Renewing real estate

Real estate is pivotal to the delivery of our five REs to REimagine ESG. Flora Harley looks at how UHNWIs view ESG in property – and the key considerations for the future

6 minutes to read

Real estate is a critical lever for UHNWIs in pursuing their sustainability goals. With the built environment responsible for 40% of global emissions, a herculean effort will be required to reach net zero. While real estate is linked to all five of our REs of ESG, here we focus on three, exploring how UHNWIs are seizing opportunities in these spaces.

RE 1: REDUCING ENERGY CONSUMPTION

What’s it all about?

Not only will measures to reduce consumption and increase efficiency cut energy costs and emissions, reduced demand is vital to enabling greater electrification of heating, adoption of EVs and support for future infrastructure. There may also be additional rewards for investors. Our previous research has identified a sales premium for green-rated buildings of up to 18% and a rental premium of up to 12% due to the unwavering demand for “best in class” assets, dependent on location, which still outstrips supply.

How engaged are UHNWIs?

While improving energy efficiency in their homes and investment property is a top priority, UHNWIs may lack urgency compared with other investment actors. Our 2023 survey of 45 pan-European property investors found that more than three-quarters were looking to improve their existing assets compared with just over a third of UHNWIs. However, the spectre of more stringent energy efficiency minimums and demand from occupiers means that UHNWIs too will have to bring buildings in line in the near term.

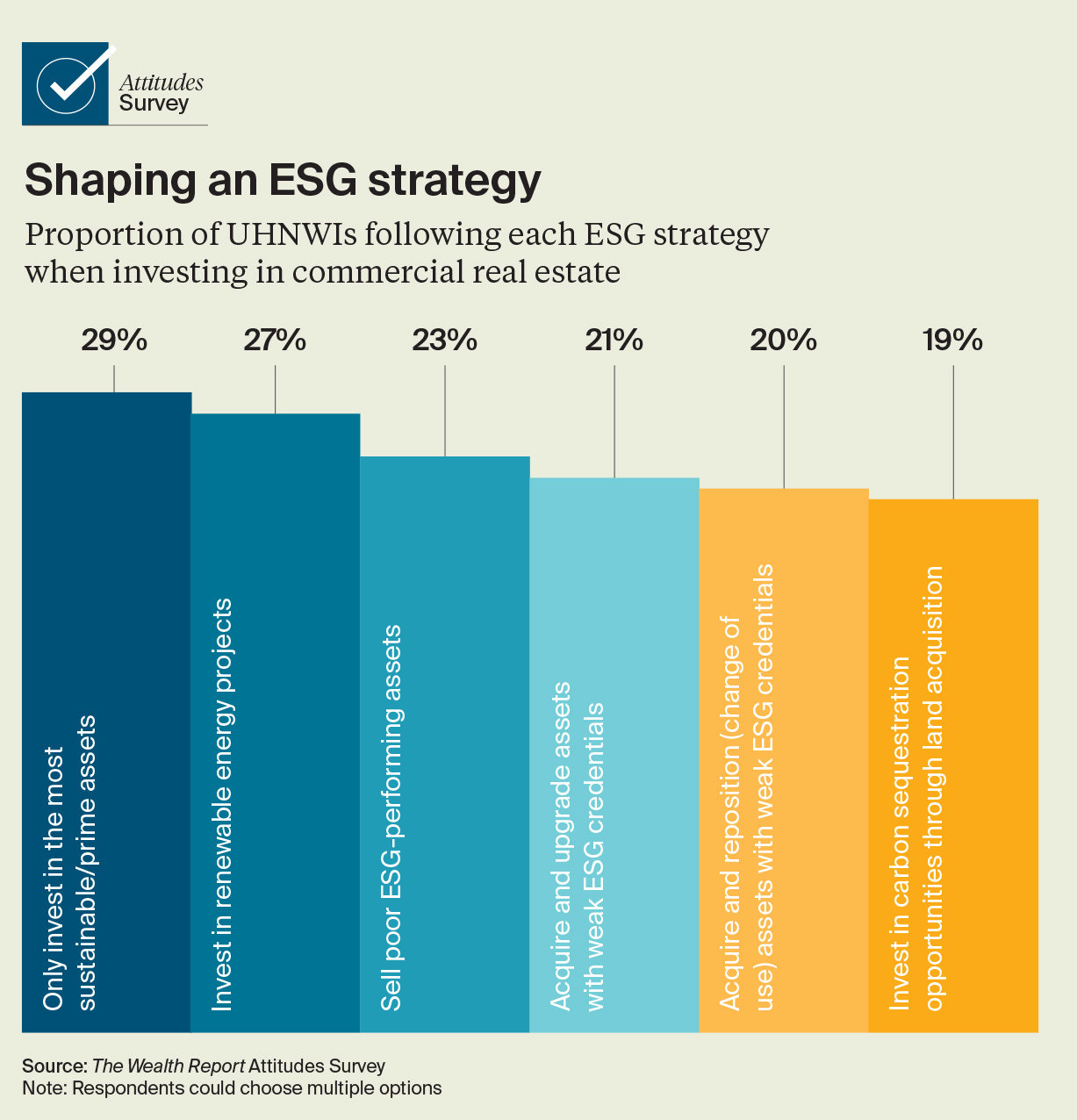

There is a broader trend of retrofitting and refurbishment. Just over a fifth of UHNWIs want to acquire and upgrade assets with weaker ESG credentials to upgrade or reposition, while almost 60% of the pan-European property investors surveyed are actively seeking poor-performing assets to improve/upgrade. However, retrofit is not for everyone. The predominant ESG investment strategy for UHNWIs has the potential to carry a lower risk profile, with 29% opting to invest in the most sustainable/prime assets.

What should be the focus?

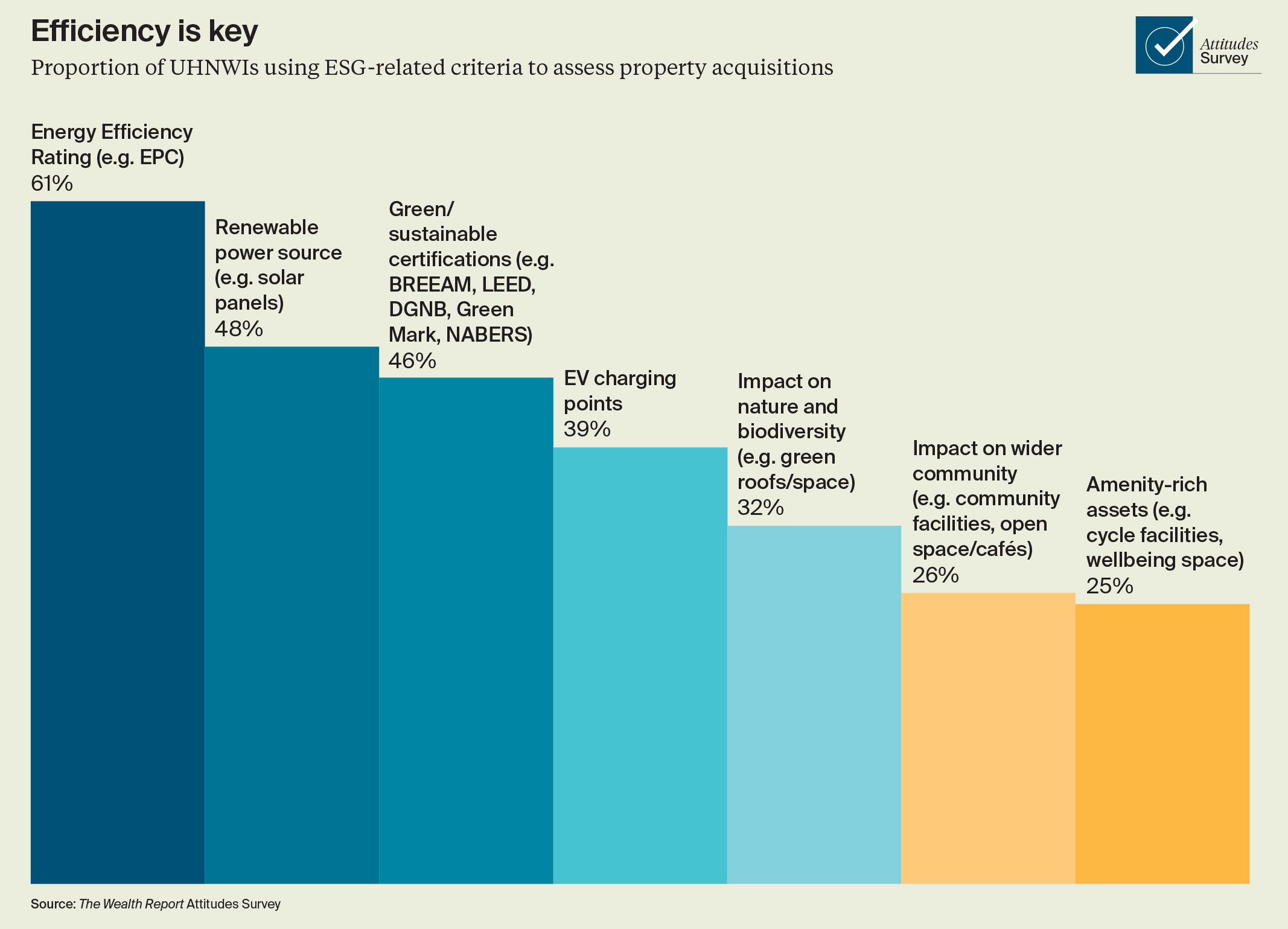

Energy efficiency ratings (such as Energy Performance Certificates or EPCs) are the clearest signal for UHNWIs, with 60% assessing property acquisitions against them. For the broader property investor market, some three-quarters of investors have a minimum certification requirement when acquiring new investment properties.

Interest in green/sustainable certifications such as BREEAM, LEED, NABERS and Green Mark is growing, with 46% citing this as a consideration, up from 25% last year. When undertaking improvements, investors must consider the requirements of occupiers and future investors, including the need for data to show how buildings are actually being used.

Thanks to the inexorable rise of the EV, 39% now look for EV charging when assessing a building for acquisition, up from 25% last year. Furthermore, a quarter are assessing provision of amenities, compared with the 9% seeking cycle facilities in our 2023 report. Social and wellbeing aspects will come to the fore as more actors come to grips with the E side – indeed, the more forward-thinking are already making these areas a priority.

RE 2: RENEWABLE ENERGY CAPACITY

What’s it all about?

Governments globally are offering investment incentives and tax breaks. According to the IEA, some US$310 billion has been committed to low-carbon electricity, with more than US$2.2 trillion for all energy spending. For leased investment properties, the provision of stabilised, zero-carbon power could be a draw, providing more predictable energy costs and a way for occupiers to reach their own net zero goals.

How engaged are UHNWIs?

More than a quarter of UHNWIs are planning to invest in renewable energy projects. The greatest appetite is among Europeans with 28%, followed by Asian UHNWIs with just over 27%. Others are not far behind, with 26% of North American UHNWIs pursuing this strategy.

What should be the focus?

Rooftop solar solutions can reduce or eliminate energy costs, lower emissions, potentially provide ancillary income and, particularly for investment property, increase capital value. Electricity grids globally need upgrades; on-site power generation and storage offer security of supply. For landowners, there are broader opportunities for ground-mounted solar and battery projects. “We have seen a number of UHNWIs seeking ways of using their land for renewable opportunities to diversify income as well as for sustainability objectives,” says David Goatman, Global Head of Energy and Sustainability at Knight Frank. “In addition, the market has witnessed sizeable rental growth of 10–20% per annum in recent years.”

RE 3: RESTORING NATURE

What’s it all about?

Nature is in the spotlight following the Global Biodiversity Framework agreement in December 2022 and the release of the Taskforce for Nature-related Financial Disclosures (TNFD) Framework in September 2023. Half of global GDP depends on nature in some way, but the benefits extend to include health, food production and emissions reduction, for example through carbon capture.

How engaged are UHNWIs?

Wealthy individuals are seeking opportunities to lower their emissions and secure returns, with 21% investing in nature-based solutions and 19% in carbon sequestration opportunities through land acquisition. Previous editions of The Wealth Report have looked at how UHNWIs are rewilding or protecting marine habitats. With the markets for nature evolving, be that biodiversity credits or carbon credits, the appetite for such projects looks likely to increase.

What should be the focus?

Almost a third of UHNWIs assess a building’s impact on nature and biodiversity before acquisition. This trend is likely to build: in the UK, for example, new developments now require a minimum of 10% net biodiversity gain. The burgeoning market for “nature credits” presents an opportunity for private investors – albeit there is a need for rigorous attention to verifiable benefits to avoid any risk of “greenwashing”.

WHERE TECH MEETS REAL ESTATE

Miguel Nigorra, partner and Head of Europe at Fifth Wall, on emerging trends in the growing arena of property technology (proptech)

Within the three macro trends where we see opportunities in the built world – companies aiming to increase ancillary revenue, delivering solutions to reduce operations expenditure, and future-proofing assets – we divide the energy retrofitting space into five verticals: data collection, retrofit assessment, financing, installation and reporting.

Plenty is happening across all five, but the most impactful today are the second and the third, with capital expenditure (capex) increasingly important to generate additional returns. While a significant amount of energy consumption data is being harvested, it is not being acted upon. There is real innovation in taking that data, benchmarking portfolios and delivering retrofit plans. Software solutions can provide accurate payback periods and return on investment for different interventions. Already evident in the US and increasingly in Europe is the shortage of labour to perform capex retrofits, pointing to a need for labour optimisation, retraining and upskilling, and the development of platforms to facilitate this.

When it comes to financing the green retrofitting challenge, there is a massive gap and an opportunity. Companies have solutions for channelling capital towards retrofit and garnering better returns, but this will vary by stage of investment and the parties involved.

For example, heat pump installers do not necessarily require venture capital funding, but debt facilities to front-load equipment purchases. The average household might not have the cash or may need a push to make decisions once incentives get eliminated, and there are multiple models emerging – from zero upfront capex solutions to leasing or saving agreements – to address the issue of how retail investors will finance asset transformations in the space.

Fifth Wall

With around US$3 billion under management, Fifth Wall is the world’s largest asset manager focused on future-proofing and decarbonising the built world.

Download the full report here