What's an attractive mortgage rate in this market?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The week ahead

Policy meetings at the US Federal Reserve and the Bank of England loom large this week despite the decisions on interest rates looking like foregone conclusions.

The Fed is widely expected to implement a fourth consecutive 75bps hike on Wednesday to bring the key rate up to 3.75% to 4%, the highest level since 2007. Likewise, economists are expecting a 75bps hike from the Bank of England. That would bring the base rate to 3%, the highest rate since 2008.

Both meetings will be parsed for signals that the pace of tightening is likely to moderate soon - we looked at a shift in tone at the European Central Bank on Friday, for example. San Francisco Federal Reserve President Mary Daly set a hare running earlier this month when she suggested that "now is the time to start talking about stepping down," - see Wednesday's note. US economic growth has effectively stalled, 30-year mortgage rates have moved above 7% and the housing market is cooling rapidly.

The last Bank of England meeting took place the day before the mini-budget and quite a lot has happened since then. The tattered agenda of tax cutting will be replaced on November 17th with a cumulative £50 billion of spending cuts and tax increases, according to the Sunday Times. That's obviously too late to factor into this weeks' decision, but it will be on the minds of the MPC and may set the scene for a shift in tone.

Current market pricing suggests the UK base rate will peak at 4.75% around the middle of next year, down from more than 6% in the days following the mini-budget.

More rate cuts

Barclays, HSBC, Santander, TSB, and Coventry, Skipton and Yorkshire building societies had all cut some of their fixed rate mortgages by more than half a percentage point by the weekend - see Saturday's Times.

The average rate on a two-year fix has fallen to 6.48%, according to Moneyfacts. That's still high relative to swap rates so there is room for further cuts.

“We had a conversation yesterday about what point does a fixed rate look attractive again? We feel like a good rate is anything starting with a 4," Simon Gammon of Knight Frank Finance tells the paper. “As long as stability in the market remains, you would like to think we will see lenders re-price. It doesn’t feel unreasonable to me, I think we will see rates starting in the mid-4 per cent range at some point.”

Active Capital

Last week we launched the 2022 edition of Active Capital, bringing together thousands of unique datasets to offer a new perspective on the global real estate investment outlook. You can watch the 25-minute webinar via our On Demand service here.

You can also read the key takeaways from the report here, we'll be publishing more deep dives on this topic during the weeks ahead. Forecasts of global cross-border capital flows suggest that investors will focus on highly liquid markets and safe-havens next year. The US will be the top destination for cross-border investment in 2023, followed by the UK, Germany, Australia and France.

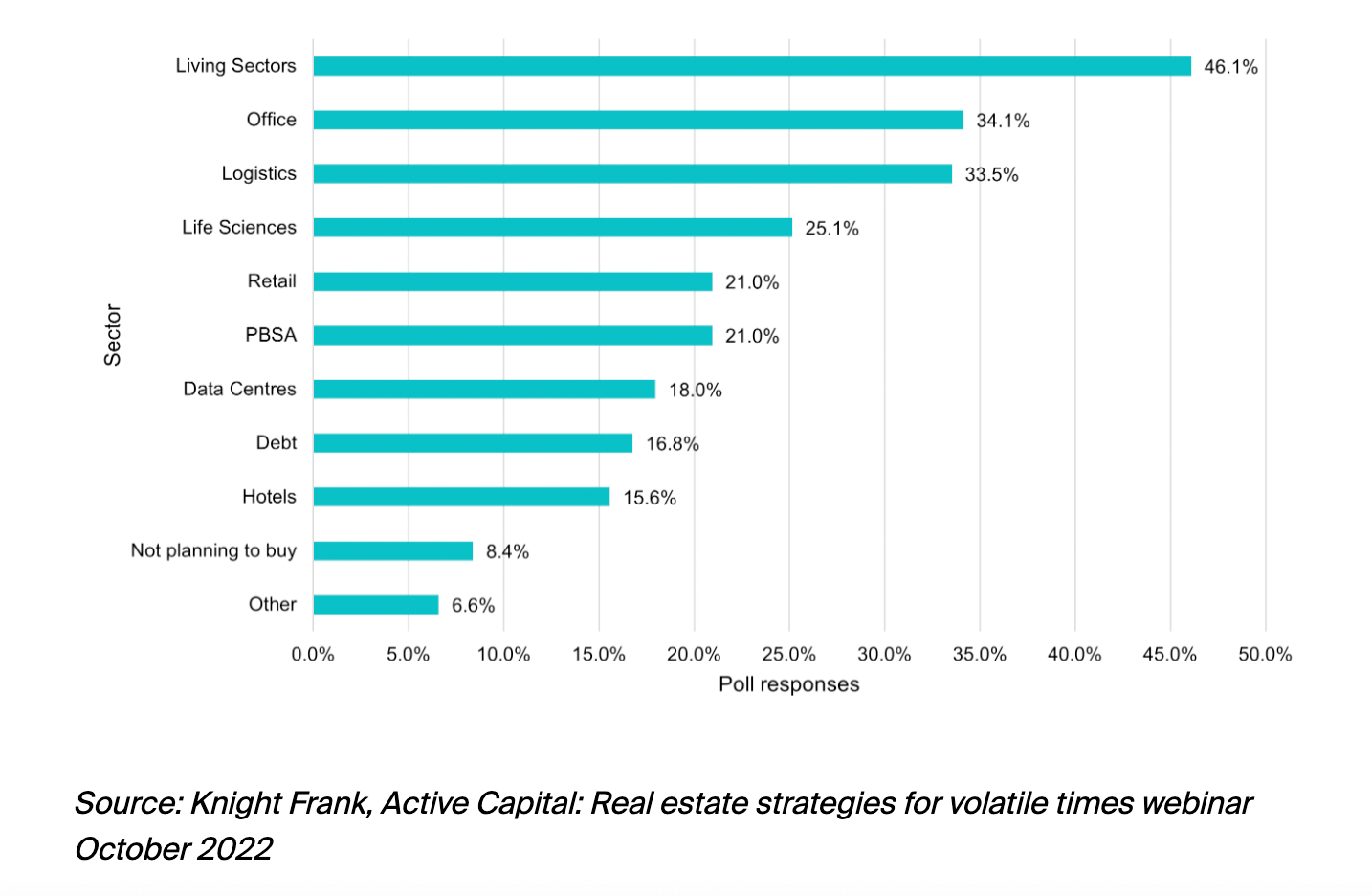

Offices will be the most popular sector for cross-border capital, followed by logistics, residential including student accommodation, then retail. During the webinar we asked our 600 attendees which top 3 sectors they were targeting over the next 18 months - see chart below.

European office markets

Office markets across Europe enjoyed robust take up during Q3, with most climbing year-on-year and relative to the five year average. You can see our round up here.

Paris looks to be the stand out. Take-up in the CBD totalled nearly 206,200 sqm, the highest quarterly take-up since 2017 and the highest Q3 take-up on record. Luxury and coworking brands were particularly active during the quarter.

The vacancy rate declined further to 3.3%, compared to 5.1% in Q3 2021. Grade A assets only represent 8% of available space which is putting upward pressure on rents, which hit a new record high of €955 per sqm per year.

In other news...

UK companies see tough conditions enduring (Reuters), housebuilders warn new rules and taxes will add £4.5bn to costs (FT), and finally, it’s hydrogen versus heat pumps in the race to heat our homes (Times).