The ECB is worried about real estate investment funds

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Taking a breather

Many of the world's major central banks are on the verge of pausing their cycle of interest rate hikes as inflation eases and pockets of stress emerge.

The Bank of Canada left interest rates unchanged at 4.5% in March. Australia followed suit yesterday, ending a run of ten consecutive hikes to leave the cash rate unchanged at 3.6%.

The nations share common themes that are also prevalent in the UK, the US and most other major economies. Unemployment rates are near record lows and surveys suggest that companies are managing well under the circumstances. Inflation is running at an annual rate of 5.2% in Canada and 6.8% in Australia, slowing but well above target.

All of that generates pressure to keep tightening, but it's clear that the banking crisis changed the picture meaningfully. Plus, domestic pockets of stress have emerged. Homebuilders in Australia are cause for concern after the collapse of Porter Davis last week, for example. Signs that the Federal Reserve is nearing the end of its cycle has also granted central bankers some breathing room.

The UK perspective

The Bank of England isn't quite there yet, at least not according to Huw Pill, the Bank's chief economist.

"On balance the onus remains on ensuring enough monetary tightening is delivered to ‘see the job through’ and sustainably return inflation to target," he told the Graduate Institute in Geneva yesterday.

That's perhaps unsurprising given inflation climbed to 10.4% in the year to February, breaking three months of declines. Sterling climbed above $1.25 for the first time since June 2022 around the time that Mr Pill's comments were published - a sign that investors believe interest rates have further to rise.

Yesterday's survey of more than 5,200 firms by the British Chambers of Commerce suggests the economy is performing far better than looked likely only a few months ago, giving the Bank more leeway to continue tightening. More than half of of respondents - 92% of whom are are small and medium-sized businesses - believe their business turnover will increase over the next 12 months, up from 44% in Q3 2022.

The US jobs market

Whether the Federal Reserve opts to pause in May looks finely balanced. Market pricing implies a 57% probability that we'll see the Fed vote to hold rates at a range of 4.75%-5.00% at its next meeting on May 3rd.

That probability moved higher yesterday after publication of the Labor Department's Job Openings and Labor Turnover Survey, which revealed a significant cooling in the jobs market. There were 9.9 million job openings in February, down from 10.6million on the last day of January. That's equivalent to about 1.7 jobs open for every unemployed worker, a decline from 1.9 in January. We'll know more when we see the more detailed jobs report this Friday.

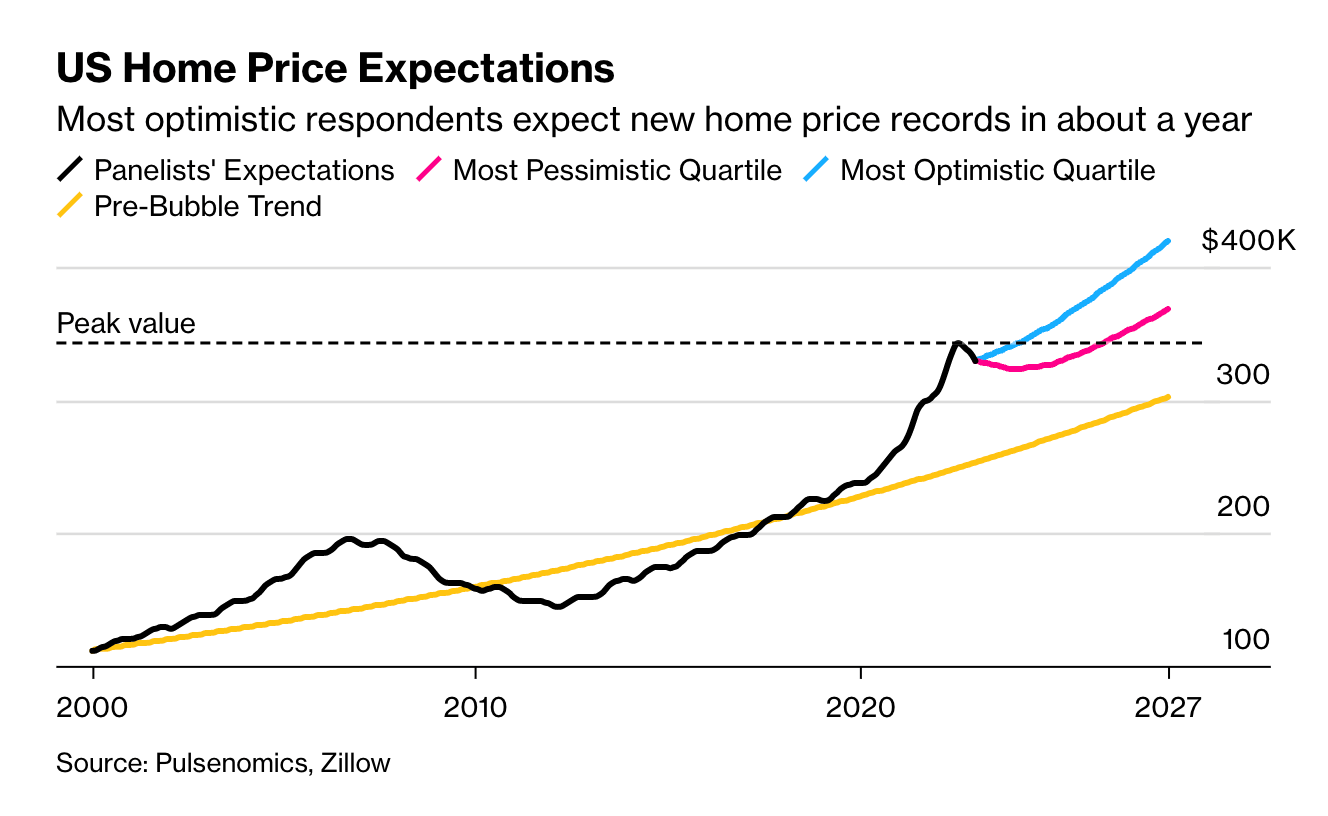

The construction industry is an outlier - job openings increasing by 129,000 in February. That tallies with surveys showing sentiment among homebuilders has increased for three consecutive months. A separate poll of 107 economists, real estate professionals and professors conducted by Pulsenomics suggests that the housing market is finding its feet. Respondents believe we'll see a 2% fall in values this year, a gain of 1.2% next year, before pricings climb at an annual rate of 4% for the following three years (see chart courtesy of Bloomberg).

Illiquidity

Silicon Valley Bank collapsed in part because it held a very large portfolio of fairly illiquid assets and large numbers of its customers asked to withdraw money at the same time. It couldn't meet those withdrawal requests, so the California Department of Financial Protection and Innovation shut it down.

Regulators have faced criticism for seemingly being unaware that the model posed risks of a liquidity crisis. The situation looks likely to prompt greater scrutiny of banks and funds that hold fairly illiquid portfolios while allowing regular or immediate withdrawals.

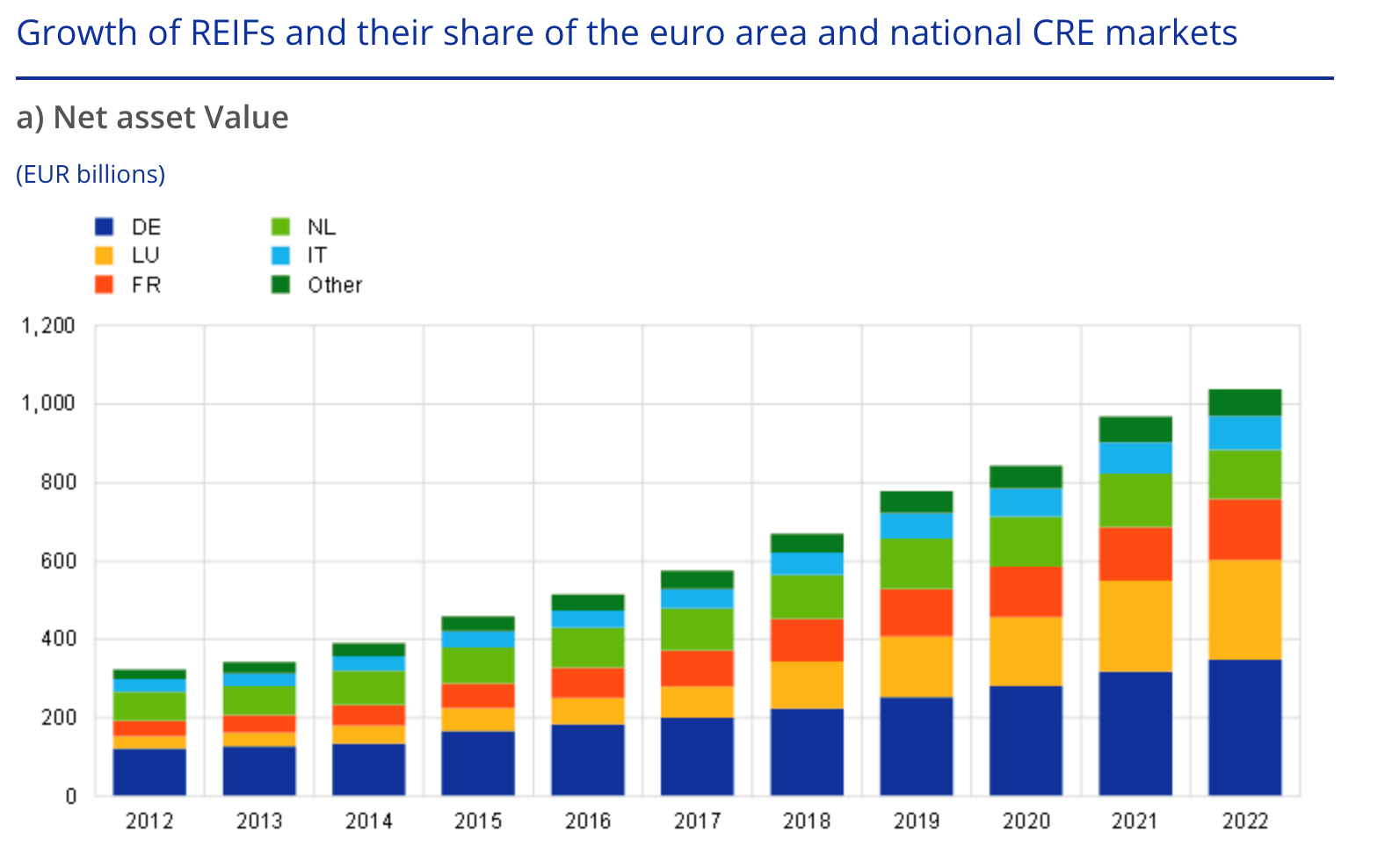

The European Central Bank is worried about real estate investment funds (REIFs). The REIF sector has grown significantly in the past decade and now accounts for 40% of CRE markets in the euro area (see chart). The funds "are exposed to liquidity risk when they offer frequent redemptions, which could affect the stability of CRE markets", the ECB says.

Indeed, this is an issue already playing out, and many major funds have imposed "redemption gates" following increases in redemption requests "triggered initially by the gilt turmoil and more recently by macro-financial uncertainty and the negative CRE market outlook."

The Bank calls for the implementation of new policies "to address the structural vulnerabilities" of open-ended property funds. Those policies could “manage spikes in liquidity demands and to internalise the cost of redemptions which can arise during market stress.”

In other news...

Seize property to build wind and solar farms, says JP Morgan chief (Telegraph), EU housing market boom ends with first quarterly price fall since 2015 (FT), and finally, more homes come on to the UK market as pressures ease (FT).