A broad property slowdown takes hold

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

Unrelenting US inflation

US inflation was little changed in September compared to a month earlier. Core inflation, which strips out volatile items including food and energy, accelerated to 6.6%, the fastest rate since 1982. About as bad as it gets, says the FT.

A 0.75% hike from the Federal Reserve in November now looks like a done deal. The average 30-year mortgage rate is creeping closer to 7% and stands at its highest level since 2002, according to Freddie Mac.

How long the Fed stays on the war path remains the most important story in global economics. Each bumper hike piles more pressure on economies elsewhere, fuelling inflation via the dollar's strength and incentivising other central bankers to respond, almost regardless of their domestic picture. "The world is starting to hate the Fed", read an FT headline this week.

The interest rate sledgehammers currently being wielded by central banks have substantial time lags. Much of the impact of the current tightening lies in the future - see this thread from Nobel laureate economist Paul Krugman. Few believe a pivot is coming before the end of the year, but it would be incorrect to believe we need the data to turn entirely before the Fed takes its food off the gas.

Buyer enquiries fall

Rising borrowing costs are now weighing markedly on housing demand, according to a raft of UK housing metrics published since Wednesday

September's RICS Residential Market Survey revealed new buyer enquiries fell for a fifth consecutive month. Tight supply continued to underpin a modest rise in prices, though clearly momentum is slowing. Barratt Developments said it had continued to see strong interest from buyers in every region, however reservations were running at 188 per week, down from 281 a year earlier, according to a trading update.

“An era of double-digit price growth was already coming to an end but the mini-budget looks set to accelerate that process,” Knight Frank's Tom Bill told the Guardian on release of the RICS survey.

You can find our view on the future, including our forecasts, here.

This time it's different

The Bank of England's Financial Policy Committee (FPC) publishes an update every quarter that seeks to identify risks to financial stability.

The latest, published Wednesday, said the proportion of householders "with high cost-of-living adjusted mortgage debt-servicing ratios" - in other words feeling pressure from elevated mortgage payments - would increase by the end of 2023 to levels last seen around the onset of the global financial crisis (GFC).

There are several caveats. Households "are in a stronger position than in the run-up to the GFC, so UK banks are less exposed to household vulnerabilities," the Bank said. The ratio of aggregate household debt to income is well below the pre-GFC peak and the share of outstanding mortgage debt at high loan-to-value ratios is also much lower. Plus, the banking sector "is much better capitalised...mitigating the risk that losses on loans cause lenders to reduce credit supply in order to preserve capital." Nevertheless, it's going to be challenging for some households to manage mortgage payments alongside the rising cost of other essentials, the committee said.

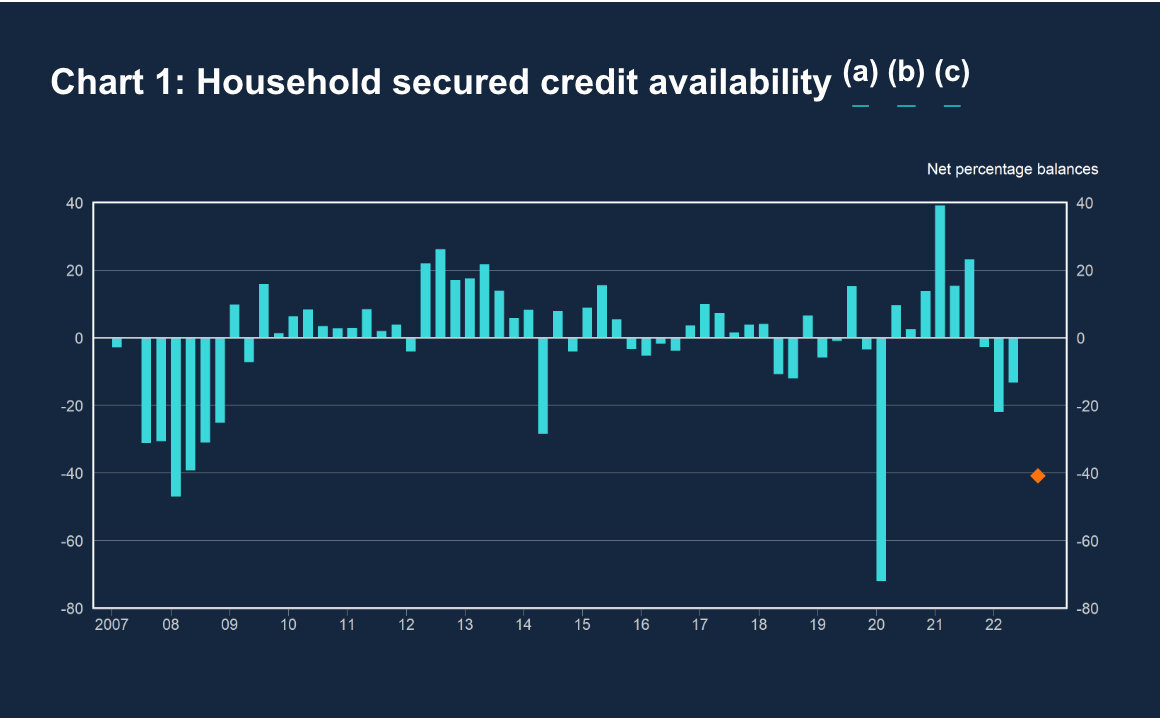

A separate survey of lenders from the Bank of England conducted between late August and mid-September - so before the mini-budget - revealed that banks expect a notable drop in mortgage lending from November onwards (see the orange diamond on the chart below).

Commercial property values

Several papers pick up on new forecasts from Goldman Sachs suggesting prices across UK commercial real estate will fall back between June this year and the end of 2024.

Higher borrowing costs are posing a problem for lenders, which are struggling to gauge the effect on property values and are more hesitant about lending as a result, Lisa Attenborough, head of the Knight Frank's debt advisory team tells the FT.

Pressure on values will differ by sector, location and property type. You can find our latest London Office Market Q3 spotlight here and our more detailed Q2 report here. West End offices, to take one example, continue to outperform from an occupational perspective. Take up has risen in-line or above trend for four consecutive quarters.

Though yields in some locations are rising, that's being offset to some extent by sterling's depreciation making capital values look attractive - that's particularly the case for overseas investors looking for a hedge against inflation.

The undersupply of Seniors Housing

The demographic case for increasing the supply of Seniors Housing continues to build, according to our 2022/23 annual review.

Data from the 2021 Census confirmed that nearly one in five people in England and Wales is aged 65 or older, the highest proportion ever recorded. More than 95% of local authorities saw an increase in their share of the population aged 65 and above.

Our forecasting, based on the new Census figures, suggest these increases are only going to accelerate. We anticipate a 24% increase in the number of over 65s between 2021 and 2031, equating to an additional 2.5 million people. The number of people aged over 75 is expected to grow by 11%.

Supply is increasing, but not enough to meet projected demand. The total number of specialist seniors housing units in the UK will grow by 8%, or around 64,000 units over the next five years - this would mean there would be 119 seniors housing units per 1,000 individuals aged 75 by 2026. That's down from 124 currently and from 137 back in 2012, underscoring the potential for significant growth in the sector across all tenures.

In other news...

The average price of agricultural land recently reached a near historic high of £8,300 per acre, according to the Knight Frank Farmland Index.

In a new edition of Intelligence Talks, I speak to Andrew Shirley and Jess Waddington about the resilience of the UK’s farmland market. Andrew and Jess explain why, despite widening economic gloom, confusion over post-Brexit environmental schemes, and the impact of rising fuel and fertilizer prices, £10,000 per acre is within reach. Listen here, or wherever you get your podcasts.

For more rural news, see Andrew Shirley's latest on the impact of the Ukraine war on the UK's agricultural transition.