The Wealth Report: is prime property well placed to weather the storm?

In this edition we focus on the outlook for luxury housing markets in the teeth of rising interest rates, consider the economic conditions influencing the world’s biggest private investor group and take a look at the outlook for crypto.

4 minutes to read

Cracks emerge...

The fragility of property values in the face of rising interest rates will be among the dominant global themes of 2023.

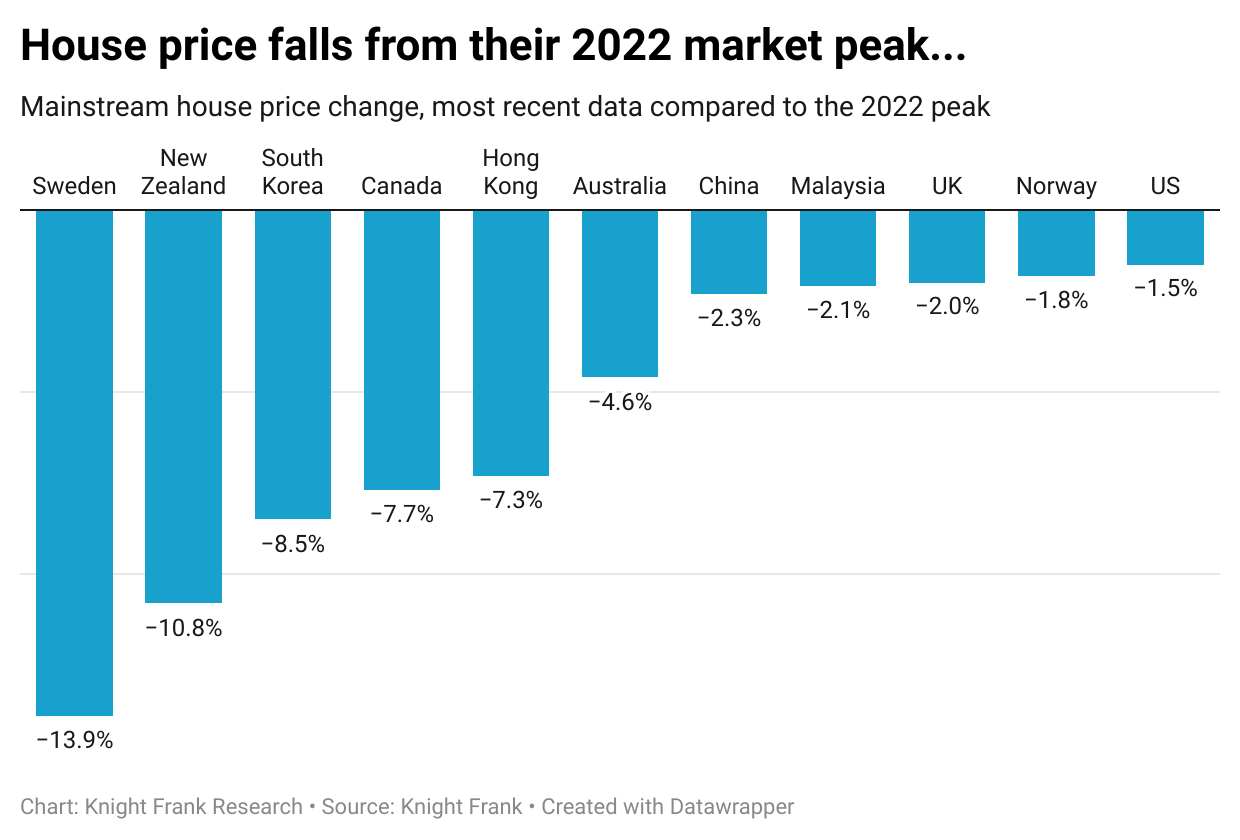

Where many housing markets saw growth of 30% or more during the pandemic, a reversal has begun. Cracks emerged in New Zealand, Canada and Australia around the beginning of 2022 - all markets where the cost of mortgage debt had risen sharply. Pressure spread through other markets as central banks stepped up their fight against inflation, as the chart below shows.

There are likely to be more reversals ahead, as rates continue to rise globally...

Prime resilience

Several major mainstream housing markets will see double-digit peak to trough falls. Australia’s central bank suggests declines could reach 20%, the Royal Bank of Canada forecasts cumulative falls of 14%, and mainstream prices in the UK and US look likely to decline by at least 10% each.

Prime property markets, however, look set to outperform. While they are not immune from the realities of higher debt costs, the relative affluence of buyers in these markets does provide some protection, as Ollie Knight explained last week.

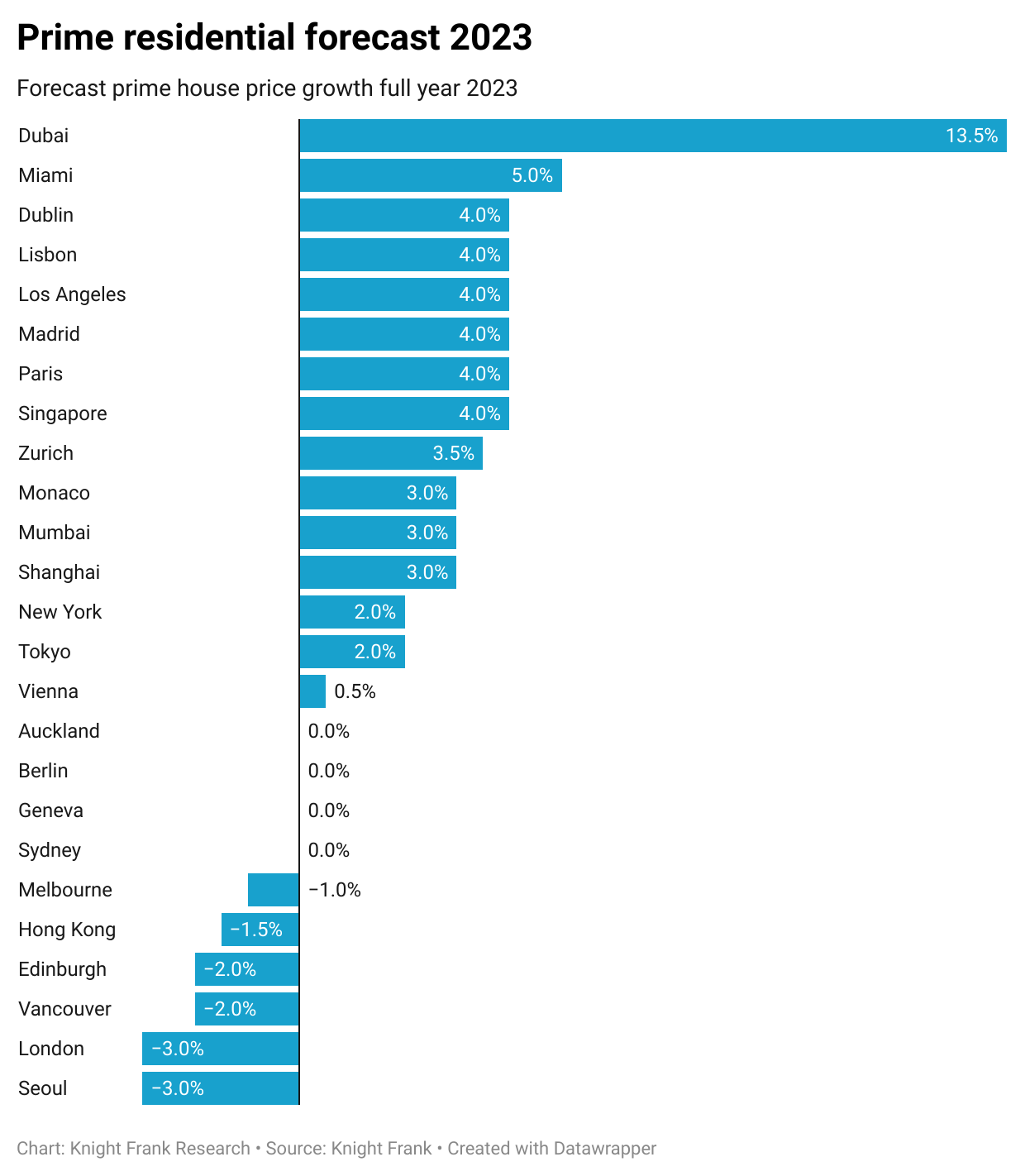

To help us understand how these markets are likely to perform over the next 12-months my colleague Kate Everett-Allen has just released Knight Frank’s Prime Residential Forecast for 2023.

Kate’s numbers cover 25 global city markets and confirm six markets where prices are likely to fall next year, four where prices will likely remain unchanged and 15 where prices are looking set to rise, albeit modestly in most cases: -

Dubai, with healthy demand set against limited luxury market supply, leads our 2023 forecast with predicted annual growth of 13.5%. Miami’s 5% prediction, together with a cluster of cities tipped to grow at 4%, including Dublin, Los Angeles, and Singapore, points to the resilience of markets benefiting from economic outperformance.

Price falls are expected in London, Seoul, Melbourne, Vancouver, and Hong Kong.

It could have been worse...

The headwinds facing the global economy are substantial and a more severe market slowdown could have occurred under similar circumstances, however several factors have put a floor under pricing, including tight supply, the search for income from investors, and demand sparked by currency swings.

Low supply has been a constant feature of prime markets for the past two years. In central London, for example, stock volumes were 33% below their pre-pandemic average earlier this year and are still running 24% below trend. Despite the best efforts of the UK Government to spook buyers, the volume of new purchaser registrations remains 50% above the long-term average, suggesting prices will at least partially be supported by an ongoing mismatch between demand and supply.

In addition to our forecast, Kate’s report also covers our first Global HNWI Pulse Survey. The survey summarises the views of wealthy residents on the threats and opportunities they see in the housing sector globally - as well as confirming the most in-demand cities for wealthy buyers – spoiler homeowners in London will be pleased to know they live in the most globally in-demand city. Access the full report here.

China watchers...

China is arguably the most pivotal market for the world’s prime residential market, in terms of buyer demand. How domestic economic conditions develop over the next year will be a significant influence on global market performance.

China's attempts to get a grip on several, interconnected crises has left investors with more questions than answers. Chinese property developer stocks soared earlier this month after the government unveiled a 16-point plan aimed at stabilising the property sector. Crucially for the sector, the plan postponed certain lending restrictions that were restricting developers and purchasers of liquidity.

Rumours that zero-Covid regulations could be meaningfully eased added fuel to the rally, but fresh lockdowns were introduced on November 23rd and 24th and protests began in several large cities including Shanghai and Beijing. That, plus rapidly souring economic data across major global economies, pushed the price of oil to lows not seen for more than a year.

Most regional stock markets came under pressure during trading on Monday the 28th, but there are investors taking the view that the continued spread of unrest will bring about some easing in restrictions. Shares in tour operators, airlines and airports all rose on the news.

We've talked before about real estate's evolving contribution to China's growth and why the government is so eager to avoid a protracted downturn. Residential investment now accounts for a much larger share of GDP than other major economies - so much so that the fall in investment between 2020 and 2021 is likely to have cost between 1% and 1.5% of GDP during the twelve-month period, according to The Bank for International Settlements (BIS).