What is happening to build and labour costs?

Plus, rising inflation and a few reasons to be bullish/bearish

3 minutes to read

Rising mortgage rates, high build costs and a complex planning environment have all prompted house builders to adopt more defensive strategies so far this year.

Build costs increased by 8.7% last year and are up 24% since 2020, according to the BCIS. Materials costs have risen 43% in two years, while labour costs are up by nearly 10%. Data from the ONS points to even faster rates of inflation for individual building materials, particularly those that are energy-intensive, or in high demand.

There are signs that build cost inflation is beginning to ease. That same ONS data points to 20% price declines for some key building materials (concrete, steel, timber) over the last 12 months, for example, following price surges in 2021 and 2022.

A slowdown in materials cost inflation reflects a general easing in construction activity across the residential space, but it also comes as supply chains recalibrate post-pandemic and following disruptions caused by the ongoing Ukraine war.

Construction companies have reported declines in residential work for six consecutive months, according to May’s Purchasing Managers Index, which registered the steepest monthly fall since May 2020. May’s PMI also noted that supply chain conditions have continued to normalise, with the greatest improvement in vendor lead times since August 2009.

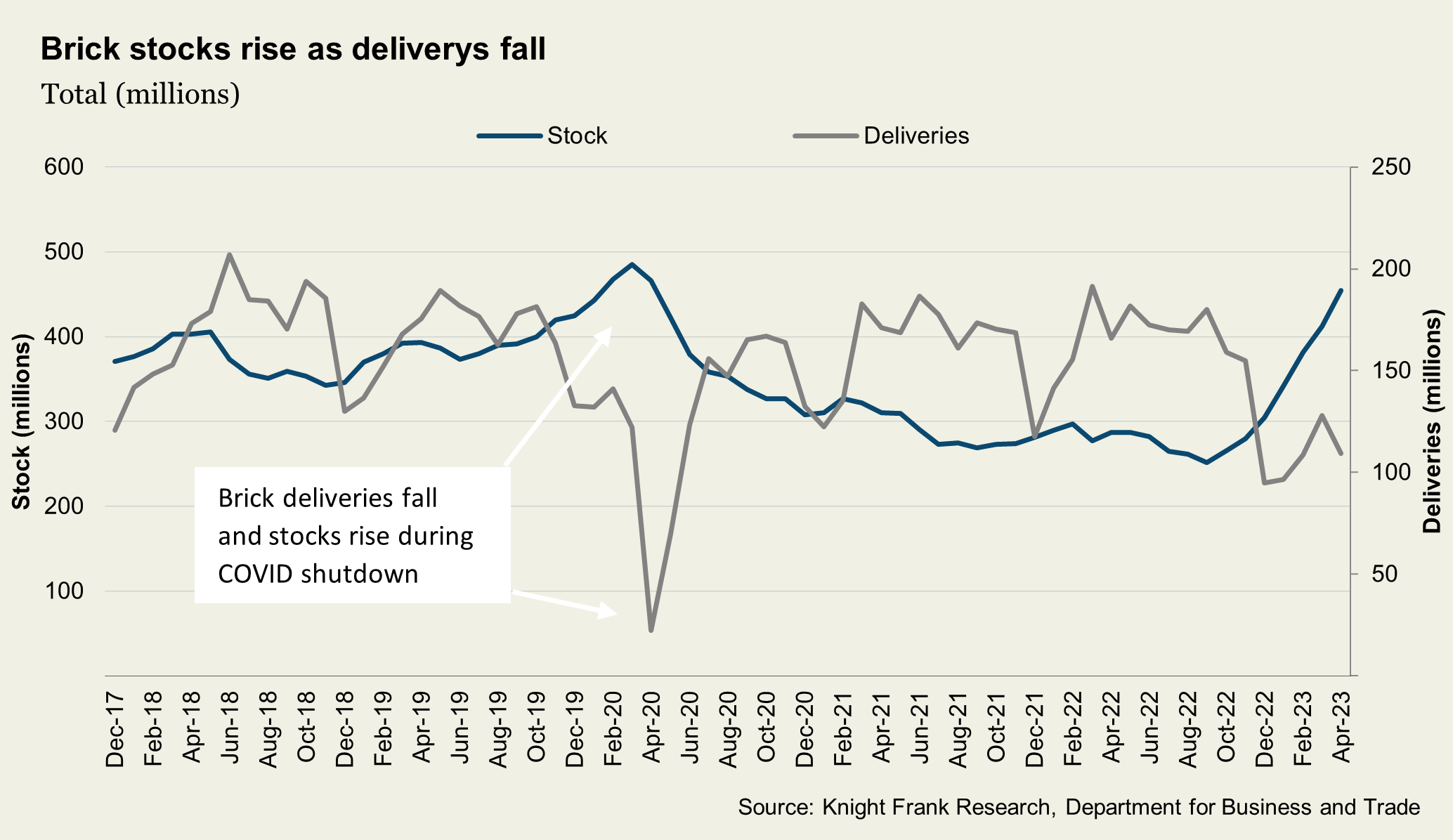

Brick data, closely linked to new housing, showed inventory levels rose by 58% year-on-year to 454 million in May. This reflected a 14% reduction in production but a greater 34%, fall in deliveries – the latter reflective of that slowdown in construction (see below).

Recent trading updates from Berkeley, Bellway and Crest Nicholson all suggest product availability is improving on the back of lower demand with an expectation that overall cost inflation will continue to ease through 2023.

All this suggests that the market is at a turning point, with both input cost inflation and demand pressures falling. This should result in tender price inflation continuing to slow over the remainder of this year. That, in turn, will support viability and reduce pressure on margins which will give investors and developers more incentive to take new or stalled projects forward.

The BCIS is forecasting build costs will increase by a more manageable 5.1% overall this year and by 10.6% between 2024-2027.

Reasons to be bullish/bearish

Build costs are, of course, just one piece of the development puzzle. While an easing in materials price inflation is welcome, there are plenty of other pressures for developers to contend with. Early results from our Q2 quarterly survey of volume and SME housebuilders, for example, show that (outside of the planning system) mortgage availability and cost and the outlook for the UK economy are housebuilders’ biggest concerns.

Last week’s interest rate hike and the subsequent repricing in mortgage markets will have been at the forefront of our survey respondents’ minds. Mortgage rates are unlikely to ease until stubbornly high inflation starts showing meaningful and consistent signs of improvement – which is unlikely to come until at least Q3 this year - that is going to take some urgency out of the sales market.

The key question from here is what happens next to pricing and sales rates. House prices have been resilient thus far, and new homes sales rates (while down on long-term averages) have picked-up from their lows in Q4 2022. Further supply shortages should be supportive for pricing in the new homes market over the medium-term.