More positive numbers on housing

Making sense of the latest trends in property and economics from around the globe

2 minutes to read

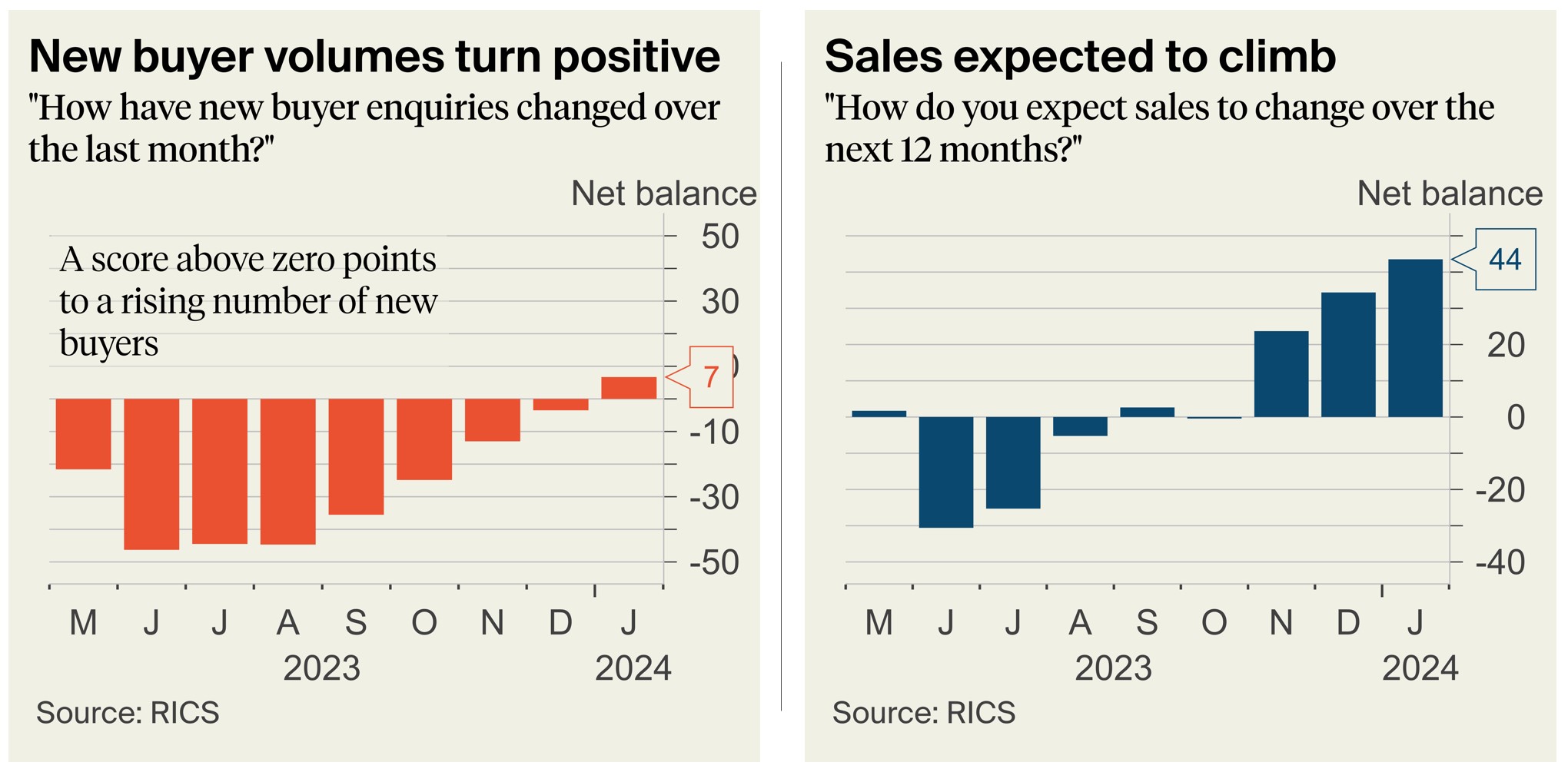

Building on my comments on Wednesday around improving transaction volumes, the latest RICS survey provided clearer evidence of improving conditions. Data for new buyer volumes, agreed sales, and new instructions all shifted into positive territory, with new buyer registrations running at their strongest rate since February 2022. In addition, the outlook for sales has improved, with increased sales expectations projected over both three- and 12-month time horizons.

Tarrant Parsons, RICS senior economist, commented: “The UK housing market has seen a continued improvement in buyer activity through the early part of the year, supported by the recent easing in mortgage interest rates. Although sales volumes through much of the year ahead are likely to remain relatively subdued compared to the longer-term average, the outlook has now turned modestly brighter on a consistent basis over the past few survey reports.”

Housing demand - the long view

While estate agents will take a keen interest in the RICS figures, house-builders and developers will be equally focussed on Ollie Knight's analysis of the latest ONS population projections. News last month that the UK population could reach 70 million by mid-2026 has huge implications for the housing market, particularly for the private rented sector.

In Ollie's view "Higher than expected migration will yield a younger population...Given nearly 40% of existing households in this age cohort rent privately, it’s fair to assume that this shift will put additional demand pressures on an already stretched private rented sector.”

The key takeaway for the sector is that a further increase in demand in the PRS – driven by demographic change – strengthens the need for more purpose-built rental housing. That provides a further tailwind for the growth of build to rent (BTR) sector, especially given this age group is most likely to live in BTR. Ollie notes that while BTR development has picked up, it remains a tiny fraction of the overall UK rental market. Completed BTR homes account for just 1.7% of total privately renting households.

The housing sector is already undergoing considerable change, as confirmed by Barratt and Redrow's announcement on Wednesday. Even if the ONS forecasts are only partly accurate the implications for planning, development, and investment are enormous.

Tenant demand eases (a bit) but rents on the rise

Back to that RICS survey, which while confirming a net balance of +28% of contributors reporting an increase in tenant demand, also noted that this marked the weakest reading since January 2021. Tenants might hope this points to a potential slowing in rental growth. However, with a decline in the volume of new landlord instructions entering the rental market, and the net balance remaining at -18% for a second consecutive quarter, the imbalance between supply and demand is still expected to drive rents higher throughout 2024.

In other news ...

China’s prices fall at fastest rate in 15 years as economy battles deflation (FT), commercial real estate and banks (Unhedged), and Knight Frank’s updates on: Glasgow, Leeds, Prague, Madrid, and Warsaw.