Revealed: the most snow-sure ski slopes across the French and Swiss Alps

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Is that it?

Halifax yesterday became the second major lender to report that UK house prices rose during October. The group said values climbed 1.1% during the month, cutting the annual decline to -3.2%. The report follows Nationwide's from this time last week that said values rose 0.9% during the month.

This is surprising given the steep rise in borrowing costs and we're very sceptical as to whether it can continue. Tom Bill wrote a good piece for the Times earlier this year outlining how the various indexes differ and why you should take month-to-month moves with a pinch of salt.

"Thin trading means monthly price movements should be handled with care but price falls have been kept in check by the hesitancy of both buyers and sellers," Tom told various media yesterday. "It means this slowdown has been a story of weak sales volumes, not fast-declining prices."

House prices, continued...

Many homeowners are opting to sit tight while waiting for borrowing costs to fall and transactions dictate property values. The probability that we'll see meaningful numbers of forced sales still looks remote, and it remains possible that the pool of buyers, even at these rates, will continue to outweigh the supply of homes, which will put a floor under values.

Large monthly declines in the final months of 2022 should mean that annual declines measured by the major indexes will ease further during November and December. Indeed, stable house prices during those months would bring house price inflation to zero by the end of the year, consultancy Capital Economics wrote in a note to clients yesterday.

"While it would be unprecedented for a rise in mortgage costs of the scale we have seen not to result in house price falls, supportive labour market conditions and generous lender forbearance mean it is plausible," the group said.

Prime central London

The thin trading extends into London's prime postcodes. Activity in prime central and outer London during October was similar to the same month in 2022, when the market was reeling after the mini-budget.

Some prospective sellers are opting to let out their property until conditions improve. The number of rental properties coming to the market in prime central London above £1,000 per week foot was 22% higher in October compared to the same month last year.

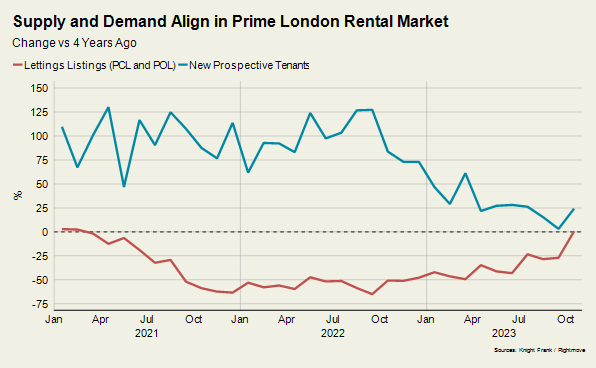

Supply and demand in the prime London rental market is now beginning to align after two turbulent years (see chart). See the index for more.

Resilience

We naturally talk a lot about interest rates and how they impact demand for property, but the factors driving buyers to purchase one home over another are changing all of the time.

Knight Frank this week released its annual Ski Property Report, which included a survey of more than 320 clients. Many ski housing markets find themselves at the sharp end of climate change and almost three quarters of buyers now say that the resilience of a ski resort influences where they buy.

To help clients understand which resorts are likely to be the most resilient in the long-term, Knight Frank’s Analytics team have mapped ski areas over 2,000 metres with north- facing slopes across key French and Swiss resorts.

While resorts such as Gstaad, Zermatt and Chamonix rank highly, it’s not all about altitude. A lower altitude dual season resort with north-facing grassy slopes, such as Villars-sur- Ollon, can prove more snow-sure than a higher altitude resorts with south- facing slopes. Temperature, snowfall reliability, not to mention the numerous micro-climates that exist across the Alps can lead to significant differences across relatively small distances. The results are fascinating - see the report, linked above, for more.

Too early to think about rate cuts?

Interest rates in many major western economies are now at or close to peaking. Optimism is seeping through markets - long duration government bond yields are easing in the UK and the US (see the latest Leading Indicators from Will Matthews). US stocks have just had their best week in a year.

This is a dangerous moment for central bankers, who will want to keep a lid on sentiment until the threat of a new round of rising inflation has eased sufficiently. Bank of England Governor Andrew Bailey was quick to shut down any talk of rate cuts following last week's MPC meeting:

“We’ve held rates unchanged this month, but we’ll be watching closely to see if further rate increases are needed,” he said. “But even if they are not, it is much too early to be thinking about rate cuts.”

It's interesting, then, that the Bank's chief economist Huw Pill isn't holding that line. Pill on Monday said that pricing in financial markets, which is pointing to a first rate cut to Bank Rate in August 2024, "doesn't seem totally unreasonable, at least to me." That prompted another dip in gilt yields. Swap markets are now pricing in 0.75 percentage points of rate cuts next year.

In other news...

Knight Frank experts across our European network have analysed the latest occupier activity in their local office markets during the third quarter of 2023. You can find a round up from Judith Fischer here.

Elsewhere - the IMF sees the European economy at a turning point (IMF), think tank urges Hunt to invest in economy, not tax cuts (Reuters), job market remains sluggish in October, KPMG/REC survey shows (Reuters), and finally, Persimmon sales increase as confidence builds in the property market (Times).