Expert view: unlocking global commercial investment opportunities

We asked our global experts for insight into how High-Net-Worth-Individuals are investing in their markets, plus their top tips for 2023.

3 minutes to read

More than a quarter of High-Net-Worth-Individuals (HNWIs) are looking to increase their commercial property holdings, according to our HNW Pulse Survey that collated the views of 500 HNWIs across 10 countries and territories.

Whether in a private capacity or through an established family office, HNWIs are commanding a growing slice of commercial property market activity.

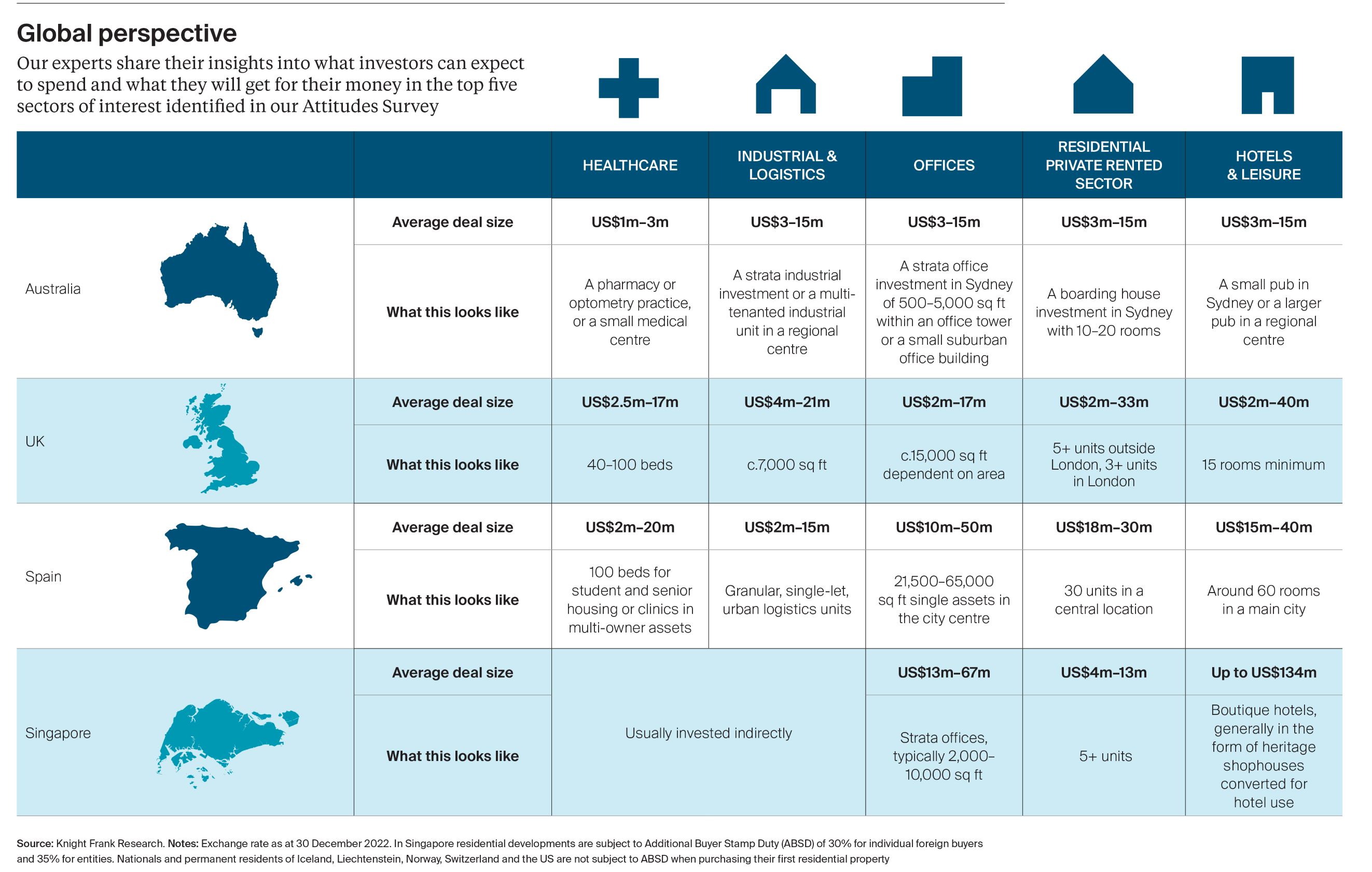

For seasoned investors the opportunities may appear clear, while others see high barriers to entry. In fact, the average level of investment required from private individuals is often smaller than for big institutional players.

HNWI transactions averaged US$18 million over the past decade, compared with US$40 million for institutions, according to analysis of RCA data.

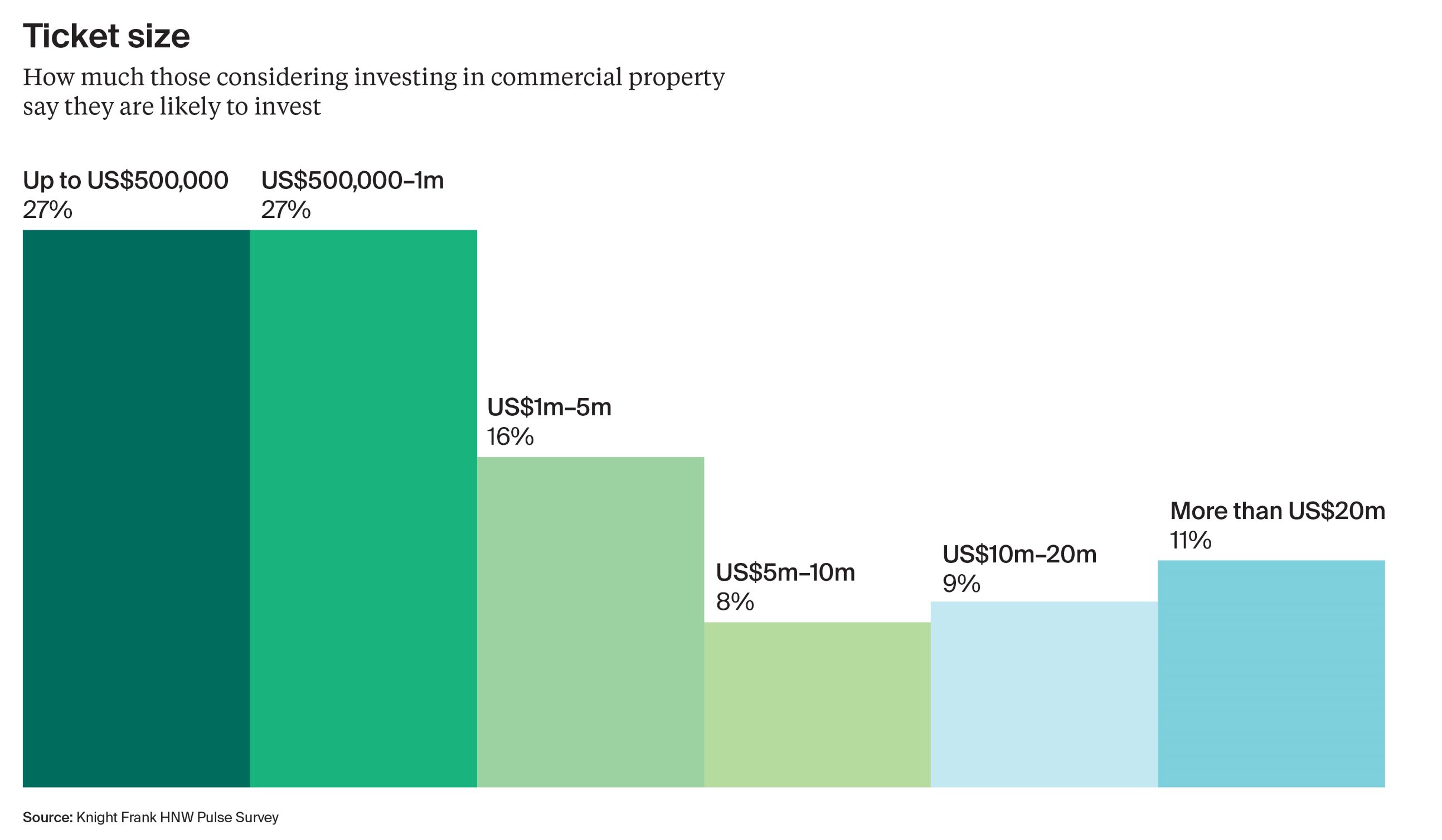

Among our HNW Pulse Survey respondents, 54% of those planning to invest are seeking opportunities under US$1 million and one in ten will be investing US$20 million or more.

What do our global experts think?

Knowing what options are available at differing price points will be critical to success.

We gathered our global experts to explore the various ways in which wealthy individuals are investing in commercial property globally and to share their top tips.

France

Alexandre Olivier, Capital Markets

What trends are you seeing among wealthy investors in France? HNWI investors are able to position themselves on a wide range of investments, whether in terms of risk level (from value-added to core) or type

of asset (e.g. office or residential). In the past year HNWIs and family offices have been active both with transactions under €10 million and landmark investments well over €100 million.

Where are the opportunities for 2023 and what are your top tips?

In the context of tightening financial conditions, the ability of HNW investors to exploit their equity resources and mitigate the impact of debt should be a source of opportunity. Moreover, the attractiveness of the Paris market in the luxury retail and residential segments should continue to appeal.

Middle East

Andrew Love, Head of ME Capital Markets & OLSS

What trends are you seeing among wealthy investors across the Middle East?

Private investors can start as low as US$2 million to US$3 million or go up to US$200 million. Typically, the sweet spot is around US$20 million to US$50 million. We have seen an array of investors, with the most active coming from the Emirates, India and the UK.

Where are the opportunities for 2023 and beyond?

Prime residential has been the best performing sector (see page 32). HNWIs have sought out mixed-use single owned towers or compounds of villas which can be broken up to sell individually. We have also seen HNWIs speculatively build good quality warehouses, take on the leasing risk and then sell to funds. More recently, we have seen a similar play in the co-living and data centre sectors, which are emerging asset classes here.

What are your top tips?

If purchasing to hold, due diligence and market assessment are critical. The build quality and maintenance of assets is generally poor compared with Europe and that can lead to greater capital expenditure than anticipated, limiting returns.

Australia

Andrew Blake, Head of Regional Capital & Agribusiness

The Australian government has a plan to increase the value of its agricultural sector from A$60 billion to A$100 billion by 2030. This requires improvement of landscape functions, provision of livestock with high welfare standards, maintaining a powerful social licence and a biodiversity programme.

Australia has a unique opportunity to leverage its location, efficient logistics networks and agtech to collaborate and make its agriculture industry a leader in the global market. We anticipate exports will increase significantly within the next six to seven years, with premium food products forecast to grow by 55%.

Producers of sheep meat, almonds, wool, lentils and wine stand to benefit the most from increased access to the Indian market when the Australia-India Economic Cooperation and Trade Agreement (AI-ECTA) comes into force in early 2023. The Australia-United Kingdom Free Trade Agreement (A-UKFTA) will also prove advantageous once it takes effect later this year.

Discover more

Download

Download the full report for more in depth analysis and the latest trends relating to global wealth.

Download the report

Subscribe

Subscribe for all the latest insights and additional content.

Subscribe