Prime global city rents soar and UK house price growth continues

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Global prime rents

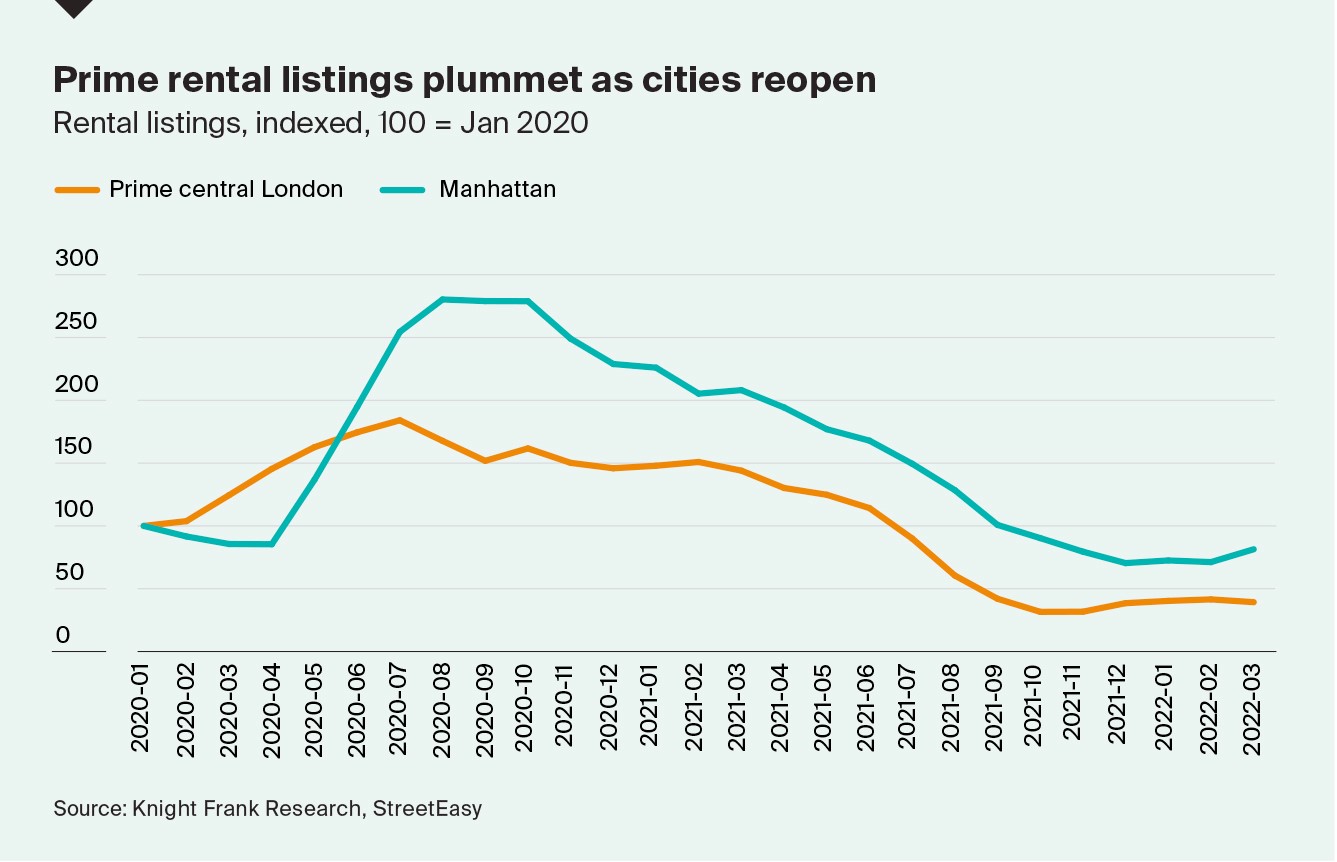

Our new Prime Global Rental Index reveals the extent to which top tier cities are seeing demand return and stock dwindle as workers, international students and corporate tenants return to the prime end of the market.

New York and London lead the rankings with rents up 38.5% and 26.4% respectively in the year to Q1 2022. Toronto and Singapore also registered double-digit growth over the period.

The lifting of Covid-19 restrictions and a lack of supply, in part borne out by a sales boom that motivated some landlords to sell, have both been key (see chart). The surge reflects a reversal of large falls in 2020, which helped attract tenants back to the city. However, with rents now reaching pre-pandemic levels, economic growth slowing and the labour market weakening, we expect prime rental growth to cool rapidly over the remainder of 2022.

House price forecasts

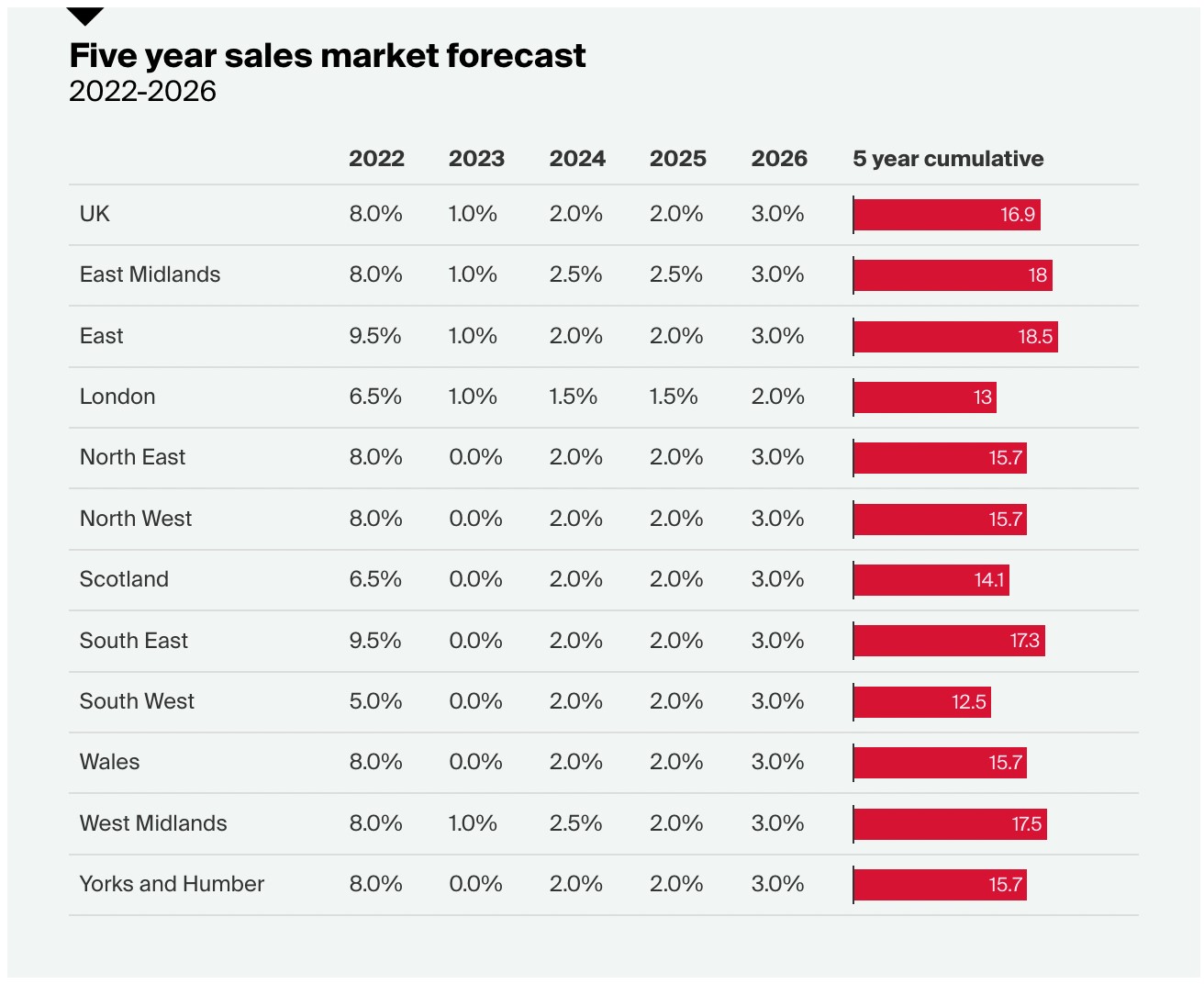

Housing market statistics continue to look positive in sharp contrast to other UK economic indicators.

With inflation at a 40-year high and interest rates at their steepest in 13 years, annual house price growth rose to 12.4% in April, data from the ONS showed last week. The housing market is clearly taking longer than anticipated to recover from the distortions caused by the pandemic and stamp duty holiday.

We have therefore revised up our UK house price forecast for 2022 to 8% from 5%, following our latest quarterly review. The new regional breakdown for 2022 can be seen below. All subsequent years are unchanged.

You can read more of our analysis here.

Engineering a soft landing

From a global economic perspective, one of two things is going to happen over the coming months.

In one scenario, inflationary pressures slow as pandemic-induced bottlenecks fall away and the war's impact on commodity prices eases, all of which enables central banks to take their foot off the gas, leaving interest rates lower than they otherwise might have been - a soft landing. In the second, inflation becomes entrenched and prompts a faster tightening of monetary policy, triggering a recession and financial stress - a hard landing.

The Bank for International Settlements (BIS), often referred to as the central bank for central banks, releases an influential report each year, and the 2022 edition - out yesterday - focuses on the likelihood of each scenario and what central banks can do about it. The report runs to more than a hundred pages, but the core message is a clear warning to central banks against reacting too slowly. A key quote:

"Gradually raising policy rates at a pace that falls short of inflation increases means falling real interest rates. This is hard to reconcile with the need to keep inflation risks in check. Given the extent of the inflationary pressure unleashed over the past year, real policy rates will need to increase significantly in order to moderate demand. Delaying the necessary adjustment heightens the likelihood that even larger and more costly future policy rate increases will be required, particularly if inflation becomes entrenched in household and firm behaviour and inflation expectations."

Or from BIS General Manager Agustin Carstens during a press conference:

“One strong result that we have obtained by our analysis of a soft versus a hard landing is that you are more likely to be on the soft landing side if you tighten in a timely and decisive fashion.”

Residential dominance in China

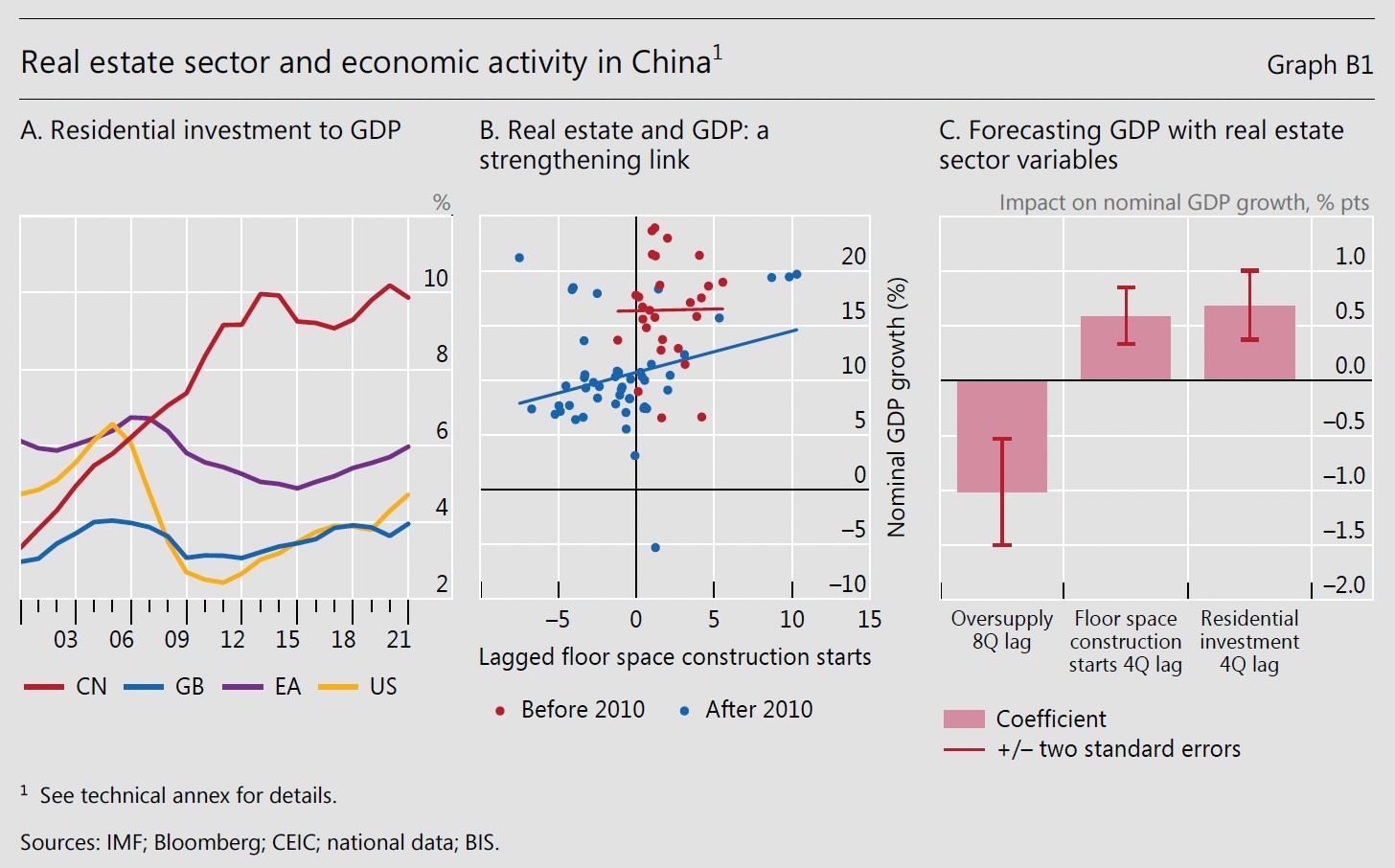

The BIS report includes analysis of real estate's evolving contribution to China's growth (p.18), and illustrates why a property market slowdown is so important from a global economic perspective.

Residential investment increased steadily through the first decade of the 2000s and now accounts for a much larger share of GDP than other major economies (see chart A below). From 2010 onwards, a "significant link" emerged between housing market activity, such as construction starts measured by total floorspace, and economic output.

That link is now so strong that the prevailing housing slowdown is likely to have had a material effect on China's growth over the past year. Had floor space starts and residential investment remained at 2018-2019 levels, year-on-year GDP growth would have been 1% - 1.5% higher in 2021, BIS estimates.

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up below.

Subscribe to our newsletter

In other news...

The UK's disappointing, rather than disastrous, retail figures.

The hybrid Spanish retail market rallies investors.

Luxury brands are tempted by the Paris retail market.

Elsewhere - why you will need another £4,000 a year to afford your first home (Telegraph), the Fed confronts a new world of inflation (NYT), and finally, China's economy improves in June (Bloomberg).