Senegal

Senegal’s property market is showing signs of maturity in certain sectors, with the office market experiencing a flight to quality, but the industrial market’s growth is still being hindered by fundamental issues such as traffic congestion and poor parking provisions.

2 minutes to read

Occupier activity focussed on prime offices

Office offerings in the market have been historically dominated by owner-occupied property, usually custom-built. There is a low level of office space constructed for investment purposes, and the bulk of the projects are delivered by indigenous developers.

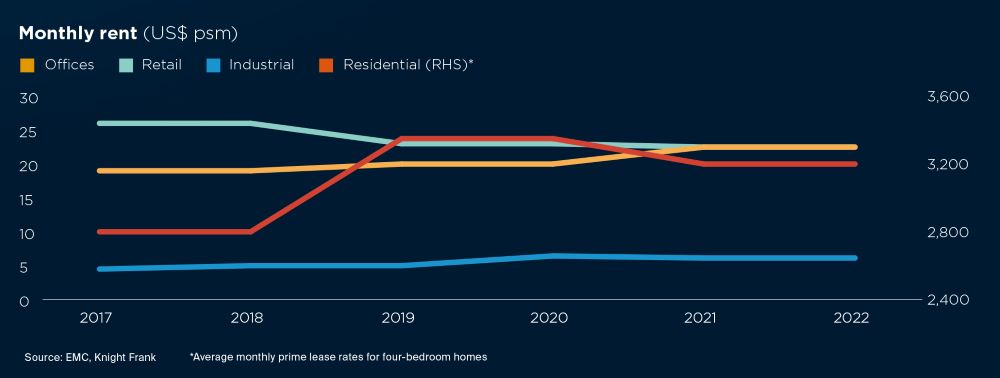

We are, however, beginning to see a shift in the market as some investors are now starting to offer shell and core space in high-quality buildings, with monthly asking rents in excess of US$ 20 psm. The rising rents at the top of the market mirror what we have seen elsewhere, with occupier attention firmly centred on the best office space.

"With the number of planned Grade A office developments limited to a handful of buildings such as the Tour des Mamelles (48,000 sqm), due to complete in 2023, we believe upward pressure on rents for best-in-class space will persist."

Retail activity centred on supermarkets

Retail real estate remains relatively nascent in Dakar, with Teyliom’s Sea Plaza being the only significant mall development; a position it has held since 2010. Brands in the mall include Mango, Hugo Boss, Benetton and Aldo.

Most of the recent retail activity and growth has been in the supermarket sector: Auchan has been the dominant player in terms of food stores, having taken over the operations of the Spanish group, CityDia, in 2017. Auchan has since grown its network from 9 to 32 shops across the cities of Saint Louis, M’bour and Thiès.

Away from Auchan, Carrefour moved into Senegal in 2019, opening a store in Point E adjacent to the Olympic Swimming Pool. CFAO, which is Carrefour’s regional franchisee, has also introduced the discount retailer Supeco in Grand Dakar.

Severe congestion holding back the industrial market

There is a severe dearth of high-quality warehouse space in Dakar. Even stock under development often falls short of international standards. Historic challenges of congestion and a lack of adequate parking continue to hamper the construction of new warehousing stock.

Industrial expansion is however possible outside the city centre, in areas such as Diamniadio and other designated industrial zones, with the former benefiting from its position between the new international airport and the two future major ports, currently being developed by the US and UAE’s DP World. Despite this, there is limited speculative development in these areas, in part due to expensive road tolls to and from Dakar.