Andalucia scraps wealth tax for residents and second home owners

Spanish nationals and foreigners with worldwide assets in excess of €700,000 living in Andalucia will no longer pay tax on their worldwide assets.

2 minutes to read

The region is home to some of Europe’s top second home hotspots stretching from Malaga to Seville and encompassing the numerous resorts of the Costa del Sol.

According to the region’s president, Juan Manuel Moreno, the move, along with a reduction in income tax, is aimed at stimulating the economy by attracting more investment.

The measure comes on the back of a reduction in stamp duty implemented in 2021 and a lowering of inheritance and gift taxes earlier this year.

Hit hard by travel bans during the pandemic and changes to pension and right to reside rules post-Brexit, the measure is expected to attract new taxpayers to Andalucia, including those from elsewhere in the Eurozone or British buyers looking to take advantage of visa options such as the Golden Visa, the Entrepreneur visa or Highly Qualified Visa.

Home to Marbella, arguably Andalucía’s most popular resort with high-net-worth individuals, the area saw prime prices increase 5% in 2021.

According to Mark Harvey, Knight Frank's Head of International, “Forward thinking policymakers are looking at new ways to attract globally mobile high-net-worth individuals. Alongside its lifestyle offer, education and accessibility, this latest move by the Andalucian government will further enhance the region, and in particular Marbella, in the eyes of overseas buyers and wealthy Spanish nationals.”

International demand

Foreign buyers are increasing their market share post the pandemic. Overseas buyers were responsible for 15.1% of all residential sales in Andalucia in the first quarter of 2022, up from 13.1% in 2021.

British buyers remain the most important source of foreign demand, accounting for 16.7% of purchases by foreign nationals in Andalucia, with Swedish buyers in second place accounting for 10.3%.

Swiss, Polish and Belgian enquiries are also strong according to Diana Morales Properties, Knight Frank’s Associate in Marbella.

Outlook

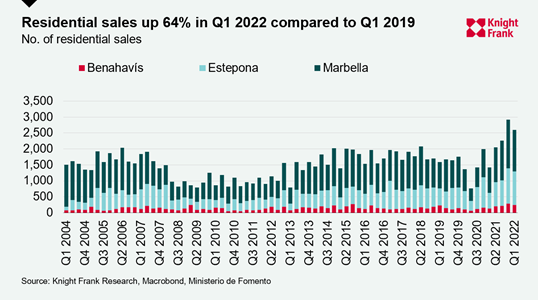

Sales activity in the Golden Triangle, which extends from Marbella to Benahavis and Estepona, increased 83% in the first quarter of 2022 compared to the same period in 2021 and is up 64% compared to pre-pandemic levels in 2019.

Against a backdrop of strengthening demand, stock levels are slowly depleting. We expect areas such as East Marbella (from Rio Real, Los Monteros to Santa Clara), Monte Mayor and Los Flamingos to see heightened interest in the next 12 months.

Discover more

Sign up to receive our Spanish research