European office occupier market Q4 2022

Providing quality work space, fit out costs and ongoing economic uncertainty all played their part in overall take-up in cities across Europe.

7 minutes to read

Local experts across the Knight Frank network have analysed the latest occupier activity in their region in the final quarter of 2022.

Updated quarterly, the dashboards provide a concise synopsis of occupier activity in Europe's markets.

Discover vacancy rates, take-up and prime rents from cities across Europe in more detail by exploring the dashboards for Q4 2022 at the bottom of each section.

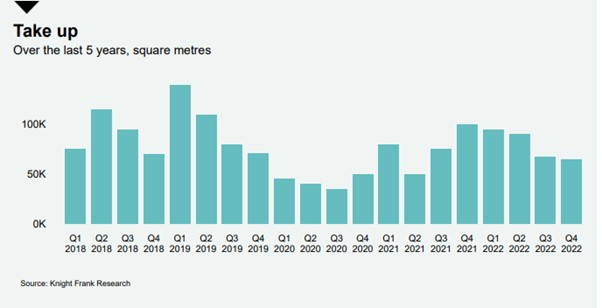

Barcelona office market

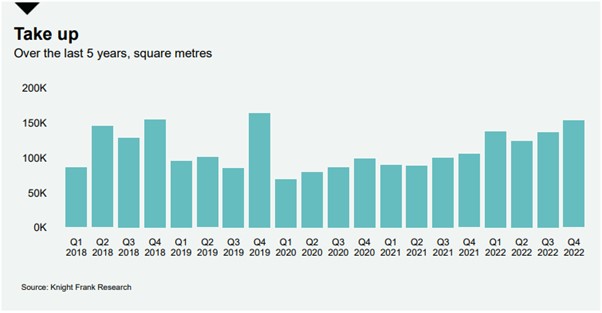

Take-up in the fourth quarter of 2022 in Barcelona was recorded at 65,000 sqm, bringing the total for the year to 317,000 sqm.

This represents a slight increase from annual take-up of 305,000 sqm in 2021. Although the first two quarters of 2022 outperformed the first halves of both 2020 and 2021, economic uncertainty in the third and fourth quarters of 2022 slowed leasing activity in the market.

The vacancy rate has remained unchanged since Q4 2020 at 7.0%, only marginally above the five-year average of 6.80%. Prime rents in Barcelona have also held steady for the last few years at €336 per sqm per annum.

View the latest dashboard

Berlin office market

Despite being a historically well performing quarter, the fourth quarter of 2022 saw weakening leasing activity, with take-up recorded at 164,600 sqm. This represents a 29.5% decrease since Q3, and a year-over-year drop of 46.4%, largely driven by a lack of large-scale deals at the end of the year.

Total annual take-up for 2022 amounted to 758,300 sqm, down 10% from 2021 but very close to levels seen in 2020. With the uncertain economic environment, some tenants may choose to defer decision-making and extend their current leases. As such, take-up below the 10-year average of 803,000 sqm is anticipated in 2023.

Construction completions for the year totalled 628,000 sqm, 8.7% less than the previous year. 725,000 sqm are expected for 2023, 60% of which is pre-let. There are currently 1.5m sqm under construction in the Berlin market.

Sustainable, ESG-compliant and high-quality furnished office space continue to be highly sought after, pushing prime rent upwards this quarter to €522 per sqm per annum.

View latest dashboard

Bucharest office market

Strong leasing activity in the fourth quarter of 2022 amounted to just under 88,000 sqm of take-up, very similar to levels seen in the same time period 2021 and almost double the volume in Q4 2020. This brings total take-up for the year to 305,000 sqm, in line with annual figures in pre-pandemic years and indicating successful recovery of office demand in the Bucharest market.

The IT & Communication sector remains a primary driver of rental activity, recorded at 36% of total take up.

Prime rents are still on the rise, up 5.6% from the fourth quarter of 2021 and now sitting at €228 per sqm per annum. They are expected to continue the growth trajectory in 2023.

The vacancy rate in Q4 2022 ticked back upwards to 15.0% from 14.0% in Q3, but unchanged when compared to Q4 2021. Overall, the conditions are favourable to the tenant, but given the lack of approvals for new building permits, a smaller number of projects are likely to be delivered in coming years.

As such, the office dynamic is likely to shift to landlord-favourable and drive further rental growth in 2024 and beyond.

View the latest dashboard

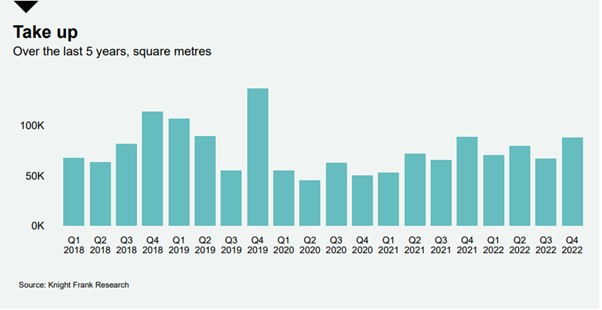

Madrid office market

The Madrid office market performed well in the fourth quarter of 2022, with 115,000 sqm of take-up exceeding Q4 volumes seen since 2018. This brings total take-up for the year to 500,000 sqm, an increase of 40% from 2021, thereby indicating a strong recovery from hesitancies during the pandemic.

The vacancy rate moved upwards slightly to 11.5% from 11.1% the previous quarter, but is below the 12.0% figure from Q4 2021.

Prime rents remained stable since Q3 at €402 per sqm per annum. This represents a 3.1% increase year-over-year after very little rental growth was seen between 2020 and 2022. The expectations for 2023 are for prime rents to continue to climb.

View latest dashboard

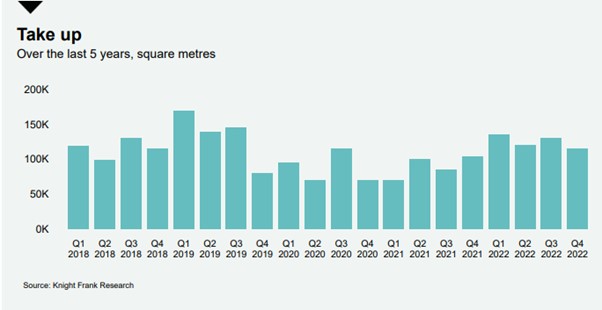

Munich office market

As anticipated, take-up figures for Q4 2022 of 154,400 sqm indicate that a year-end rally did not materialise in the Munich office market. Nevertheless, total take-up for the year exceeded levels seen in 2021 by 12%, amounting to 751,300 sqm. This is also the highest annual take-up in four years.

Overall vacancy for the city ticked upwards slightly to 5.3%. Munich CBD vacancy remains low at 2.2%, and the city centre saw a moderate drop to 3.0%.

Scarcity of supply in central locations continues to drive prime rental growth to a historic high of €522 per sqm per annum, representing a 4% increase when compared to Q4 2021.

Construction completions for the year totalled 242,200 sqm, with more than half of this located in the city centre submarket. There are an additional 801,600 sqm of new supply under construction in the Munich office market as a whole.

Demand and vacancy are anticipated to remain stable in 2023, and further upticks in prime rental rates are expected.

View latest dashboard

Paris IDF office market

In the Paris Ile-de-France market, 2022 ended on a positive note with 616,000 sqm of office space let or sold to occupiers in Q4, an increase of 26% on the previous quarter. This volume brings the total amount of office space let or sold to occupiers in 2022 to 2.19 million sqm, a result 16% higher than in 2021 and very close to the ten-year average.

Demand from coworking and education tenancies was stronger in 2022 than the previous year, but tech companies' activity slowed significantly in the second half of the year, against a backdrop of a slowdown in fundraising and a decrease in valuations.

In most suburban sectors, negotiation conditions are more favourable to tenants than before the start of the health crisis, with generous rental incentives sometimes in excess of 30 or even 35% in certain office hubs. As a result, the gap has widened with Inner Paris and its most expensive districts, the CBD in particular, where prime rents continue to climb.

View latest dashboard

Prague office market

In the fourth quarter of 2022, 153,192 sqm of take-up were recorded in the Prague office market, bringing total take-up for the year to 551,488 sqm.

This is the highest this figure has been in ten years, and points to a strong recovery of the office market after challenges during the pandemic. Despite this, the environment of increased uncertainty is preventing many occupiers from being willing to make relocation decisions – as such, renegotiations accounted for the largest share of take-up.

The vacancy rate ticked downward to 7.7% in Q4, compressed in part by low construction completion figures throughout the year.

Prime rental growth continues as the demand for top-quality space persists, climbing to €318 per sqm per annum. This represents a 10.4% increase from Q4 2021. Average rents have not demonstrated the same trend, indicating that the gap in perceived value between prime and B class product has widened.

View latest dashboard

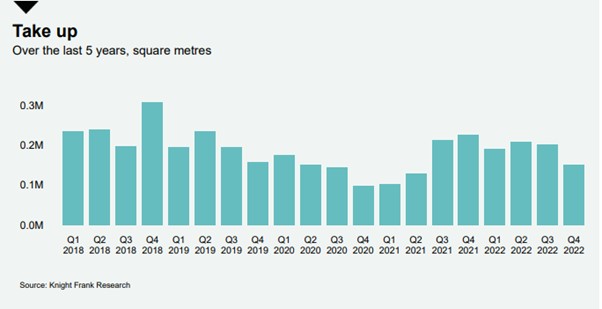

Warsaw office market

Overall, 2022 saw a significant improvement in tenant sentiment in the Warsaw office market, with the weaker pandemic demand less and less visible with each passing quarter.

Take-up was strong in the fourth quarter of the year at 253,310 sqm, bringing total take-up for the year to 866,166 sqm. This represents a 33% increase from 2021 and is well within the levels seen in pre-pandemic years.

Economic uncertainty and high fit out costs are discouraging some tenants from relocating and expanding, affecting the take-up structure. As a result, the share of renegotiations grew, recorded at 40% of signed deals in 2022, while the number of new agreements and expansions fell.

As a result of the high tenant activity in the Warsaw office market, and also due to the low new supply seen in 2022, the vacancy rate in Warsaw stood at just under 11.6% at the end of 2022, a 9% drop from Q4 2021.

Developer activity in 2022 remained at a relatively low level, in large part due to a reduced willingness to start construction as the cost of financing grows.

View latest dashboard

Subscribe for more

For more market-leading research, analysis and insights subscribe to our newsletters.