E-commerce growth and rising rents signal positive industrial and logistics outlook

There are positive signs in the market despite weakening business confidence.

5 minutes to read

EU avoids recession in the first quarter, yet interest rates continue to rise. Though weak business confidence and the economic outlook continue to weigh on occupier sentiment, the temporary pullback in online sales is set to reverse in 2023, and prospects for rental growth are improving.

The pace of repricing has picked up across Europe's ten core markets and should encourage investment activity.

EU narrowly avoids recession

The EU narrowly managed to avoid recession in Q1 2023, posting GDP growth of 0.1% in the first three months of the year, following a contraction of 0.2% in Q4 2022. However, Europe's largest economy Germany entered a recession, with inflationary pressures impacting consumer demand. The Netherlands also recorded an economic contraction, and France recorded marginal growth. Yet southern European economies, including Spain, Italy and Portugal, all posted strong growth rates. Despite some weak or negative growth figures, it is hard to argue that this represents a recessionary environment, with unemployment at a record low. Yet, the economy's stagnation does mark a clear shift from the recent post-pandemic boom. Since spring, Europe's overall economy has picked up slightly, and the European Commission has lifted its growth outlook, forecasting expansion of 1.1% this year and 1.6% in 2024.

Interest rates continue to rise, but the end could be in sight

In June, the European Central Bank announced a new rate increase of 25 basis points, taking its deposit rate to 3.5% and the marginal lending rate to 4.0%. Since last July, the ECB has lifted rates by 400 basis points and promised further policy tightening to combat runaway price growth. Following the recent interest rate move, ECB President Christine Lagarde said that a further rate hike in July was very likely.

Still, most policymakers agree that the central bank is now in the final stage of policy tightening. Inflation in the eurozone eased noticeably in May, but at 6.1%, it is still well above the ECB's target of 2%. Despite the recent cooling in inflation, the ECB has raised its headline and core expectations for this and next year. It now expects headline inflation at 5.4% this year, 3% in 2024, and 2.2% in 2025.

Rising prospects for rental growth

Expectations for future rental growth have been revised up in Q1 2023. Despite weaker take up and softening vacancy rates, rental growth has remained robust, with average rental growth of 9.9% (MSCI) and 13.2% rental growth across key prime markets (Knight Frank Research) in the year to Q1 2023.

As a result, our Knight Frank forecasts for 18 key European logistics markets have been revised up an average of 56bps to an average CAGR of 3.23% per annum. Other projections have also been revised; IPF has upgraded their 5-year rental growth forecast for the UK by 75bps per annum (since Q4 2022), while forecasts for the UK from RealFor have been revised up 48bps over the five years.

Weak business confidence and economic outlook weigh on occupier sentiment

The relatively weak economic outlook and deteriorating business sentiment have meant many logistics operators are choosing to postpone expansion plans or commitments to take on additional facilities. As a result, take up levels have been subdued. Overall business confidence in the European Union decreased to -5.8 points in May from -3.8 points in April 2023 (European Commission).

Sentiment indices indicate a weakening of confidence in industry and retail trade businesses. Industry confidence weakened for the fourth month running and retail trade confidence also reported a sharp fall. However, the Economic Uncertainty Indicator (EUI) eased in May, to 21.2, from 21.8 in April and a peak of 29.8 in October 2022. Notable month-on-month decreases were recorded in Southern Europe along with the Netherlands, while France and Germany recorded a slight uptick in uncertainty.

Although firms may be reluctant to commit to additional facilities in the short term, most operators remain in expansion mode (over the medium to long term), supporting continued growth for the sector over the longer term.

The temporary pullback in online sales set to reverse in 2023

According to ecommerceDB, European e-commerce generated total revenue of US$634 billion (excluding Russia and Ukraine), a 7% drop compared with 2021. However, revenue of US$822 is forecast for 2023, with an annual growth rate of 29.7%. EcommerceDB predicts a 12% CAGR over the next five years (2022-26), with the market set to exceed US$1 billion by the end of 2025. This growth in the e-commerce market should support long-term demand in the occupier market.

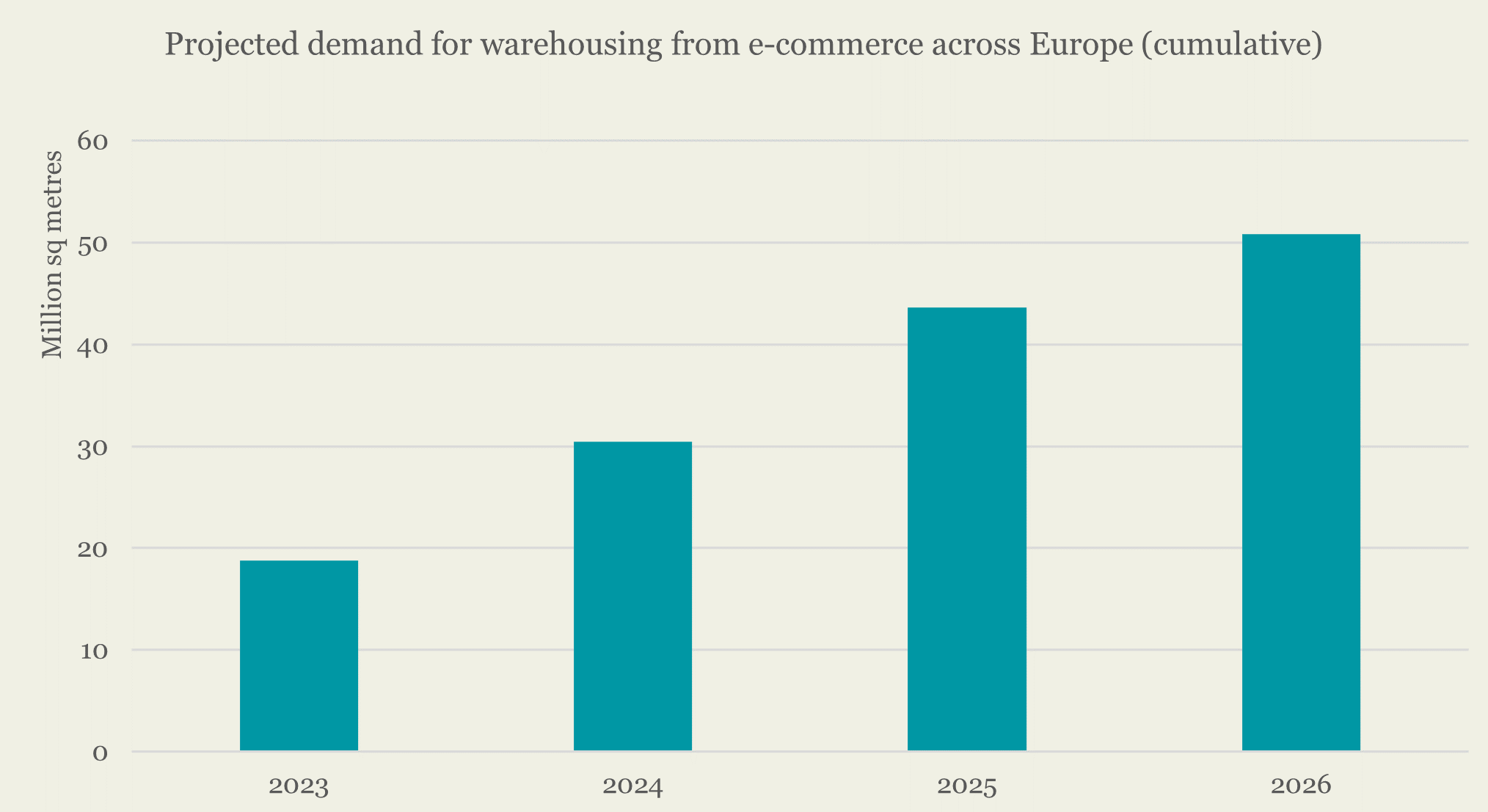

Knight Frank analysis shows that each £1 billion spent online requires 1.36 million sq ft of warehouse space, corresponding to approximately US$1 billion needing around 100,000 sq m of warehouse space. Based on the recent projections from ecommerceDB, this could mean an additional c.50.8 million sq meters of warehousing space would be needed across Europe by the end of 2026.

Source: Knight Frank Research

Repricing pace picks up across Europe's ten core markets

Year-on-year, prime yields have shifted out an average of 111bps in Q1 2023, up from 95bps in Q4 2022. Six out of the ten markets recorded a softening in yields quarter-on-quarter. London was the only market to see yields compress, with prime yields at 4.75% from 5.00% in Q4 2022. Repricing has been fastest and most pronounced in the UK, and despite having recorded some (25bps) compression over the last quarter, prime London yields remain 150bps above where they were in Q1 2022.

Most other prime European markets are further behind in their repricing journey but are catching up, with annual decompression rates between 75bps and 145bps. While Amsterdam, Madrid and Paris follow closely behind London (with between 145 and 120bps movement in yields), markets including Milan and Warsaw are lagging (with just a 75bps yield shift over the past year).

Prime yields across mainland Europe will adjust to their new level as the gap between buyer and seller expectations narrows, and this should stimulate investment market activity.