Gear change

A slew of record-breaking sales can’t hide the fact that luxury investment markets weakened in 2023. Andrew Shirley investigates

8 minutes to read

The priciest bottle of Scottish whisky. The most expensive Ferrari 250 GTO. The costliest blue diamond. Even the dearest sword. In 2023, the major auction houses achieved a string of record-breaking sales.

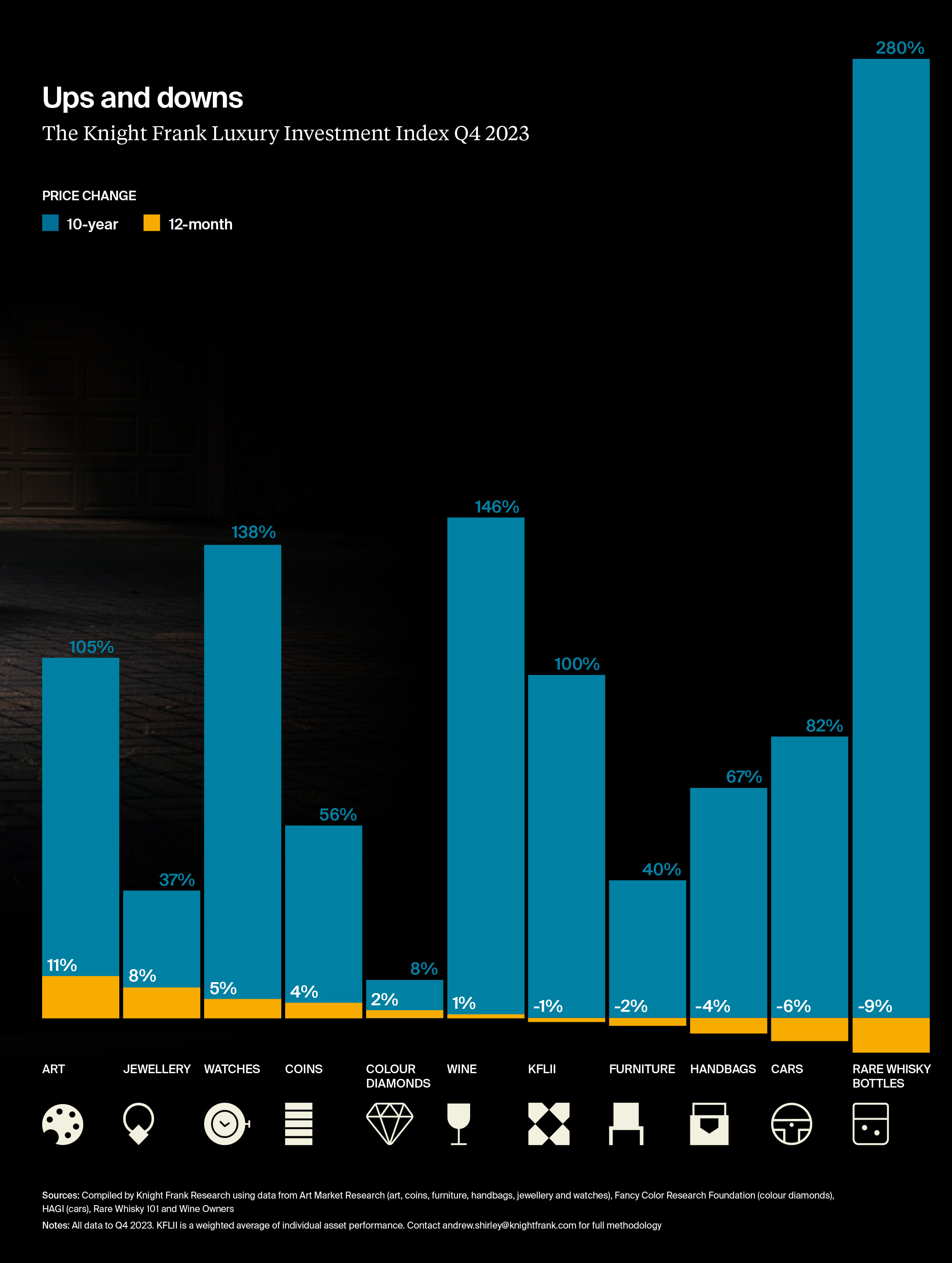

It sounds like a bumper year for luxury investments, but the latest results of the Knight Frank Luxury Investment Index (KFLII), which tracks the performance of 10 popular investments of passion, reveal a less positive picture. For only the second time, KFLII edged into negative year-end territory, albeit by a fraction of a percent, as several stalwart members of the index dropped into the red or showed minimal gains.

However, a peek behind the headlines reveals it’s not all doom and gloom, with some of the losses simply down to the froth coming off markets, according to the experts who supply the data for KFLII.

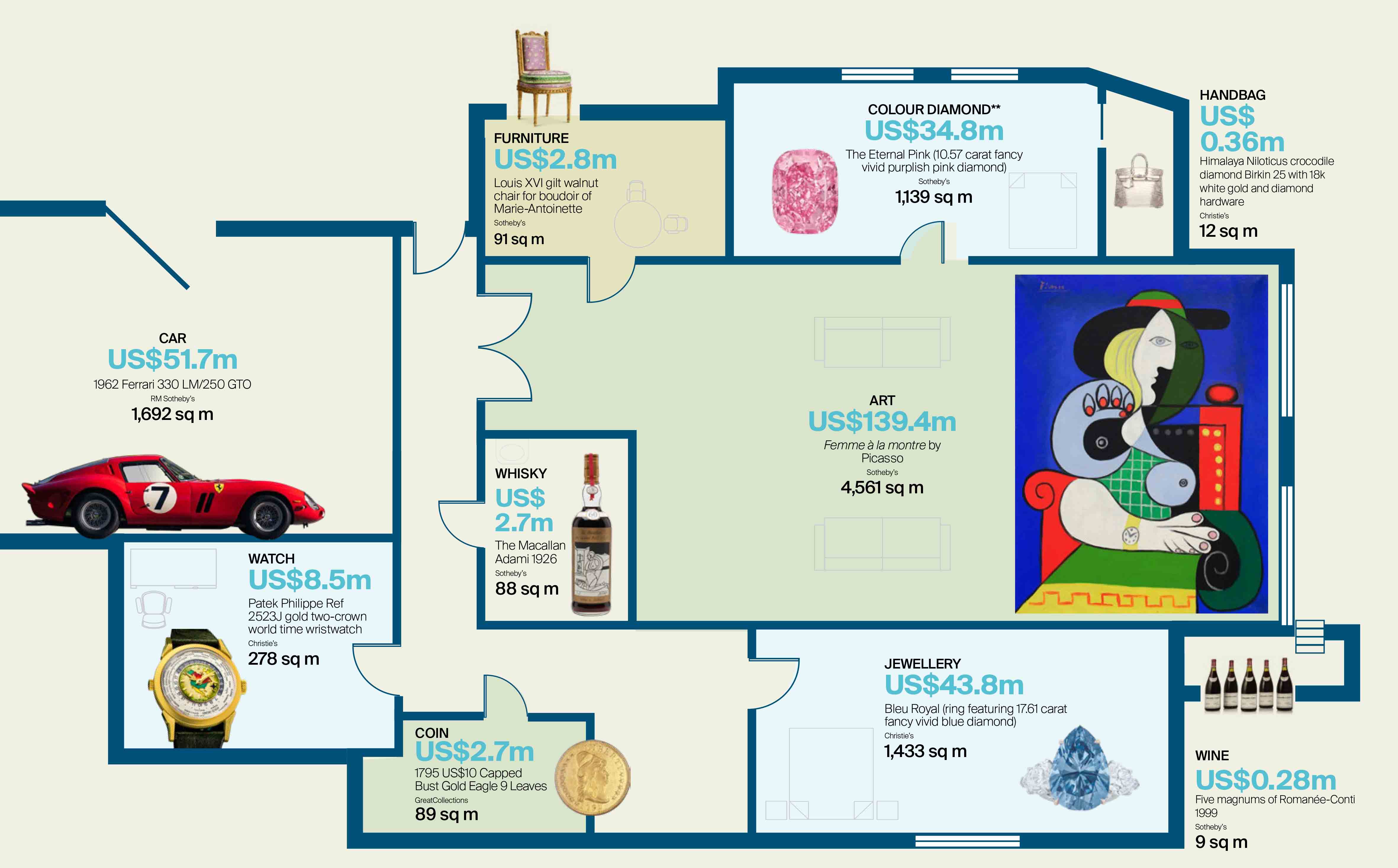

Living in luxury

How many square metres of prime London property the top luxury collectible sales* of 2023 will buy you

- Art

US$139.4m, Femme à la montre by Picasso

Sotheby’s, 4,561 sq m

- Car

US$51.7m, 1962 Ferrari 330 LM/250 GTO

RM Sotheby’s 1,692 sq m

- Jewellery

US$43.8m, Bleu Royal (ring featuring 17.61 carat fancy vivid blue diamond)

Christie’s1,433 sq m

- Colour Diamond**

US$34.8m, The Eternal Pink (10.57 carat fancy vivid purplish pink diamond)

Sotheby’s 1,139 sq m

- Watch

US$8.5m, Patek Philippe Ref 2523J gold two-crown world time wristwatch

Christie’s 278 sq m

- Whisky

US$2.7m The Macallan Adami 1926

Sotheby’s 88 sq m

- Coin

US$2.7m, 1795 US$10 Capped Bust Gold Eagle 9 Leaves

GreatCollections 89 sq m

- Furniture

US$2.8m Louis XVI gilt walnut chair for boudoir of Marie-Antoinette

Sotheby's 91 sq m

- Handbag

US$ 0.36m Himalaya Niloticus crocodile diamond Birkin 25 with 18k white gold and diamond hardware

Christie’s 12 sq m

- Wine

US$0.28m, Five magnums of Romanée-Conti 1999

Sotheby’s 9 sq m

Knowledge is critical

Whisky, our worst annual performer, is a good example, explains Andy Simpson. “To some degree, 2023 continued to be a challenging year with the Knight Frank Luxury Whisky Index dipping almost 9%. But while the worst performing 50 bottles lost 26% of their combined value, the remaining 50 bottles gained 5%, with the 20 best performers increasing by a respectable 20%.”

This is further proof that knowledge is ever more critical when it comes to selecting the right bottles and distilleries, Andy points out. “In my opinion some bottles that lost significant value in 2023 will return through the next two years as they are simply so scarce and, right now at least, so undervalued.”

Classic car guru Dietrich Hatlapa is also sanguine. “The value of the HAGI Top Index was up 22% in 2022, so a retreat of 6% isn’t all that bad,” he says, noting that the strong performance of other investment classes such as equities may have dampened collectors’ appetites. “It’s a very small market so it only takes a minor change in portfolio allocations to have an effect, and there has also probably also been a degree of profit taking.”

But it wasn’t all one-way traffic, he notes. Some marques like BMW (+9%) and Lamborghini (+18%), which appeal to a younger breed of collector, bucked the trend in 2023.

Classics endure

Handbags, which topped KFLII just a few years ago, were also notable fallers. Sebastian Duthy of AMR, which supplies data for a number of the asset classes we track, says bags are one of the investments of passion more influenced by the retail market.

“The secondary market for handbags follows the retail market more closely than any other collectible. A dip in the share price of the top luxury car brands last autumn appears to have spooked collectors wanting top-of-the-range bags.

“Last autumn it was possible to pick up an Hermès white Niloticus Himalaya Birkin in good condition for under £50,000. This is a far cry from a slightly better condition but refurbished bag that sold for the equivalent of more than £130,000 18 months earlier in Hong Kong. The recent slide reflects a general correction at the upper end that’s been under way for some time rather than changing attitudes to the harvesting of exotic skins. Collectors are prepared to pay a premium if the bag has recently left the Hermès workshops and so prices are also dependent on annual production.

“At lower price points, bags such as the Birkin in Togo leather in classic colourways such as gold and black remain very popular. Prices for these versatile bags have increased slightly over the year, with one nearly new bag reaching £15,000. At times of great economic stress, it is normal for people to reach for reliable fashion standards. The ongoing cost-of-living crisis appears to have encouraged the same behaviour.

“Another example where prices have edged up is the iconic Kelly in crocodile which Hermès has produced since the 1960s. One exceptional vintage example from 1962 sold for the equivalent of £14,500 at Sotheby’s in November.”

The market for fine wine – up just 1% according to the Knight Frank Fine Wine Icons Index (KFFWII) – is going through a period of price correction, asserts Nick Martin of Wine Owners. “It’s been a hell of a long run, so I’m not that surprised.” Some wines from very small producers that had enjoyed the most exuberant growth have seen the biggest drops, he says. “It had got a bit silly, £50 bottles had shot up to £200 or £300.” That KFFWII still just edged into the black shows the value of a diversified cellar, he adds. “The wider Burgundy market has dropped by 12% since the autumn.”

Surprising to many market observers will be the fact that watch prices, as tracked by KFLII, rose by 5% to take third place in our luxury rankings. AMR’s Duthy explains: “Sales of watches at the big three auction houses totalled £488 million in 2023, a very slight increase on the previous year. This includes post-millennial watches as well as true vintage pieces, which typically attract separate collector bases. Our index tracks prices of the latter; the biggest slide in values recently has been for the newer watches.

“In such an increasingly financialised climate, it was no surprise to see collectors chase the most iconic and truly rare timepieces. A Rolex John Player Special broke the model record when it sold for £2 million at Sotheby’s in May, double the price for a similar example sold at Phillips in 2021. Prices of classic Cartier watches continued their journey northwards, with a number of asymmetric designs coming to market.

“The top 10 of the most expensive watches to be auctioned last year once again included a high proportion of independent watchmakers such as Philippe Dufour, Roger Smith and Richard Mille, as well as rare Patek Phillipe watches. Their total value was £42 million, an increase of 40% over

the previous year.”

Jewellery put in another strong performance with annual growth of 8%. “The demand for colour gemstones of exceptional quality, iconic signed period jewels and single-owner collections, as well as items with historic provenance stood out in 2023,” Duthy notes.

I’m often asked if younger collectors have different attitudes to their parents. Duthy says the impact of hip hop culture on the jewellery market is a good example and shouldn’t be underestimated, particularly as the trend for male music stars to add jewellery to their look continues to grow.

“Sotheby’s Hip Hop auction in July offered several possessions that belonged to the music legend Tupac Shakur, but none more personal than a gold ruby and diamond crown ring.

The buyer was soon revealed to be the artist Drake, another huge hip hop star, who used his purchase to promote his new album on Instagram. Drake paid US$1 million for the ring – three times the estimate.”

Talking of shiny things, colour diamonds continued to perform steadily, says Miri Chen, CEO of the Fancy Color Research Foundation. “In 2023, we observed a shift towards smaller sizes and higher colour saturations, along with a slight decline in the prices of pinks and blues. The overall trend indicates a steady increase in prices for the whole segment. We are delighted to witness the continued resilience of the fancy colour market in comparison to other markets, including colourless diamonds.”

Notable sales

Art, which leads KFLII, was the only one of our 10 index constituents to hit double-digit growth in 2023, but all of the gains came in the first half of the year with values sliding significantly later on, according to AMR’s All-Art Index.

“The auction year traditionally begins with sales of Old Masters, and last season started with some notable sales, including a record for a work by Bronzino,” says Duthy. But the same could not be said for other key sectors, he points out.

“It was telling that in May, Sotheby’s inserted one of its top Old Master lots – a Rubens’ portrait – into a 20th Century Modern evening sale. But by then, it was clear that the confidence among sellers, set by the previous year’s record-busting figures, was ebbing away. In the same month, modern and contemporary works from the collection of the late financier Gerald Fineberg sold well below pre-auction estimates. With all but five lots selling, it was clear the market had swung in favour of the buyer.”

There was even less appetite for the ultra-contemporary or “red-chip” sector, which experienced the biggest contraction in 2023, he adds. “Works by a growing group of artists born after 1980 have been heavily promoted by mega galleries and auction houses in recent years. With freshly painted works in excess of £100,000 almost doubling in 2022, it was little surprise that this sector was one of the biggest casualties last year. There is a risk there are now simply too many fresh paint artists with none really standing out.”

*As far as can be ascertained sales represent the most expensive item sold at auction from each asset class in the Knight Frank Luxury Investment Index. Where not sold in US$, price based on mid-market exchange rate on day of auction. **Excluding the Bleu Royal

Download the full report here