Mapping the UK's cash buyer hotspots

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Gilts

The Sunday papers were packed with gory details as to how last week played out and rich with opinion as to whether the sacking of the Chancellor and scrapping of another flagship mini-budget policy would be enough to shore up Britain's economic fortunes, however it won't be until 8am this morning that those who really matter begin having their say.

UK gilts will have resumed trading around the time this email reaches your inbox and any significant spike in yields will be read as the market's judgement that more needs to be done. Sterling gained as much as 0.9% to $1.1273 in Asia trading. New Chancellor Jeremy Hunt told the BBC on Sunday that nothing was off the table when it comes to reversing the mini-budget. He is scheduled to announce details of various tax and spending measures later today.

Activity in the gilts market has significance for the housing market beyond acting as a broad signal of Britain's economic health and credit worthiness. Investors use swaps to turn variable government yields into fixed rates, so the spikes in gilt yields inflate swap rates, which are then used by banks to price mortgages.

Cash buyers

More than 5 million families will see their annual mortgage payments rise by an average of £5,100 over the next two years, according to calculations from the Resolution Foundation think tank. Of that, £1,200 reflects expectations of higher interest rate rises since the mini-budget.

Indeed, the distribution of mortgage debt and housing equity will shape regional differences in housing market activity during the next two years.

Buyers in outer London and parts of the south-east areas have typically relied most on mortgage debt in the UK, our analysis of Land Registry data since 2011 shows. Cash buyers have accounted for less than 20% of sales in areas including Barking and Dagenham, Slough, Thurrock, Dartford and Waltham Forest. The UK average was 31%.

Conversely, the list of areas where cash buyers are most prevalent has a distinctly second-home feel. It is topped by the coastal areas of North Norfolk (59%), East Lindsey (57%) and Rother (55%). Relatively higher levels of retiring homeowners are also likely to have affected the figures. See the full analysis, linked above, for more.

Recession forecasts

Economic growth forecasts are now trickling in after the mini budget.

EY Item Club expects Britain to be in recession until next summer. The group expects GDP to contract 0.3% next year, from a previous estimate of 1% growth, though the risk of a severe downturn has been mitigated by the government's intervention on energy bills. You can see the Times write up here.

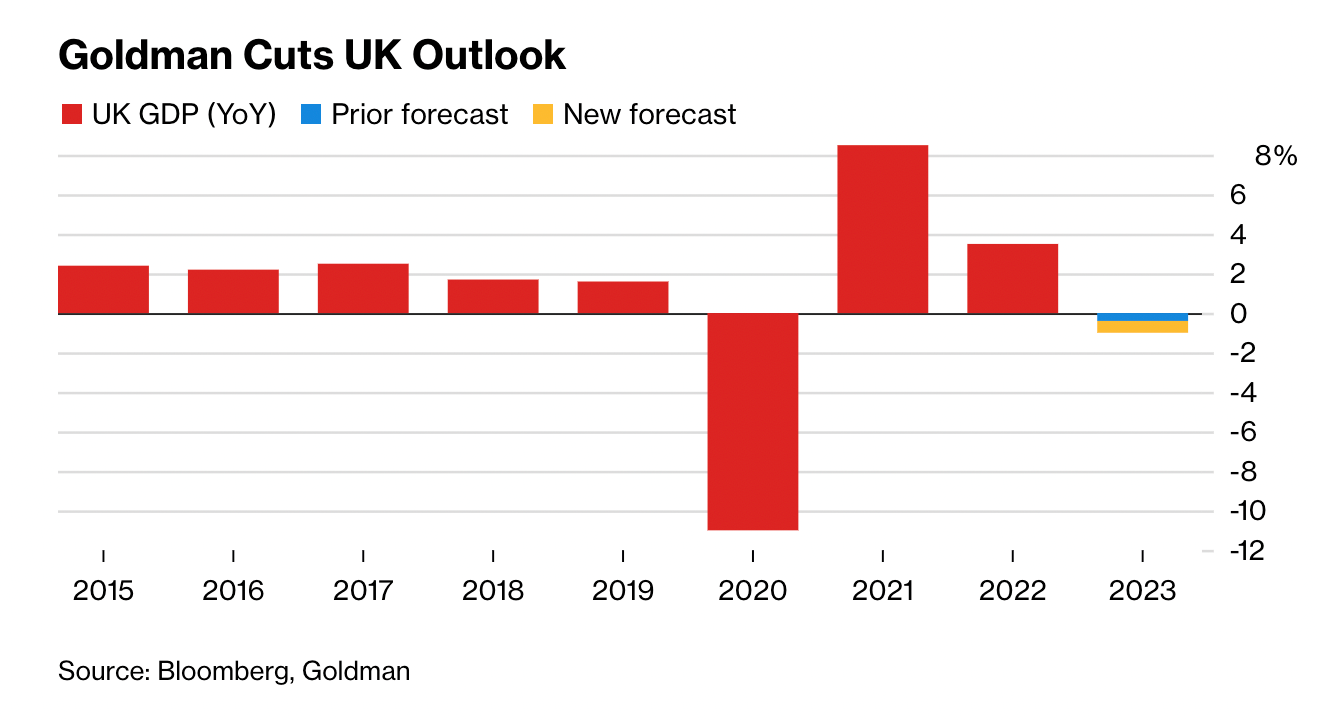

Likewise Goldman Sachs now expects GDP to contract 1% next year, from its previous forecast of -0.4%. It sees core inflation running at 3.1% at the end of the year, down from 3.3% previously. See chart below and write up here courtesy of Bloomberg.

Asking prices

Asking prices for homes coming to the market rose by 7.8% year-on-year in October, the smallest increase since January, according to Rightmove. The group also reported a rush of buyers trying to complete sales before mortgage offers expire.

That metric should continue to slow over the coming months, though much will now depend on the pace and scope of rising mortgage rates. You can find our sales market forecast below with more detail here.

Key for the mortgage market will be the UK's next inflation reading, due out Wednesday. Economists polled by Reuters expect the UK consumer price index to rise to 10% for the year to September, from 9.9% in August. Investors currently expect the Bank of England to execute a 0.75% hike at the next meeting in November.

In other news...

Global economic warning lights are flashing red (FT), Piccadilly hotel with royal pedigree to be given £90m makeover (Times), and finally, Germany seen dragging Euro area into contraction next year (Bloomberg).