Annual UK house price growth slows to 1.1%

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

It's all relative

Global growth is projected to fall from 3.4% in 2022 to 2.9% this year before rising again to 3.1% in 2024, according to upgraded projections from the International Monetary Fund. The new forecast for 2023 is 0.2% higher than predicted in the October outlook, which reflects "positive surprises and greater-than-expected resilience in numerous economies."

The UK economy will shrink 0.6% this year, making it the weakest performer. The IMF puts the gloomy outlook down to a mixture of higher energy prices, mortgage rates and taxes. That's not good, and it understandably dominates UK coverage this morning, but the outlook does represent a decent upgrade from the Bank of England's November forecast of a 1.9% economic contraction between Q4 2022 and Q4 2023.

The Bank of England is set to upgrade its forecasts on Thursday to figures that are more in line with the IMF in light of recent declines in energy prices, the FT reports this morning.

As an aside, the IMF’s take on the UK has surprised some commentators – higher taxes are bad but the prospect of lower taxes under Truss were also bad, leading the Spectator ask “what does the IMF actually want?”

House prices

Annual growth in UK house prices slowed to 1.1% in the year to January, down from 2.8% in December, Nationwide reports this morning. Prices have now eased 3.2% since August's peak.

"There are some encouraging signs that mortgage rates are normalising, but it is too early to tell whether activity in the housing market has started to recover," says Nationwide chief economist Robert Gardner.

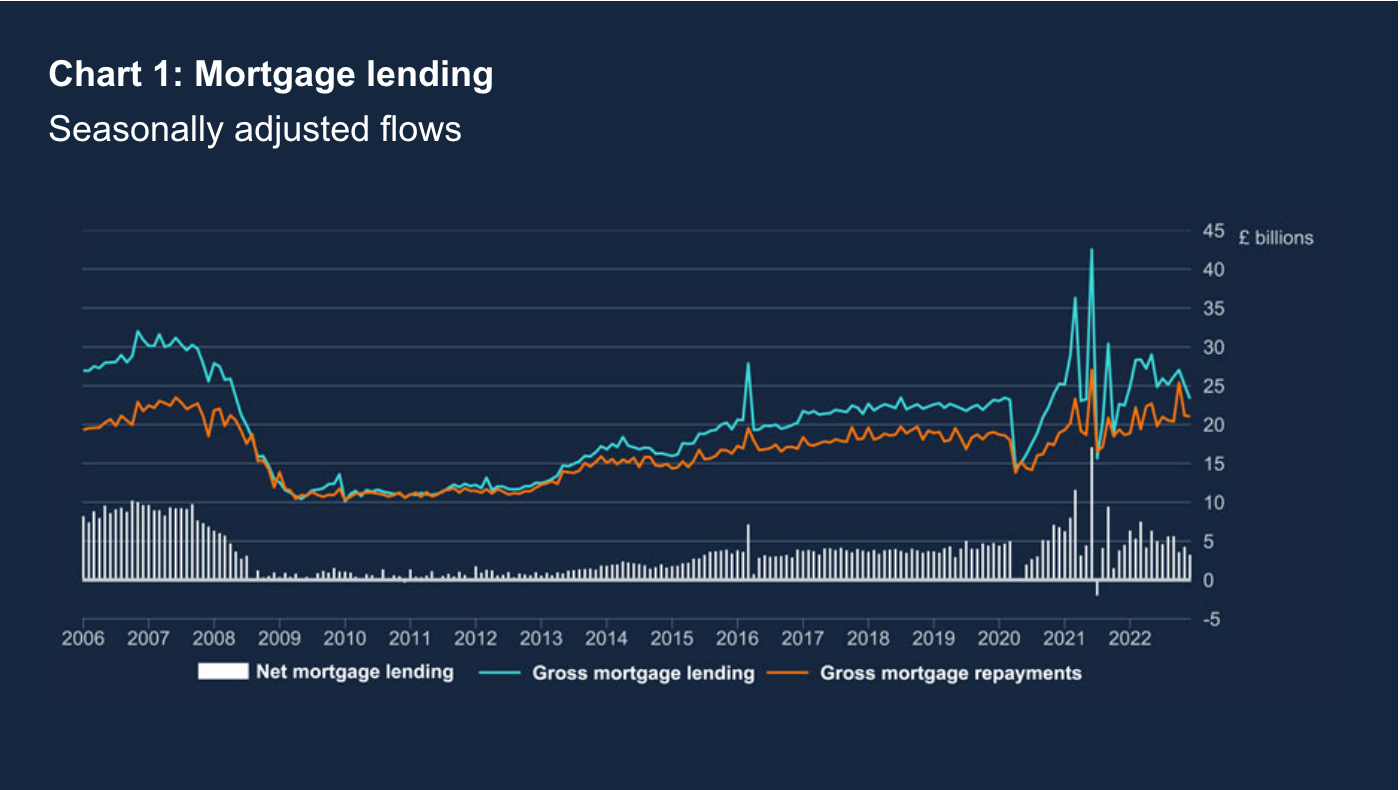

Indeed, while the data we're seeing for January suggests sentiment has improved markedly (see recent notes), numbers that cover the final weeks of 2022 continue to reveal the degree to which the mini-budget weighed on housing market activity. Mortgage approvals for house purchase fell to just 35,600 in December, the lowest level since May 2020, according to Bank of England figures published yesterday.

Approvals for remortgaging (which only capture remortgaging with a different lender) fell to 26,100, from 32,600 in November, the lowest level since January 2013.

Mortgage rates

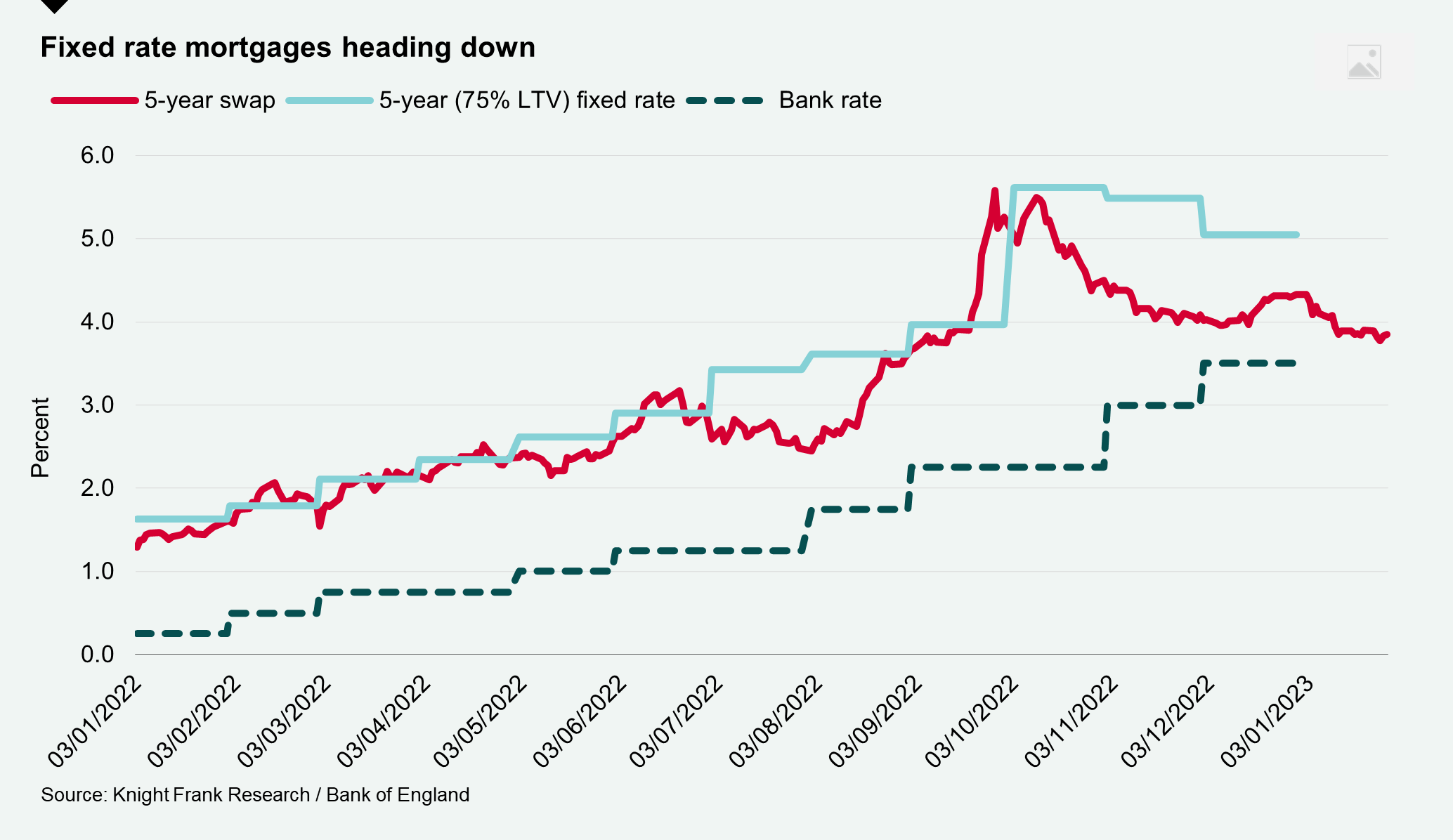

Falling mortgage rates have been the primary driver in the change of sentiment. The best five year fixed products can be found as low as 4.19%, while the best trackers sit around 3.94%, according to Knight Frank Finance.

Economists expect the Bank of England to raise the base rate by 50bps to 4% on Thursday. That will push tracker rates above the best available fixed products for the first time since the mini-budget, and will likely prompt large numbers of borrowers to fix. Many have been waiting on tracker products for fixed rates to fall further. Swap rates suggest further reductions in mortgage rates are likely to be marginal - see chart courtesy of Ollie Knight's Residential Development note.

Thursday's hike to 4% is now priced in and financial markets expect just one more rate rise after February. Citi and YouGov's closely watched survey showed inflation expectations for five to 10 years ahead fell to 3.5% in January, from 3.6% a month earlier - within touching distance of the 3.0% to 3.4% range seen ahead of the pandemic.

New homes

Trading updates from the major housebuilders showed a sharp slowdown in new homes reservations in the final three months of the year. That market has also seen an improvement in the near year - Knight Frank figures show the number of prospective buyers registering their interest in purchasing a new home in January was markedly higher than both 2020 and 2021, and only just behind the number at the start of 2022. (see Ollie's note linked above for more).

The figures chime with the latest update from online property portal Zoopla, which reveal a distinct revival in demand for flats. Of those looking to make a move, 27% are seeking one or two-bedroom flats, up from 22% this time last year. In London, one and two-bedroom flats now account for 49% of demand, up from 42% a year ago.

Pre-sale rates relative to scheduled completions also look particularly robust in London. Six in ten units due to complete in 2023 are priced below £800 per square foot, of which 60% are already sold, according to figures from Molior London's Tim Craine. Units priced £1,400 to £1,900 account for another 13% of completions, of which 83% are presold.

In other news...

Time to plan your staycation – the global elite produce almost half greenhouse emissions, UN says (FT), Eurozone mortgage demand falls at record pace (FT), US office occupancy hits 50% for the first time since the pandemic (Bloomberg), and finally, European real estate has a $55 billion credit problem (Bloomberg).