Nigeria

Nigeria’s residential market is roaring back to life. The office market is slowly finding its feet in the aftermath of the pandemic, while the industrial sector continues to be plagued by poor infrastructure.

2 minutes to read

Strong demand for high-quality homes

Since the ending of the pandemic-induced lockdowns, there has been a steady increase in residential transactional activity in Lagos and Abuja as life tentatively begins returning to normal.

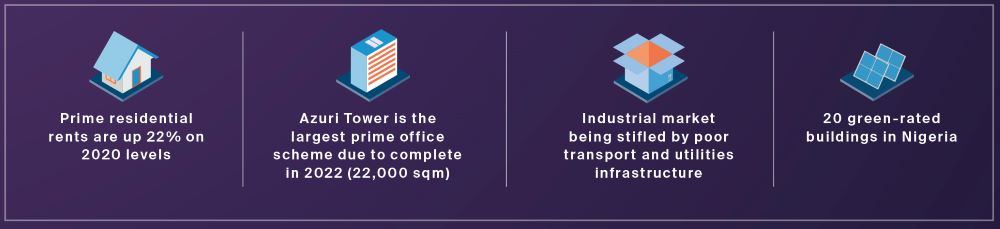

Prime residential rents have also recovered as demand rebounds. Lease rates now stand some 22% above pre-pandemic levels and tenant demand appears unimpacted thus far.

In response to the surging demand for better quality homes, high-end supply is also growing, despite high construction costs. We forecast over 100 apartments to be completed along the 3 km Bourdillon Road in Ikoyi in the next two to four years, for instance.

Subdued office market

Elsewhere, the office market continues to remain subdued as it grapples with the fall-out of the pandemic. The Grade A office market has not been spared either, with weak demand persisting. Some multinational firms are persevering with work-from-home policies, including the seemingly permanent implementation of hybrid working patterns, echoing occupier behaviour globally.

"Despite the subdued conditions, the office market is showing signs of recovery, with an increase new requirements from businesses in the technology and finance sectors, in particular."

- Frank Okosun, Managing Director Knight Frank Nigeria

Domestic occupiers have been quicker to begin the ‘great office reoccupation’; however, some have downsized and continue to reduce their office footprints in an effort to contain costs. Most recent demand stems from businesses linked to the tech and finance and banking sectors.

Industrial sector hamstrung by poor infrastructure

Elsewhere, the industrial market is experiencing rising demand. In line with strengthening global requirements for distribution and storage facilities, there is a rapidly emerging delta between demand and supply, particularly for high quality warehouses.

The demand gap is however not putting upward pressure on lease rates just yet. Inadequate utilities infrastructure and unreliable transportation networks continue to plague the sector and remain a critical drag on the emergence of a vibrant warehousing market.

Retail opportunities in smaller malls

In general, the retail market is still adjusting to the effects of the pandemic, however the luxury goods sector remains one of the worst hit. The tough operating environment, coupled with difficulties exporting FX have caused some retail brands to opt for a franchise model, while some have left the country altogether.

Despite this, the rapidly growing population continues to present an opportunity for retailers and investors, with some responding by targeting smaller neighbourhood malls (under 5,000 sqm) for expansionary projects.

Key asset to watch

Demand for fully furnished, short-let apartments, as well as accommodation for students and young professionals is on the rise, mirroring what we are seeing in rapidly growing markets like Kenya.

Developers are mobilising and we are recording an increase in the number of single-occupancy apartment schemes being brought to market. An example of this includes the recent development of two 20-room hostels in the Yaba Axis, targeting students and young professionals. In addition, some landlords are also converting traditional single-family flats to better match market demand.