Global residential property: potential good news for Brits with second homes in France

Your roundup of the trends shaping global housing markets and the latest market indicators.

4 minutes to read

France

Last week, France’s Senate took its first step towards relaxing the 90 out of every 180-day rule for British visitors, a restriction that came into force on 31 January 2020 following the UK’s departure from the European Union.

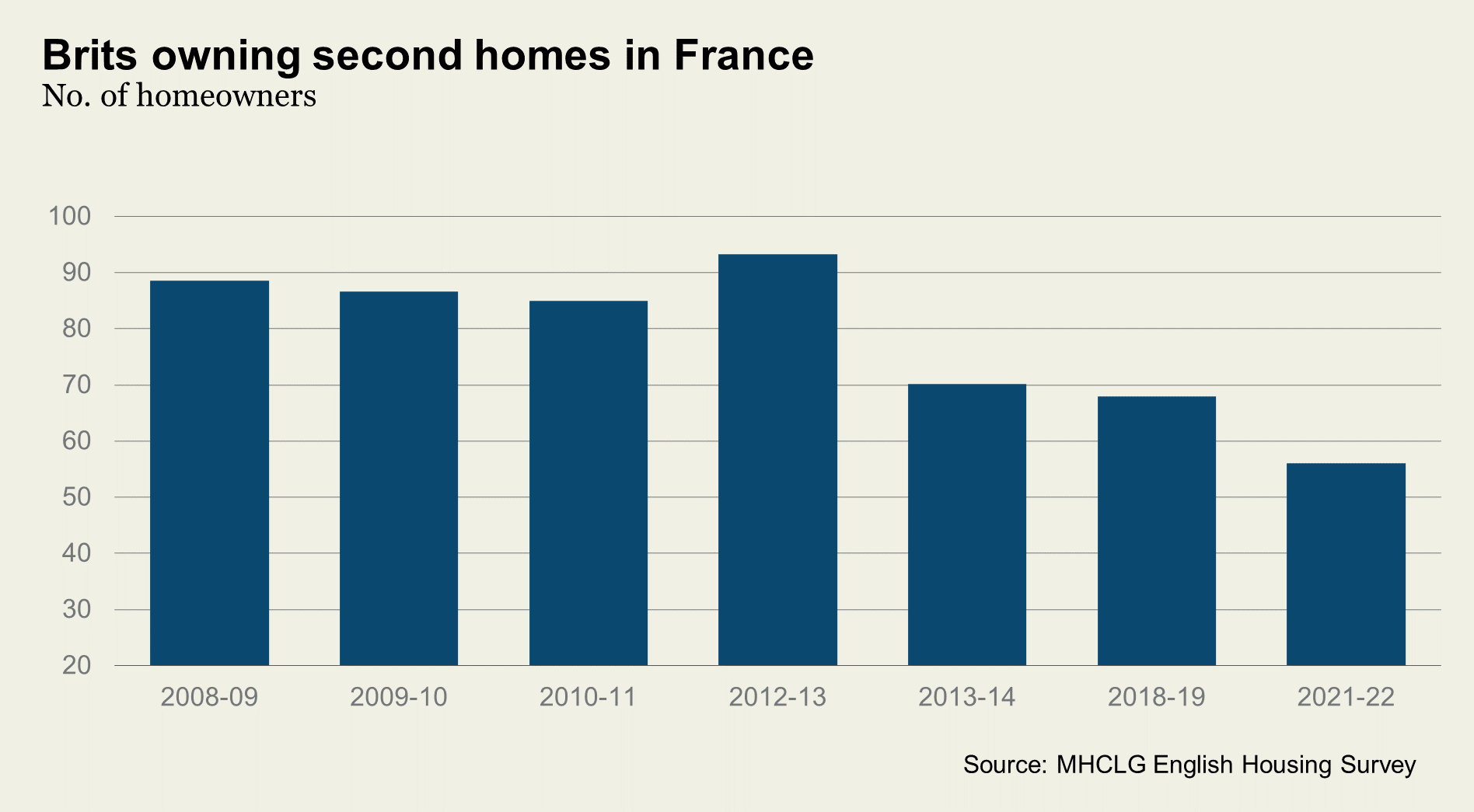

For the 60,000 Brits who own homes in France, down from 89,000 in 2008, the Bill, if passed in December, will grant them an automatic right to a long-stay visa.

Undoubtedly, the motive primarily relates to economics and a concern that vacant properties may increase. However, the ramifications may go beyond France. If the Bill is passed it is likely other European counties such as Italy, Spain and Portugal may follow its lead in relaxing the rules for British homeowners.

According to The Economist, government debt as a share of GDP across the rich world, is higher than at any time since the end of the Napoleonic War and governments, particularly tourist-dependent ones, need to maximise revenue generation and shore up fragile looking housing markets.

Portugal

Portugal’s political chaos may yet add further good news for British expats in Europe.

The ending of the country’s highly attractive non-habitual residence initiative (NHR) which was slated to close at the end of December, has now been called into question.

Introduced in 2009, the NHR allows qualifying foreign residents to take advantage of significant tax savings during their first ten years in Portugal. It includes a 20% flat rate of income tax and exemptions for some private sector pensions.

Elections will now take place in March 2024 and it will take time for a new State Budget to be drafted. This allows potential NHR applicants with a narrow window to progress their move, although there is a chance the brief reprieve could be permanent if the next political incumbent opts for a U-turn.

Florida

Ken Griffin, Jeff Bezos, David Beckham and Lionel Messi can’t all be wrong, can they?

Out this week our new Florida Market Insight report reveals how the sunshine state is not only evolving into a major financial hub for the US, but also the world’s top sporting city.

Key findings:

- The sunshine state is the top destination for overseas buyers purchasing in the US, accounting for 23% of foreign purchases in 2022

- Low taxes and the relocation of firms such as Citadel are boosting Miami's reputation as a financial hub.

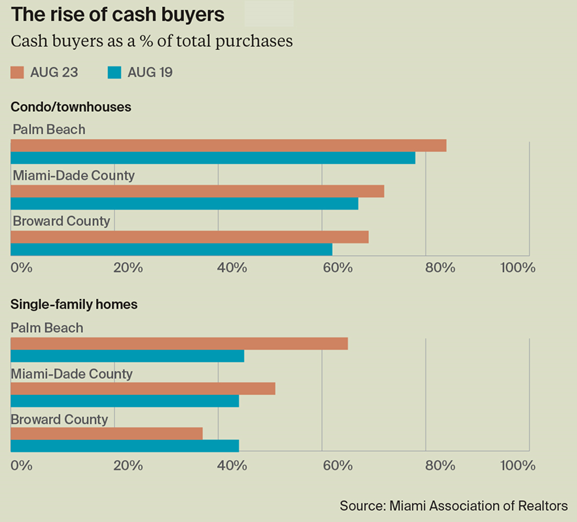

- Cash buyers now account for half of all US$1million-plus sales in South-East Florida.

- Miami is evolving into the sporting capital of the world driving tourism, infrastructure and new revenue streams.

The Alps

Published last week, our Ski Property Report is a must-read for those who own an Alpine property, as well as potential buyers and those simply with a passion for the mountains.

This year, as the spreadsheets were returned by our Alpine teams in late summer (which always seems slightly odd) there was a slight sense of foreboding as we expected a notable slowdown in prices.

Three years of Covid lockdowns, and a shaky start to the last year’s ski season due to low snowfall, means the ski sector has not been without its challenges. Yet, the figures surprised on the upside.

The price of a ski chalet increased by 4.4% on average in the 12 months to June 2023. Except for the pandemic years, it represents the strongest rate of growth since 2014.

As I mention in the report, “The pandemic-induced Alpine mini boom is ending with a fizzle rather than a bang, as limited supply keeps a floor under prices in most markets.”

But the resilience of Alpine prices is also due to the rebranding of ski resorts as year-round destinations, particularly the mid-altitude ones, offering a packed calendar of events for hikers, climbers and cyclists.

Swiss resorts lead our price index this year with Chamonix the frontrunner for the French Alps.

View the full rankings or visit our Ski Property Hub for the results of our Alpine Sentiment Survey, to gauge current market conditions in Aspen or for our Alpine market outlook.

In other news

Spain’s constitutional court rejects challenge over additional wealth tax (International Investment), bankers brace for smaller bonuses (Bloomberg) and property price declines are running out of steam (PrimeResi)

Finally, our new Global Prime Residential Forecast report will be released shortly, sign up here to be the first to receive a copy.