Asia-Pacific real estate market outlook for 2023

We take a look at some of the ‘big picture’ issues impacting owners and users of real estate in the Asia-Pacific region for the upcoming year.

2 minutes to read

Global inflation in 2022 is at its highest since 1996. As most central banks in Asia-Pacific turn the screws on monetary policies to stave off inflation, growth will inevitably slow in the coming year. As monetary authorities are compelled to keep pace with the Fed's hiking cycle in addition to walking the tightrope between growth and inflation, the region's interest rates in 2023 will approach multi-year highs.

Despite these ongoing stressors, Asia-Pacific is set to remain the world's fastest-growing region in 2023. Even as growth momentum continues to normalise across much of the region, domestic-oriented economies such as emerging Southeast Asia and India are forecast to remain supportive of overall regional growth in the upcoming year.

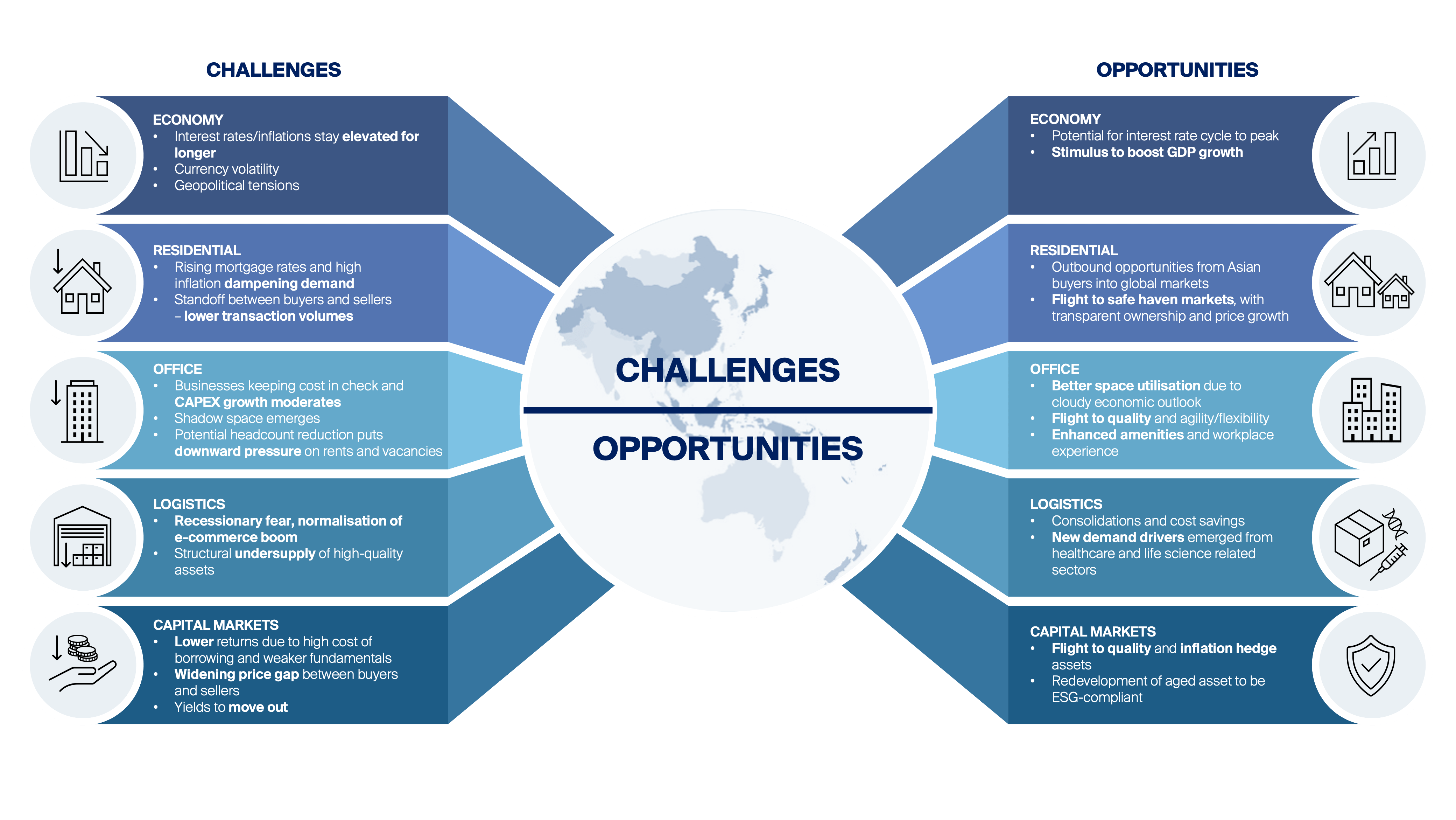

As such, we expect to see real estate markets in the region weather a period of transition as occupiers and investors review their strategies in a rapidly evolving environment.

Here's an overview of our sector outlook for 2023:

Office

- Growth in office rent will moderate from 3% to 2% as occupiers add flexibility to their portfolios to generate savings.

- Vacancies are forecast to rise from the current 14.6% to 16% as corporates turn more cautious with expansion.

- Many occupiers are anticipated to move swiftly to an office at first stance – emboldened by increased rates of return to the office driven by job insecurity.

- Co-working footprint in the Central Business Districts (CBDs) is expected to expand in line with the shift in preference for flexibility by space users.

Logistics

- Normalising e-commerce growth and supply chains are expected to alleviate some pressure on demand and rent for logistics spaces.

- Structural demand from “China Plus One” strategies and new economy sectors in the healthcare and life sciences is expected to remain resilient.

- Market fundamentals will render a balanced logistics market. Rental growth is set to moderate as compared to the past two years.

Capital Markets

- Volatility will hold up transactions in the short term as investors seek price discovery in various markets. Activity is expected to pick up in the latter part of 2023 as the macroeconomic picture stabilises.

- Investors will gravitate towards core, liquid assets in prime locations with attractive yields relative to the cost of debt as defensive options.

- Private wealth investors from the region, with a lower reliance on debt and a tendency to hold assets for the long term, are expected to turn active.

Residential

- Cross-border residential investments from Asia Pacific high-net-worth individuals are expected to climb due to demand for prime properties in global safe-haven markets.

- Singapore remains highly sought after by Greater China buyers due to its reputation as a safe haven and a growing hub for business and finance.

___

The Asia-Pacific Outlook Report is an annual publication that delves into the repercussions of the pandemic, increasing interest rates, and rising mortgage rates on the Asia-Pacific residential landscape using official statistics and outlines the forecast for 2023.

For more insights, please download the full report here.