Residential listings rise as autumn approaches

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

August was quieter than usual in the property market. The number of new properties put up for sale was 6% below the ten-year average. Agreed sales were down 18% compared to the same month in 2019, according to Rightmove.

The figures, out this morning, suggest that sellers are still finding their way when it comes to values. Asking prices increased 0.4% in September - a sign that "some sellers are clearly being too optimistic on their pricing [though] it does appear that others are listening to their agents’ advice to price correctly from the outset," the company said. More than a third of properties on the market have now had a price cut.

The first-time buyer sector (two-bedrooms or fewer) was the best performing sector during September. Agreed sales were down by 13% versus 2019. Activity will pick up as autumn arrives and values will continue to soften. Indeed, the number of new properties coming to market jumped 12% in the first week of September when compared with the average weekly through August.

Confidence

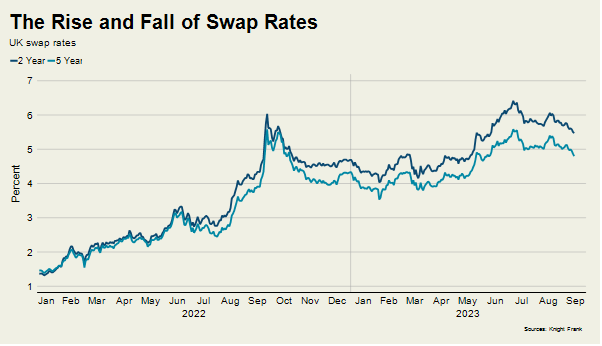

It's unsurprising that values are taking time to adjust given the year we've had. Five days from now it'll be exactly a year since then Chancellor Kwasi Kwarteng delivered the 'mini-budget' that set off a surge in borrowing costs.

Repeated forecasting errors from the Bank of England have also contributed to the most volatile period for mortgage rates in decades. Public confidence in the Bank of England’s approach to tackling inflation is now at a record low, according to a survey published on Friday.

Tom Bill likens the path of borrowing costs to a roller-coaster, though the hairpin turns now appear to be behind us (see chart). The Bank of England will likely hike the base rate by 25 basis points to 5.50% on Thursday, a move that we expect to have little impact on mortgage rates. That will probably mark the end of this tightening cycle, which should - barring any new crisis - usher in a period of stability for mortgage rates that will allow values to properly adjust. It's still our view that a peak to trough decline of 10% looks about right.

Single family renting

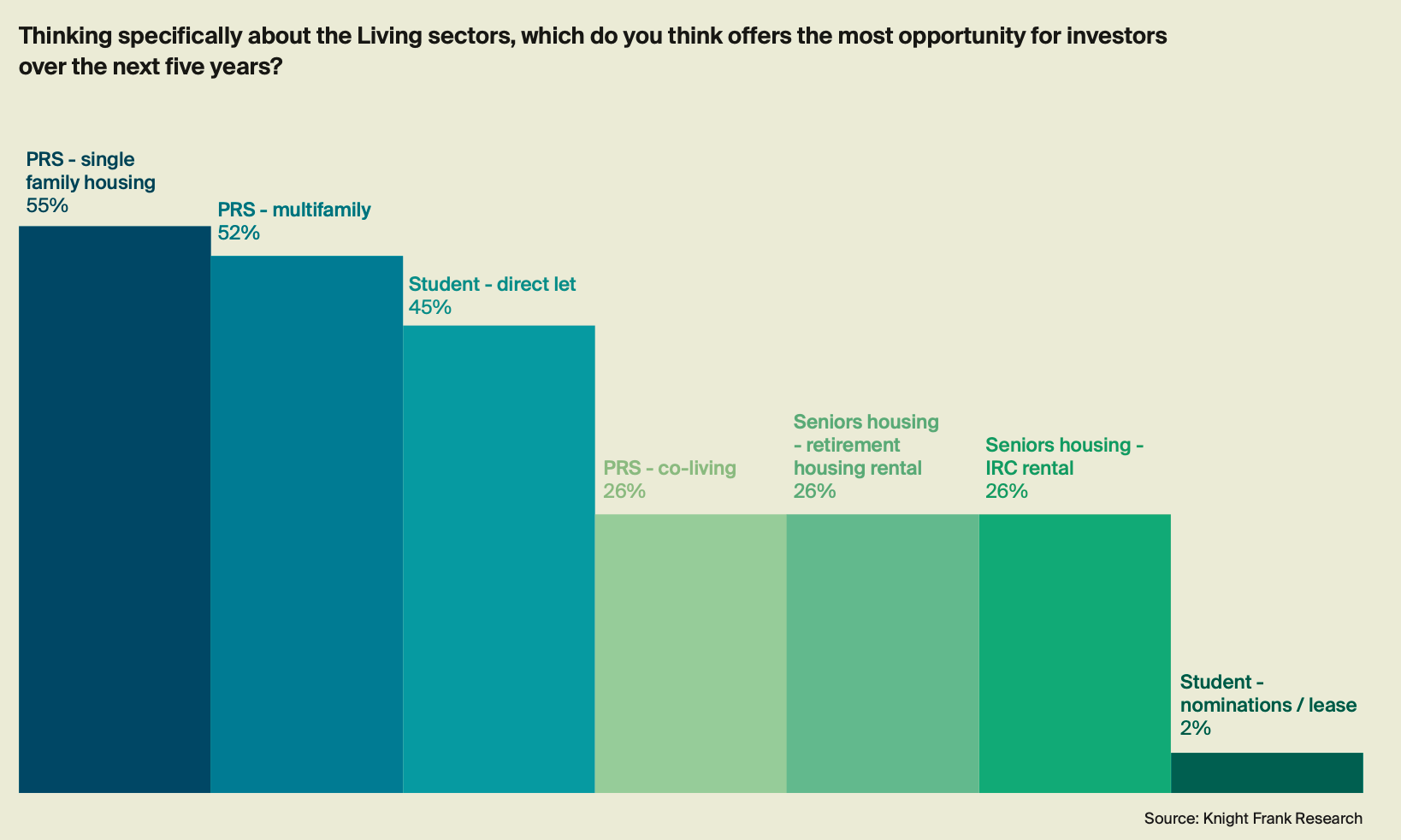

I talked on Friday about new Knight Frank data showing investors have set aside £45 billion to invest in the UK living sectors over the next five years - you can read our survey here.

Multifamily and Purpose Built Student Accommodation will remain at the heart of most investors’ strategies over the next five years. More than 95% and 79% of investors expect to target, or continue to target, these sectors respectively. Single Family Housing took the third spot, and was picked by investors as the sector that could provide the greatest opportunity over the next five years.

Now is a good time to be building a Single Family Housing portfolio. Housebuilders are happy to offload some risk by agreeing deals with investors. More than £450 million in SFH deals were agreed in the first three months of this year alone, exceeding last year's total. It's a massive opportunity - more than 60% of privately renting households in the UK already live in houses, equating to over three million households. While SFH delivery is increasing, it accounts for just 11% of overall BTR delivery to date, and only c.0.3% of the total number of privately renting households who live in houses.

Where next?

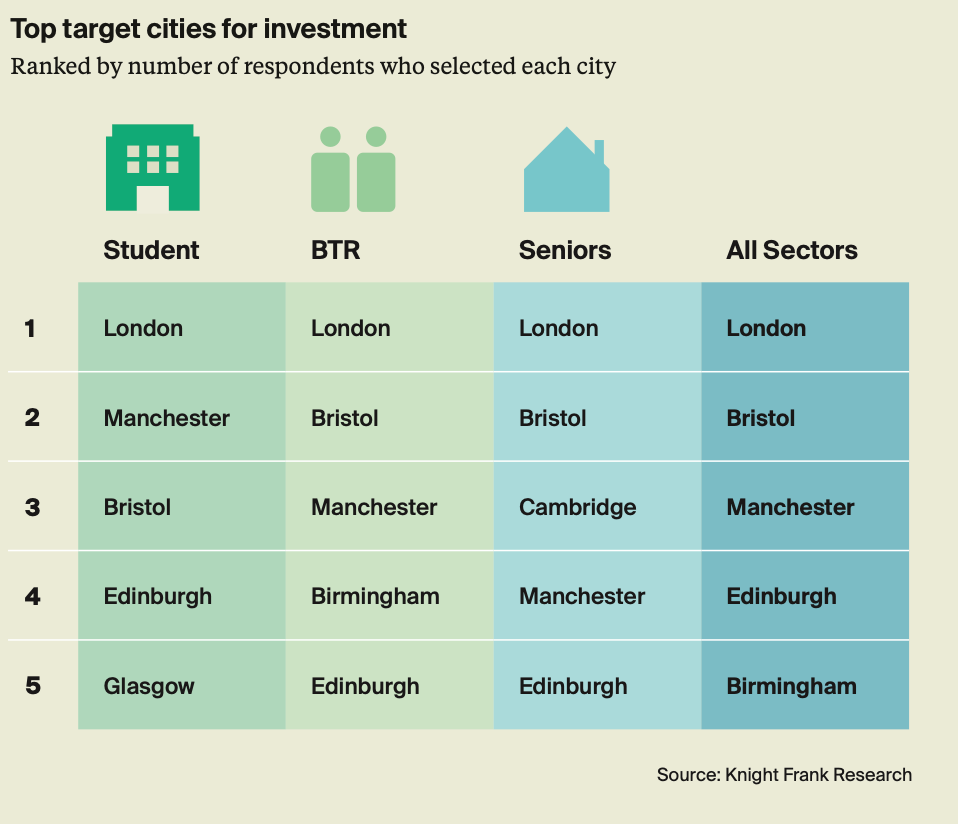

Our survey respondents identified the cities where they saw the biggest opportunities in each sector.

When examining the top five cities in each market, London, Bristol, Manchester, Edinburgh and Birmingham emerge as opportunity areas across all three sectors. This suggests an overlap of the different drivers for each sector to provide a favourable investment environment – from strong student demand, large-scale city regeneration and development as well as strong employment conditions, and a lack of seniors housing units.

Suburban markets, and other city locations which boast strong economic and rental demand fundamentals, including Glasgow, Leeds and Cambridge, were also mentioned. See the report for more.

In other news...

How long can the world’s borrowers hold on as higher interest rates bite? (Bloomberg).