Luxury brands tempted to Paris retail market

Upturn in footfall is encouraging retailers to expand.

5 minutes to read

After a positive end to 2021, the situation for Paris's major retail districts improved again in the first half of 2022, despite the threats posed by the global political and economic situation. The upswing in footfall is one of the main reasons for this, with the retail market benefiting from both the return of employees to offices and the recovery in international tourism.

Nevertheless, "Parisian business is not suffering as badly as we feared from this temporary drop in international customers. After more than three difficult years, impacted by the "Gilets jaunes" (Yellow Vest) movement and then by the Covid-19 pandemic, real estate demand from retailers is bouncing back thanks to the improvement in the health crisis and the return of tourists, as well as more favourable negotiating conditions for tenants due to the adjustment of rental values," explains Antoine Salmon, director of the Retail Leasing Department at Knight Frank France.

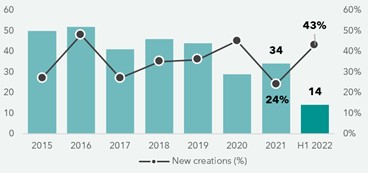

After the drop in 2020 (with only 16 new arrivals), 2021 saw a rebound in the number of new entrants in the retail market with a total of 26 arrivals including several express delivery players opening their first "dark stores" (FLINK, GETIR, GORILLAS, etc.).

While the inflow of new express delivery service concepts has dried up, that of traditional retailers has increased. In the first half of 2022, there were 14 new arrivals in Paris, and there will be at least as many in the second half. Many of these new brands belong to the fashion and sportswear/streetwear sectors.

Luxury: the big moves continue

The list of new entrants recently established in Paris or expected by the end of 2022 includes a significant number of high-end or luxury brands, in various sectors such as home appliances, jewellery, footwear, or even art with the announcement of the inauguration of the first HAUSER & WIRTH gallery at 26 bis rue François 1er.

The major Right Bank shopping streets still account for the vast majority of openings. On Rue Saint-Honoré, KERING is strengthening its position with the expansion of ALEXANDER MCQUEEN at 372-374 and the planned arrival of GUCCI at the corner of Rue Castiglione.

The Golden Triangle is also very lively: rue François 1er, avenue George V and avenue Montaigne account for nearly a third of the luxury stores expected to open in Paris in 2022. Avenue Montaigne is particularly busy with the inauguration of major brands following renovation and extension (DIOR at no. 30-32), transfers (JIMMY CHOO at no. 41) and pop-up stores (TIFFANY at no. 34, FENDACE at no. 44).

Evolution of the number of luxury store openings in Paris*

Source: Knight Frank / Creations, renovations-extensions, transfers and pop-up stores

Unlike previous years, the dynamism of the luxury market is also spreading to the left bank. At the turn of the 2010s, rue de Sèvres and boulevard Saint-Germain saw an increase in the number of prestigious retailers before falling back into a certain drowsiness, coinciding notably with the closure of “Le Lutetia” luxury hotel for refurbishment. Four years after the reopening of the only "palace" status luxury hotel on the Left Bank, the neighbourhood is experiencing a resurgence in interest illustrated by a handful of significant projects.

Evolution of the number of new foreign retailers in Paris

Source: Knight Frank

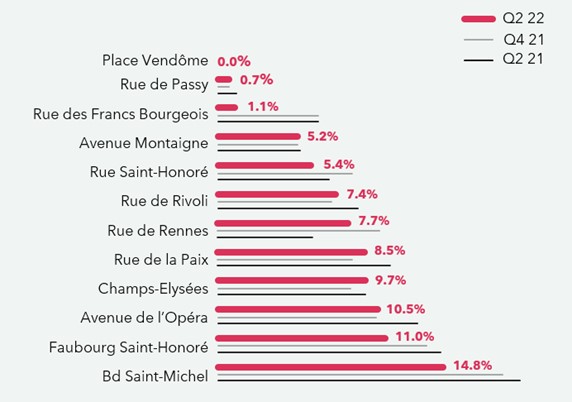

A drop in overall vacancy

The upturn in activity in the luxury sector has been accompanied by a fall in vacancy rates on a few prestigious streets such as rue Saint-Honoré (down from 8.8% to 5.4% since the end of 2021), rue du Faubourg Saint-Honoré (from 13.7% to 11.0%) and rue de la Paix (from 10.6% to 8.5%). Elsewhere, vacancy is non-existent (Place Vendôme) or very limited (Avenue Montaigne).

Evolution of the vacancy rate on some of the major Parisian shopping streets

Source: Knight Frank /*Prime section of the street / NB : the rate indicated is for Q2 2022

The situation remains very disparate mixed outside the luxury districts. The recovery in demand from retailers is in fact patchy; they are prioritising the best locations, which has the effect of keeping vacancy rates at sometimes high levels.

This is the case for Boulevard Saint-Michel: despite a significant drop of 5 points, it is still at 14.8%, and the recent movements are concentrated in its busiest section, the stretch between Boulevard Saint-Germain and the banks of the river Seine.

Elsewhere, the trend is also moving towards a decrease or stabilisation in the share of available space. This is the case for some of the major Parisian mass-market highstreets, such as rue de Rennes and rue de Rivoli, where the vacancy rate has stabilised at around 7.5%, and avenue de l'Opéra, where it remains slightly above 10%.

Finally, the vacancy rate is almost zero on rue de Passy, as well as on rue des Francs Bourgeois, where it has fallen from 6.6% to 1.1% in just one year, whilst still exceeding 10% in other streets in the Marais (12.9% on rue des Archives).

After several significant transactions in 2021 (PSG at no. 92, FOOT LOCKER at no. 36), the first half of 2022 has already been marked by several important transactions, including ZARA's lease of nearly 3,000 sq.m. at no. 74, where the Spanish brand will open in 2023 over twice the surface area of its current store at no. 92. ZARA is also preparing a 1,500 sq.m. extension of its store at 88 rue de Rivoli. More than ever, the brand is making the flagship store its strategic format, enabling it to expand and modernise by deploying new concepts that combine the physical and digital.