East London takes first place in London marathon price race

Analysis of price inflation along the route places Charlton at the front of the pack.

2 minutes to read

With the London Marathon taking place this weekend (23 April), we looked at the price performance of properties sold along the race’s 26-mile route during the past decade.

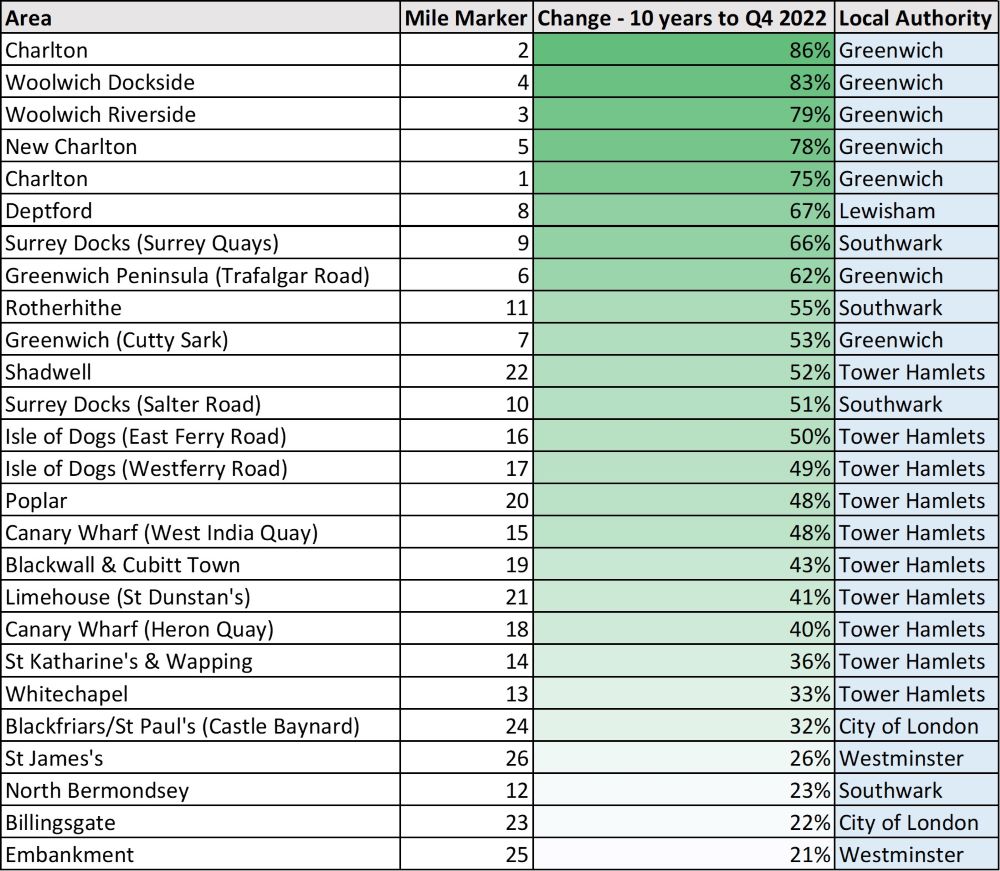

Our analysis, which calculated the price inflation of homes within 800m of each mile marker, reveals that East London has led the pack over the last decade.

London’s Woolwich and Charlton areas, covering the opening miles of the world-famous race and within the London Borough of Greenwich, top the table. They have seen price inflation of 75% and above in the ten years to the end of 2022 (see table).

Deptford (+67%) in the borough of Lewisham is the highest placed area outside of Greenwich on the list.

With the average price of a property in London now standing at more than £533,000 according to the Land Registry, buyers have increasingly looked to more affordable areas in the capital to get a foot on the housing ladder or upsize.

“East London has seen strong growth as transport links have improved and buyers have sought more space for their money. Given that property in the capital is the least affordable in the country we would expect this trend to continue,” said Chris Druce, senior research analyst at Knight Frank.

While all areas along the route have seen price inflation in the past decade, it has been weakest in higher-value areas, where demand has been kept in check in recent years by a series of tax changes.

St James’s and Victoria Embankment (miles 26 and 25) located in Westminster, which has an average property price of £905,000 compared with £445,000 in Greenwich, have seen growth of just 26% and 21% respectively.

However, with PCL prices still below their 2015 peak and an additional discount available for international buyers purchasing property in dollar-dominated currencies, we forecast PCL will lead the price growth recovery in the UK market over the next five year period as pent up demand from international buyers is released.

For now the London market is experiencing a period of relative calm and stability after the shockwaves caused last year by September’s mini-Budget.

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here