Forecasting global cross-border capital flows

The Capital Gravity model forms a cornerstone of our Active Capital research. Now in its sixth year, we’ve employed the latest machine learning and regression techniques alongside unique datasets to predict where real estate capital will flow in 2023 and beyond.

6 minutes to read

Next year is an especially challenging year to predict, with a diverse range of economic and financial outlooks. The current base case scenario for 2023 is that we could see cross-border capital flows at similar levels to the middle of the last decade.

This comes with the potential upside risk as the model has been particularly conservative in predicting the impact of swings in economic fortune on the residential sector.

While private capital is a small proportion of the total, we could see an increase in cash rich investing.

The top five global destinations for cross-border investment in 2023 are forecast to be:

1) US

2) UK

3) Germany

4) Australia

5) France

with a focus on liquidity and safe havens, with some opportunistic investment.

The forecast for the top global sectors for cross-border capital in 2023 are:

1) Office

2) Logistics

3) Residential including student accommodation

4) Retail

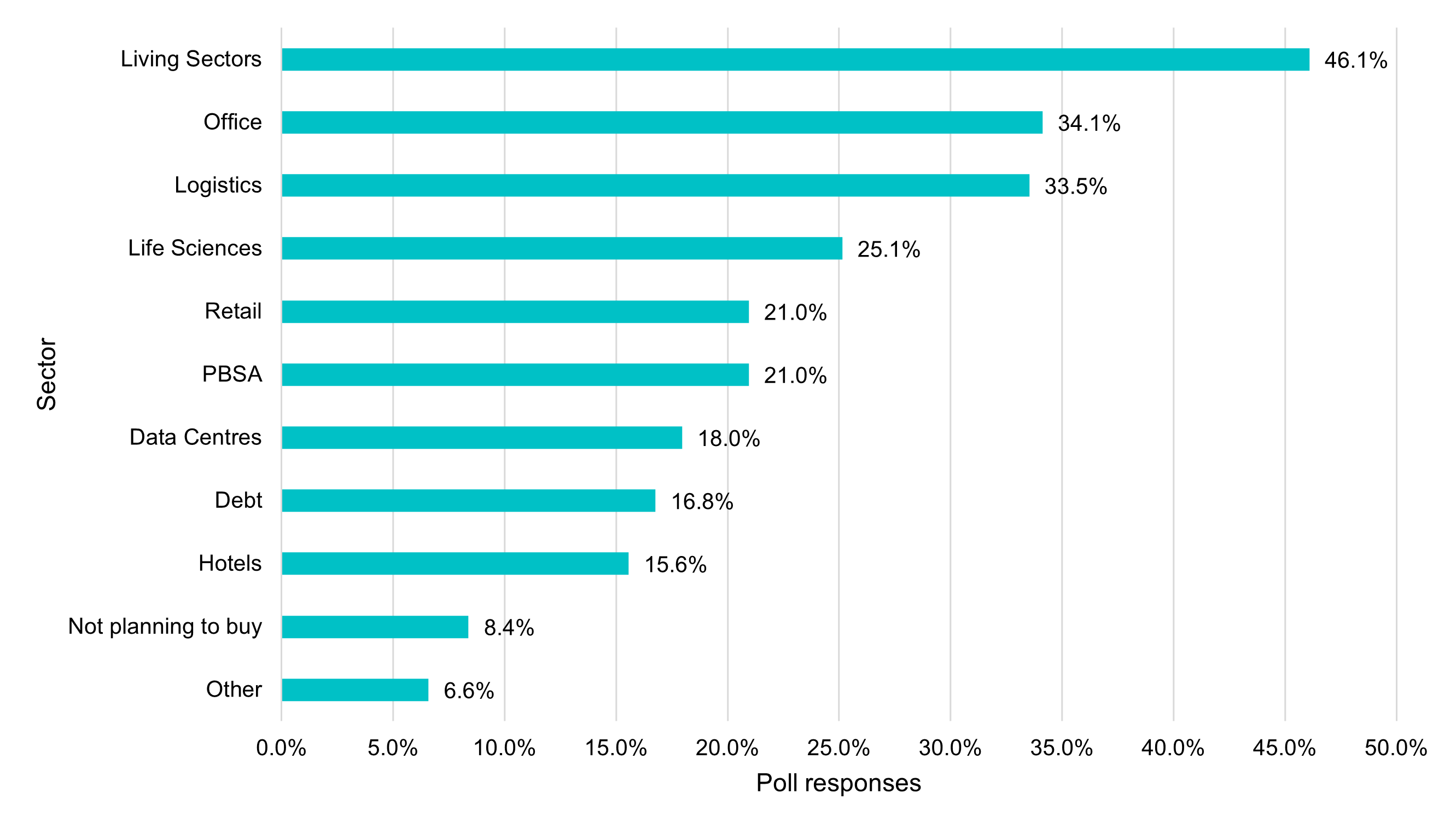

In our latest launch webinar, we asked our 600 attendees which top 3 sectors they were targeting over the next 18 months (% represents the proportion of respondents who are targeting the given sector):

Source: Knight Frank, Active Capital: Real estate strategies for volatile times webinar October 2022

Sector outlook for 2023

Hotels

After the challenging pandemic years, hotel sector activity is forecast to see a significant step up in activity, although not quite a return to pre-pandemic levels.

The US, UK, Germany, Australia and Japan are forecast to be target destinations, with capital flowing from US private equity and investment managers, Singapore REITS and Canadian investment managers.

For those investors who understand the hotel industry’s fundamentals and keen to seek out opportunities, the ongoing recovery in hotel trading performance is safeguarding the sector’s attractiveness. A wealth of capital continues to be deployed, with well-performing assets in prime destinations, or those which offer value-add and long-term plays, highly sought after.

The ability to adjust room rates in real time and benefit from multiple revenue streams is also proving an inflation hedge and protection against rising interest rates, with many markets seeing trading and profits surpass pre-pandemic levels.

Logistics

After two years of record activity levels, the logistics sector we forecast to remain the second most invested sector in 2023, although cross-border volumes could moderate to just above 2019 levels globally.

The US, Germany, UK, Australia, France and Japan are likely to be destinations of interest, with capital flowing from the US, Singapore, Canada and UK. Interest here too is likely to come from a more diverse range of investors.

Offices

The office sector is forecast to be the most active sector worldwide in 2023, targeted by an increasingly diverse range of investors and in particular, private investors looking at the UK and US.

The top destinations in 2023 are expected to be well understood and relatively more liquid locations in the UK, US, Germany, Netherlands, Australia, France, Japan, Greater China and Singapore.

Residential

Residential is likely to remain at the top of the shopping list for globally mobile capital. Robust rental performance through historic downturns makes it a good hold for the current period.

"Living sectors in America last year were the largest investible asset class and within the next decade they will be the largest investible asset class globally"

James Mannix, Partner, Head of Residential Development and Investment

Retail

This wide wide-ranging sector may benefit from its recent history of right sizing, rebasing and repricing in many locations. It is already ‘battle hardened’ from structural changes post-Covid and artificial pandemic-induced trends normalise. The rebasing of the retail sector could now provide opportunity for forward thinking investors. In particular, investors from the US, Canada, the UAE and Singapore are expected to focus their interest across the US, UK, Germany and France.

Student housing (PBSA)

Cross-border activity in this sector is forecast to continue its recovery next year, returning to 2017 levels.

We forecast increased interest from the US, Canada, Singapore and South Korea with institutional investors in particular targeting the US, UK and Germany.

Investor types

High-Net-Worth-Individuals

High-Net-Worth-Individuals (HNWI) activity is expected to increase next year.

Combined with growth in the number of Ultra High Net Worth Individuals (UHNWI), as set out in The Wealth Report, activity is expected to increase in 2023, as cash-rich investors take advantage of currency benefits, and potentially less competition by larger institutional capital, to target the UK and US amongst other locations across Europe and beyond. All sectors will benefit but we could see particular focus on the office sector.

We forecast a wide geographical spread of HNWI activity from Brazil, the US, UAE and Germany, Spain and Switzerland.

Cash rich investors looking to take advantage of currency benefits and potentially less competition by the larger institutional capital will target the UK and US, focussing in the main on the office sector.

Institutions

Our model suggests that institutions will look to the office, industrial and retail sectors in 2023, with a particular focus on EMEA.

We forecast a mixed picture with the US and UAE institutions likely to increase their activity, accompanied by some moderation of interest worldwide.

Investment Managers

Historically, global cross-border transactions by Investment Managers have tended to be fairly steady with peaks of activity in ‘recovery’ years, notably 2018, 2019 and 2021.

Overall, investment levels are forecast to be moderately muted, particularly as moves in the equity and bond market may have led to ‘accidental’ increases in relative weightings of real estate. However, investment managers in, for example, South Korea and the UAE are expected to increase activity, targeting a broad range of sectors.

While activity is likely to hold relatively steadier in the Americas and Asia Pacific, EMEA is forecast to remain the principal target.

Listed/REITs

Listed real estate companies and REITs are forecast to increase their interest in Asia Pacific, particularly targeting the office and industrial sectors in Australia and the office sector in Japan and Singapore.

Listed/REIT Investors from Singapore, the US, Canada, Greater China, and Japan are expected to lead global cross-border interest.

Private equity

We could see slightly moderated activity, compared to recent years, from private equity investors over 2023, although significant weight of money, dollar strength and pricing is likely to lead to a flow of US capital and a possible increase in Singaporean investor interest.

The US, Germany, UK, Japan and Netherlands are expected to top the interest list, with a focus on the office, industrial and residential sectors.

Other investor types

Banks, sovereign wealth funds, and corporates are collectively forecast to maintain similar levels of investment to the last two years.

Capital is expected to flow from broad sources across the US, Canada, Germany, Singapore, France, Greater China, Sweden and UK, targeting the full suite of sectors.

EMEA and the Americas are expected to remain the top two regions for Capital flows but APAC is forecast to see a notable increase in activity.

In particular, that includes the office sector in Japan, Australia, Singapore and South Korea and the industrial sector in Australia, Singapore, Japan and Greater China, along with the residential and hotel sectors in select locations.