European office occupier market Q3 2023

Take-up continued to soften as vacancy rates picked up, but prime rents have held up in most markets.

13 minutes to read

Local experts across the Knight Frank network have analysed the latest occupier activity in their region in the third quarter of 2023.

Updated quarterly, the dashboards provide a concise synopsis of occupier activity in Europe's office markets.

Discover vacancy rates, take-up and prime rents from cities across Europe in more detail by exploring the dashboards for Q3 2023 at the bottom of each section.

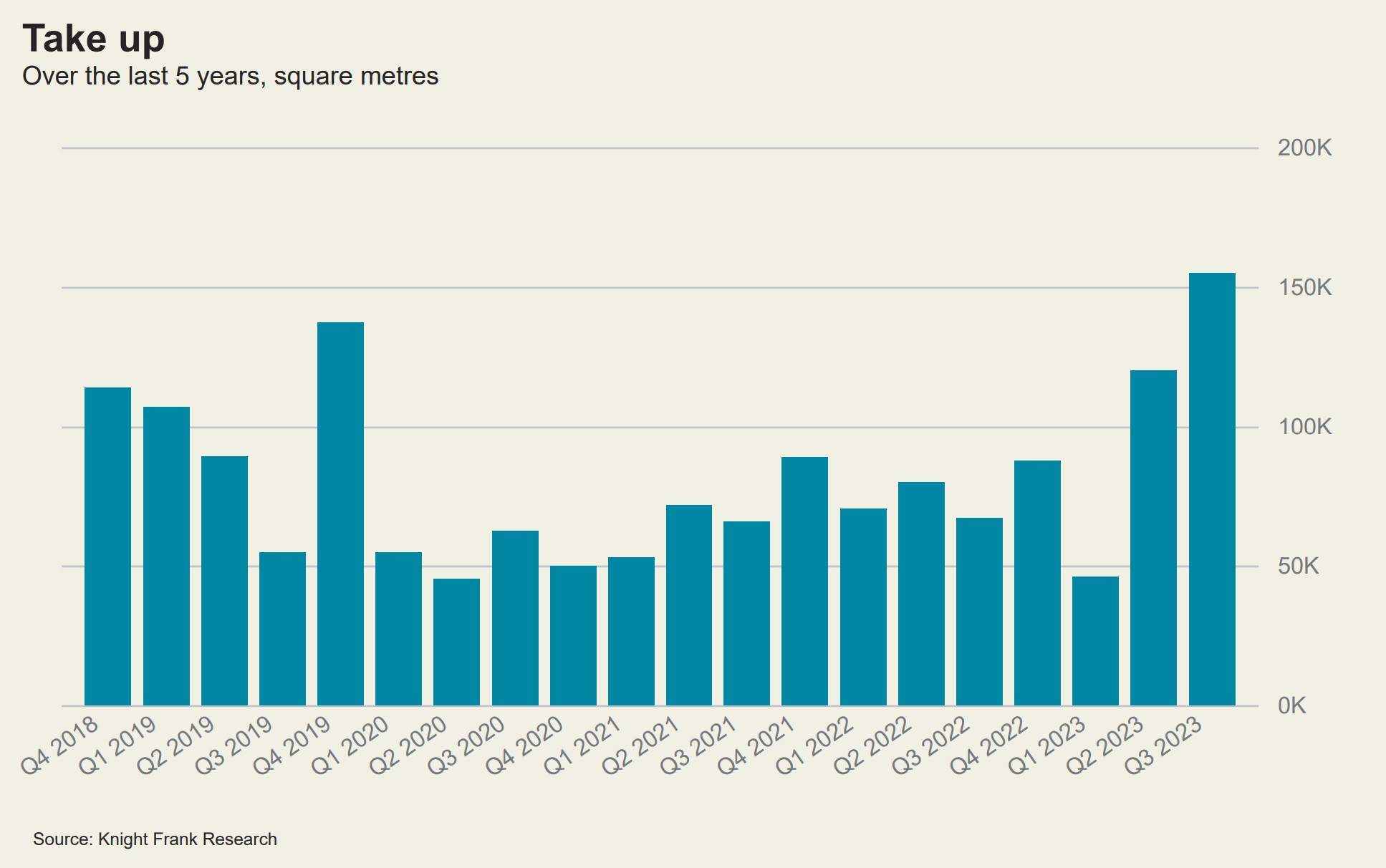

Bucharest office market

In the Bucharest office market in Q3, take-up reached a record level of 155,000 sqm, bringing the total take-up for the first three quarters of the year to 321,000 sqm. This is 48% higher than what was seen in this time period last year, and the highest Q1-Q3 take up in the last ten years.

There were 65 deals signed, of which almost 60% were renewals as tenants anticipate a limited number of new space deliveries to relocate their premises to in coming years. The IT & Communications sector remained the most active sector making up 41% of volumes, followed by the Banking & Finance sector with 18%.

The most sought-after submarkets in 2023 have been the Floreasca/Barbu Vacarescu which saw approximately 72,000 sqm of leasing activity (22% of total take-up), the Dimtrie Pompeiu area where 65,000 sqm of space was leased (20%), as well as the Center-West with 18% of total leasing activity.

Prime rents in the Bucharest office market held firm in Q3 at €240 psqm, an increase of 8% year-over-year. The vacancy rate remained unchanged at 16%.

Construction completions in Q3 amounted to 32,500 sqm, bringing the total for the year so far to 102,500 sqm. However, amid a lack of approvals for new building permits, it is estimated that a smaller number of projects will be delivered in the next few years than in recent years.

There are 7,500 sqm of space under construction to be delivered in Q4, and only 50,000 sqm in the next two years. In the last five years, the average annual construction completions have stood around 200,000 sqm, making this decrease a notable one that is likely to change the dynamics of the office leasing market. As the balance shifts in landlords' favour, further upward pressure on rents is expected.

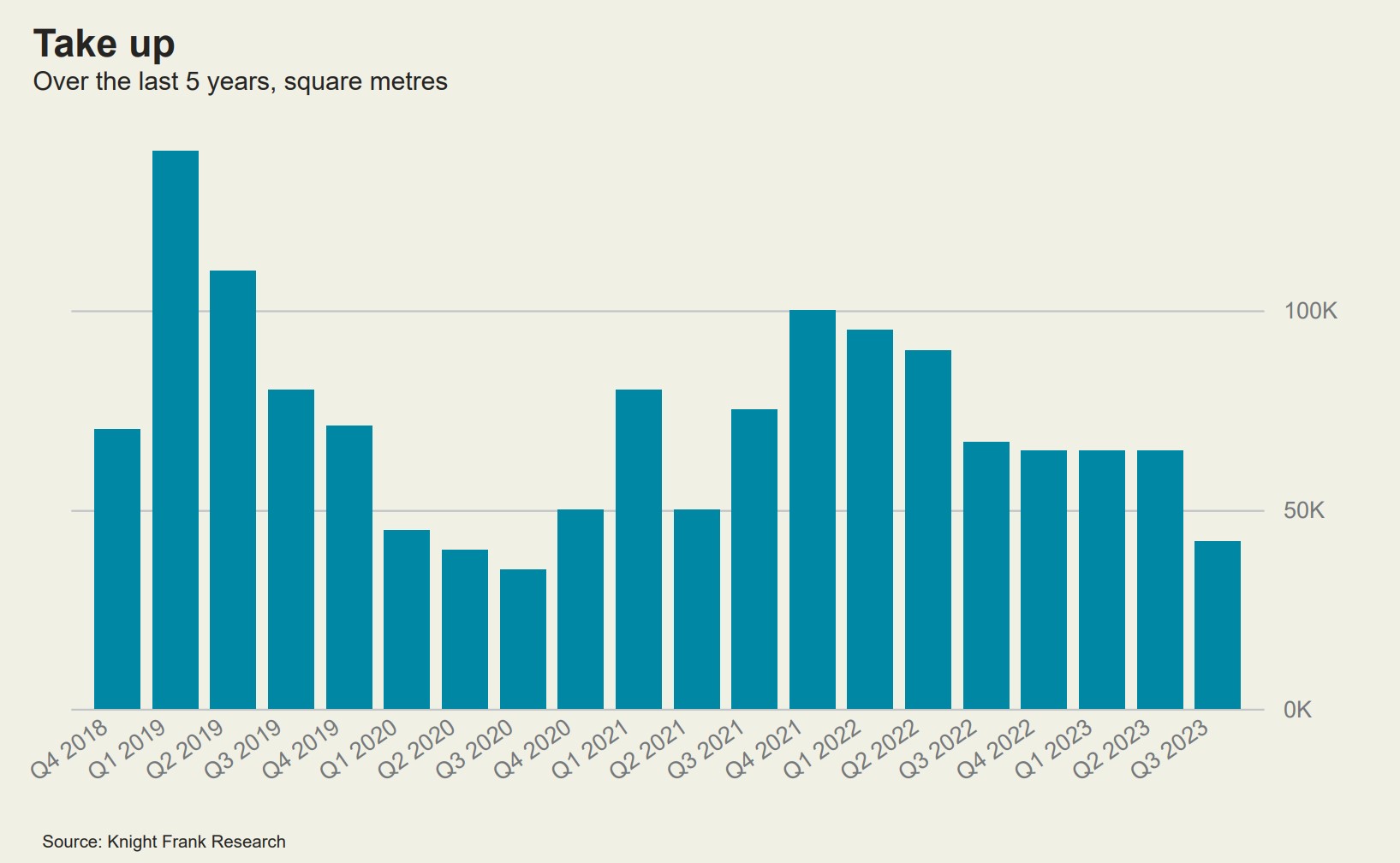

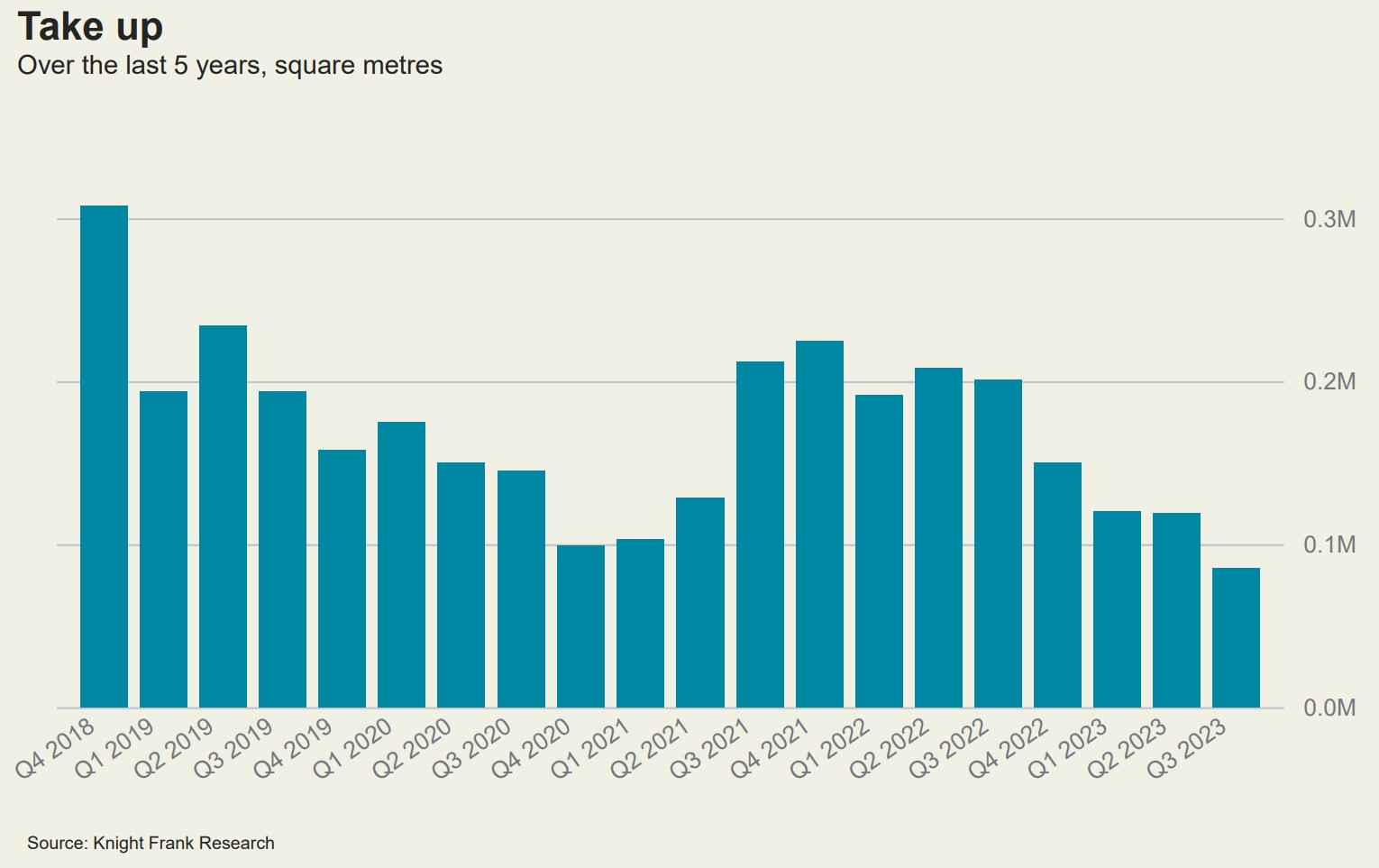

Barcelona office market

In the third quarter of 2023, the Barcelona office market recorded 42,000 sqm of take up. This represents a 35% decrease from the take up volume in Q3 2022. The central area and the 22@ district remain the most sought-after submarkets.

Total take up for the first nine months of the year stands at 172,000 sqm. The technology and healthcare sectors are among the most active in terms of leasing activity.

Two notable deals signed in Q3 included Sanitas for 2,175 sqm, and Qilimanjaro Quantum Tech for over 1,900 sqm.

There are approximately 6.6 million sqm of office stock in the Barcelona market, and a further 600,000 sqm of new supply are expected to be added to the market during 2023 and 2024. The districts of 22@, La Fira, and the rest of the 'New Business Area' are to be the main areas of office development in the city.

The vacancy rate has increased since Q3 2023 to 11.5%, from 10.4% in Q2 2023 and 8.7% in Q3 2022. This is largely due to the addition of new stock to the market of 203,240 sqm in 2022, the volume of which surpasses the current leasing demand.

Prime rents have also held firm at €330 psqm per annum, slightly higher than the level seen in the same period a year ago. The search for high-quality buildings continues to maintain rental levels.

View the latest dashboard

Berlin office market

Office take up in the Berlin market totalled 424,300 sqm in the first three quarters of 2023, down 28.5% from the volume seen in Q1-Q3 2022. The third quarter was the strongest so far this year, reaching 173,200 sqm, but nevertheless remains 25.8% below the Q3 2022 take-up.

New remote and hybrid concepts have led to higher demand for small and medium size segments. The 5,000-10,000 sqm segment is the only one that experienced growth of 6%, while there were only three deals above 10,000 sqm year to date. The public sector contributed 18% of the overall take-up.

The vacancy rate continued to increase in Q3 by 30 bps since last quarter, coming to 4.2%. This represents a 41% rise over the year and can be attributed to lower market activity, ongoing high completion figures and an increase in sublet space.

Prime rents increased to € 534 psqm per annum, demonstrating a willingness to pay top rents for high-quality and ESG-compliant spaces in well-connected locations. This demand, together with inflationary price pressures, has led to a 3.5% increase in prime rents year-on-year.

There were 376,600 sqm of construction completions in the first three quarters, 13% more than in the same period the previous year. Looking ahead, construction activity remains high and an approximated 1.3 million sqm of office space is currently under construction.

Expectations for the remainder of the year are subdued as the challenging economic environment continues to weigh on the real estate market. The prime rent is expected to remain under upward pressure amid high construction costs and limited high quality ESG compliant space.

View the latest dashboard

Madrid office market

The Madrid office market saw 80,000 sqm of take up in the third quarter of 2023, a fall from the 110,000 sqm recorded in Q2 2023 and a 20% decline compared to the same period the previous year. In 2023 YTD there have only been four transactions above 5,000 sqm, totalling around 26,500 sqm.

Two notable leasing deals recorded in Q3 2023. The ca.10,500 sqm take-up of Straumann Holding of the entire Alcalá 544 building and the lease of ca. 4,600 sqm in Paseo de la Castellana 77.

The vacancy rate remained stable at 11.8% in Q3. The most recent peak for the figure was in Q1 2022 at 12%, and the most recent low was 11.1% in Q3 of the same year.

There are an estimated 90,000 sqm of remaining new supply expected in 2023, and a further 207,600 sqm anticipated throughout 2024 and 2025.

In terms of rents, there is a polarisation in the Madrid office market. Inside the M-30, prime rents have increased to €456 psqm per year due to the scarcity of available high and very high quality space and prime rents are likely to continue to increase. Outside the M-30, there is no general trend of rising prices.

The market favourability is currently tipped towards the tenant but is expected to shift

towards the landlord in 2024.

View the latest dashboard

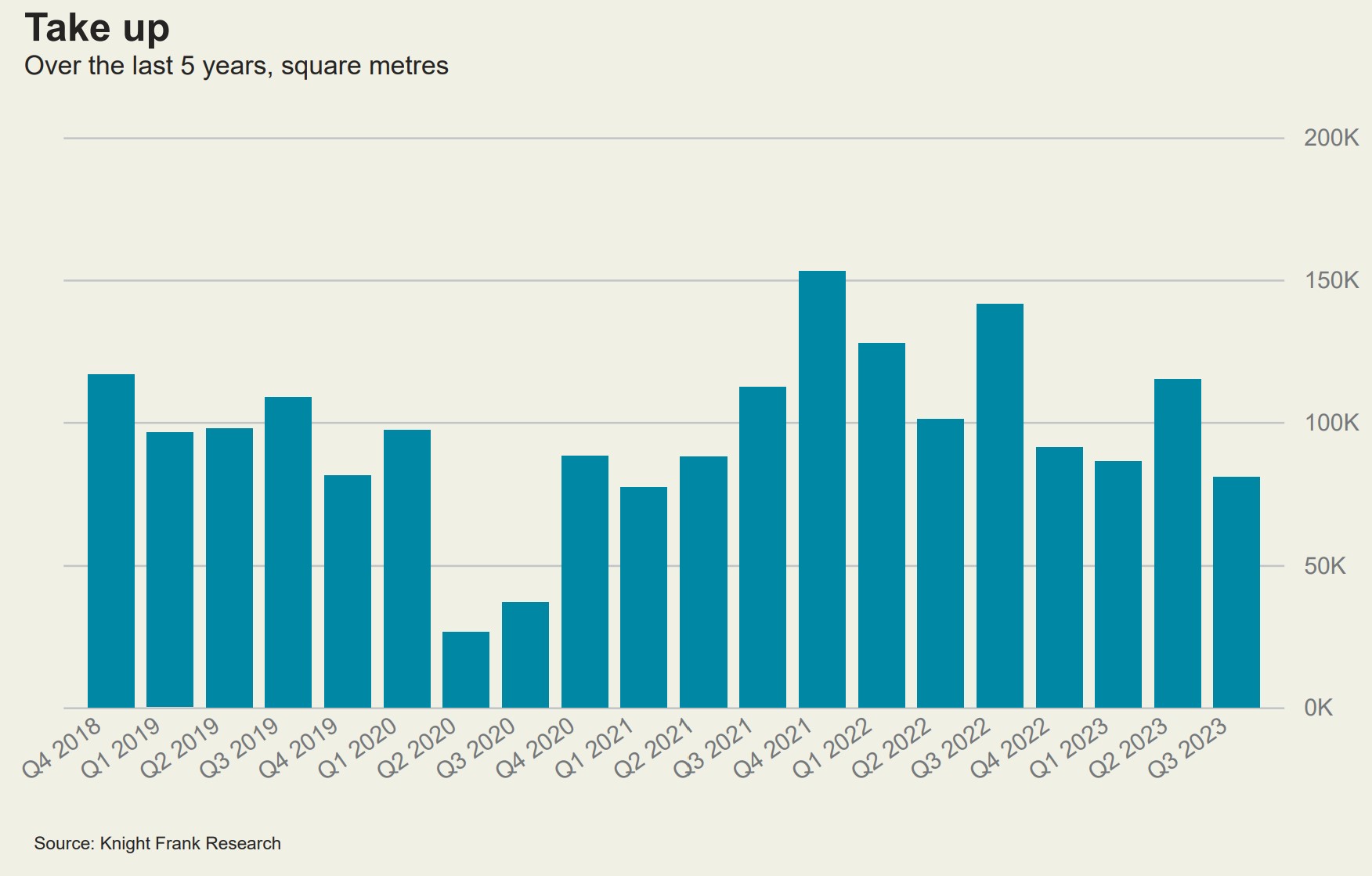

Munich office market

In the Munich office market, the downward trend in take up this year continued in Q3, recording 85,400 sqm. This brings the total for the year to date to 324,500 sqm, representing a 46% decrease when compared to take up recorded in the same time period last year and 34% below the five-year average.

As a result, the vacancy rate has continued its upward trajectory, ticking up slightly to a new high of 5.8% from 5.7% last quarter. The vacancy rate remains lowest in the Old Town and City Centre markets, and highest in the periphery of the city.

Prime rents in the market remain at € 552 psqm per annum in Q3 after reaching this historically high level in Q2. This represents an increase of 8% year-on-year. Prime rents are expected to keep stable for the rest of the year.

The market saw 24,500 sqm of construction completions in Q3 2023, bringing the total for the year to date to 215,800 sqm. This is above last year's volume for the same time period of 129,300 sqm, but 32% below the five-year average for the first three quarters of the year.

There are another 135,000 sqm of space under construction that are expected to be delivered in Q4 2023, and more than 900,000 sqm under construction or in planning stages set for completion in 2024-2025. Only a small proportion of the development pipeline is space found in the Old Town, therefore unlikely to reverse the current supply shortage in prime locations.

View the latest dashboard

Paris CBD office market

The Paris CBD office market saw a 22% slowdown year-on-year in leasing activity in Q3 2023, after a near record performance in 2022. The CBD accounted for 21% of total takeup in the Île-de-France region in Q3 2023, compared to 24% in the same period the previous year.

The Paris CBD saw a 30% decrease in leasing transactions above 5,000 sqm in the first nine months of the year compared to the 10-year average. There was demand from sectors such as finance, luxury and consulting that faces an increasing scarcity of supply. In the CBD, supply decreased by 8% over the quarter and by almost 20% year-on-year. This translates to a vacancy rate of 2.4% compared to 2.9% a year ago and 5% at the same period in 2021.

With vacancy remaining low in the CBD, the shortage of supply is continuing to uphold prime rents. The prime rent is at a record high, reaching the symbolic threshold of €1,000 psqm per year for the first time in Q3 2023. The average rent in Paris CBD stands at €775 psqm per year, an increase of 8% in one year and 13% compared to the same period in 2021.

View the latest dashboard

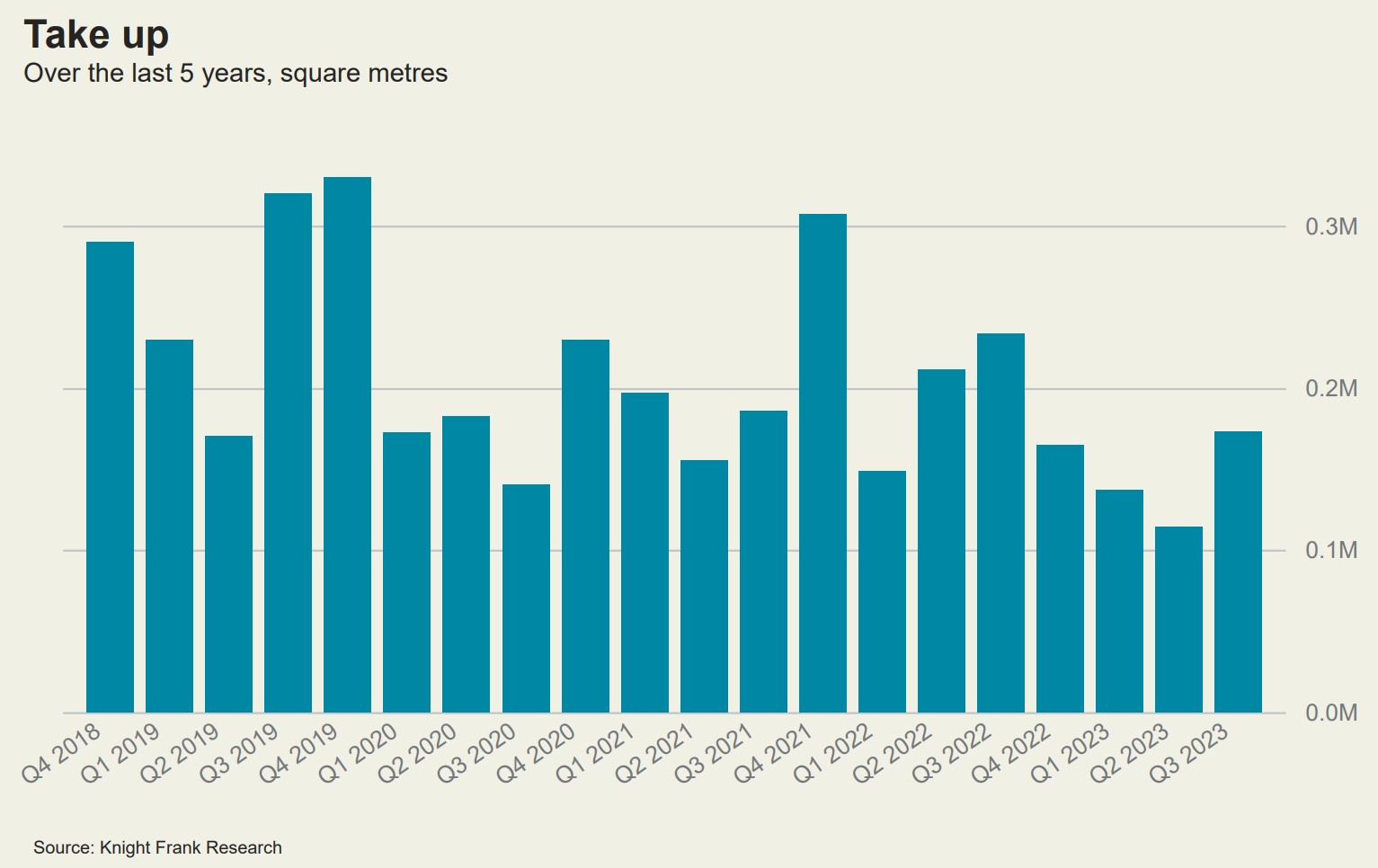

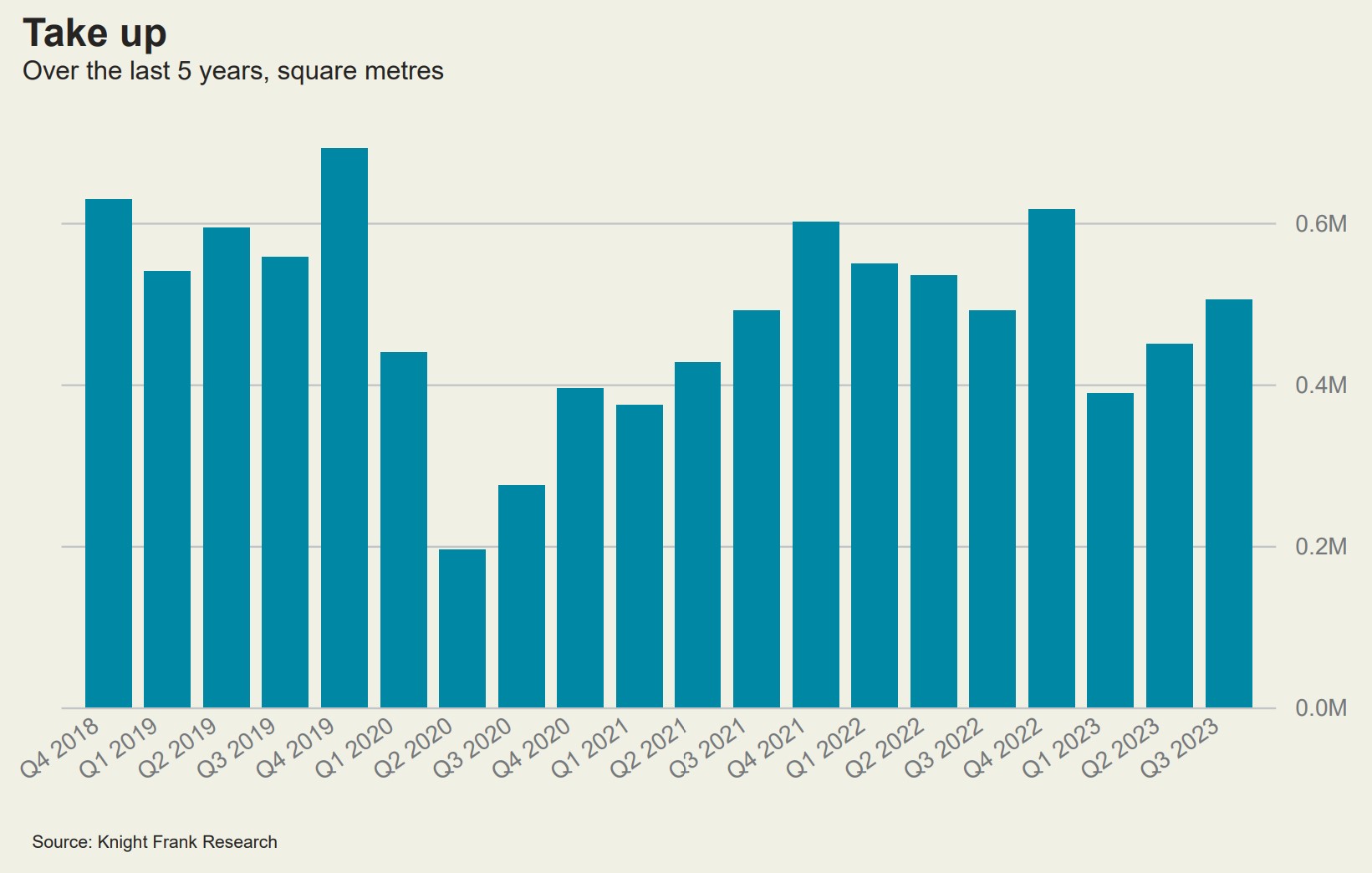

Paris IDF office market

In the third quarter of 2023, the Île-de-France office market saw over 500,000 sqm of take up, 13% more than the volume seen in Q2 2023. This brings the total for the first nine months of the year to 1.37 million sqm, representing a drop of 13% compared to the same period in 2022 and 10% relative to the Q1-Q3 10-year average. This suggests that the strong leasing performance in 2022 was only a temporary surge resulting from pent-up demand after the pandemic.

Geographic polarisation is an underlying trend in the office market. Thus, inner Paris, the Western Crescent and La Défense accounted for three quarters of the take-up in the Ilede-France region since the start of 2023, compared to 69% just before the pandemic. Across the Île-de-France region, the immediate supply totals 4.6 million sqm, an increase 13% in one year and 60% compared to the start of 2020.

This brings the vacancy rate for the region to 8.2% at the end of the third quarter of 2023 compared to 7.9% in the previous quarter and 7.2% a year ago. There are, however, significant disparities across the submarkets. The vacancy rate stabilised in La Défense (14.5%) and in the Western Crescent (13.6%), while it continued to increase in the Inner Suburbs where it reached 14% (+0.6 bps on the quarter).

Amid the overall rise in vacancy, average rents for the region remained stable at € 485 psqm per annum.

Unless there is as stronger rebound in take-up, available supply will start to rise more significantly in the coming months. More than 330,000 sqm of office space should be delivered in the fourth quarter in Île-de-France, of which 147,000 sqm are still available. This will bring the total for 2023 to 542,000 sqm.

In 2024, nearly 1.3 million sqm of new office space is expected to come to the market, of which 65% is still available. The rebound in construction deliveries will, however, be temporary. The development pipeline will decrease significantly in 2025, falling to 860,000 sqm, of which 67% is available space.

View the latest dashboard

Prague office market

Total leasing activity in the Prague office market decreased in Q3 2023 by 36% quarter-onquarter and 34% year-on-year to 88,200 sqm. Technology companies accounted for the highest share in total leasing activity in Q3 2023 (14%), followed by the pharmaceutical sector and construction, making up 11% of take-up respectively.

Recent figures confirm that occupiers tend to prefer renegotiations of their existing leases which represented 50% of the total leasing activity in Q3 due to increased relocation costs and changes in workplace strategy. While subleases recorded only 3% of the total leasing activity, there were 58,500 sqm of office space offered for sublease, representing an additional 1.5% shadow vacancy.

Overall office vacancy increased to 7.4% in Q3 2023. Looking ahead, vacancy rates are forecast to remain relatively stable due to the combined effects of lower new supply with second-hand excess office space coming to the market upon lease expiries.

Only one smaller refurbishment project started in Q3 2023 and there have been no new construction projects initiated since Q2 2022. This will undoubtedly limit the choice for prospective occupiers searching for prime office space in both 2024, and notably, in 2025. New supply in 2024 is expected to amount to only around 80,000 sqm.

Looking ahead, we foresee sustained rental growth pressures primarily in the city centre and in some inner city locations where demand outpaces supply due to limited supply pipeline in the coming two years. On the other hand, outer city locations with higher vacancy rates may face rent reductions.

View the latest dashboard

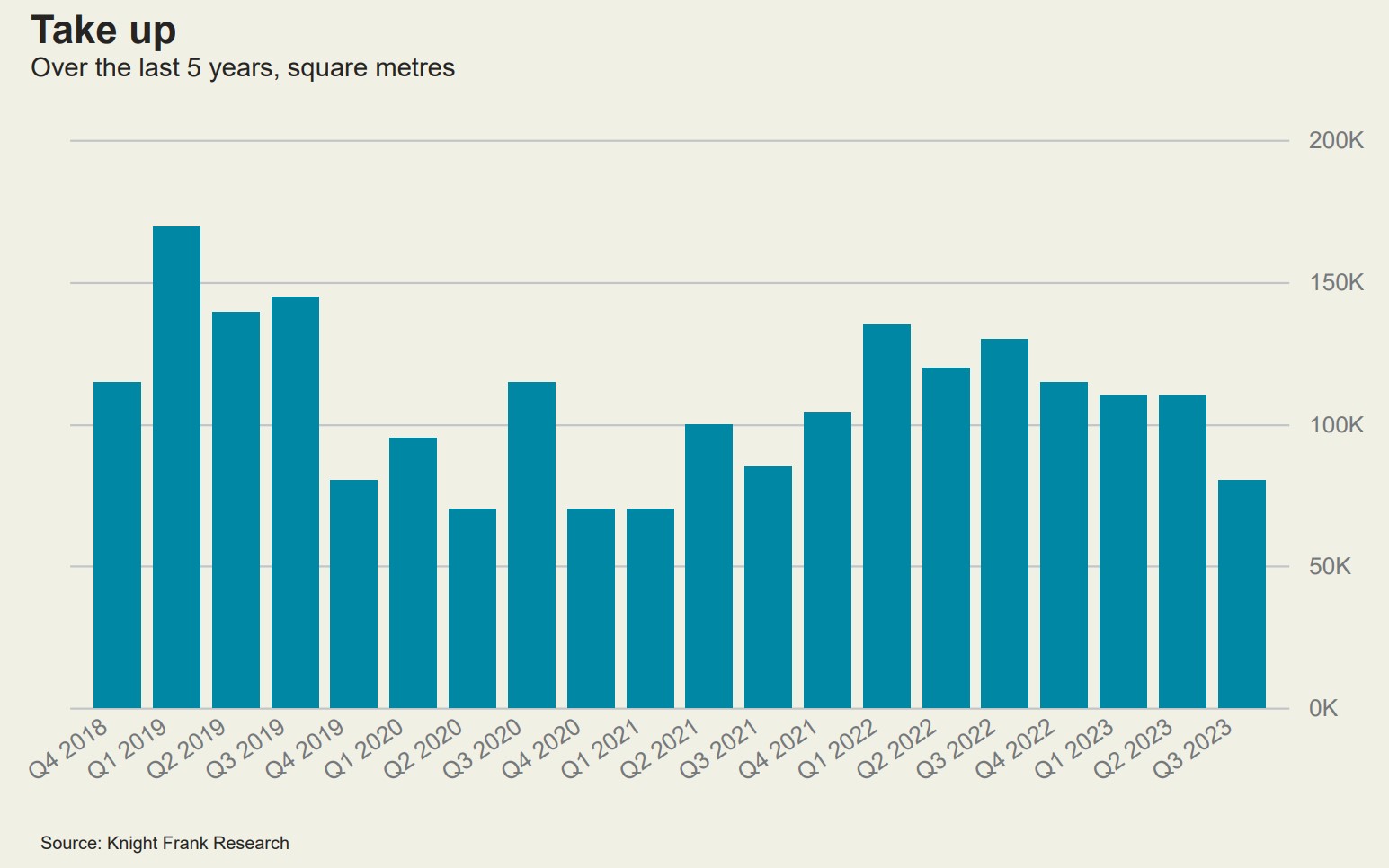

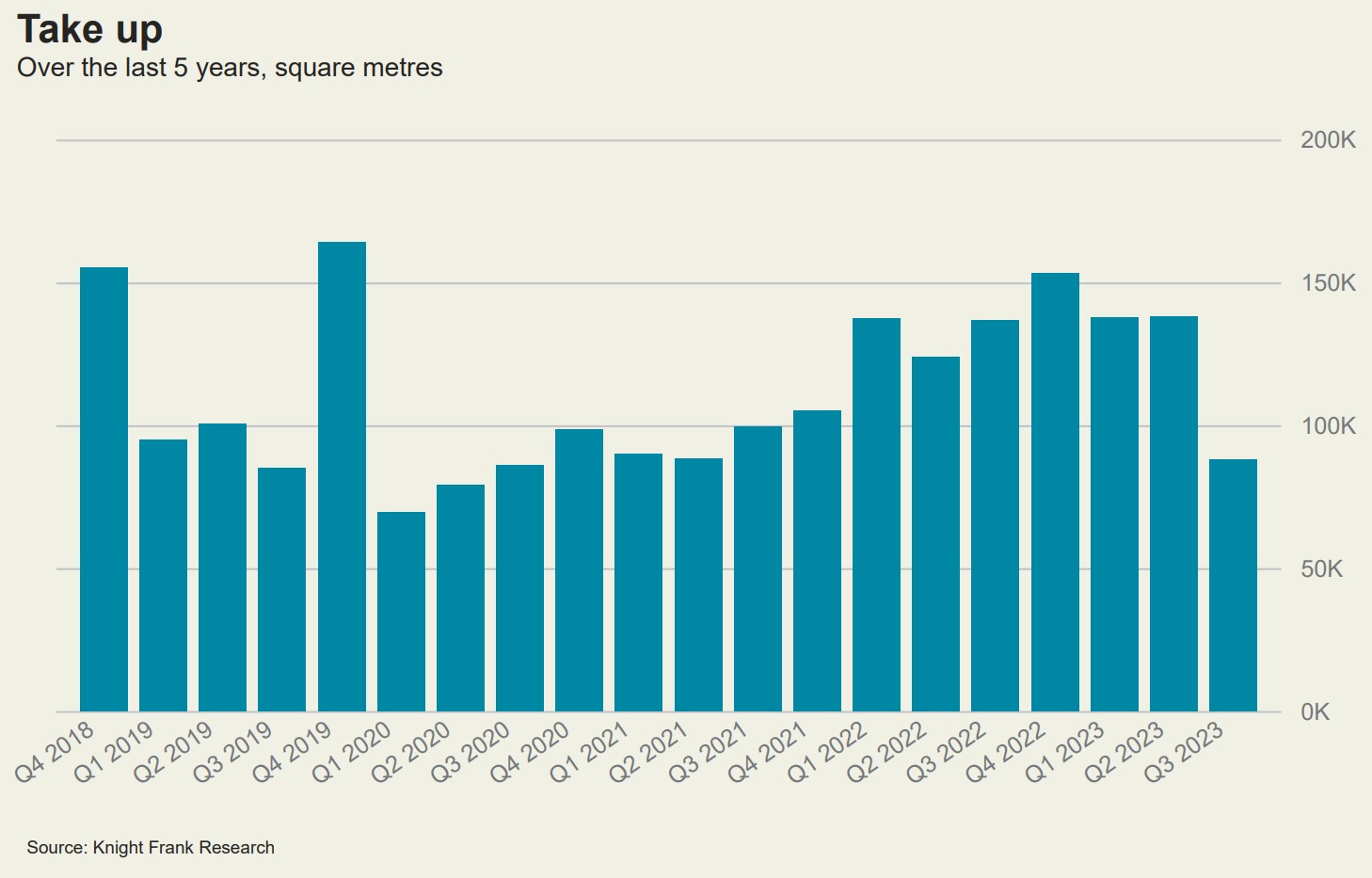

Warsaw office market

The third quarter of the year in the Warsaw office market saw higher tenant activity, than in Q2 2023 and Q1 2023. Take up of more than 174,000 sqm were recorded, a 4.1% increase over the quarter. This brings the total for the first three quarters of the year to just under

500,000 sqm.

In the first nine months of 2023, new agreements accounted for the largest share of transactions, representing more than 58% of the transaction volume (more than 287,800 sqm, including owner agreements). It should, however, be noted that twelve of the twenty largest leases concluded during this period are renegotiations, which accounted for more than 38% of the lease volume (around 190,000 sqm leased) between Q1 and Q3 2023.

Still, a limited number of tenants are opting to expand their leased space, meaning expansion agreements in the structure accounted for only 18,700 sqm – i.e., only 4% of the agreement volume recorded between January and September 2023.

Available office space at the end of Q3 2023 in Warsaw amounted to 657,400 sqm, representing 10.6% of office stock. Compared to Q2 2023, the vacancy rate was down 0.8 pp, while compared to 2022’s corresponding period, it was down 1.5 pp. In the central zones, the vacancy rate stood at 9.1% (down 0.8 pp on the previous quarter). Outside the city centre, the rate also saw a decrease (by 0.9 pp.), standing at 11.8%. The lowest vacancy rates were recorded in the North zone (4.8%) and in Mokotów (5.6%), while the highest was in Służewiec (20.2%).

The largest deal in the quarter was the 7,000 sqm take-up of ING Hubs Poland in The Form building. Elavon signed a lease of nearly 5,500 sqm in the Europlex building.

Prime rents increased in Q3 2023 to € 324 psqm per annum after a period of stable prime rents, representing a 3.9% increase compared to Q2 2023. Rents are expected to continue to rise in the near future.

View the latest dashboard