Commercial real estate investment and the banking crisis

Are we witnessing the calm after the storm? Our global teams look at the implications of the banking crisis for commercial real estate.

6 minutes to read

Is it too soon to say the banking crisis has been resolved? Or is that tempting fate?

Whatever your take, we can at least point to improving financial market stability. So how will this new environment affect what has been a sluggish start to commercial real estate investment in 2023?

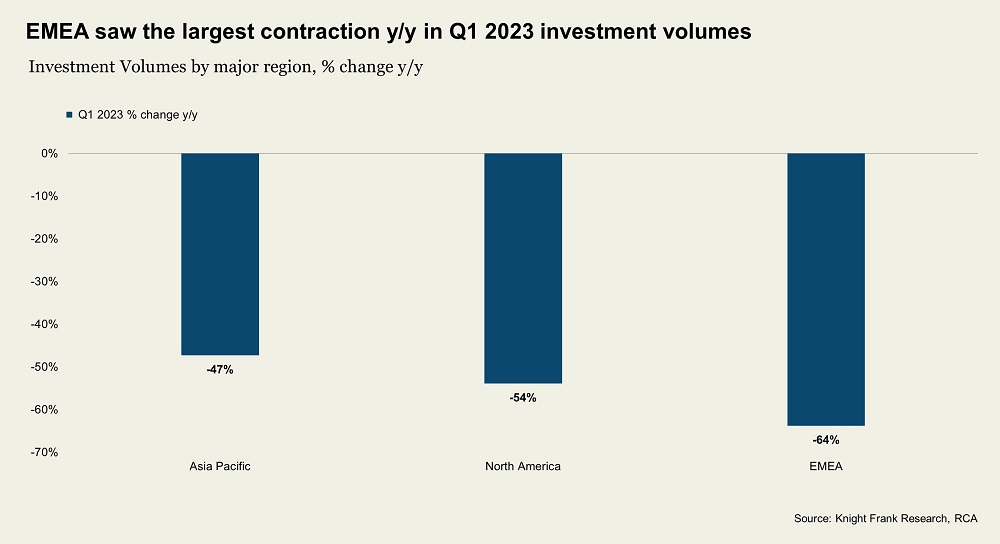

Researchers across our global network agree that, aside from banking volatility, higher interest rates have been the main culprit behind the reduced transactional activity. Indeed, data shows an -56% year-on-year fall in Q1 investment globally. Yet there are nuances depending on where you are in the world, and even tentative signs of optimism emerging.

Why investment could recover

According to Victoria Ormond, Head of Capital markets research, the uncertainty from the knock-on effects of stresses in the US regional banking sector, including the testing of weaknesses of European banks such as Credit Suisse, served to cap the customary start-of-year hubris in investment markets globally.

But that was not the only factor at play.

“Global investment has suffered for several reasons. For instance, there has been a general mismatch between buyer and seller expectations as markets adjust. Many US investors also remain anchored on lower occupancy rates in their own office markets, dampening investment demand for what has traditionally been the most significant sector.

"But there are some reasons to expect activity to improve. One is that continued pressure from increased refinancings could bring liquidity back to the market. The next 18-24 months will see a conveyor belt of refinancings in an environment of shifting real estate values. There will be pressure on LTV covenants and, importantly, on ICR covenants due to a significantly higher cost of debt. At the same time, banks will be reassessing their risk exposures. However, set against this, capital is waiting in the wings to position through debt funds and fill some of the looming funding gap.

"Another reason to expect increased activity is the rise of polarisation between the best assets and the rest. Liquidity for prime, safe-haven investments will come from purchasers less dependent on leverage, including high net-worth individuals and sovereign wealth funds. Conversely, secondary and tertiary assets will see a larger repricing – potentially to the extent that some become viable refurbishment projects that can be enhanced to modern sustainability standards or repurposed in other ways.”

The search for price transparency

Speaking about the Multifamily residential market in the the US, Dori Nolan, senior vice president at Berkadia, said:

"Multifamily transaction activity in the United States is anaemic and we need greater stability in the capital markets before we see a material pick up. Roughly $13 billion of multifamily trades closed over $25 million in the first quarter of 2023 compared to $47 billion in the first quarter of 2022, a 68% decline in sales activity.

"Many institutional investors are desperately looking for pricing transparency, confidence, and clarity on their cost of capital before moving off the sidelines. Private investors remain the most active.

"We believe 2023 is the Year of the Margin Call as we are starting to see distress bubbling up in many corners of the market given the amount of floating rate financing procured over the past few years, coupled with investors searching for liquidity."

The view from Asia Pacific

Christine Li, Head of Asia Pacific Research, comments on the high-interest-rate environment that poses challenges for lenders.

“The recent banking failures have drawn attention to the challenges lenders are facing in a high-interest-rate environment. Financing costs in the Asia Pacific commercial real estate market, especially in Australia, South Korea, and Singapore, remain elevated. Coupled with a potential decline in property valuations, this has limited the amount of investable capital in the region.”

Ben Burston, Head of Research in Australia, elaborated on the high-interest-rate environment and points towards the end of the hiking cycle and possible inflation decreases that could reassure investors.

“The market is continuing to adjust to much higher funding costs, which have widened bid-ask spreads, reduced liquidity and placed downward pressure on asset values.

However, the peak of the hiking cycle now looks to be within reach. If inflation subsides in the coming quarters, the macro context will look more reassuring for investors, with the potential for rate cuts in 2024-25 if the economy slows as expected.

“In the current climate, the income growth equation has become more urgent. Locations and assets perceived to offer a stronger rental growth outlook will be favoured, and we expect a renewed focus on achieving income growth to guide investor strategy and asset selection.”

Europe: the top target for overseas capital?

Judith Fischer, European research associate, explained that financial markets in Europe have calmed following the banking sector turmoil earlier this year but remain sensitive to systemic stress.

“Commercial real estate accounts for an average 9% of European banks’ loan book, which is notably less than US banks, which have 25% of their loan books in the sector.

“European CRE investment will remain muted this year, reflecting global trends. Nevertheless, we predict that the EMEA region will be the top destination for cross-border capital flows, with liquid, safe-haven markets, especially the UK, France and Germany expected to see inbound flows.

“We expect private capital to take advantage of reduced competition and other international investors to take advantage of currency benefits to look at a range of CRE across Europe. The living sectors will see increased interest, including the counter-cyclical student and affordable housing sectors, as far afield as Spain and the UK.”

David Bourla, Head of Research in France, described a challenging start to the year, in which first-quarter investment was down 40% on 2022.

“A full recovery is unlikely to happen in 2023. Transactions are still taking a long time to be finalised as the change in yields has not yet dispelled the hesitancy among buyers. The phenomenon primarily concerns offices in the Paris region, which led several owners to withdraw assets from the market or to put their disposals on hold.

“However, a modest rebound in investment volumes is still possible in the second half of 2023, provided that the international banking and geopolitical situation does not deteriorate further, liquidity does not dry up and monetary policies are eased. Until then, the performance of the French investment market will remain very mixed, evolving according to the opportunities seized by investors in a context which is still favourable to equity-rich players (private investors, pension and health insurance funds, etc.)”

Pause, plateau or pivot?

The broad consensus across our global network is that, while unhelpful, the banking crisis itself has begun to wane as a source of stress.

The challenge now is to operate within a higher interest-rate environment – not easy for a debt-reliant asset class – but with central banks looking to pivot to lower rates, even this challenge should ease before long.

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here