The sharp end of rising mortgage rates

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

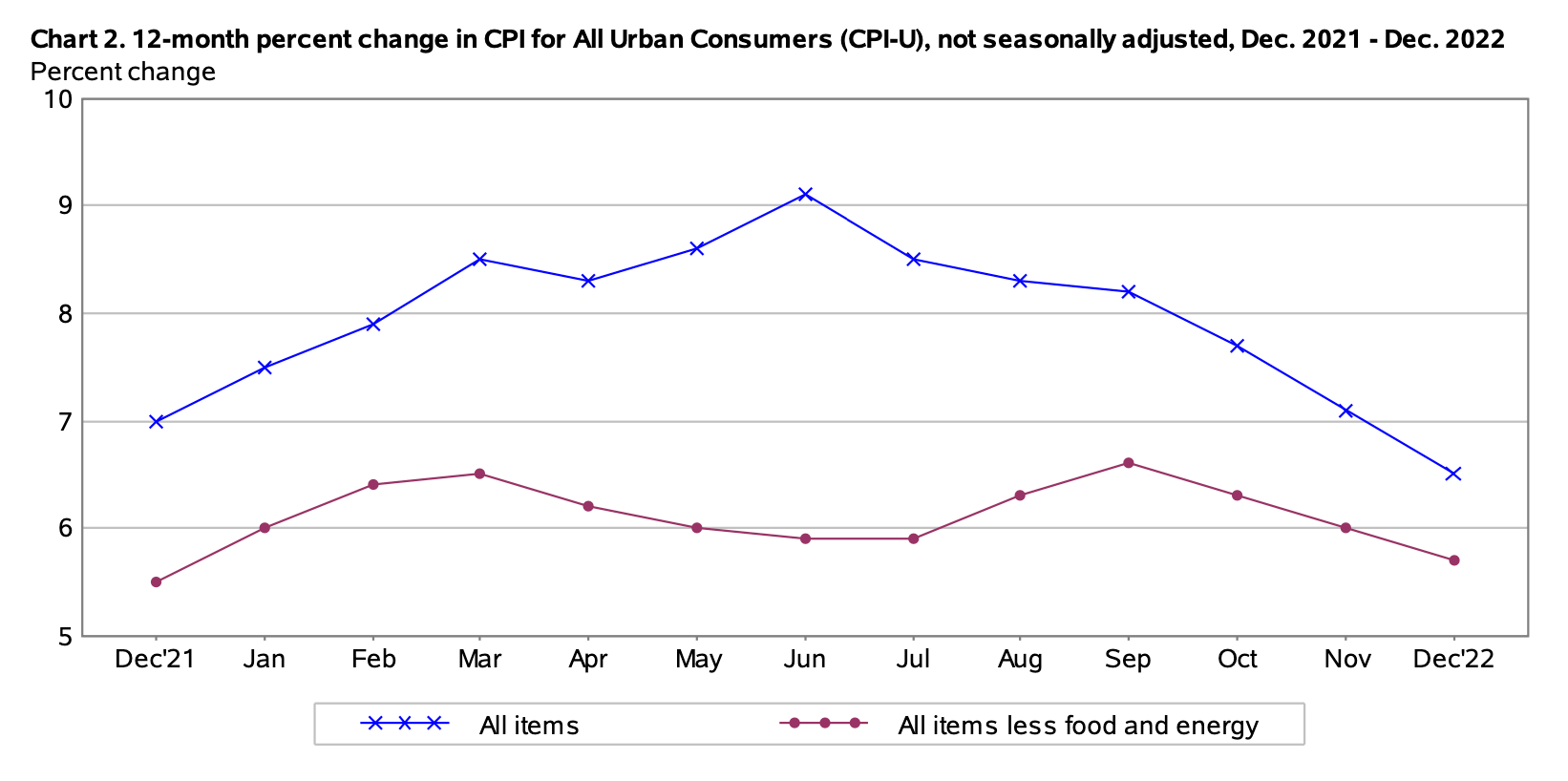

US inflation

US consumer price inflation dropped to 6.5% during the year to December, its lowest level in a year, according to official figures released yesterday. The data confirms that, barring any new shocks, peak inflation passed about four months ago (see chart).

Several Federal Reserve officials suggested it would be necessary to downshift to smaller interest-rate increases at the coming meetings. Indeed, it's very likely that we are reaching the end of this cycle of interest rate hikes and attention will now turn to the pace at which inflation returns to the Fed's 2% target. Some expect that process to be pretty straight forward - Morgan Stanley, for example, is expecting one further 25bps hike followed by a pause, with the first rate cut taking place as early as December.

Fed officials have repeatedly warned against expectations of rate cuts during 2023. St. Louis Fed President James Bullard did so again shortly after the release yesterday. The Fed's fear remains that inflation proves stickier than previously anticipated and even starts to rise again.

The World Cup bounce

The UK economy expanded 0.1% during November, a surprise increase underpinned by growth in food and beverage services during the World Cup, according to official figures published Friday morning.

The construction sector was flat during the month after growth of 0.4% the previous month. More recent indicators confirm that the sector largely stagnated at the end of the year. The RICS said the industry's net workloads balance dropped to -1% in the fourth quarter from +17% and +30% in the previous two quarters. Similarly, the S&P Global / CIPS UK Construction PMI, published last week, showed the fall in construction activity during December was the fastest since May 2020.

Costs faced by construction companies continued to increase during the month, linked by panellists to energy, material, fuel and import costs. However, the rate of inflation was the weakest for two years.

Housebuilding in 2023

Trading statements from Persimmon, Barratt Developments and Taylor Wimpey published since Wednesday revealed the impact of rising mortgage rates on the new homes market - particularly the spike in the wake of the mini-budget.

Persimmon's private net sales averaged 0.69 per outlet per week during 2022. However, that metric dropped to 0.3 during the final quarter and 0.19 in the final 7 weeks. The monthly cash cost of mortgage payments for some first time buyers has approximately doubled over the past year, when taking into account both the spike in mortgage rates and the absence of Help to Buy, the company estimates.

Barratt reported a similar drop off - its net private reservation rate per outlet per week fell from 0.6 from July to August, to 0.48 through to October 9th, then 0.3 for the remainder of the year. The company has been "very selective" when it comes to bidding for land, given the prevailing uncertainty.

Indeed, it looks like land values will have to ease soon or delivery of new homes will begin to drop. "Pricing in the land market is yet to reflect the changing market environment," Taylor Wimpey said in its update.

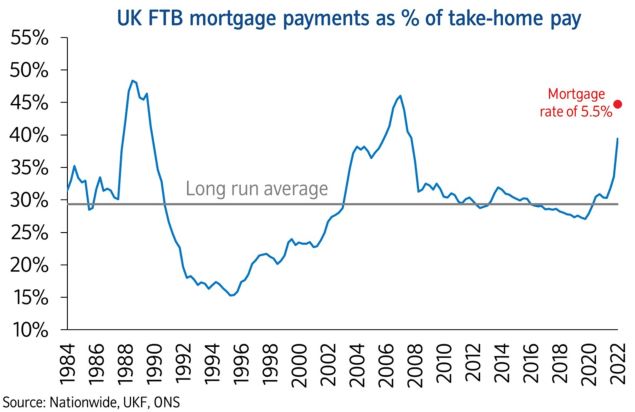

Mortgage costs

First-time buyers are at the sharp end of rising mortgage rates. Nationwide yesterday shared the chart below, which shows first time buyer mortgage payments (based on 80% loan-to-value mortgage, at prevailing mortgage rates) as a share of take-home pay.

The metric is now at 39%, levels last seen during the financial crisis. Raising a deposit continues to represent the largest barrier to home ownership, however. Nationwide estimates that a 20% deposit on a typical first time buyer home is now equivalent to 112% of the pre-tax income of a typical full-time employee, a similar level to a year ago, and only modestly below the all-time high of 117% recorded earlier in 2022.

Mortgage costs rising to more than 30% of income is generally where regulators start to worry. The Financial Conduct Authority wrote to the House of Commons Treasury select committee this week expressing concern that 570,000 households would move through that threshold within the next two years.

Still, the value of mortgages in arrears remains at historic lows for the time being, according to official figures.

In other news...

Hong Kong Bill introduces tax concessions for family offices (STEP) in an apparent bid to compete with Singapore’s surging private wealth growth - something we covered in this week’s Wealth Report update here.