Jobs Data Stands Out in a Blizzard of Economic News

For the UK housing market, last week’s wage data was more significant than news of a recession.

3 minutes to read

For anyone speculating about how quickly interest rates will fall and the implications for the UK housing market, there was arguably too much information last week.

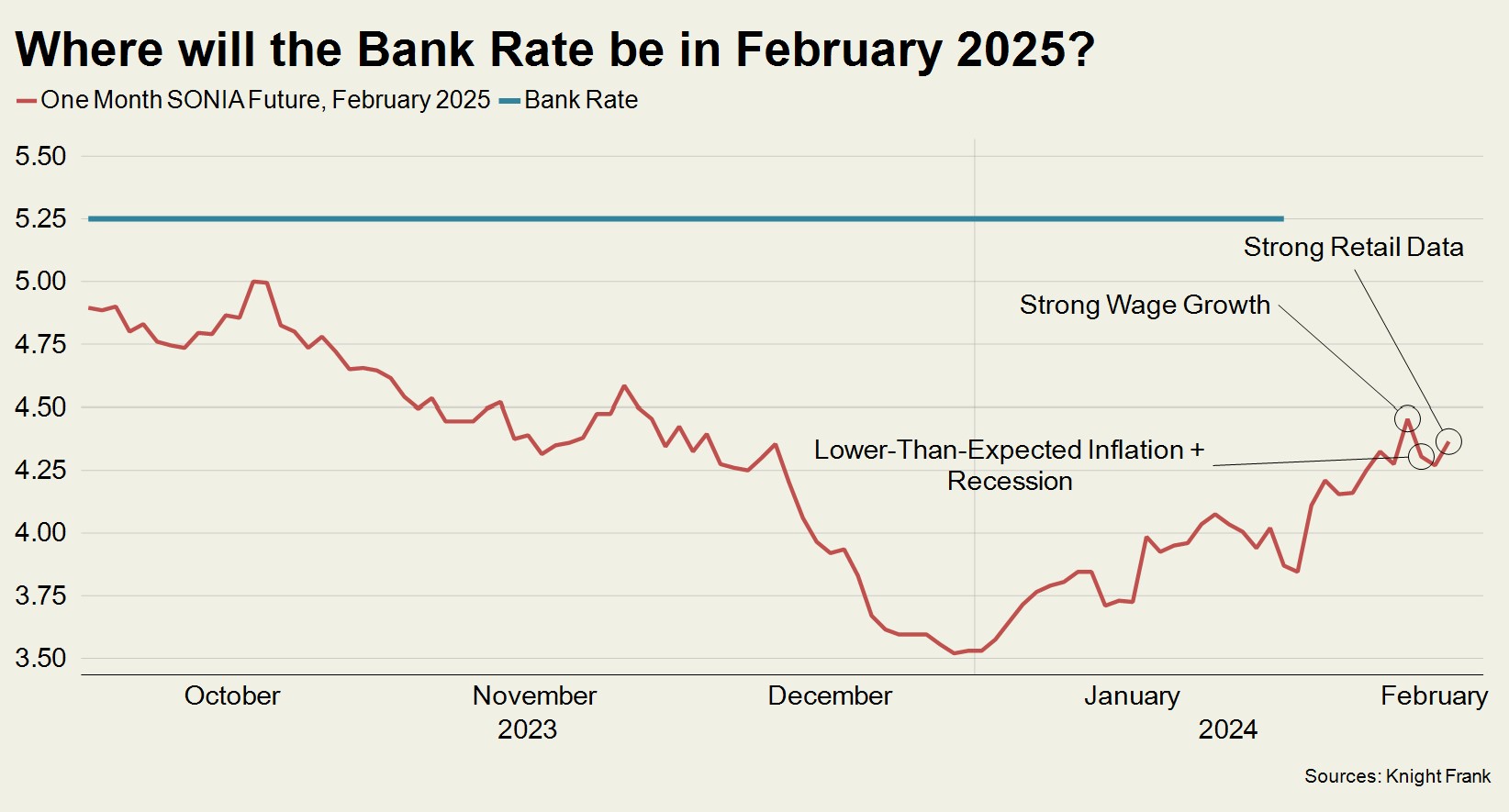

On Tuesday, annual wage growth of 6.2% was slightly ahead of expectations (6%), which meant investors scaled back their bets on how quickly the Bank of England would cut rates.

Only 24 hours later, inflation came in lower than expected at 4% (versus an estimate of 4.2%), which sent a more positive signal to anyone buying or remortgaging as expectations rose in money markets that rates would be trimmed sooner.

Later on Wednesday morning, the ONS announced that house prices fell 1.4% in 2023. It appeared to contradict the Halifax, which reported a 2.5% rise in the year to January.

Cue more confusion, although the ONS lags the other main indices, as we have previously analysed.

If that wasn’t enough economic data for one week, the UK officially fell into a recession on Thursday, which meant investors increased their bets on an earlier cut to support the economy.

And on Friday, some surprisingly strong (inflationary) retail figures meant money markets performed their second U-turn in four days and bet on rates staying higher for longer.

My colleague Stephen Springham explains why the January retail figures should be handled with care here.

The week’s ups and downs can be seen on the chart below.

Just for good measure, there were two by-elections last week that made Rishi Sunak’s position more precarious as the messy countdown to the general election continues.

For anyone wondering where mortgage rates are headed, it was a disorientating week of mixed signals.

The question therefore is which signal should be listened to most attentively?

Unfortunately for the housing market, the most important number last week was the 6.2% wage growth recorded on Tuesday.

This stubbornly-high figure is driving core inflation and proving to be the Bank of England’s biggest headache, even as headline inflation falls back towards its 2% target.

How else to explain that two members of the Monetary Policy Committee voted to raise rates at the start of the month despite headline inflation falling faster than expected?

Strong wage growth will remain the nemesis of lower mortgage rates for the foreseeable future, as we have explored before.

Furthermore, there will be a change to the way private rental prices are calculated in the inflation figures from March.

Economist Savvas Savouri believes the new method could mean more inflationary pressures. He currently forecasts a single rate cut this year due to the strength of the labour market.

Either way, lenders will continue to price their rates on market expectations rather than what the Bank of England does.

Markets currently expect between three and four cuts of 0.25% over the next 12 months, as the chart above shows.

Overall, we think housing market activity will continue to improve compared to last year as mortgage rates stay close to their long-run average and lenders continue to show forbearance.

As a result, we forecast that UK house prices will increase by 3% this year as demand strengthens, thanks in part to a strong labour market.

The irony is that if the labour market was slightly weaker, it may benefit the housing market even more.