The slow death of "higher for longer"

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

For weeks, the idea that interest rates would remain at their peaks for a protracted period has wobbled. Data points have stacked up from Europe to the US showing inflation cooling, leaving investors totally unconvinced that interest rate charts will take the path of South Africa's Table Mountain, as one Bank of England official suggested in August.

The Federal Reserve opted to hold rates at a 22-year high last week, but chair Jerome Powell and his colleagues all but killed the 'higher for longer' narrative by issuing a set of forecasts showing they expect to lower rates by 75 basis points next year. Officials expect the Federal Funds Rate to settle in the range of 4.6%.

A massive rally followed. The S&P 500 climbed 2.4% over the course of the week, settling within 2% of the record high it hit in January 2022. The 10-year Treasury yield dipped below 4% for the first time since the summer. Two Fed officials toured TV studios on Friday in an attempt to temper the optimism, but it largely fell on deaf ears.

“Higher for longer is dead,” Kristina Hooper, chief global markets strategist at Invesco told the FT over the weekend. “Powell wrote the epitaph [this week].”

New targets

The Bank of England also opted to keep its key rate on hold, but stuck with pretty hawkish messaging.

Three of the nine Monetary Policy Committee members wanted to execute another hike, and Andrew Bailey issued a statement alongside the decision in which he maintained that there is still "some way to go” to bring inflation back to target.

Still, investors aren't convinced. Markets expect five rate cuts next year, bringing the base rate down to 4%. Swap rates tumbled, which will pave the way for more cuts to mortgage rates in January.

“The mortgage market is getting quiet as we approach Christmas, but we expect rates to keep easing through January," Simon Gammon of Knight Frank Finance told the Times. "Lenders are locked in a battle for customers in a subdued market, and they will return in January with fresh targets, eager to make some headway."

A brighter outlook

The moderate easing of mortgage rates during the second half of 2023 has improved conditions in the housing market, but only to a point. Activity is picking up marginally and house price declines are slowing, according to Thursday's RICS Residential Market Survey.

The net balance for new buyer enquiries came in at -14% - still consistent with a relatively soft trend in buyer demand, but the least negative reading since April 2022. Agreed sales came in at -11%, from -23% the previous month, suggesting the downward trend in sales volumes is abating.

The outlook is beginning to look brighter. The near-term sales expectations series posted its first positive reading since early 2022. A net balance of +24% of respondents foresee an improvement in sales activity at the twelve month time horizon, marking the most upbeat reading since January 2022.

"Speculation is turning to the timing of a bank rate cut rather than the size of the next rise, providing a boost to sentiment that means transaction volumes should be higher over the next six months than the last six," Knight Frank's Tom Bill said in a statement. "The key uncertainty now is political ahead of a general election next year. Not only the uncertainty of when it will be called but a familiar question of whether the government will be forced into action sooner rather than later due to internal divisions.”

The collapse in house building

House building is falling rapidly under the pressure of higher mortgage rates and an increasingly dysfunctional planning system. The number of sites granted planning permission in England during Q3 was the lowest quarterly figure since the Home Builders Federation began gathering the data in 2006.

Quarterly approvals of 50,316, represents a decline of 12% on the previous quarter and 28% compared to the same quarter a year ago. The number of units gaining permission during the 12 months to Q3 was 245,872 – a 15% drop on the previous year and the lowest for a 12-month period since Q3 2015. The HBF estimates completions could drop to fewer than 200,000 next year, which would be the lowest level since 2014.

"If ministers continue with the proposals to rid the planning system of targets and consequences, no matter how it is packaged, it will result in fewer new homes and represents another victory for NIMBY backbenchers," said Stewart Baseley, executive chairman at the HBF. “Removing the requirement for local housing needs assessments and allowing councils to plan for as few homes as they wish will see housebuilding in some areas collapse with investment in jobs and communities all suffering."

Super prime sales

Activity in London’s property market has been stronger than the rest of the country as the effects of the pandemic fade.

The rebound in the capital is driven by the relative value on offer. While prices in prime central London fell 0.8% between the first quarter of 2020 and the end of 2022, country house prices rose by 18% over the same period, as successive lockdowns drove demand for space and greenery.

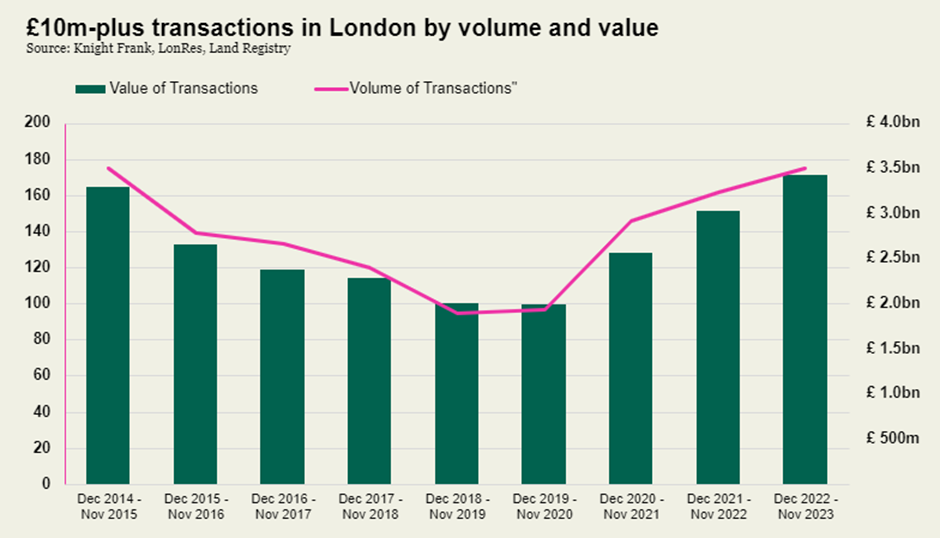

It has been the same story in the highest price brackets. The number of super-prime (£10 million-plus) sales in London reached an eight-year high of 175 in the 12 months to November, whole-market data shows.

"Clients can buy a trophy home in most PCL postcodes at the same price, or lower, than around 10 years ago," says Rory Penn, head of London sales at Knight Frank. "London is showing genuine value at what could be the low point in a 20-year cycle.”

In other news...

For the final episode of Intelligence Talks of 2023, Anna Ward gathers some predictions for the year ahead. How quickly will real estate markets recover, to what extent will elections disrupt proceedings, and how might the battle for sustainable buildings develop? Find out here, or wherever you get your podcasts.

Elsewhere - UK consumers turn a little more optimistic (Reuters), John Lewis denies 24-storey ‘Waitrose Tower’ will ‘loom’ over locals in planning row (Telegraph), house price predictions from the mortgage lenders (FT), Manhattan’s billionaire condo buyers would lose the ability to keep their identities secret (Bloomberg), and finally, Goldman sees India to Australia easing monetary policy following the Fed pivot (Bloomberg).