Leading Indicators | Autumn Statement | GDP | COP 27

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

No big surprises in Hunt’s ‘Autumn Statement

The fiscal tightening of £55bn in last week’s ‘Autumn Statement’ was widely trailed in the run up to the announcement. The statement which included £30bn of spending cuts and £25bn of tax, was the largest tax raising plan for 30 years, other than during the pandemic. Much of the planned measures will be delayed, with the majority of the consolidation starting in 2024/25. The largest fiscal support was the extension of the Energy Price Guarantee for 12 months until April 2024, while National Insurance, Inheritance and Income Tax thresholds were frozen until April 2028. Business Rates were reviewed, with the Chancellor announcing a £13.6bn package that would mean the total increase in Business Rates bills will be less than 1%, compared to over 20% without intervention.

What impact will this have on the economy?

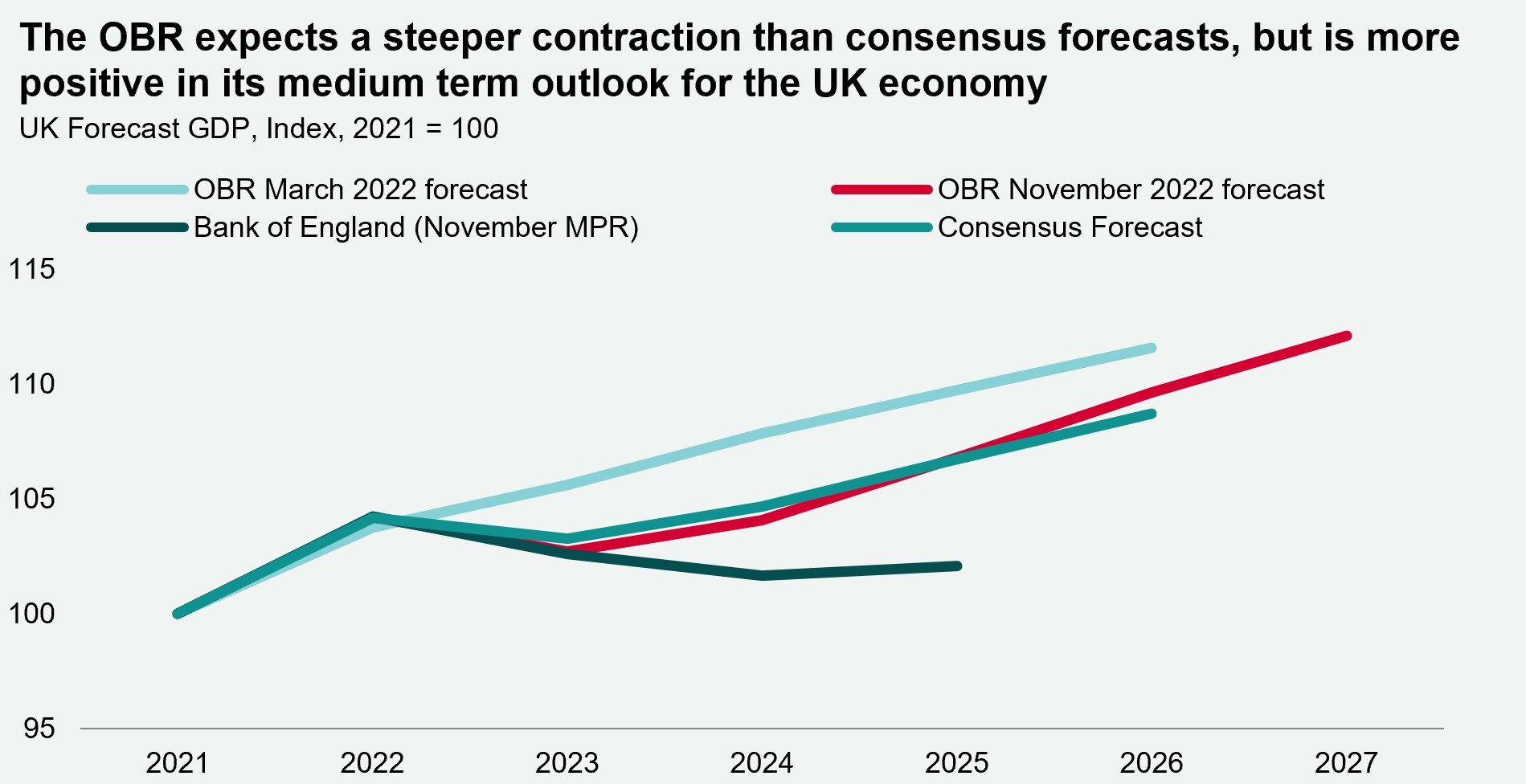

The OBR now forecasts a recession lasting five quarters from Q3 2022 to Q3 2023, with a peak-to-trough fall of -2.1% as a result of the government’s intervention, compared to an estimated -3.2% fall without intervention. Overall, the OBR forecasts the UK economy to contract by -1.4% in 2023 and then grow by +1.3% in 2024, +2.6% in 2025, +2.7% in 2026 and +2.2% in 2027. The OBR increased its CPI inflation forecast from 1.7% last forecast in March to 9.1% in 2022 and from 4.1% to 7.4% in 2023. However, it expects CPI inflation to ease to 0.6% in 2024. The response from the financial markets has mostly been muted, as the Chancellor’s plan was largely already priced in before the statement was delivered. The UK 10-year gilt yield was 3.24% pre-announcement, compared to 3.28% currently. Meanwhile, UK 5-year Sonia swaps are currently 3.86%, up by 2bps since the 'Autumn Statement'.

Sunak commits to a better green energy transition at COP 27

In November, global leaders came together at COP 27 to create a path forward and establish plans for reducing carbon emissions. At the summit, the UN Secretary General called out weak Net Zero pledges and requested the establishment of interim targets to be reviewed every 5 years. At COP 27, Rishi Sunak committed to a better green energy transition in the UK and globally. At present, 37% of the UK’s electricity is produced by renewable sources. Sunak’s commitment follows last week’s fiscal statement, where the UK Chancellor announced a 35% windfall tax for oil and gas companies, a doubling (+£6bn) in annual energy efficiency investment and proceeded with a new nuclear power plant, Sizewell C. For real estate, the built environment emits 25% of greenhouse gases in the UK compared to 40% globally, with new buildings using 40% less carbon.

Download the latest dashboard