A recovery in mortgage volumes

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The recovery

The UK housing market is recovering gradually from a very slow end to 2022, when activity fell to levels last seen during the early months of the pandemic.

It's a long road back. Lenders approved 43,500 mortgages for house purchases in February, the first monthly increase since August last year, but still well below the pre-pandemic average of about 66,000.

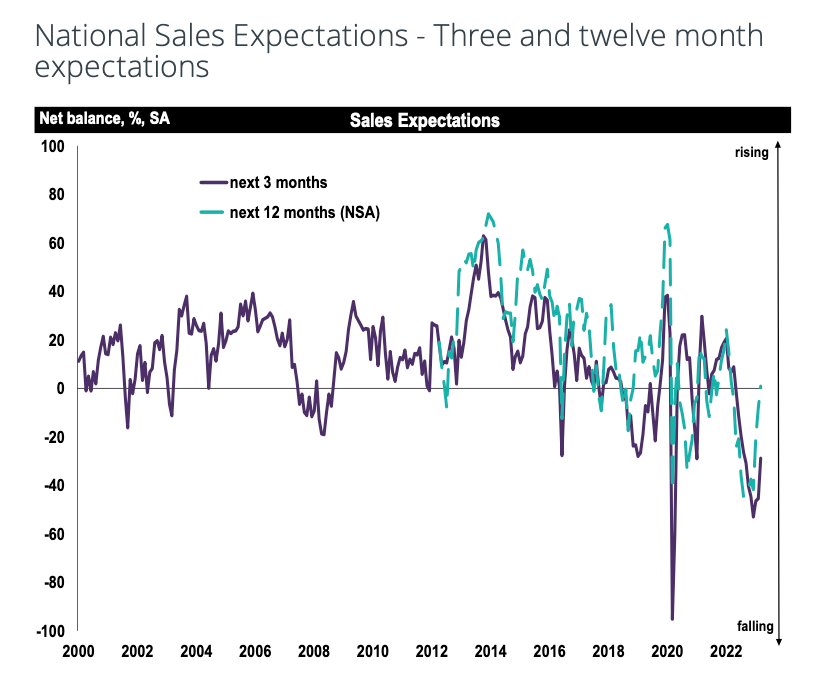

Surveyors and mortgage lenders think the recovery has further to run. The March RICS UK Residential Market Survey, out this week, depicted a broadly weak market backdrop, with indicators on demand, sales, new listings and house prices all in negative territory, but many of the key metrics are improving. Near-term sales expectations returned a net balance of -29, still poor, but far better than the reading of -45% posted in February. At the twelve-month time horizon, the net balance for sales expectations came in at +1%, the first positive reading since March 2022 (see chart).

“Supply, demand and sales volumes are gradually recovering as buyers and sellers come to terms with higher mortgage rates but prices are likely to fall by a few per cent as more distress enters the system,” Knight Frank's Tom Bill told the FT.

Demand for mortgages

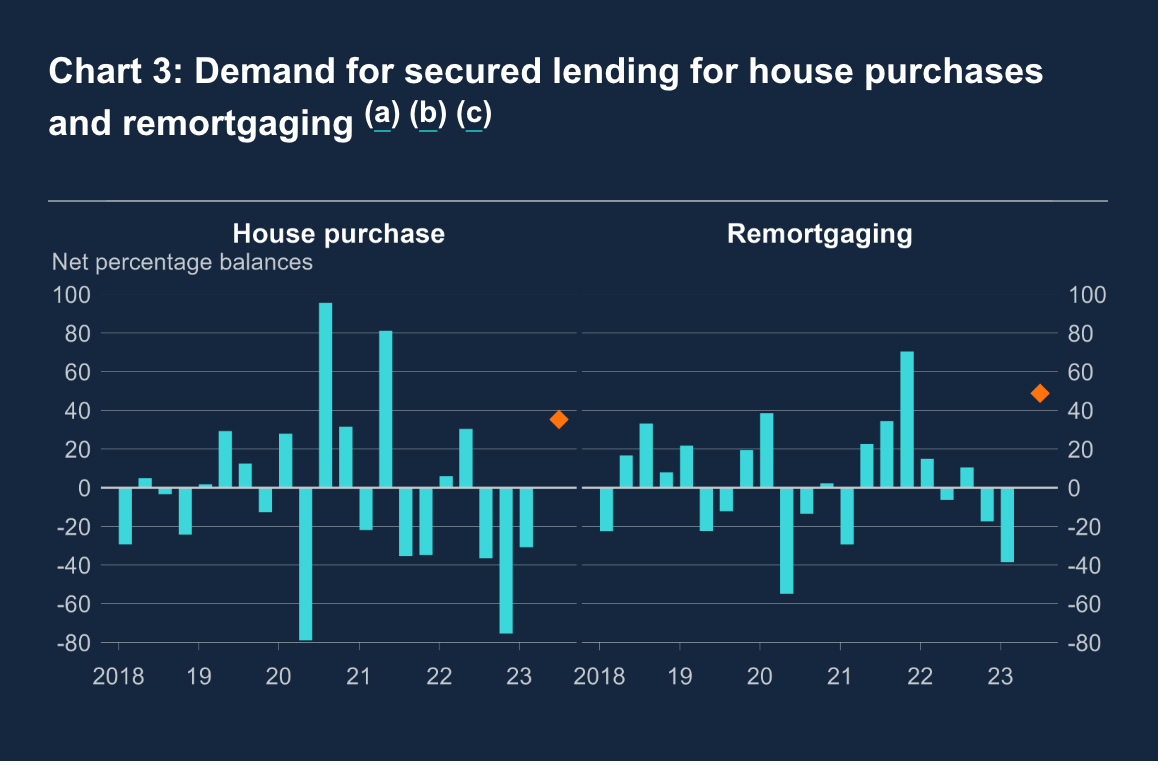

Lenders are expecting a pick-up in demand for mortgages during the next three months, according to a Bank of England survey published yesterday.

After reporting falling demand in Q4 2022 and again in Q1 2023, a sizable number of respondents anticipate that demand for both remortgaging and house purchase will pick up during Q2 (see orange diamonds on the charts below).

Whether the availability of credit will meet demand is another matter. The volume of secured credit to households remained broadly unchanged in the three months through February. Lenders expect a decrease in availability during the next three months, though there are few signs yet of the much mooted tightening of credit conditions following the collapse of Credit Suisse.

Breathing space

As Tom Bill notes above, the recovery has been underpinned by borrowers coming to terms with higher mortgage rates, but also growing confidence that interest rates are nearing a peak.

Mortgage rates have been stable for several weeks, and falling inflation and a cooling jobs market are likely to give Bank of England policymakers more breathing room at coming meetings. The latest Recruitment and Employment Confederation/KPMG survey, out this week, showed pay growth slowing and an easing in the shortage of candidates for the first time in two years. Increases in starting salaries for permanent staff were the second-weakest in nearly two years.

Economists, too, are predicting that the UK labour market is at a turning point - the FT provides a good overview here. Investors are currently betting that the base rate will peak as high as 4.75%, up from where it currently sits at 4.25%.

We talked earlier this month about the gradually expanding group of central banks that are opting to pause their cycle of interest rate hikes as inflation eases and pockets of financial system stress emerge. Whether the US Federal Reserve would be next on May 3rd has been a source of speculation for several weeks, though the probability of a pause has eased a little recently. Minutes from last month's meeting, published yesterday showed that several policymakers were tempted to pause.

Holiday lets

The government is considering a clamp down on short term lets in tourist hot spots.

Proposals in a consultation published yesterday include introducing planning permission for an existing home to be used as a short term let, though homeowners could be given flexibility to let out their home for a specified number of days in a calendar year without seeking permission.

The government says it's introducing the policy after listening to local people in popular tourist locations that say they are priced out of homes to rent or buy within a reasonable distance from where they work.

It’s unlikely that the clampdown will have the required impact on affordability. “It doesn’t matter how you change the planning laws, there will be someone who is willing to pay more money than the locals in order to secure a prime property,” Knight Frank's Christopher Bailey tells the FT.

Demand for land

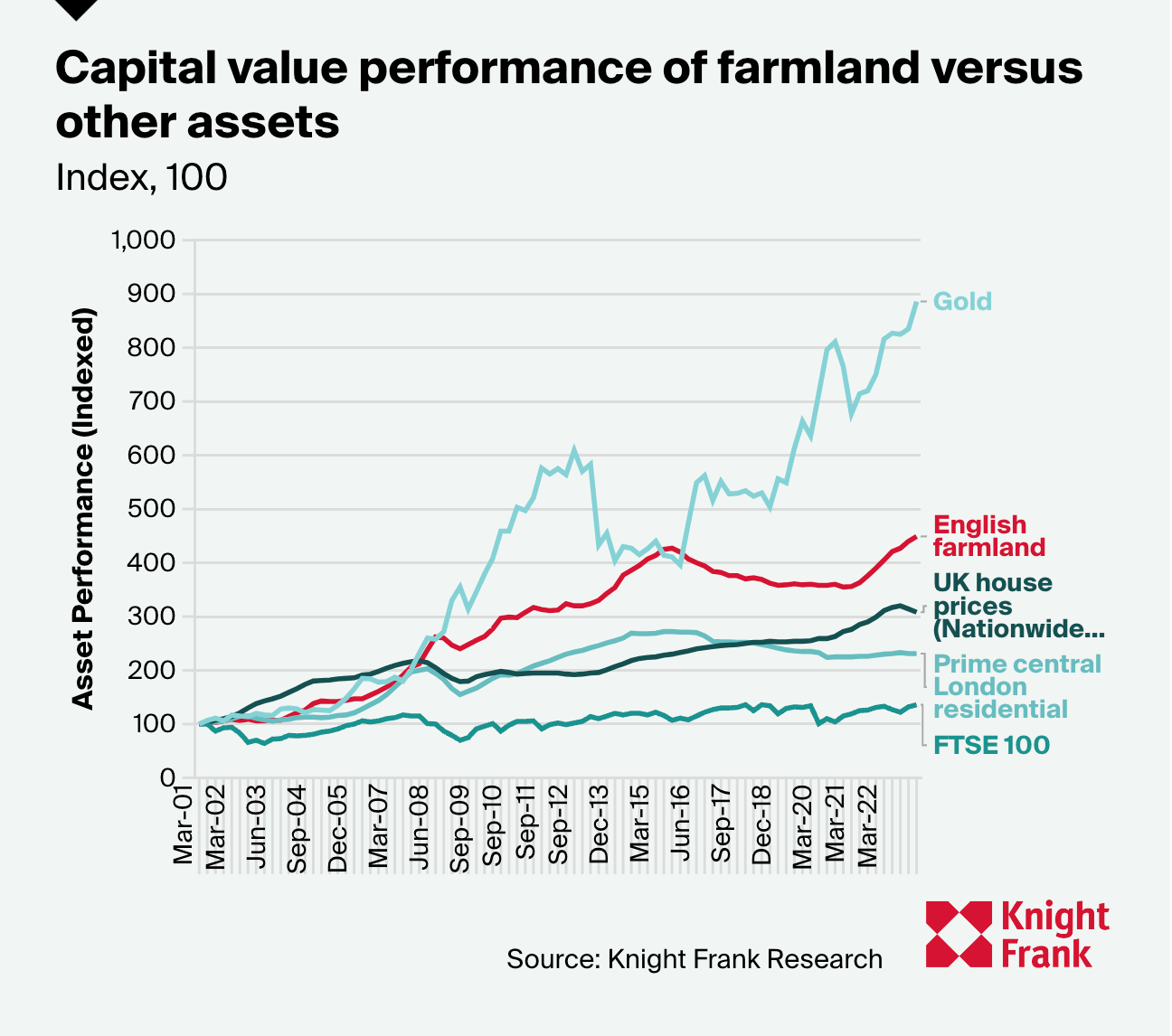

A shortage of supply continues to underpin the value of farmland in England and Wales. The Knight Frank Farmland Index rose 2% during Q1 compared to the previous quarter, capping 11% growth for the year (see chart).

Although supply is up compared to 12-months earlier, the volume of land for sale is still at historically low levels. Purchases by environmentally focussed buyers, including natural capital investors and funds, have generated a great deal of interest, however they are far from dominating the market and, more often than not, are being outbid by more ‘traditional’ tax-driven, farmer or amenity buyers, according to Andrew Shirley.

We do expect the volume of land for sale to continue rising as more farmers approaching retirement take advantage of current market conditions to exit the industry before the next general election and a potential change of government.

In other news...

GPE reports record leasing year (Company Release), low heat pump uptake ‘an embarrassment’ (Times), and finally, shadow lenders to bridge real estate void left by banks, bonds (Bloomberg).