Expert view: unlocking UK commercial investment opportunities

We asked our UK experts for insight into how High-Net-Worth-Individuals are investing in their markets, plus their top tips for 2023.

7 minutes to read

More than a quarter of High-Net-Worth-Individuals (HNWIs) are looking to increase their commercial property holdings, according to our HNW Pulse Survey that collated the views of 500 HNWIs across 10 countries and territories.

Whether in a private capacity or through an established family office, HNWIs are commanding a growing slice of commercial property market activity.

For seasoned investors the opportunities may appear clear, while others see high barriers to entry. In fact, the average level of investment required from private individuals is often smaller than for big institutional players.

HNWI transactions averaged US$18 million over the past decade, compared with US$40 million for institutions, according to analysis of RCA data.

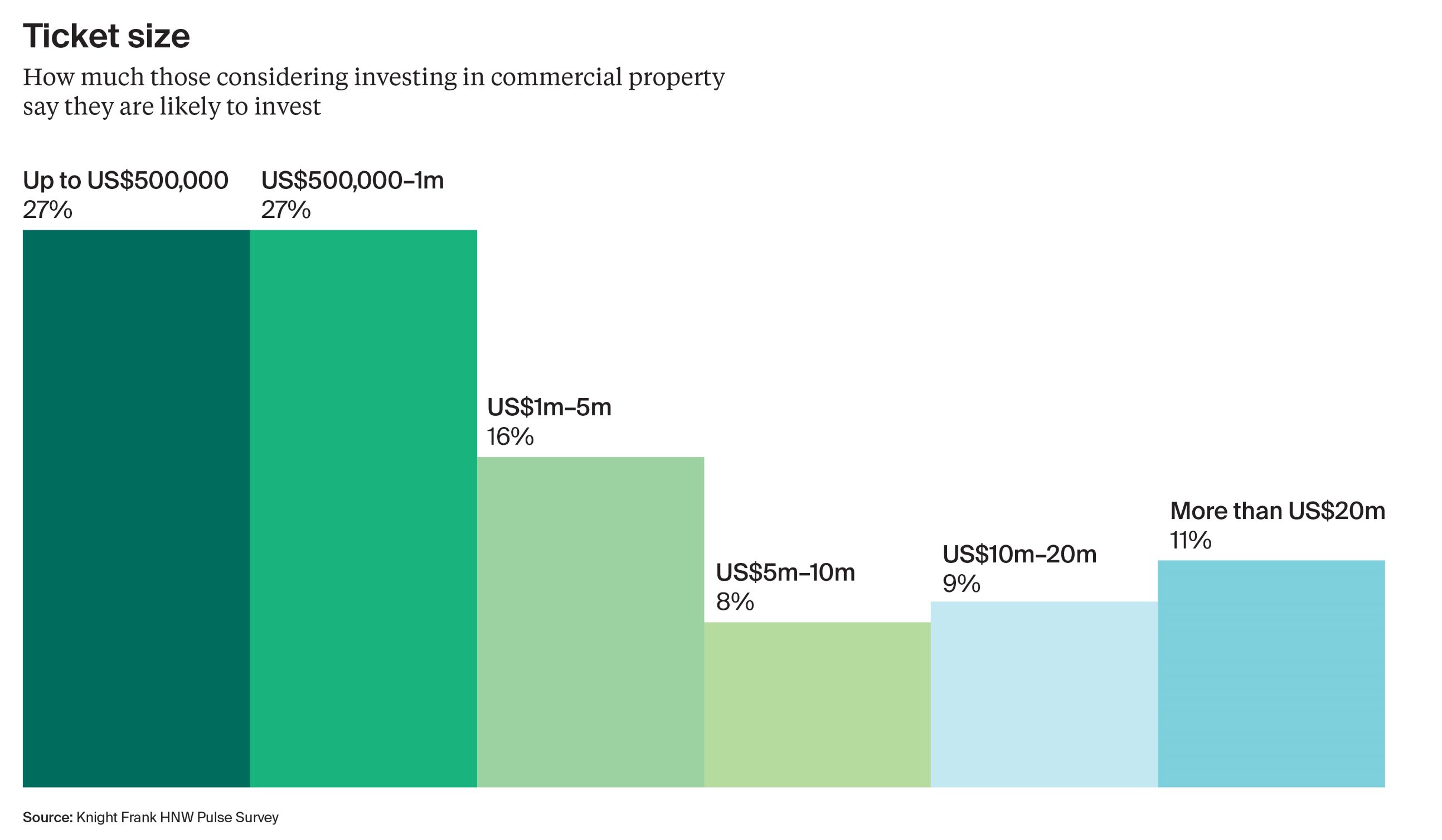

Among our HNW Pulse Survey respondents, 54% of those planning to invest are seeking opportunities under US$1 million and one in ten will be investing US$20 million or more.

What do our UK experts think?

Knowing what options are available at differing price points will be critical to success.

We gathered our UK experts to explore the various ways in which wealthy individuals are investing in commercial property globally and to share their top tips.

Alex James, Head of Private Client Advisory, UK

What are your top tips for those looking to invest?

Energy and operational costs have been a major issue throughout 2022 and highlighted the importance of ESG throughout the property market.

Energy efficiency will be under increasing scrutiny: our research previously demonstrated the premium attached to green-rated buildings, but this may expand given upcoming regulations and historically high energy costs.

What trends are you seeing among wealthy investors in the UK?

Private clients are typically investing anywhere from £5 million to £25 million on average. In the long term, cash rich private investors have been taking advantage of repricing, currency benefits and less competition from larger institutions to target the UK, among other locations.

They have been opportunistic across a diverse range of sectors and risk profiles throughout 2022. As a result, we saw an increase in demand for offices, retail and hospitality which offer post-Covid recovery opportunities along with strong fundamentals.

What are the opportunities for 2023 and beyond?

Supermarkets and logistics, especially larger lots with good covenants. The fundamentals are still strong and tie in with the supply chain for both online and in-person consumers. Online sales are anticipated to grow by an additional £31 billion by 2026. Over the next five years, this could result in additional demand for roughly 10 million sq ft of last-mile fulfilment space.

Then there are the living sectors, which are more defensive. Student housing has favourable demographics, and we are likely to see greater international demand following the lifting of Covid-19 travel restrictions. A record £7.2 billion was invested in purpose-built student accommodation in 2022 in the UK, a 62% year-on-year rise.

What are your top tips for those looking to invest?

Energy and operational costs have been a major issue throughout 2022 and highlighted the importance of ESG throughout the property market. Energy efficiency will be under increasing scrutiny: our research previously demonstrated the premium attached to green-rated buildings, but this may expand given upcoming regulations and historically high energy costs.

Harrison Collins, Residential Development Capital Markets, UK

What trends are you seeing among wealthy investors looking to the living sectors?

First-time investors tend to start small to get a general feel for the transactional process before committing larger sums of capital. In the past year we have sold assets to HNWIs or family offices ranging from £2.5 million to £40 million.

Where is the added value and what are the opportunities for 2023 and beyond?

The rental market was extremely strong in 2022 and is expected to continue to grow in 2023. There is a natural lag in capturing rental growth with 12-month tenancies, i.e. those that commenced or renewed in Q1 2022 failed to capture the growth in the later part of the year.

This presents an opportunity for investors acquiring residential assets this year, who can expect to see a significant reversion in their headline rents.

Investors are looking to balance their portfolios between core London assets and regional investments. Regional assets offer more attractive returns (yields tend to be 75–100 basis points higher) and a lower entry point, with the average price per unit being considerably less.

Some would-be vendors have been discouraged from divesting by the economic and political backdrop of the second half of 2022. This lack of stock, paired with continued demand for residential investments, has resulted in good competition which has underpinned pricing.

What are your top tips?

It is crucial for incoming investors to have efficient management structures in place. Owning residential investment property requires proactive asset management and all investors need to be aware of the relevant statutory compliance, legislative and best practice issues.

Andrew Shirley, Head of Rural Research, UK

What can wealthy investors expect to see when investing in farmland?

For wealthy investors there is often a residential amenity element to agricultural investments. When looking at a basic farmland investment, in the UK the entry point would be around £1 million for 100 acres. For scale, the minimum size of a commercial farm is 1,000 acres, or around £10 million. In terms of forestry land, around £1 million would be required for a modest investment.

Where is the added value and what are the biggest opportunities for 2023 and beyond?

Natural capital, nature-based solutions, climate change, biodiversity loss – all have come to the fore over recent years and farmland is key to delivering on targets globally. The commitments from COP15 in Montreal last year indicate greater value to come. Some of the biggest opportunities will be in locations where land has been treated poorly, offering the greatest scope to boost natural capital values and carbon credit opportunities.

The other area is food security. This was highlighted by global food shortages and price hikes in 2022 following Russia’s invasion of Ukraine, which accounts for 42% of the world’s sunflower oil exports and 10% of wheat. UK Prime Minister Rishi Sunak has committed to introducing a government food security target this year.

What are your top tips?

Have a clear strategy. How will you manage the land? What’s the objective and time frame? How will you finance it and who will run it?

Farmland can be relatively cheap in developing nations, but you need a local management team that you can trust if you don’t live there. The other consideration is environmental and climatic conditions. In the 2021 edition of The Wealth Report our Analytics team mapped predicted climate shifts to pinpoint parts of the world likely to see the biggest impacts on their agricultural sectors.

This information is key for longer-term investing.

Lisa Attenborough, Head of Debt Advisory, UK

What trends are you seeing among wealthy investors looking indirectly at property investment through debt?

Debt funds backed by private wealth tend to play in the smaller ticket lending space, with loans ranging from £5 million to £15 million per transaction. That said, we have also seen some funds issuing loans as large as £200 million.

HNWIs in this space will typically be seeking an internal rate of return of 15%. They tend to target development or value-add opportunities where significant capital expenditure is required. We have also seen private debt funds offer bridging facilities.

There is an overarching drive towards investing in debt rather than equity because it represents better value. The debt is secured above equity in legal charges and returns tend to be in the mid-double digits. That means lower risk for a slightly lower but still very healthy return.

Where are the opportunities for 2023 and beyond?

The funding gap. Loans that were provided in 2018 carried an all-in cost of around 3%: now that cost has more than doubled.

There will be a wave of refinancing in 2023 where the loan amount will need to be reduced because of interest coverage ratios. This will drive a requirement for flexible capital as not all borrowers will be able to bridge this, creating a key opportunity for private capital via debt funds. Investors can bridge the gap through debt, mezzanine financing or preferred equity.

What are your top tips?

Have a unique selling point. New capital needs to differentiate itself, whether by focusing on a particular segment – development, loans of a certain amount or in a specific geography – or sector. Something that sets you apart will help you find the right investment opportunities.

Discover more

Download

Download the full report for more in depth analysis and the latest trends relating to global wealth.

Download the report

Subscribe

Subscribe for all the latest insights and additional content.

Subscribe