What are buyers prioritising as mortgage rates rise?

Spacious, energy-efficient homes with access to amenities top home buyers’ wish lists.

4 minutes to read

Knight Frank's Residential Property Sentiment Survey is conducted twice a year. It is sent to individuals registered with the business, and is also open to the general public. Topics include sales and purchasing intentions; what the most important factors in a home and location are; and the impact issues such as the cost of borrowing and energy efficiency are having on purchasing decisions.

- Access to a garden or outdoor space is essential for 74% of buyers

- One in seven rate the energy efficiency of a home as more important than before the Ukraine conflict

- Buyers have seen their spending power reduced by a third due to the increase in borrowing costs

While the UK’s ‘escape to the country’ boom has faded with the end of Covid restrictions and the stamp duty holiday, the drivers that led to a sales surge during the pandemic are still topping buyers’ wish lists.

Our latest sentiment survey found that space and greenery are still key factors influencing decision-making, even with the resurgence in demand for urban locations and against the backdrop of a sharp increase in borrowing costs.

Asked ‘how important are the following factors when choosing a home’, access to a garden, outdoor space or land was essential for 74% of respondents and important to 20% - making it the top factor for buyers.

Proximity to green space or countryside was either essential or important for 86% of respondents. Close to three quarters (72%) of people rated more indoor space to live and work in as either essential or important to have.

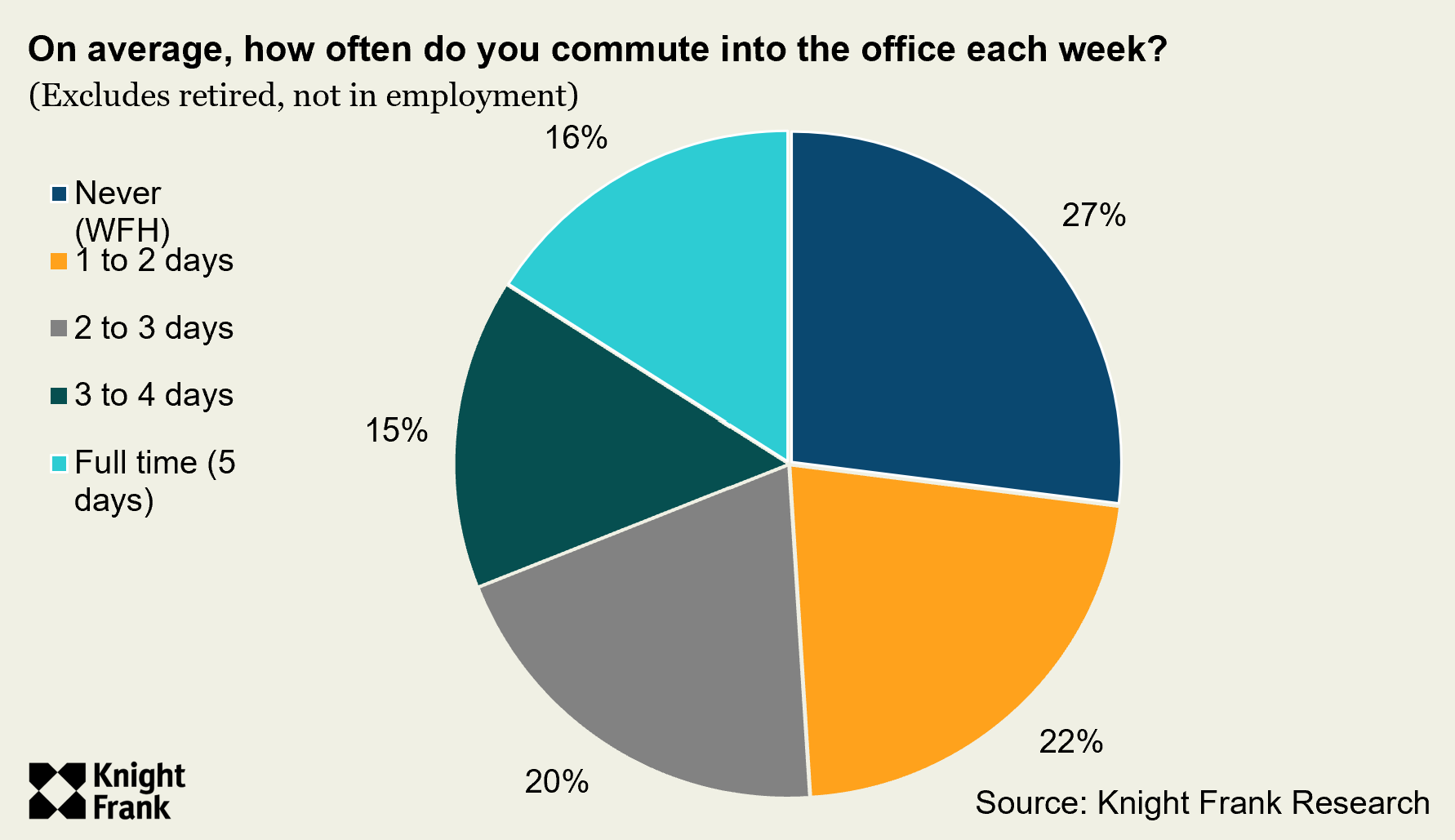

Underpinning this all is the change in how many people now work, with hybrid working now embedded as part of the return to the office (see chart).

“Unsurprisingly activity in the UK residential property market has softened against a backdrop of increased borrowing costs and stretched affordability. However, the key drivers that drove the ‘race for space’ during the pandemic remain, and with ever more of us hybrid working, space to live and work in, along with good connectivity, are key requirements for buyers,” said James Cleland, head of Knight Frank’s Country Business.

Excluding those that have retired or aren’t in employment, 57% of respondents undertake some form of hybrid working (commuting in between one and four days a week). This is unchanged from last year. With 27% working from home exclusively, just 16% are in the office five days a week.

Our Prime Sentiment Survey from November 2019 found 48% of respondents had ‘an element of working from home’ as part of their jobs.

This shift in working patterns since the pandemic means a home office or study remains essential or important to 73% of survey respondents, while 90% rated high-speed broadband as either essential or important. On the same basis good transport links were either essential or important to 86% of respondents.

The ability to live further from the workplace has seen the expansion of the commuter belt since the pandemic as buyers seek more for their money, something that will continue to evolve as we have previously explored.

However, buyers remain highly price sensitive, which has seen the gap between buyer and seller price expectations grow. As we previously explored, a third have seen their spending power reduced due to the increase in the cost of borrowing, with the Bank of England having now raised interest rates to 5.25%.

For 17% of survey respondents the hit to their spending power has been more than 10%, which is why we expect house prices to remain under pressure and fall by 10% across the remainder of this year and next.

Energy efficiency a key consideration in a home

Almost 18 months since the start of the conflict in Ukraine, which sent domestic fuel bills soaring, the efficiency of a home is more important to 72% of respondents.

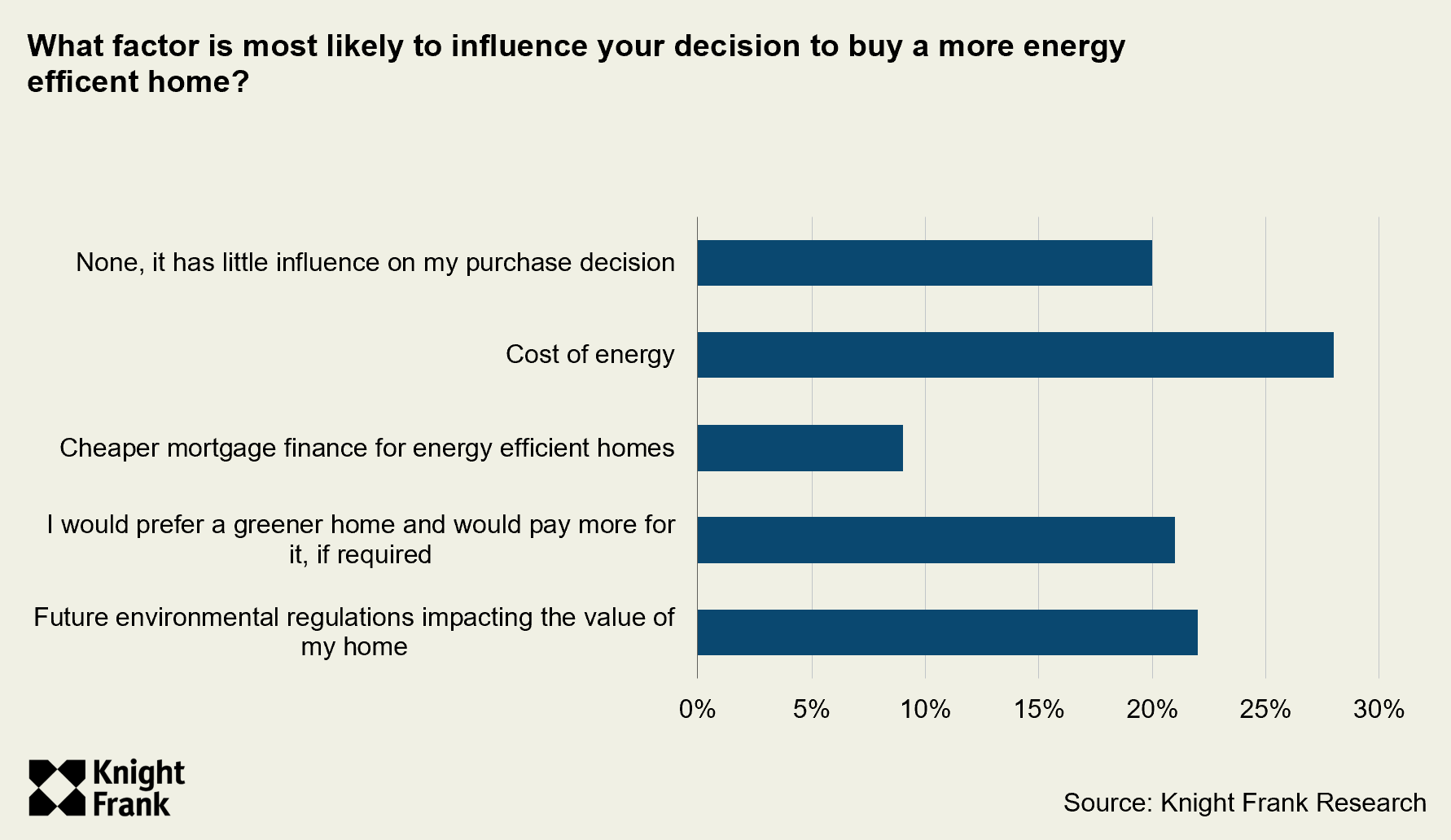

However, while the cost of energy was still the single-most important factor when purchasing an energy efficient home, scoring 28% (compared with 35% in December 2022 at the height of the energy bill crisis), it isn’t the only one.

The prospect of future environmental regulations negatively affecting the value of their property (22%) and preference for a ‘greener’ home (21%) were also key motivators (see chart).

“The energy efficiency of a home has become much more important over the last five years. I’m seeing demand from all ages and buyer profiles,” said Louise Glanville, office head at Knight Frank Exeter.

“Yes, there is a premium attached, but people are much more willing to pay it now than they were in previous years,” Louise added.

Other key survey findings

- 87% of people rate being close to amenities such as pubs, restaurants, and theatres as either essential or important. An equivalent question asked during May 2020 as the first national lockdown ended found just 16% of people rated proximity to similar amenities as ‘more important’ to them.

- Despite wanting to be closer to work and amenities, privacy was essential for 55% of respondents.

- Upgrading the family residence (32%); downsizing (22%) and a lifestyle change (19%) were the top three motivations behind a home purchase.

- A detached home (72%) was the most popular tenure type for home purchase with flats (13%) second.