After the Pandemic: London Super-Prime Market Rebounds as Country House Demand Cools

The number of sales above £10 million in the capital has hit an eight-year high, although political risks remain

4 minutes to read

Activity in London’s property market has been stronger than the rest of the country over the last 12 months, as the effects of the pandemic fade.

The rebound in the capital is driven by the relative value on offer. While prices in prime central London fell 0.8% between the first quarter of 2020 and the end of 2022, country house prices rose by 18% over the same period, as successive lockdowns drove demand for space and greenery.

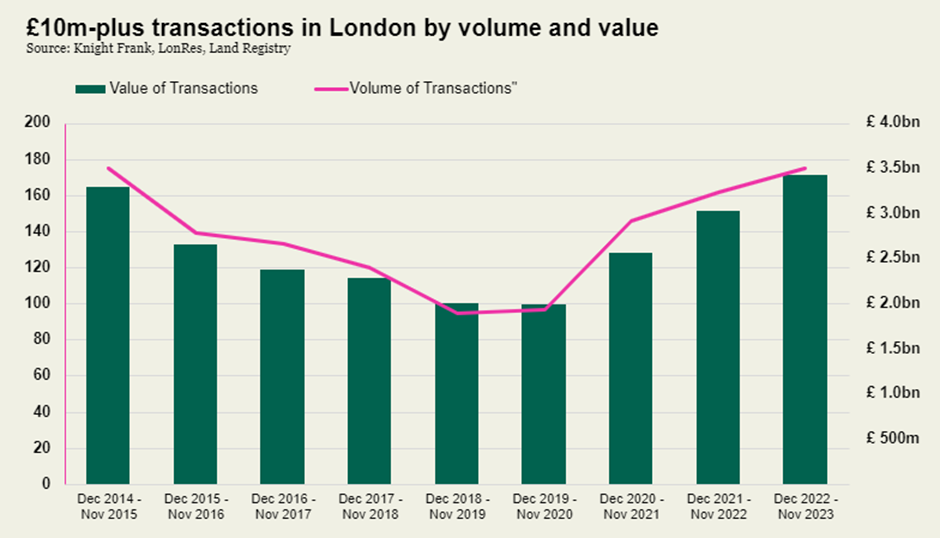

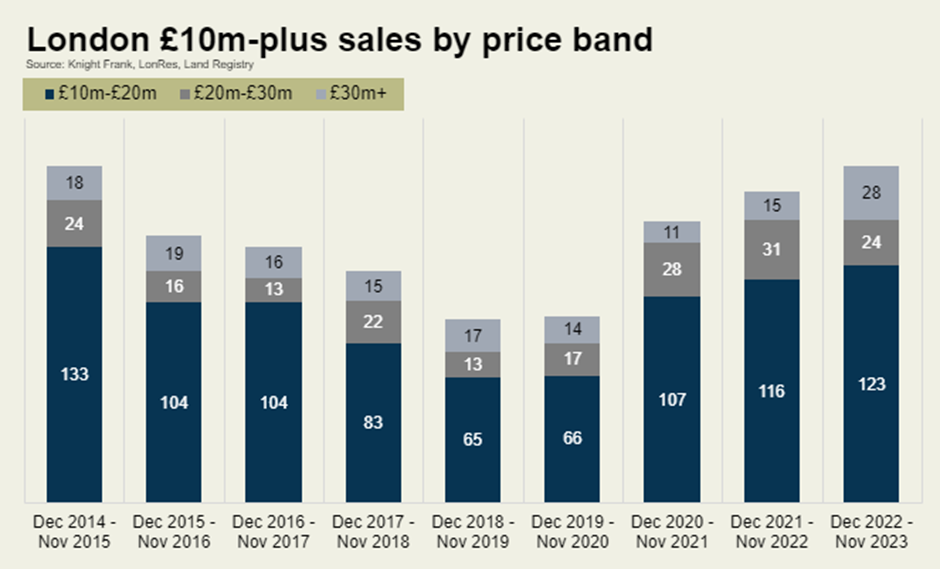

It has been the same story in the highest price brackets. The number of super-prime (£10 million-plus) sales in London reached an eight-year high of 175 in the 12 months to November, whole-market data shows.

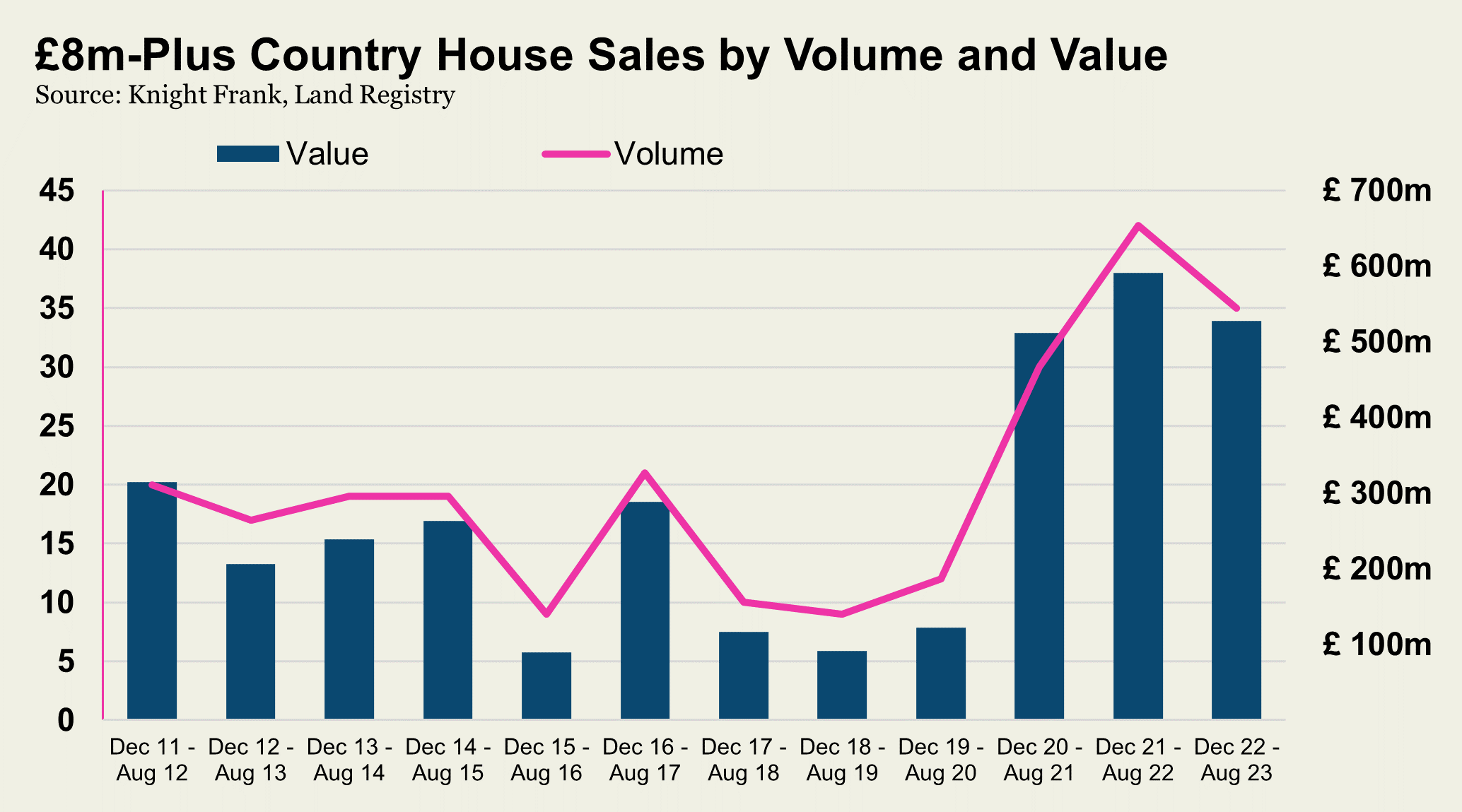

Meanwhile, the number of super-prime (£8 million-plus) sales outside of London fell to 35 from 42 between December 2022 and August this year. The total amount spent outside of the capital declined to £527.5 million from £590.6 million.

London super-prime sales are tracked independently so there is no three-month lag from the Land Registry.

There are two reasons driving London’s strong performance, said Rory Penn, head of London sales at Knight Frank.

“First, its enduring appeal as global ‘super city’ alongside New York, Paris, and Singapore – London remains front and centre on this list, Brexit or not. The other reason, often overlooked, is financial. Clients can buy a trophy home in most PCL postcodes at the same price, or lower, than around 10 years ago. London is showing genuine value at what could be the low point in a 20-year cycle.”

The last time there were more London sales above £10 million was in 2013/2014, a period before the introduction of higher rates of stamp duty for properties above £1 million. Some £4.2 billion was spent on 225 properties in the 12 months to November 2014, which compares to £3.4 billion this year.

Despite the stronger overall performance nine years ago, there were a total of 28 transactions above £30 million this year, which matched the 2013/14 figure.

“International demand has remained resilient above £30 million,” said Paddy Dring, global head of prime sales at Knight Frank. “This has been helped by the weakness of the pound, the fact average prices above £10 million are still 13% below their last peak in mid-2015 as well as the emergence of more super-prime developments in London.”

Not that demand has been consistently strong over the last 12 months. The fallout from the mini-Budget at the end of last year and the negative impact of stubbornly-high inflation and fast-rising interest rates over the summer caused periods of subdued activity.

However, there has been a notable pick-up over the last six weeks as the UK economic outlook has improved, said Paddy.

Inflation is now less than 5%, the best five-year fixed-rate mortgage has fallen below 4.5% and speculation has turned from the size of the next rate rise to the timing of the next cut, as we explored here.

That said, as the economic risks recede, the political risks will increase ahead of a general election and a potential new government in 2024. In particular, changes to non dom rules and rates of stamp duty for overseas buyers could curb demand in London’s prime postcodes.

“To some extent this is priced in,” said Paddy. “It has been the direction of travel globally for at least a decade. Governments want to control the flow of wealth around the world as it becomes increasingly mobile.”

There is also the risk that divisions in the ruling Conservative party over how to tackle the issue of immigration may bring forward a leadership challenge or general election.

The most popular London location for super-prime transactions over the last year was Mayfair, where 29 sales took place. This was followed by Kensington (24) and Belgravia (23).

Furthermore, in a sign the so-called ‘race for space’ is winding down, 38% of sales in London were flats, a figure that fell to 30% during the pandemic and compares to 40% in 2019.

The popularity of apartments has also been driven by the changing demographic of buyers in London’s super-prime postcodes, said Rupert de Forges, head of prime central London developments at Knight Frank.

“West Coast US and mainland Chinese buyers have become more active above £10 million,” he said. “They tend to be younger and less focussed on traditional family houses.”

Meanwhile, the Country house market has evolved since the pandemic, during which demand surged for picture-postcard locations.

“A two-tier super-prime market has emerged,” said Ed Rook, head of the country department at Knight Frank. “Properties that are well-located, in a great condition and ready to move into are still attracting great interest. What’s changed since the pandemic is that properties needing work can get overlooked. It’s gone from a market driven by outdoor space and privacy to one driven by the state of the property itself. People will pay a premium if they can move in straight away.”