Prime Global Forecast 2021

Knight Frank’s analysts provide their prime residential price forecasts for 2021 and assess future market drivers

2 minutes to read

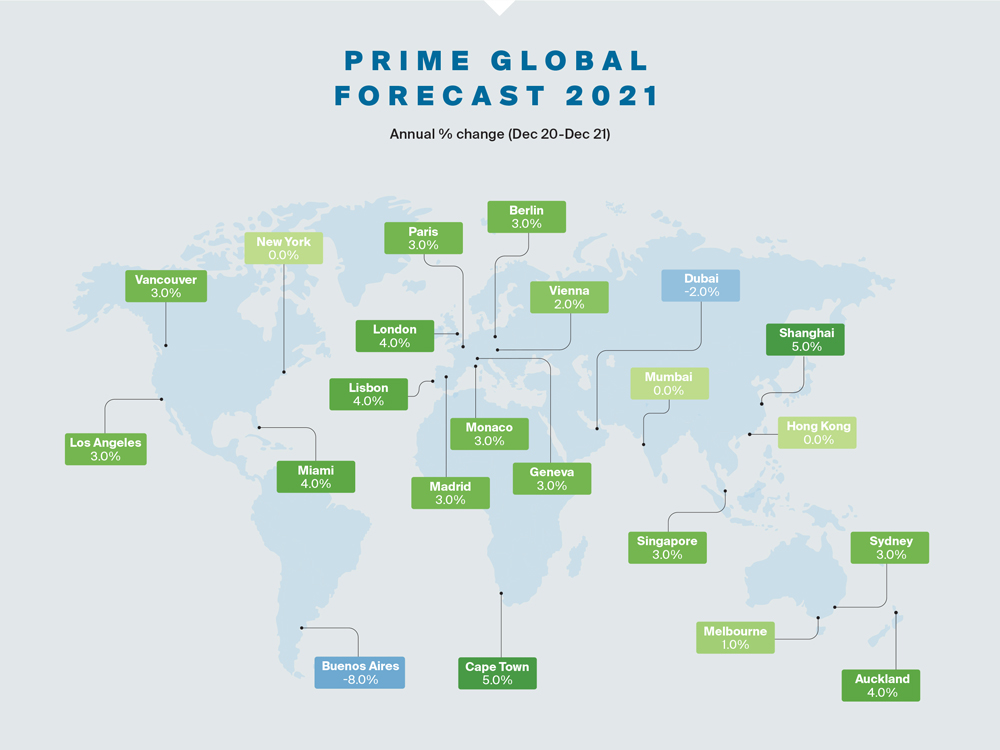

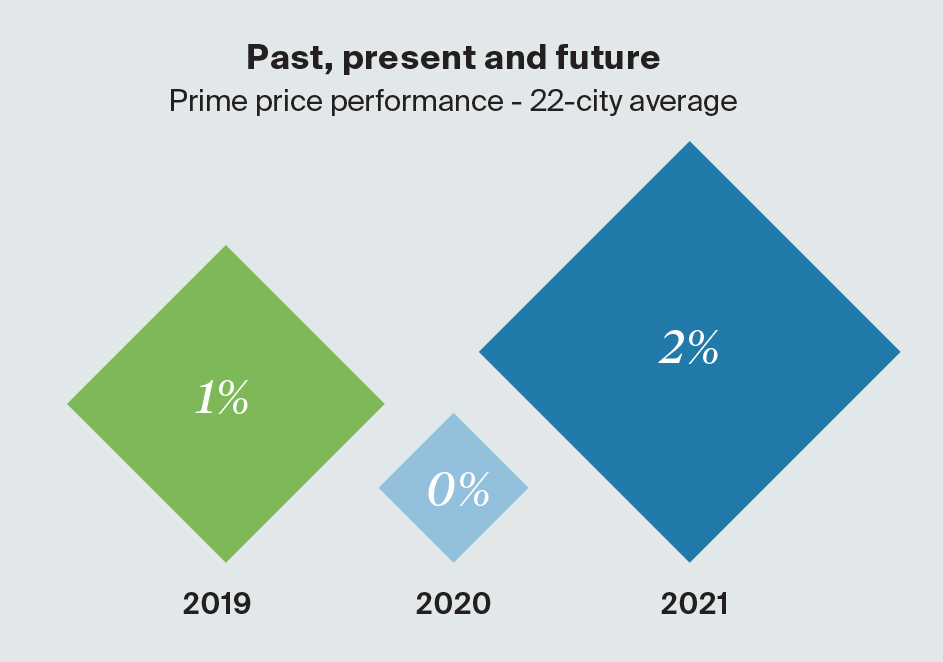

In 2021, we expect 20 of the 22 cities to see prices remain flat or increase, a slight reversal of the trend seen in 2020 when we expect nine cities to end the year with lower prices. In 2020, prime prices across the 22 cities are, on average, expected to remain static, before rising by 2% in 2021.

Shanghai and Cape Town lead the forecast for 2021 with annual price growth of 5% forecast.

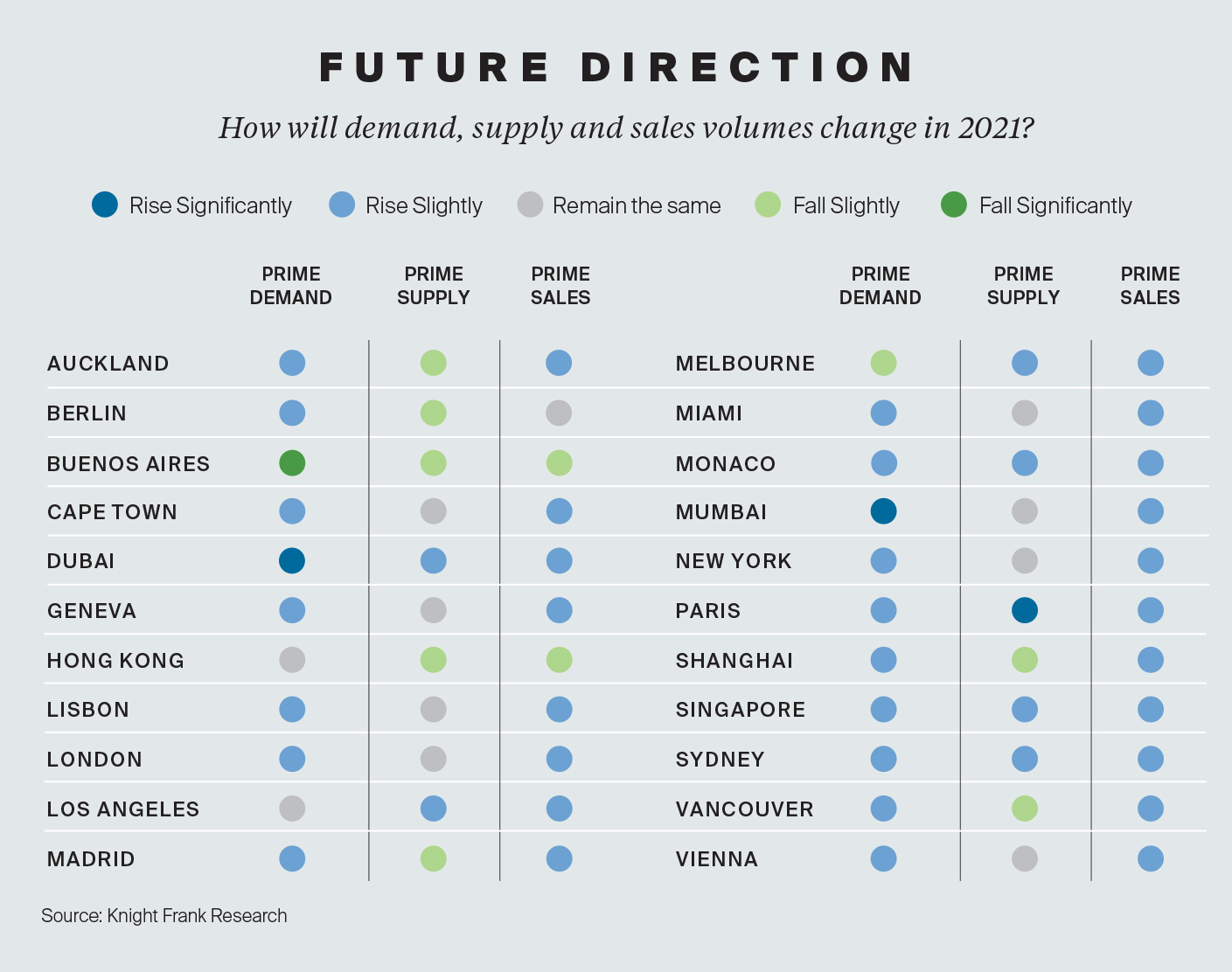

Three broad groups look set to emerge in 2021. Firstly, those markets where prime prices are expected to rebound, assisted by low interest rates, pent-up demand, tax holidays or because of firm market fundamentals, these include London, Sydney, Paris, Berlin and Madrid.

New York is also expected to register an improvement, largely because excess inventory is being absorbed and buyers are recognising its relative value.Furthermore, a Biden administration could lead to a reversal of the State and In 2021, we expect 20 of the 22 cities to see prices remain flat or increase, a slight reversal of the trend seen in 2020 when we expect nine cities to end the year with lower prices. Local Tax (SALT) deduction which led to higher taxes in states such as New York and California.

Secondly, there are some markets where the pandemic will have little impact on prime pricing, in some cases because growth was already weak and will remain so (Buenos Aires), because the market has already picked up where it left off prior to the pandemic (Shanghai) or because prime prices were accelerating and are expected to do so again due to strong investment in infrastructure (Lisbon).

Finally, there are a handful of markets that unexpectedly saw activity surge in 2020 as residents looked to upgrade to larger properties with more outdoor space, these include Auckland, Vancouver, Geneva, Los Angeles and Miami. Here, prime price growth will moderate slightly on the back of a frenetic 2020, but still remain in positive territory.

Read the report in full here

For more information please contact Kate Everett-Allen