UK residential property market subdued in December

Activity suffers as buyers navigate choppy waters

4 minutes to read

December was not a vintage month for the UK housing market. The aftereffects from September’s mini-Budget and subsequent spike in interest rates hadn’t fully dissipated, and many prospective buyers decided to wait until the new year and pause their searches ahead of the festive break.

December’s RICS Residential Market Survey confirmed that it was particularly quiet in the property market in the final days of 2022. Net balances for both new buyer enquiries (-39%) and new listings (-23%) were in deeply negative territory.

The net balance score represents the difference between the number of respondents that saw an increase in the month and those that saw a decrease.

The downward momentum in sales became further entrenched across virtually all parts of the UK over the month, according to RICS, with respondents in the North West of England, Scotland, Wales and London all citing a particularly subdued month for activity.

Near-term sales expectations turned a little more downbeat, posting a net balance figure of -54% compared to -46% last time.

Following the year-end lull, Rightmove data suggested there was a January bounce, albeit this may be short-lived. The property portal reported average asking prices up 0.9% with an increase of 4% in the number of prospective buyers contacting agents.

Lettings

In contrast to the sales market, tenant demand in lettings increased over the month, with a net balance of +28% from contributors, the survey confirmed.

However, with the sales market slowing there are signs of growing supply in the lettings market and signs that the run of upwards pressure on rents will end this year, which we explore here.

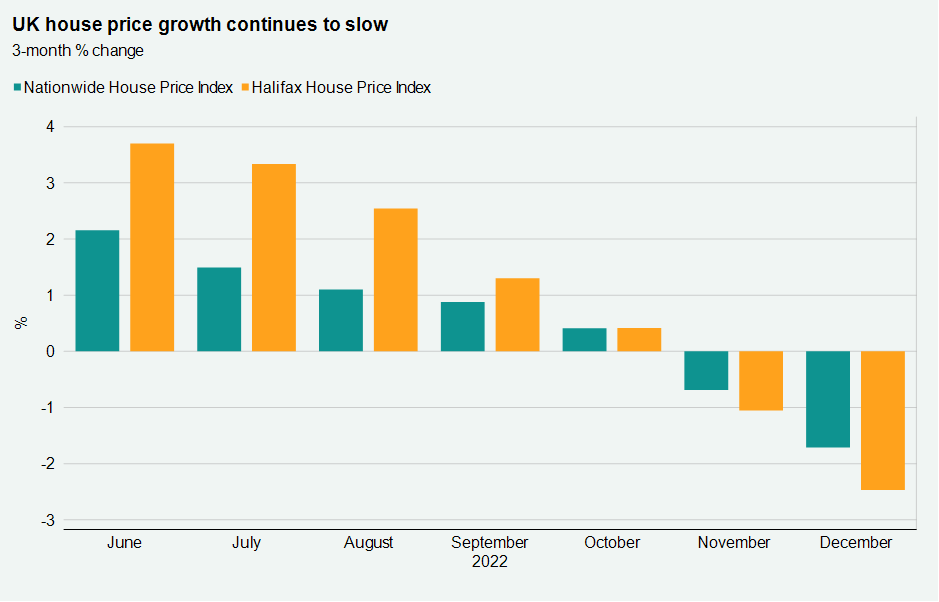

December was also the fourth consecutive month of house price declines. Nationwide recorded a monthly decrease of 0.1% (compared with November’s fall of 1.4%). This took the annual growth rate to 2.8%.

Halifax said the average house price was down 1.5% in December (compared with 2.4% in November) taking the annual growth rate to 2%.

We expect a price recalculation this year as buyers find their spending power curbed. This will place cash and equity rich buyers in a strong position, as we explored in our latest sentiment survey piece.

November’s mortgage approval data showed a further fall to 46,075, which was down by a third (33%) on the same month a year earlier. It also trumped October’s performance of 57,875 approvals, which had been the lowest monthly total since the closure of the market in 2020.

The spike in borrowing costs seen after the mini-Budget has now broadly corrected itself but the volatility it introduced made judging true buyer appetite tricky in the final months of December.

As the rates reset continues in the first week of 2023 it means the impact of cheaper mortgages in 2023 could eclipse house price declines.

However, with the Bank of England expected to raise the current base rate beyond 3.5% to tackle double digit inflation, interest rates will not return to their mini-Budget lows and the period of ultra-cheap debt experienced since the global financial crisis is over. We expect house prices to fall 5% this year as a consequence.

Prime London sales

The resilience of prices in prime London property markets will be put to the test this spring, when activity levels traditionally pick up across the UK.

Until then, prices should remain in somewhat of a holding pattern, although the monthly declines that followed the mini-Budget have now ended.

Average prices were flat in both prime central London and prime outer London in December, taking annual growth to 1.5% and 4.4%, respectively.

Prime London Sales Report: December

Prime London Lettings

There has been a marked imbalance between supply and demand for 18 months, and the narrative of frustrated tenants and fast-rising rents has become familiar.

Consequently, average rental values in prime central London (PCL) ended the year 17.8% higher, or 23.2% above their pre-pandemic average. In prime outer London, the annual rise in December was 15.8%, meaning rents were 21.1% above their level in March 2020.

There are some signs that supply is improving in higher-value markets as owners tend to be more discretionary with their options. It could even be a sign of things to come for the rest of the market in 2023.

Prime London Lettings Report: December

The Country Market

Activity resumed in prime UK regional markets in November after buyers hesitated in the weeks after the mini-Budget.

Accepted offers were up 4.1% versus the five-year average in November and by 4.3% in December, after a dip of 9% in October. In the 12 months to November, exchanges stand at the third highest in 15 years.

Average price growth fell 0.9% in the fourth quarter, taking the annual rate of change in the prime regional market to 3.1%.

Prime Country House Index: Q4 2022