Multiple headwinds ahead for the Chinese Mainland

After pressing the pause button at the end of the first quarter of 2022 due to the COVID-19 outbreak, what is the outlook for the Chinese Mainland'?

4 minutes to read

In 2021, China’s economy rebounded strongly, with GDP growth reaching 8.1% for the whole year, becoming more vital to support global economic growth. With a robust economic recovery from the COVID-19 pandemic, business’ confidence and investor sentiment continued to recover.

According to Knight Frank, the total transaction volume of China’s real estate investment market reached CN¥442.78 bn in 2021 with a YoY increase of 50.7% from 2020. Both domestic and overseas investors have shown their confidence in the Chinese market.

Transaction volume for investment destinations

In terms of investment destinations, the total transaction volume of Beijing, Shanghai, Guangzhou and Shenzhen in 2021 accounted for 36.7% of the total transaction volume in China.

In terms of its transaction volume, Shanghai is still the most attractive investment destination for investors, which recorded CN¥82.93 bn in 2021, an increase of 23.1% YoY; Beijing recorded CN¥38.91 bn, an increase of 3.5% YoY; Guangzhou recorded CN¥26.01 bn, an increase of 59.7% YoY; Shenzhen recorded CN¥14.59 bn, up 44.7% YoY.

Preferred asset classes

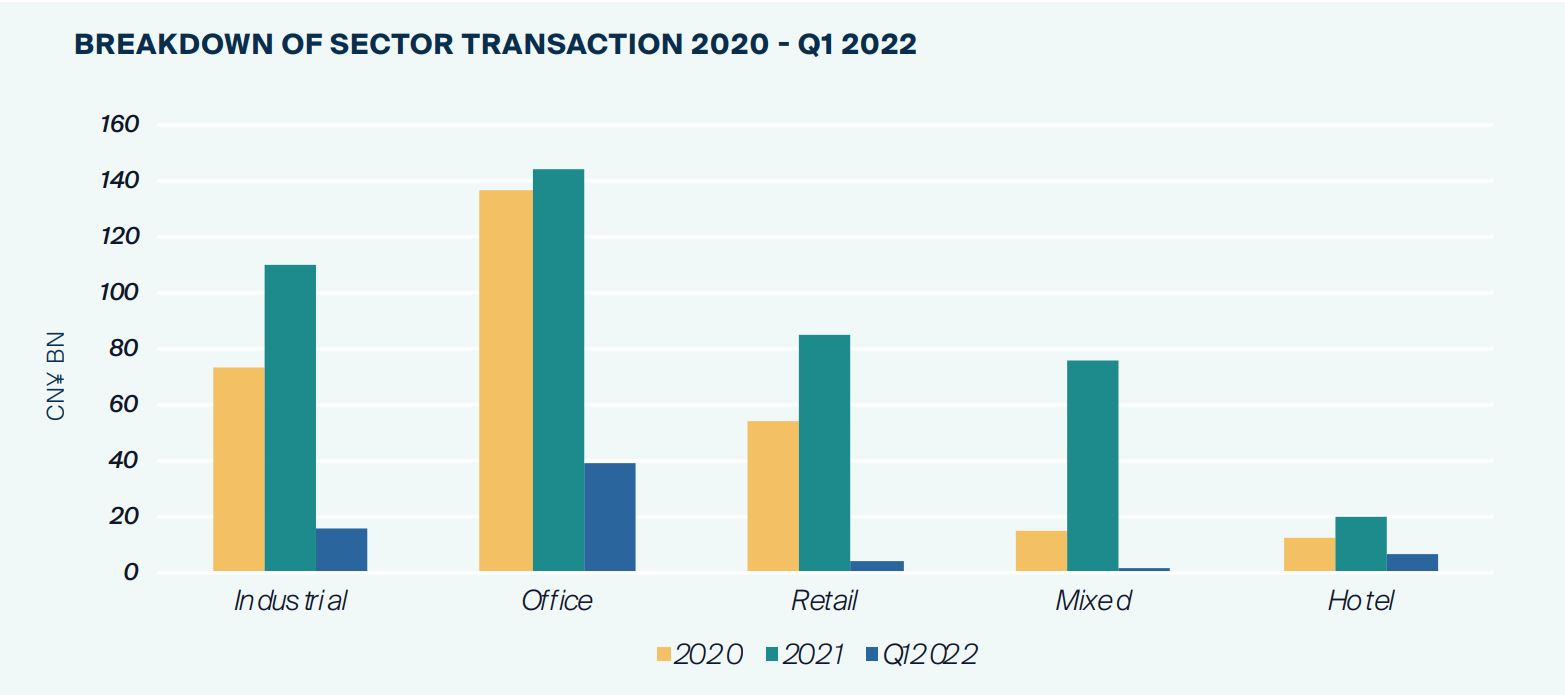

In terms of asset class, with the economic stabilization, office buildings, industrial and logistics warehouse and retail properties are the most preferred asset classes among investors, and the transaction volume of these asset classes accounted for over 76.7%.

Offices have always accounted for the largest percentage of the transaction volume of the real estate investment market in China, reaching approximately 32.6% of the total transaction volume in 2021.

The total transaction volume of industrial and logistics assets increased significantly, from CN¥73.15 bn in 2020 to CN¥110.37 bn in 2021, with a YoY increase of over 50%.

Buyers' Origin for China

In terms of buyers’ origin, due to the influence of international travel restrictions, domestic transactions were dominant in the market, with major buyers including domestic enterprises, insurance and real estate trust companies.

Meanwhile, the number of owner occupiers is also gradually increasing. In addition, foreign-funded institutions with experienced local teams were relatively active, thus facilitating the completions of transactions.

Milestones in China's real estate investment market for 2021

One of the milestones is the launch of China’s first batch of listed infrastructure REITs, including industrial parks and logistics assets, which will facilitate capital recycling and divert significant funds to developing critical infrastructure in the country.

The asset class has gained investors’ interest with the first batch of public REITs as a whole trading above their IPO prices. We expect investor interest in C-Reits to remain strong.

Looking forward to 2022

Shanghai pressed the pause button at the end of the first quarter due to the COVID-19 outbreak. Meanwhile, there are also outbreaks in first tier cities such as Beijing, Guangzhou and Shenzhen.

The recurring epidemic and strict lockdown policies will have a significant negative impact on the real estate investment market. We expect that if the epidemic continues in the second half of 2022, both investment activity and transaction volume will decline.

Foreign investment will slow, and domestic institutions will have opportunities to accelerate the acquisition of properties for self-use or investment purposes. Logistics warehouse, biopharmaceutical business park and office buildings will be the focus of the market.

With a robust economic recovery from the COVID-19 pandemic, business’ confidence and investor sentiment continued to recover. The total transaction volume of China’s real estate investment market reached CN¥442.78 bn in 2021 with a YoY increase of 50.7% from 2020.

With the economic stabilization, office buildings, industrial and logistics warehouse and retail properties are the most preferred asset classed among investors. Domestic transactions were dominant in the market, with major buyers including domestic enterprises, insurance and real estate trust companies.

Breakdown of Sector Transaction from 2020 to Q1 2022

Drivers for the Chinese Mainland

• Loose monetary policy

• Strong leasing demand for logistics warehouse

• ESG-linked real estate investments will increase

Sectors to watch in the Chinese Mainland

• Offices

• Industrial and logistics

• Biopharmaceutical business park

___

This piece was originally published in 'Rising Capital in Uncertain Times' Active Capital Asia-Pacific Perspective (June/July 2022)'. The report aims to provide an insight into how the real estate market in Asia-Pacific performed historically and how it is predicted to play out in 2022, thereby acting as a guide for investors. It also highlights an important theme – Environmental, Social and Governance (ESG) – for investors that are looking to expand their ESG foothold in their portfolios.