Resilience amid caution in Asia-Pacific's residential sector

What is the outlook for Asia Pacific's residential sector for 2023? We explore some of the key observations leading up to the coming year and more.

3 minutes to read

Prior to the acceleration of mortgage rate hikes in 2022, many authorities in the Asia Pacific region have been implementing macro-prudential policies to rein in housing prices.

With rates not expected to come down any time soon, coupled with recessionary fear and the rising cost of living, markets are entering a standoff phase between buyers and sellers, the extent of which will vary significantly across the region.

Average interest rate across APAC (5-year historical and forecast)

(Source: Macrobond, Knight Frank Research)

Here are some of the key observations that we expect to see in the coming year:

1. Demand-supply bottlenecks to continue

Despite rising mortgage rates, price correction is unlikely to be of the same magnitude as previous downturns due to significantly higher construction costs which would likely be passed on to end-users.

Besides that, the tight labour markets across the region and unemployment rates will provide a cushion to prevent a steep fall in housing prices should the economic prospect deteriorate further.

While higher mortgage rates are impacting buying sentiments across the board from gateway to emerging markets, rental markets are at the other end of the spectrum.

Despite rising demand, the current squeeze in the development pipeline is still felt by a lack of supply. In most markets across Asia-Pacific, pipeline supply is still playing catch up with rising demand.

2. Return of international investors in tandem with the relaxation of border controls

The resumption of travel brings back Asian buyers and investors, who continue to show strong interest in these international gateway markets.

Despite tightening lending regulations around home loans and an increase in foreign investment taxes and stamp duty, international investors still find them relatively reliable and resilient in times of uncertainty.

Rate of prices slowing down and normalising offers a more sustainable backdrop for growth in most markets moving forward as large parts of the world move to a post-pandemic landscape coupled with inflation, rising taxes, and more property regulations.

3. Popularity of international trophy homes in ‘safe haven’ markets

Gateway markets such as the United Kingdom, United States, Singapore, Monaco, and Switzerland are highly sought after by Asia investors, particularly Greater China buyers, due to their safe haven reputation and business/financial hub.

Further fuelled by the recent weakness of the pound and strengthening of the US dollar with prime prices increasing by 7.1% in New York, the highest rate in 8 years, and Singapore offering economic prospects and a steady inflow of inbound talent, these cities remain the markets to watch for Asian investors whose currencies are dollar-pegged.

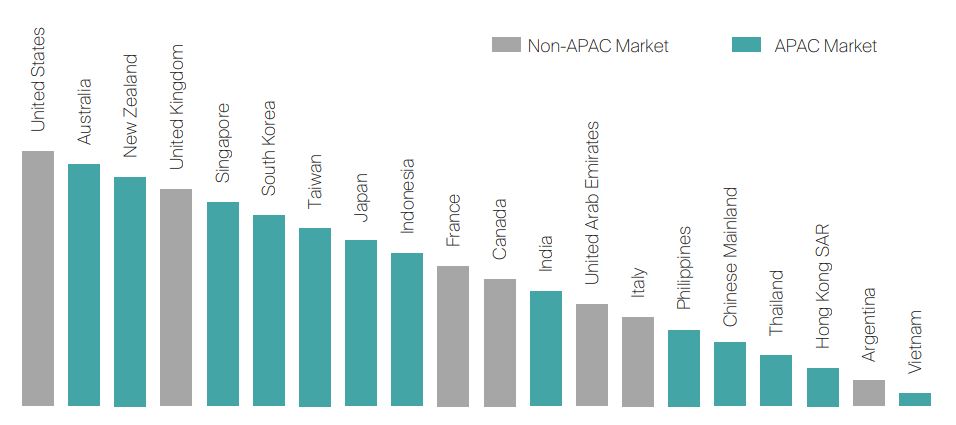

Asian buyer's top 20 preference in destinations for a second residence (descending order)

(Source: Knight Frank Wealth Report 2022)

4. New Zealand and Australia lead Asia-Pacific in price reversal trends

Key markets leading the price reversal include New Zealand and Australian cities, given the strong price run-up during the pandemic. New Zealand has seen the biggest decline, with prices down 3% on a 3-month basis.

New responsible lending laws and seven rate rises since October 2021 have shifted buyer sentiment from a fear of missing out to a fear of overpaying.

___

The Asia-Pacific Outlook Report is an annual publication that delves into the repercussions of the pandemic, increasing interest rates, and rising mortgage rates on the Asia-Pacific residential landscape using official statistics and outlines the forecast for 2023.

For more insights on the residential landscape, watch the on-demand recording of Asia-Pacific Residential Outlook 2023 webinar here and download the full report here.