any, will be necessary to reach proposed minimum requirements.

These assessments can be used as a tool to understand the level of capital expenditure required to bring the building up to regulatory standards.

4. Improving property efficiency is a primary goal

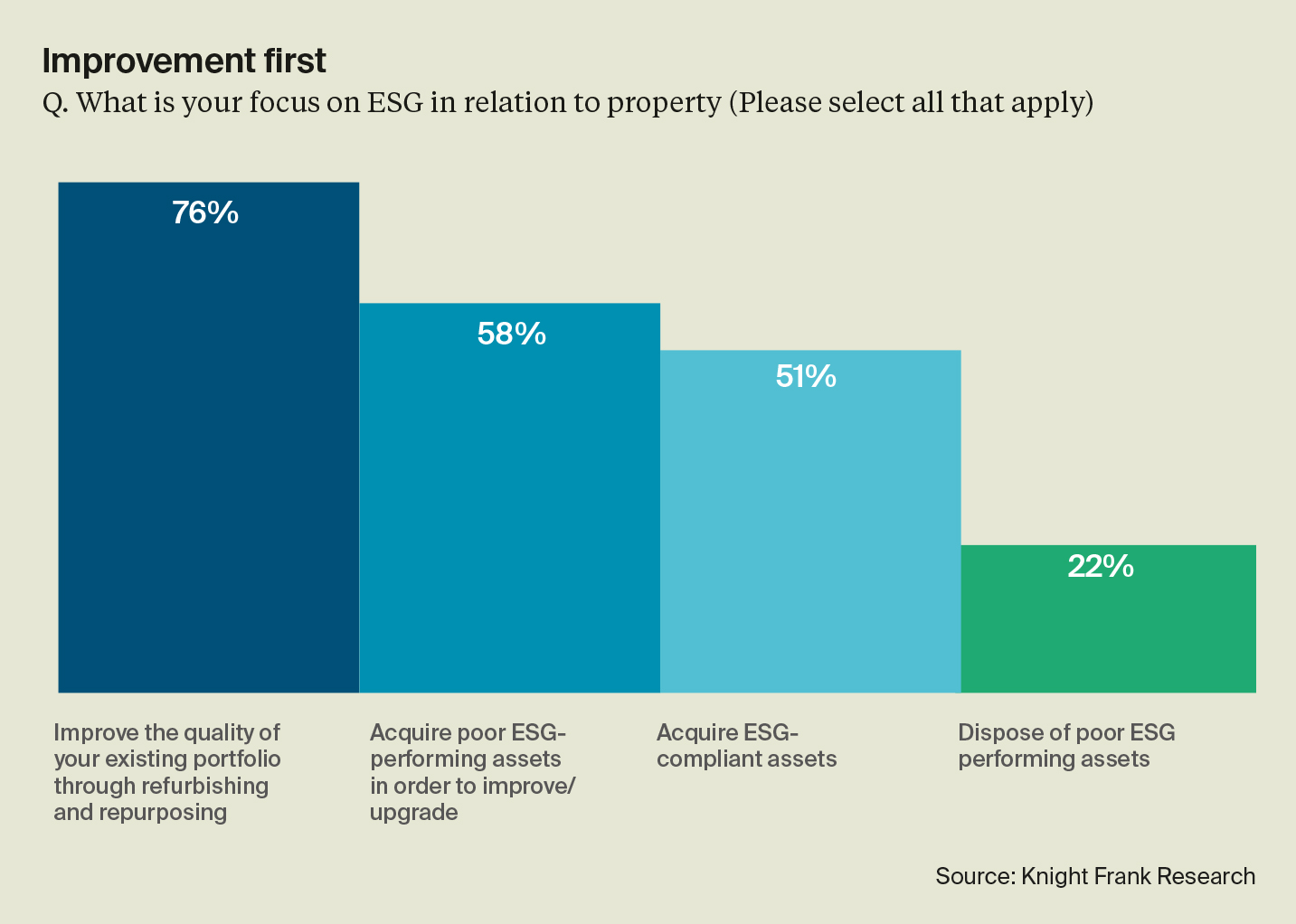

Surveyed investors are actively looking to acquire poor EPC-performing assets to improve/upgrade and reposition, with 58% of respondents saying this.

Several investors have launched ‘impact funds’ to achieve this.

5. Wider adoption of NABERS

The survey showed 44% own or are developing a NABERS-rated building and 68% require energy use data before acquisition.

A wider adoption of NABERS ratings may go some way to enhance the transparency of building performance, in the first instance investors are looking to verify this themselves by assessing energy use data as part of the due diligence process.

6. Green leases to become standard

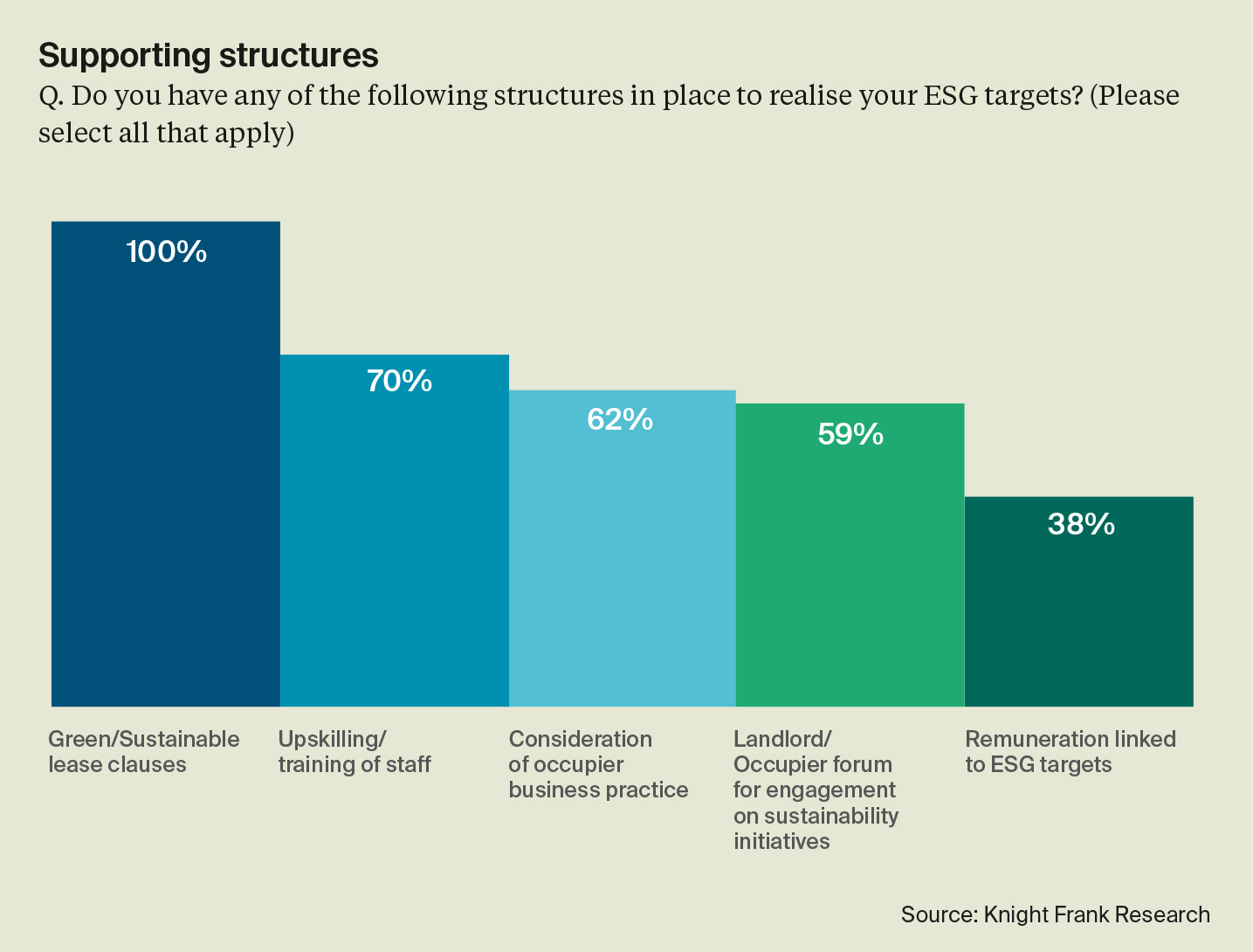

A resounding 100% of our investor sample employ green leases, with 36% associating compensation with ESG objectives.

Green leases are becoming more common because investors see them as a way to meet their ESG goals. These leases typically include provisions for sharing energy, water, and waste data, which is the minimum recommendation from the BBP.

What does the future hold for ESG in real estate?

The drive for net zero and increasing regulatory and occupational requirements are focusing property investors on the efficiency of buildings.

Most are looking to improve the buildings they already own, but when buying new buildings, they often need to consider energy use data, EPC Plus/Pathway reports, and CRREM analysis, among other things.

It is likely we will see this requisite grow as net zero targets draw closer, regulation tightens and industry expertise evolves.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here