Inflation slows rapidly, teeing up a brighter 2024

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

The UK's annual rate of inflation dropped to 3.9% in November, down from 4.6% the previous month. That's a sizable drop, beating analysts expectations and perhaps paving the way for more meaningful cuts to mortgage rates through January.

Economists had been expecting a fall to 4.3%, according to a Bloomberg poll. Core CPI, which excludes volatile items like energy and food, fell to 5.1%, from 5.7%. Services CPI, the key cause of concern among Bank of England officials, fell to 6.3%, from 6.6%.

Prices are now rising at the slowest rate since Autumn 2021. Crucially, the data should kill any suspicions that the UK is in some way an outlier on inflation. We'll have to wait until the Bank of England's next meeting in February to know whether it's enough to push officials into guiding towards the timing of rate cuts.

Of course, we are in the midst of a volatile period for geopolitics which presents new risks all of the time. Missile strikes on ships moving through the Red Sea have prompted some shipping companies to divert cargo round the horn of Africa, raising the prospect of more disruptions to supply chains, for example.

Noisy wages

For now, wage growth remains the key point of contention and is the primary reason the services CPI is proving so sticky. Wages have risen at their fastest sustained pace in three decades over the past year, according to the Times write up of XpertHR data.

Wage data is subject to a lot of noise, which is why officials are so cautious, BoE deputy governor Ben Broadbent told an audience at the Institute of International Finance on Monday.

"Given the volatility in the official estimates, and the disparity... among the various indicators we have, it will probably require a more protracted and clearer decline in these series before the MPC can safely conclude that things are on a firmly downward trend.”

Deputy governor Sarah Breeden expressed similar sentiments yesterday when she said "monetary policy still needs to be restrictive for an extended period of time to keep pushing down on inflation and to return it sustainably to target."

Call me sceptical. We'll cover the reaction in markets in Friday's note.

Housebuilding policy

I talked on Monday about new projections from the Home Builders Federation suggesting that annual housing delivery will fall below 200,000 next year, which would be the lowest level since 2014.

That would come at an awful time for the Conservatives, who will be in the midst of an election campaign within which housing affordability will play a central role. We got a glimpse of how the party will try to address the issue via a Times interview with Michael Gove on Monday. As the writer Oliver Wright notes, Mr Gove intends to walk "a very thin line" between appeasing "Tory MPs who are worried about losing their seats at the next election while addressing the concerns of those who believe the Conservatives have given up on the idea of affordable home ownership in the face of Nimbyism."

For the former, that will mean offering new protections against building on the green belt or prime greenfield land, while granting "additional powers for councils to prohibit development that could change the character of a particular area." For the latter, councils will be given three months to put local plans in place that identify land to be developed. Those that fail will lose planning powers indefinitely to independent planning inspectors.

In a separate speech yesterday, written up by the FT here, Mr Gove said local housing targets would "remain the basis” of the planning system but said they would be “advisory”. He added the approach would be a “sensitive adjustment in meeting targets, not their abandonment”. Labour responded by stating it would begin unpicking the changes to planning policy "on day one".

A lack of competition

Policy uncertainty is compounding what is already a challenging environment for UK housebuilders, with mortgage rates close to their highest since 2008.

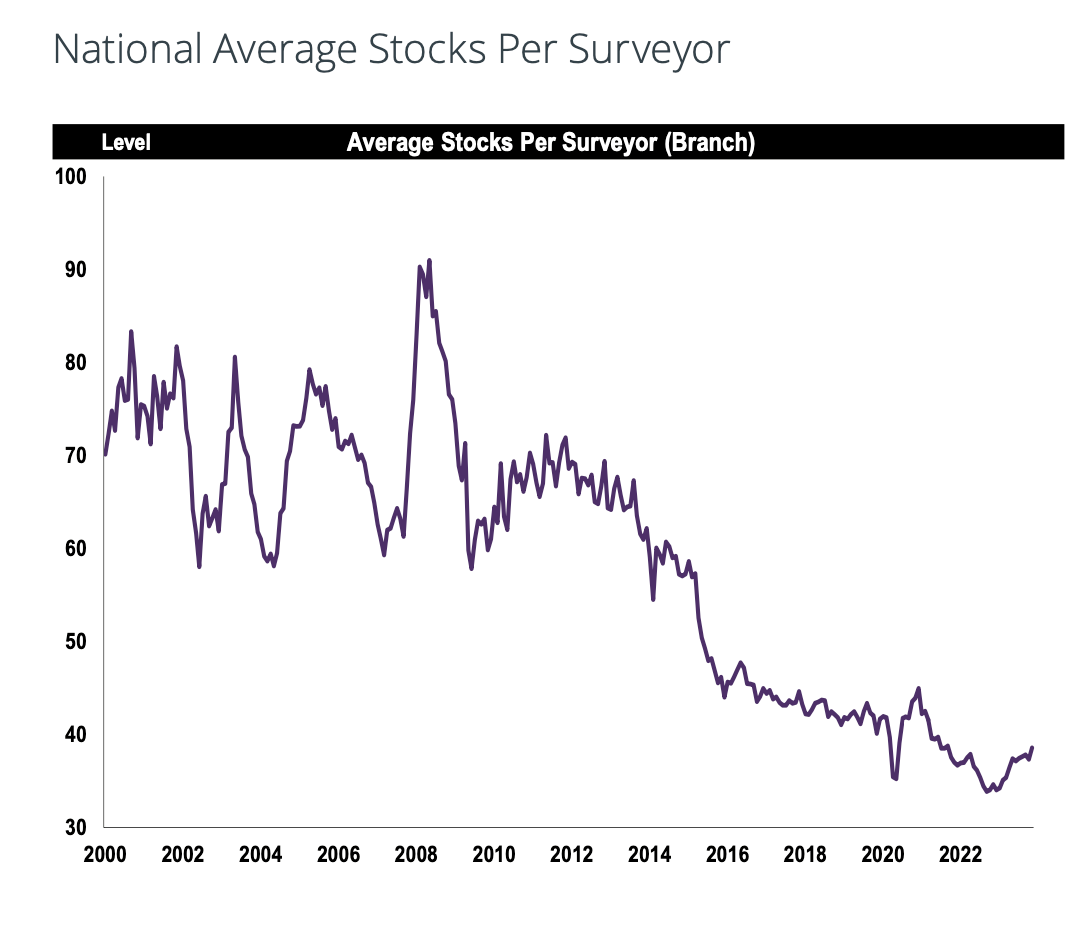

The combination of the two is preventing developers from capitalising on what could be a tailwind: the lack of competition from existing homes. People are delaying moves due to higher mortgage rates and average stock levels offered by estate agents is very low by historic norms (see chart below from the latest RICS survey).

US homebuilders have seized on the brightening domestic economic outlook to take advantage of similar supply side conditions. Residential starts increased 14.8% last month to an annual rate of 1.56 million, government data showed yesterday. Permits for single family homes rose to the highest level since May 2022.

In other news...

UK landlord LondonMetric in talks to buy Alton Towers owner LXI (FT), and finally, Hong Kong is starting a program next year that will give residency to people who invest HK$30 million into the city (Bloomberg).