Cash buyers move into pole position in 2023

Overall buyer appetite tempered by increase in borrowing costs.

3 minutes to read

Key findings:

- 67% of those surveyed are concerned about the increase in borrowing costs

- 62% of those surveyed expect the value of their home to fall in 2023

- 41% have seen their spending power reduced by rising borrowing costs

Cash and equity-rich buyers are looking to capitalise on their strong position in the UK housing market this year amid wider concerns over higher mortgage rates, our latest sentiment survey shows.

After the fallout from September’s low-tax mini-Budget, which spooked financial markets and led to a leap in borrowing costs, most buyers are now more circumspect than a year ago.

While there are signs that inflation has peaked and that borrowing costs will undershoot previous expectations, the base rate stands at 3.5%, a 14-year high, after nine consecutive increases.

However, while mortgage debt is at the forefront of many buyers’ minds, the geographical distribution of cash buyers and equity-rich homeowners is far from uniform. It means that some parts of the country will be more insulated than others, as we highlighted here.

For context, it should also be remembered that more homes were owned outright in England and Wales (8.1 million) in 2021 than with a mortgage (7.4 million), according to census data released last week. It means that, some UK regions are more reliant on mortgage debt than others.

Unsurprisingly, 67% of survey respondents were concerned about the increase in the cost of mortgage repayments, with 13% ‘extremely concerned’. An Increase in borrowing costs was also the most popular reason why prospective buyers hadn’t committed yet to make a purchase (18%).

However, a quarter of respondents (24%) said the increase in mortgage costs is not relevant to them, with 9% stating they were of little concern (see chart).

“A lot of prospective sellers we’re talking to are downsizers that want to sell but didn’t do anything in the last two years as they were put off by the fast-moving market,” said Shaun Hobbs, office head at Knight Frank North Hampshire.

“The cash buyers that are out there will likely sit back and watch how things play out in the next few months. However, they know they will be in a very strong position when they choose to act,” added Shaun.

Asked if the rising cost of borrowing had affected their spending power for a home purchase, 41% said it had. Some 12% of respondents said it had shrunk their budget by 10% or more, which was the largest group.

For 7% of respondents, the increase in borrowing costs means they can no longer secure a mortgage for their required amount.

“Some people are going to have to realign their ambitions in the coming months, as their spending power will have been affected,” said Andrew Johnson, sales manager, Knight Frank Finance.

“However, on the flipside it means cash buyers are in a strong position. In recent years I’ve advised clients to make use of the ultra-low mortgage rates rather than pull money out of higher yielding investments. However, with the increase in rates I’d expect to see more cash purchases if those clients are not getting a high enough return on their investments” Andrew said.

With eight in ten mortgage holders on a fixed-rate deal according to UK Finance, the pain of increased rates has been blunted.

However, a ‘price recalculation’ is coming, which will push down house prices by an expected 10% over the next two years.

Pricing

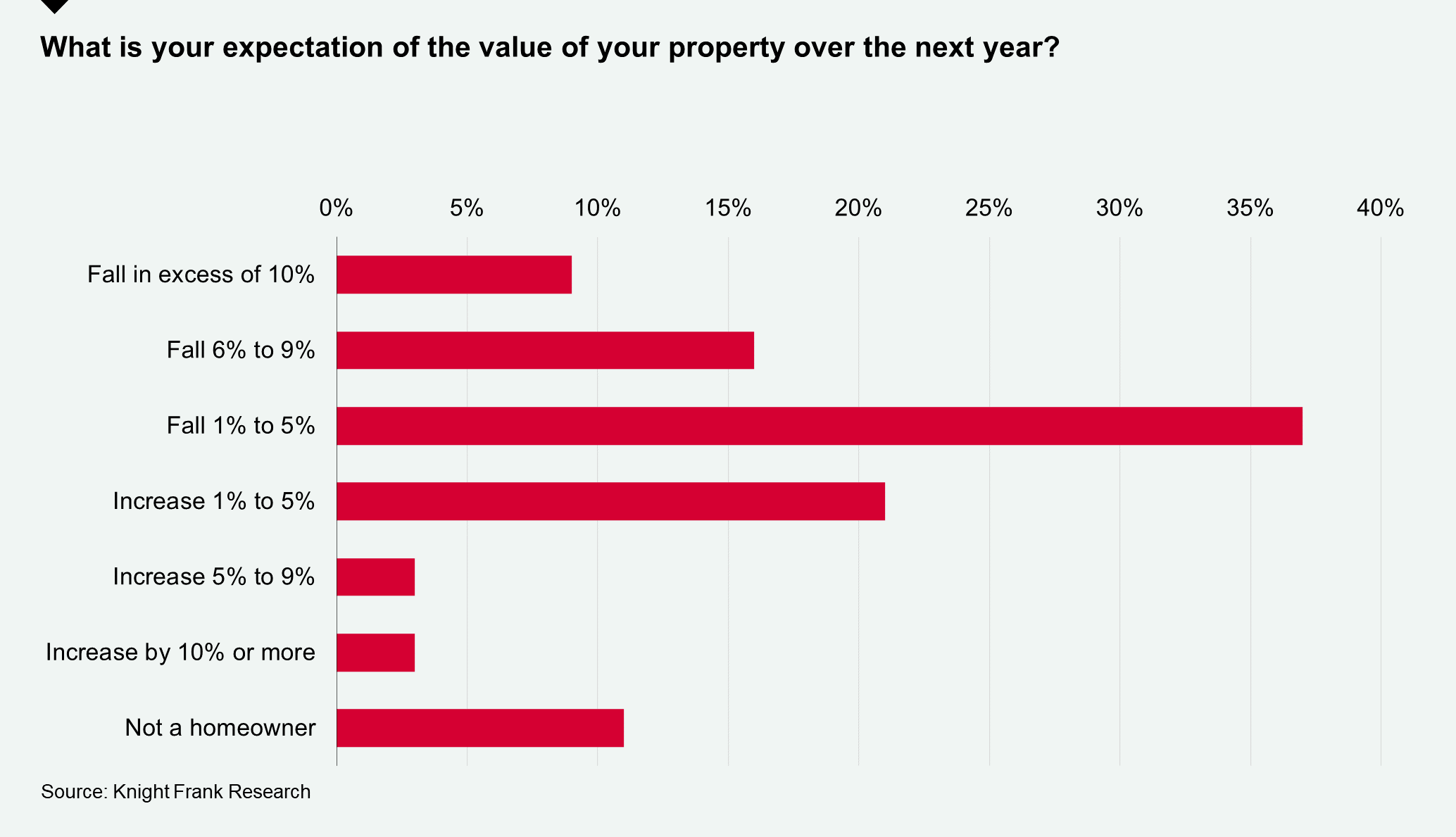

The majority (62%) of respondents expect the value of their home to fall over the next year, with most anticipating a decline of 1% to 5%, which was selected by over a third (see chart).

However, continuing tight supply is likely to protect against a large fall in house prices in 2023.

Asked if they intended to sell in the next 12 months, 60% of respondents said they did not, while 19% are still deciding.

The most popular reason for this was an inability to find somewhere to buy (14%), followed by a forecast fall in house prices (13%).