The US inflation supertanker begins to turn

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The first positive number?

US inflation came in below expectations yesterday, prompting the S&P 500 to soar more than 5%. Sterling had its biggest daily gain against the dollar since 2017.

Investors starved of good news seized on the release, which showed inflation had slowed to 7.7% in October, the lowest level since January. Economists had been expecting a reading of 8%. Core inflation, which strips out volatile energy and food prices, fell from a 40-year high to 6.3%.

For several months there have been tentative signs that US inflation is peaking but October's report offers a much more solid signal that the worst may have passed. The component of the index that acts as a proxy for housing costs rose almost 7% and contributed to more than half of the overall monthly inflation increase - that's a lagging indicator that more recent data suggests will ease markedly in coming releases.

“As inflation starts to moderate, we expect the Fed to continue raising rates to around 5%, but then potentially pause to assess the effect that their recent rapid monetary policy tightening is having on the economy," Mike Bell, market strategist at JP Morgan Asset Management tells the Times. "If growth continues to weaken, we could see rates peak at about 5% next year."

European living

Soaring inflation, higher commodity prices and supply side constraints weighed on institutional investment into European living sectors during the third quarter - provisional data shows volumes hit €10.8 billion, down 37% on the same period of 2021. That brings 2022 investment to €44.5 billion, down 8% on the same period a year earlier.

The results from our European Living Sectors Investor Survey include responses from more than 40 investors active across the continent. The team shared the results during a webinar yesterday that you can catch on demand here.

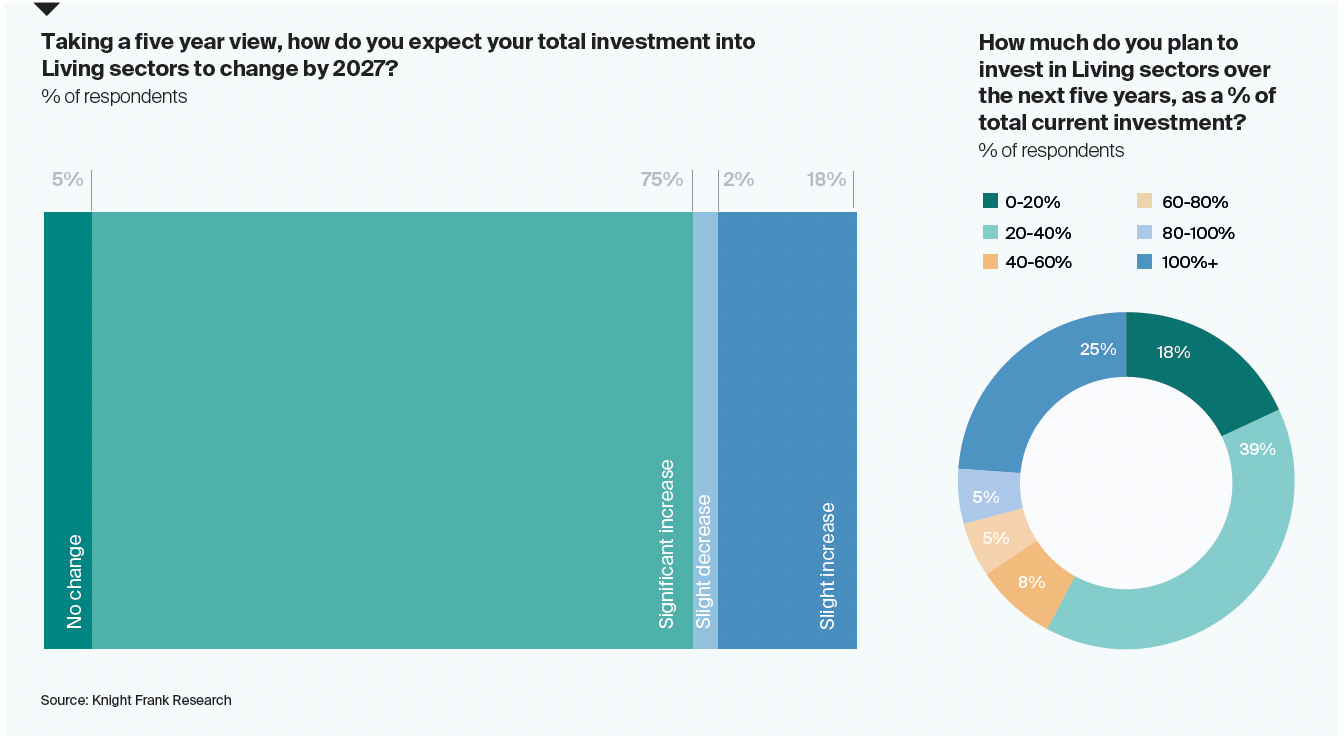

The results suggest that investors remain bullish despite current volatility. Three quarters of respondents said they plan to “significantly increase” their total investment into European Living markets over the coming five years (see chart). A quarter said that this would represent a doubling of existing investment levels.

Q3 was a period of acute uncertainty but we may see an uptick in activity during the final months of the year as investors get more comfortable with where values sit longer term. Pricing looks to be stabilising at the time of writing, though discounts vary across markets as far out as 50 to 75 basis points.

New buyer enquiries fall

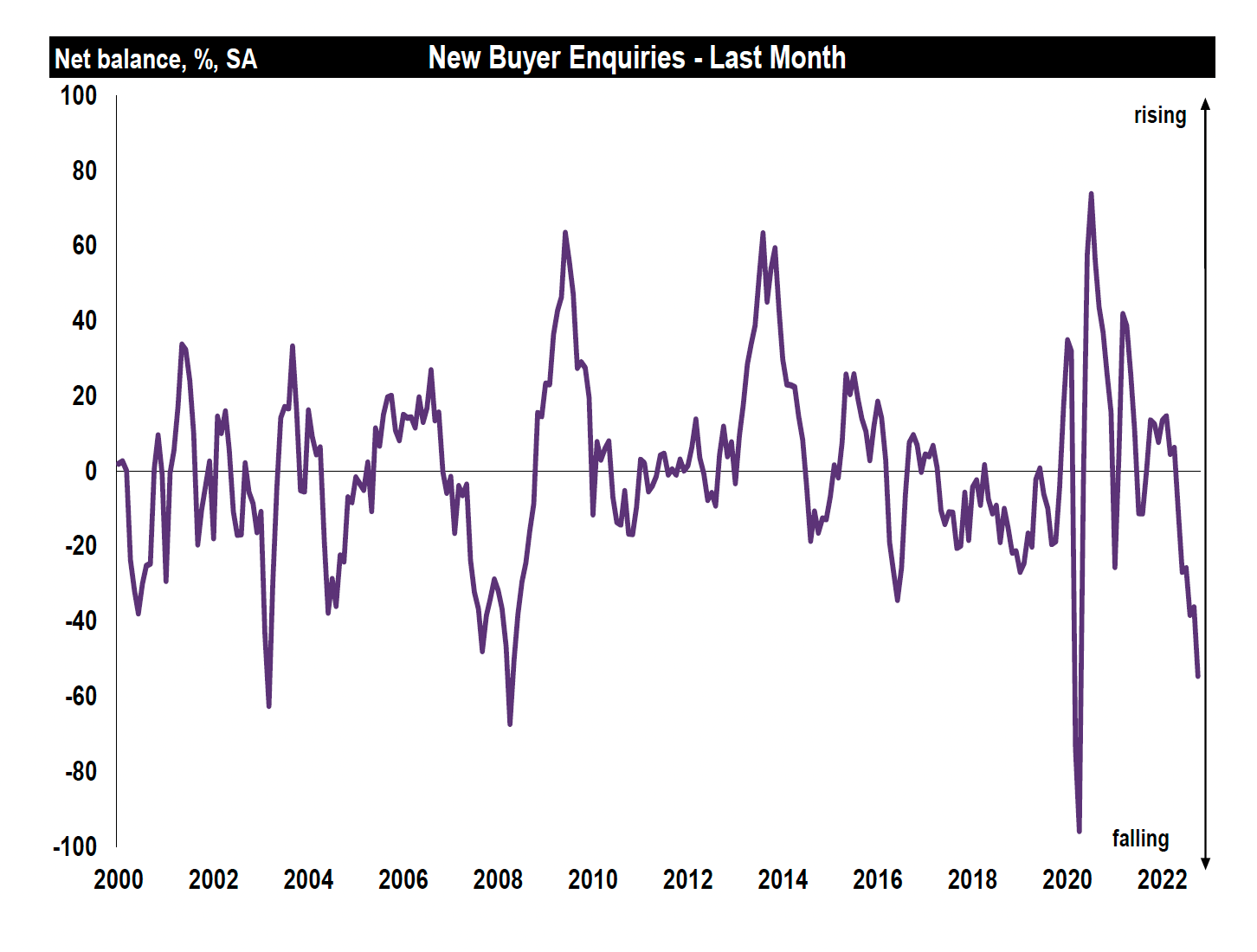

The latest RICS Residential Market Survey offered more confirmation that October was a particularly bad month for the UK housing market. The measure of new buyer enquiries fell for a sixth consecutive month to hit a net balance of -55, the lowest reading since the depths of the pandemic (see chart).

For a closer look as to why October's data is unlikely to set the tone for the coming months, I recommend Tom Bill's piece from Monday. The October dip was almost certainly magnified by the impact of the mini-Budget and accompanying mortgage market volatility that has now begun to recede.

Nevertheless, after price growth of 25% during the pandemic and a significant reset of mortgage costs, it is clear prices are under pressure. We don’t expect the sort of cliff-edge moment seen during the financial crisis but we do expect prices to fall back to the level they were at in summer 2021 as rates normalise after 13 years.

For a view from the new homes market, see Taylor Wimpey's trading update from Monday.

Prime London

We saw similar patterns in prime central London. Average prices fell 0.3%, the biggest monthly decline since the onset of the pandemic. A fall of 0.1% in prime outer London (POL) was the first decline in 30 months.

The number of offers made in London was down by just over a fifth versus the five-year average (excluding 2020) in October while viewings were down by 12%, Knight Frank data shows.

Forward looking indicators look better - the number of instructions to sell was 28% higher, which will support transactions for now. Plus, a higher proportion of cash buyers means prime markets may be more insulated from the effects of rising rates, as we explore here.

In other news...

The latest Knight Frank Cresa Corporate Real Estate Sentiment Index is out now

Elsewhere - UK GDP contracted 0.6% in September (ONS), Fed officials back slower pace of rate rises after inflation data (FT), WeWork to close offices in cost-cutting drive (FT), Europe's gas use slides 22% as households keep the heating off (Bloomberg), and finally, a mansion tax could be coming to LA (Bloomberg).