The housing market begins to move

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

House prices are rising, will sales follow?

UK house prices rose again last month, for the fourth consecutive month, with prices now standing 2.5% above the level they were in January 2023. I’ve talked before how house prices have surprised on the upside, pretty much everywhere, during this cycle. The latest numbers from our Prime Global Cities Index confirm that across 46 leading prime residential markets, prices have rebounded sharply since the beginning of 2023, rising by 3.8% in the past 12 months.

This theme dominated the recent Luxury Roundtable debate I joined last week – you can watch the debate here.

The central issue in the debate was the lack of incentive for owners to bring their properties to market if that results in moving from a lower mortgage rate to a higher one. This means that low stock volumes, combined with above-inflation wage growth and high savings, are conspiring to push prices higher while leaving sales volumes stubbornly low.

Unsurprisingly, the key is rate cuts, which increasingly appear in touching distance. As we approach this turning point, evidence of improving liquidity is beginning to emerge. Mortgage demand has improved here in the UK, and data coming out of the US points to a flurry of activity in recent weeks – news on US$162 million of sales here.

Construction optimism in the UK...

British construction companies indicated a strong improvement in business activity expectations in January, with optimism reaching its highest level for two years.

The latest S&P Global UK Construction Purchasing Managers’ Index (PMI), pointed to strengthening future demand due to improved financial conditions and better economic prospects. Behind the headlines house building remains a weak spot with the survey noting weaker demand and a shortage of new projects to replace completed ones. Despite this, the rate of decline in residential activity eased to its lowest level since March 2023 – building on recent housebuilder statements.

Tim Moore of S&P Global Market Intelligence noted: "UK construction companies seem increasingly optimistic that the worst could be behind them soon as recession risks fade and interest rate cuts appear close on the horizon.”

...but difficulties in Europe

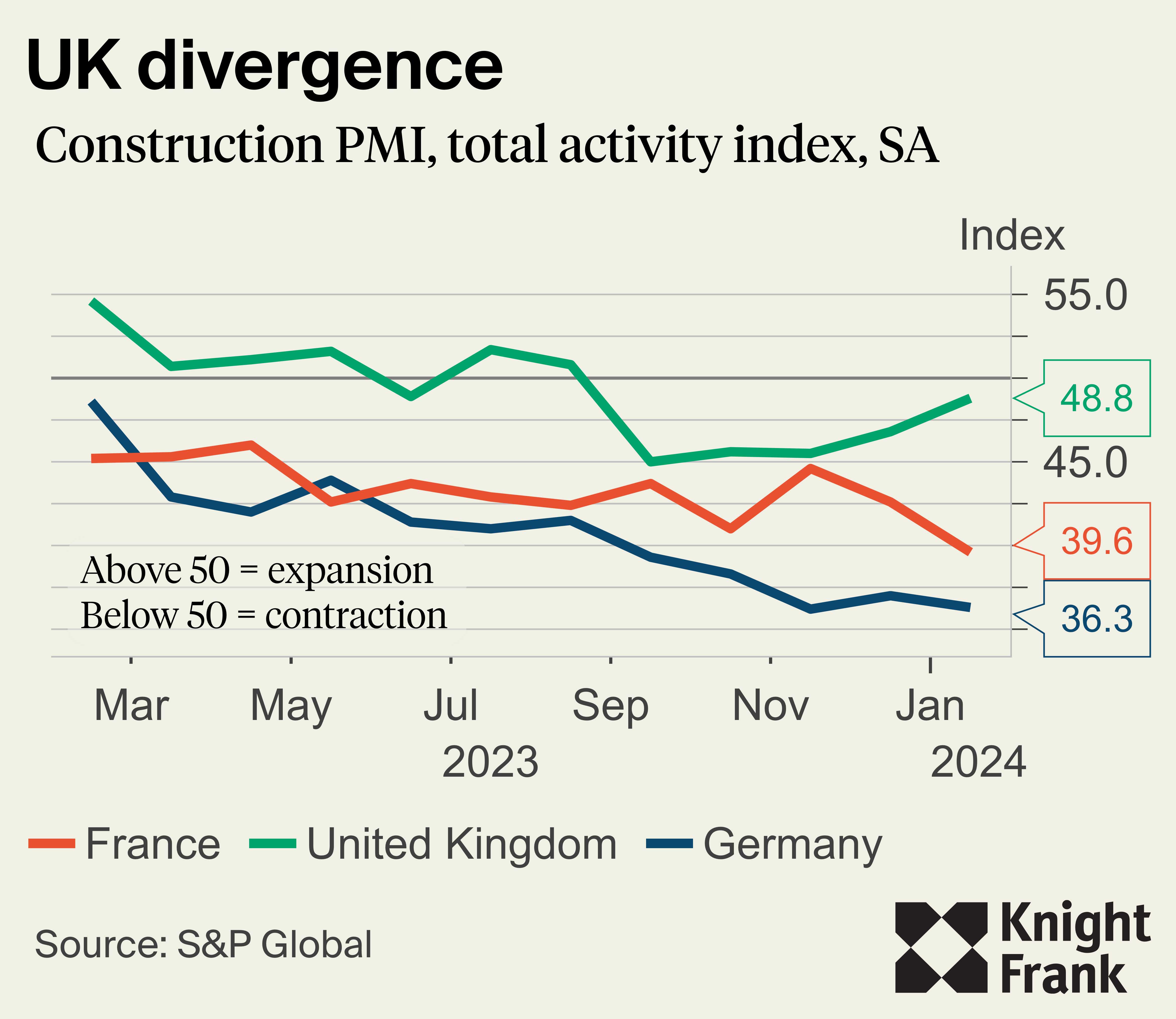

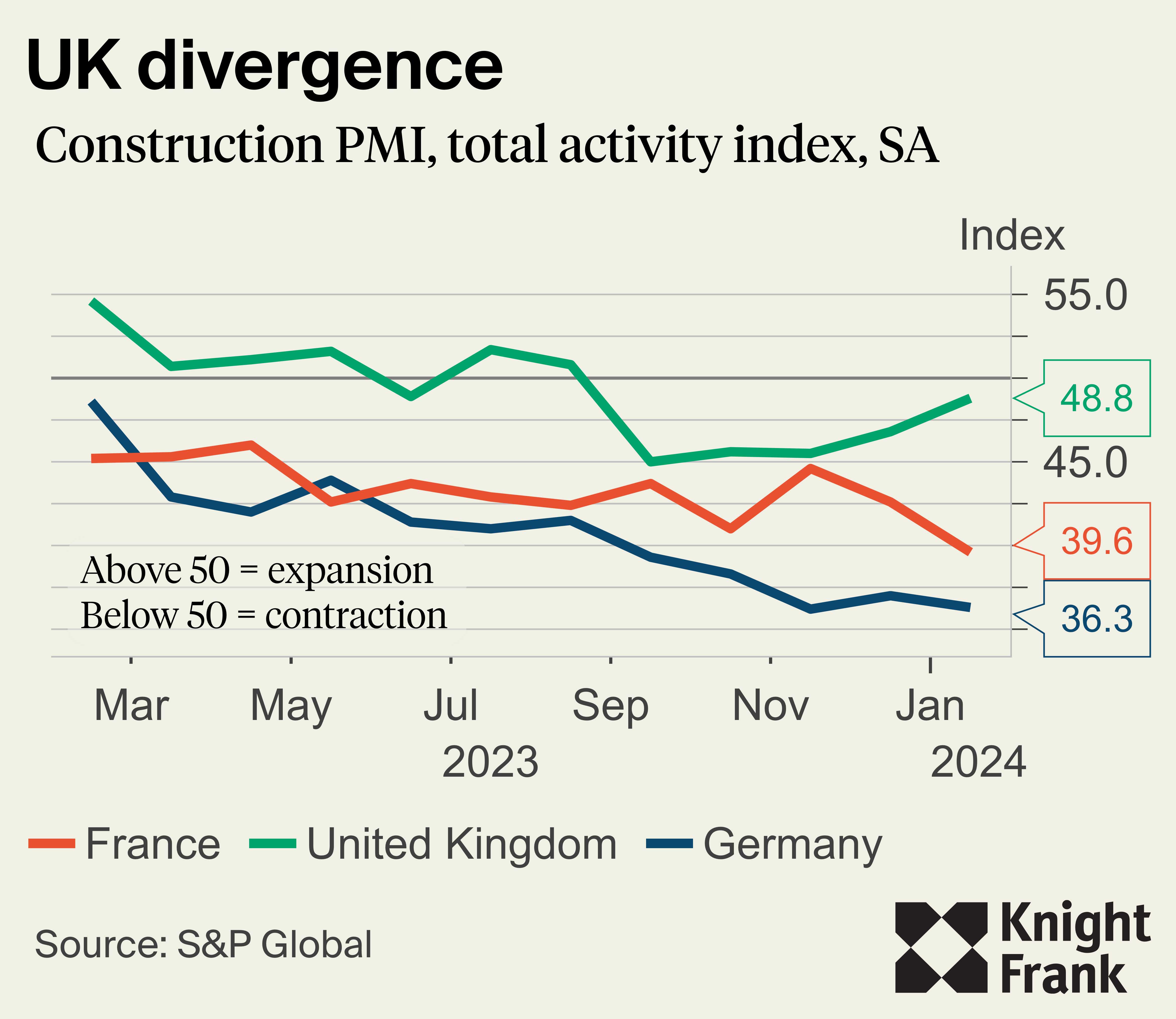

While the UK is inching towards expansion territory for the construction sector, in Germany the property slowdown appears to be deepening, with house building acting as a drag on activity.

In a refreshingly frank note Hamburg Commercial Bank’s Chief Economist notes: “Just when you think it cannot get any worse, it can...” before offering some hope for the beleaguered sector: “For optimists, the set of PMI construction indicators may resemble a desert…having said this, given the perspective that interest rates will most probably be cut eventually this year, some investors may be able to breathe a bit easier.”

Our graphic confirms the different path the UK sector is following: -

Heat pumps (again)

The FT reported this week that Rishi Sunak looks set to drop plans to fine boiler makers who fail to meet strict production targets for heat pumps. While this sounds technical and appears to signal a retreat from another net zero target, it reflects the market reality. Despite the government’s commitment to reach an annual target of 600,000 heat pump installations by 2028, the current run rate is barely 37,000 a year.

David Goatman, Knight Frank’s Global Head of Energy and Sustainability commented: “The UK Government’s approach of ‘carrot and stick’ in regard of heat pumps seems to have backfired. Suppliers of heat pumps are often also boiler suppliers, so the impact of threatened fines for missing heat pump targets was only having the result of pushing up boiler prices.

“This is a clear example of how decarbonisation policy must bring industry along on the journey, otherwise well-meant policy can have negative impacts in the real world.’’

In other news ...

Soaring rents make buying a home a better option once more (Bloomberg), blow to British expats as Trudeau extends ban on buying homes (Telegraph).